The dermo-cosmetics in China is a rapidly growing industry, driven by a combination of factors including sales increase in the sensitive skincare category, a rising middle class with more disposable income, and a growing demand for anti-aging and other specialized skin care products. With more and more Chinese consumers turning to derma-cosmetic products for sensitive skin, the market is expected to continue expanding in the coming years.

In this article, we will take a closer look at the current state of the Chinese derma cosmetics market, including key players and trends, as well as the opportunities for imported cosmetics and foreign products in this market.

Overview of the Chinese skincare market

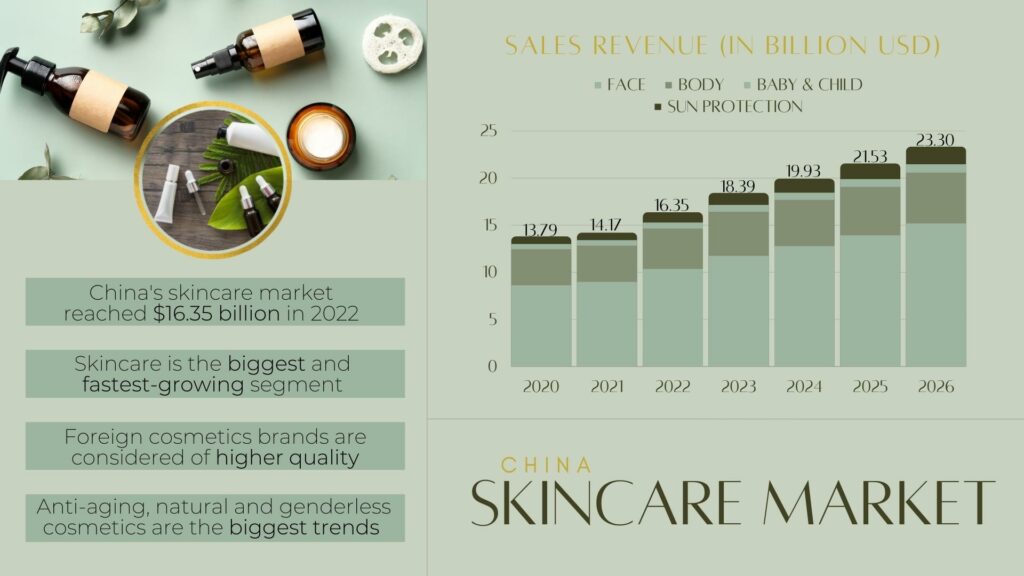

The cosmetics industry is growing rapidly in China and is among the most important sectors in the country, accounting for 18.39 billion dollars in 2023. The market size is predicted to reach 23.30 billion dollars by 2026, with cosmetics for the face being the top category.

When it comes to the skincare market and China’s dermo-cosmetics market, Western, Japanese, and Korean skincare brands are more popular than cosmetics with a Chinese label on them.

Chinese derma cosmetics market

The annual growth rate of revenues from sales of dermo-cosmetic products is approximately 15% compared to the previous year.

The dermo-cosmetics market is flourishing worldwide – it was estimated to be worth $52.12 billion in 2021 and its growth rate is set to skyrocket, projected at a compound annual growth of 7.5%. In China alone, acne & sensitive skincare products are predicted to emerge as the leading category in the industry’s expansion which has an expected CAGR of 7% over the next eight years!

Why dermo-cosmetics in China are gaining popularity?

This significant increase is due to new trends in skincare routines imported from Korea and Japan and a better understanding of cosmetics, as well as the growing interest in cosmetics-related content and products, especially on Chinese social media platforms.

Chinese people have sensitive skin and most of them have oily skin type which requires products without harmful chemicals. Thanks to the Covid-19 pandemic, Chinese people also got more interested in health and more of them incorporates skincare products into their daily routine, as well as healthier food and exercise. They are looking for skincare products and cosmetics ingredients that are safe and natural, perfect for oily skin types and dry skin.

What are the successful foreign skincare brands focusing on dermo-cosmetics in China?

Below are some examples of rapidly growing cosmetics and skincare brands in China;

Pierre Fabre: pioneers in dermo-cosmetics

Pierre Fabre offers innovative solutions for skin and hair care based on an intangible principle: anchoring beauty in ethics.

Backed by a pharmaceutical laboratory, they design dermo-cosmetic treatments according to the most demanding efficiency and safety criteria.

The group is No. 1 in Europe and No. 2 worldwide in the dermo-cosmetic market with a turnover of more than a billion euros across 130 countries and a portfolio of 10 complementary brands.

They exclusively sell organic products, based on a wide range of flowers and plants. The Pierre Fabre group has two flagship brands in China; “Rene Furterer” and “Klorane“.

Klorane & René Furterer: international quality brands

Rene Furturer responds to the high-end haircare market by offering hair products in the sensitive skincare category.

An inexhaustible source of plant-based active ingredients, nature has always been at the origin of the great discoveries of Pierre Fabre Laboratories. The pioneering spirit that has animated Pierre Fabre for more than 50 years is illustrated by a responsible development approach aimed at enhancing and preserving the plant world while using chemistry to develop well-formulated products.

Klorane

Klorane is associated with a range of quality family cosmetics. Klorane Laboratories carefully select worldwide the most suitable plant species and extract the richest active ingredients to provide health and beauty to hair.

Such brands have a strong international reputation for quality. “International” products from the Chinese consumer’s point of view generally is linked to quality. Chinese-made products, however, are associated with counterfeit products and substandard cosmetics.

As the wealth levels of Chinese consumers rise, so do the standards and expectations. 80% of the cosmetics products sold on the Chinese market belong to foreign brands and groups.

Quality focused on Health

China, with its 350 million middle-class consumers, is the largest country for cosmetics, especially when it comes to the skincare category.

The Pierre Fabre Group has identified a strong demand for its high-quality and high-end cosmetic products and has since made China a priority. They want to bring their passion to the Chinese market by promoting their values of quality, authenticity, and health awareness.

Although the group is selling in China and has to follow local hygiene and safety requirements, it had kept its respect for pharmaceutical rigor and ethics, botanical know-how, authenticity, and a strong commitment to protecting the heritage and values of its brands.

Fabre brands sold in China still hold the European quality label EFQM (European Foundation for Quality Management). This label is for consumers a sign of safe-to-use products and sets the group apart from its competitors.

How to market your cosmetics in China?

Chinese consumers are very demanding. They won’t purchase anything if they have not searched it online beforehand. The easiest way to find information about a brand or a product is through internet forums, social media, and other PR.

Without a digital presence, it would have been difficult for Klorane and Rene Furturer to find a buyers base in China. As of today, Klorane has its own Tmall store while Rene Furturer is sold by many accounts on Tmall Global.

Both brands are active on the social media eCommerce platform Little Red Book as well as Weibo.

Digital marketing: finding the right local partner

They have chosen to work with our agency to develop their digital marketing strategy in China for increased growth. You can find out more here: Klorane & Rene Furterer

We’ve worked on improving the brand’s eCommerce sales on Tmall store (B2C) and raising awareness of the two brands on the most effective and targeted platforms.

Chinese e-commerce platforms: how to increase the conversion rate

In order to boost the brands’ conversion rate on eCommerce platforms we came up with a plan: Increase their e-reputation in China. Not only we helped Klorane and Rene Furterer with the launch of their Tmall (B2C) and Taobao (C2C) stores, but we also did market research and worked on the brands’ social media and internet reputation. This was paired with in-depth reporting on performance and sales statistics. Quality analytical data is most important to ensure accurate feedback on sales and marketing.

Chinese social media will help with e-reputation

Because social media platforms are so widely used in China it is almost impossible not to incorporate at least one of them in your marketing strategy. Let’s be honest, if you want to look legit, and gain visibility and popularity, social media are one efficient way to achieve this.

The social media landscape changes every year with newcomers and new trends. The growing trend is short videos and live streaming. Douyin, Kuaishou, Wechat, Weibo, little red book… they all launched their own version of live streaming.

For the Klorane and Rene Furterer campaigns, we decided to use Weibo (similar to Twitter) as the subject. The platform is perfect for commercial content and buzz marketing.

Weibo is a very open network, users can see anyone’s messages, and it still has 300 million active users. When you compare it to the very close and intimate environment of Wechat, you quickly understand the commercial value of Weibo. The app also works with Alibaba making it ultra-easy to use hyperlink and send visitors from your Weibo account to your Tmall/Taobao store.

At the time, the two brands were mostly unknown in China, however, Kols were already big things. The idea behind the Weibo campaign was to create interest from influencers and gain more visibility and credibility in the Chinese market.

Conclusion of the Pierre Fabre Case Study

The two brands significantly increased their profile among the Chinese as a result of the campaign. Klorane got 50,000 new followers on Weibo and 1.5 million page views. Rene Furterer attracted 60,000 new followers to their Weibo and got 2.1 million page views. 100 influential people approached the brands to represent them, building the foundations for a better and more focused community strategy in the future that is still lasting to this day.

The business plan on Tmall resulted in increased sales and better market performance. Pierre Fabre’s managing director, Mr. Ducournau, said the company would take steps to adapt to the changing environment.

“We pay special attention to China’s economic development and the pace of growth of the Chinese economy,” he said.

About Gentlemen Marketing Agency

We are a China-based digital agency with the focus on e-commerce and digital marketing solutions for foreign brands interested in China market-entry. We help brands reach their target audience in China by providing tailor-made solutions depending on brands’ goals and budget.

If you have a project and need help, feel free to reach out to us, and we will be happy to schedule a phone call with you.