Luxury brands always promote their own social media because it is part of their identity. When Bottega Veneta deleted all its social accounts (Facebook, Instagram, Twitter), the whole world obviously shook. Even some fashion experts anticipated the end of Instagram and the death of social media.

Is the luxury House implementing a new strategy? Organizing a coming back on international social media with a new identity? Or a new communication strategy? After all, it raises the important question of whether fashion brands can perform without social media. It could be a payback strategy to reconnect with the distant luxury image. Except in Asia where social media are the quintessence of e-commerce.

Did Bottega Veneta retire from all social media? Not exactly… In reality, the brand is still active on its Weibo, WeChat, and Little Red Book accounts and keeps publishing content.

What are the specificities of social media in China?

State of Chinese social media in 2021

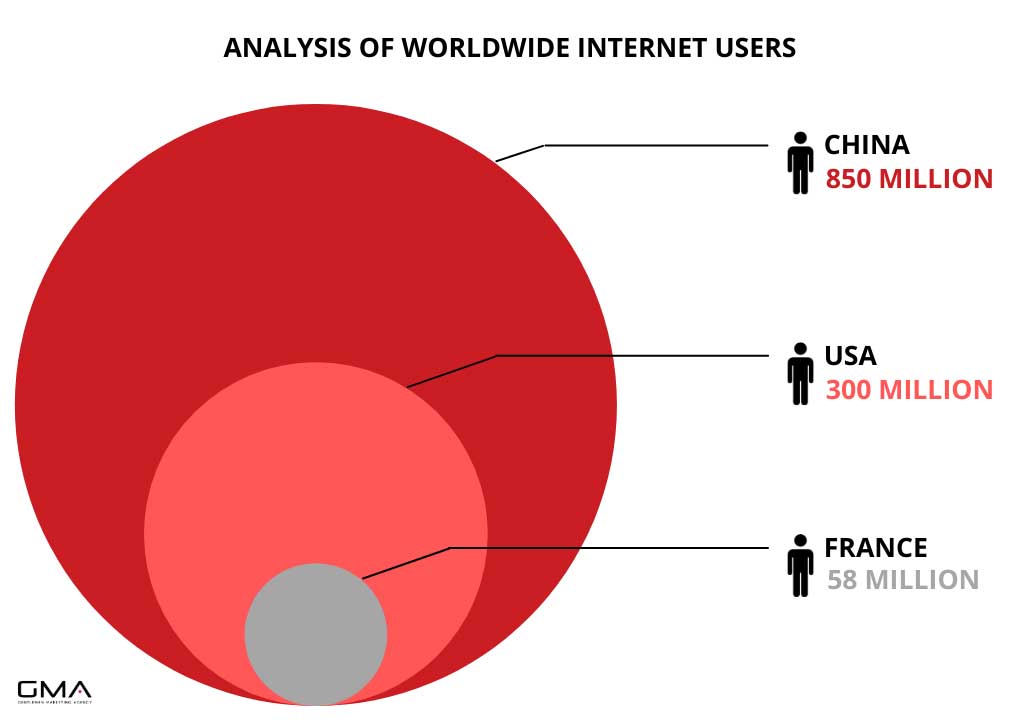

China is the largest social media market in the world. There are 850 million Chinese people using the internet, which is 60% of the population. Each year the number of people joining the internet keeps growing and even increased by 18% between 2019 and 2020.

Social media in China are not a trend, they are a daily lifestyle. On average, the Chinese spend 358 minutes per day on social media, which is about 6 hours. They are more and more dependent on these platforms. They especially love to talk with their friends, share their opinion, and ask for product recommendations.

Multiple social media means multiple opportunities

You are all very aware of the Chinese Great Firewall now: no Instagram, Facebook, or Google. China has its own ecosystem of apps with its own codes. For instance:

- Youtube: Bilibili or Youku

- Facebook: Weibo

- Instagram: Little Red Book

- WhatsApp/Twitter: WeChat

- TikTok: Douyin

Read as well: China Top Social Media for Fashion and Luxury Brands

Bottega Veneta case study: Why a different Strategy in China & the West?

Figures about Bottega Veneta

Following the “Invisible store” launch in Shanghai in July 2020, Bottega Veneta played again with the concept of invisibility by disappearing from the social media landscape on January 6th, 2021.

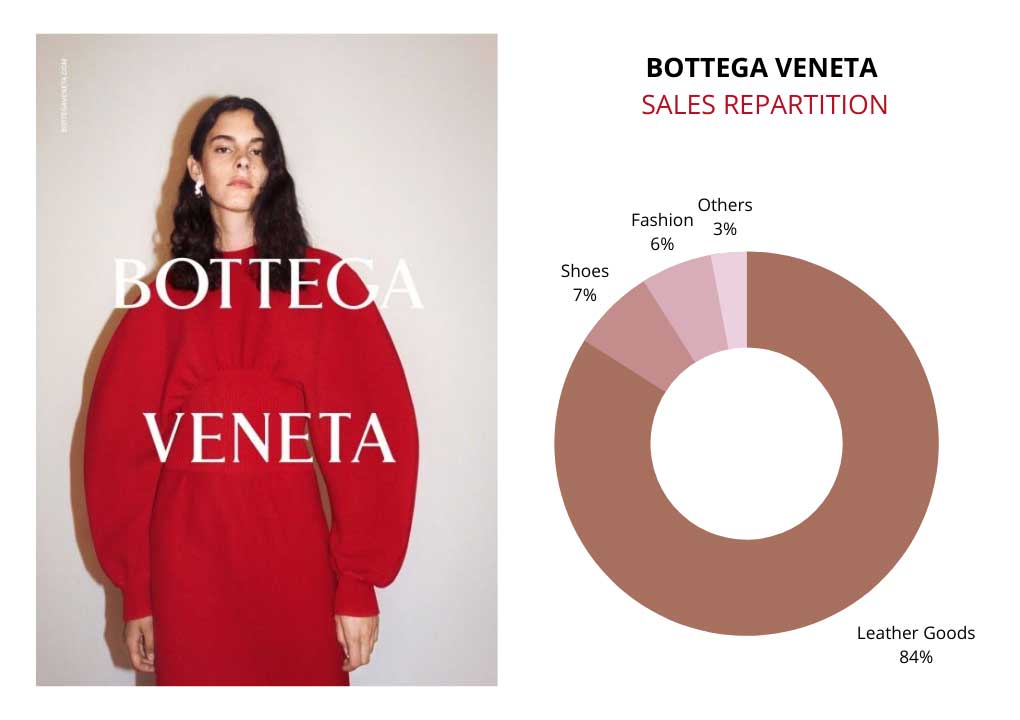

The new strategy of Bottega Veneta is to be more discreet, more distant, and emphasize the values of “true luxury”. It is kind of a back-to-roots strategy. François-Henri Pinault, the Kering CEO, advised that the group strategy is to turn Bottega Veneta “into a couture house and international leather specialist, and not a leather and couture brand, which was the case previously”. Driven by its leather good sales, the fashion portfolio only reaches 6% of the total sales of the brand. The objective for the coming years is to reach 15%.

Since the arrival of the new artistic director Daniel Lee in 2018, the Italian brand is willing to reconnect with the success. They reached a growth of 17% between Q4 2020 and Q4 2019. The wholesale distribution sales raised by 63% with great market shares. Most importantly, online sales are increasing by 3-digit growth kept confidential by the brand.

International social media strategy: build an exclusive image

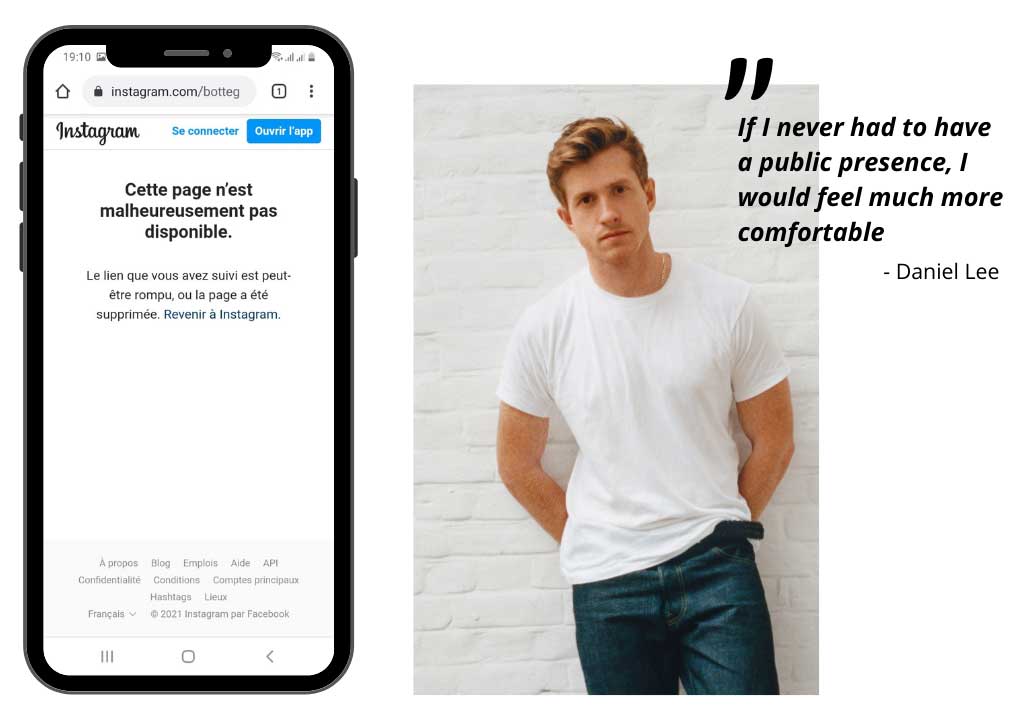

Why did Daniel Lee would decide to cut the contact with its 2.5 million followers on Instagram? Is it to announce a brand image come back? How would he survive without international social media?

At least, this radical decision is animated by two visions: brand image and data analysis.

Brand image: Maintaining a “luxury” image

Bottega Veneta is an ultra-exclusive luxury brand. The tremendous online presence of the brand was harming the exclusive image the brand wanted to build.

Daniel Lee emphasizes this idea by avoiding public appearances. His objective is to avoid the noise of online presence. As a matter of fact, Instagram, Facebook, and Twitter have recently suffered from trust issues and premiums decrease. And these platforms were not built for luxury consumers. Do you really reach your target with a Facebook account?

Social Media and the Lack of business data Available

The functioning of Instagram does not allow brands to follow efficiently the conversion rate. How to prove that a consumer who liked your post on Instagram bought this new bag? How could you know the impact of your content on your targets?

All these questions are still totally different in China. Overseas, social media have been considered to be the quintessence of e-commerce.

In China, Social Media Serve has a Communication Media for Luxury brand

Among the Chinese social media, you can see that Bottega Veneta kept its Weibo, WeChat, and Little Red Book accounts. In brief, the famous Kering brand is still posting content and engaging with its community, even after January 6th.

Bottega Veneta could not follow the same strategy overseas. In China, if you delete your social media you do not exist anymore for the Chinese consumers.

You need to remember that Chinese consumers are spending the majority of their time online. For instance, only 8% of Chinese consumers have an offline journey only. Their purchasing decision is made of both online and offline experiences: they gather information online and try the product in-store. The more you appear on their phone, the more they will remember and trust your brand.

The performance criteria are obvious in China. You can test and learn easily with Chinese social media. Indeed, you can constantly analyze your ROI (Return On Investment) to understand the impact of your online campaign.

How to perform on Chinese social media as a Fashion Luxury Brand?

Branding: Build a strong image online

Exist with a clear e-reputation

Maintaining a good image on the web is the key and you have to be extremely cautious. Branding in China is all about the image and the storytelling, and you need to focus on the values you will share with the Chinese consumers.

First, you can create an official WeChat account. With 368 million monthly users, WeChat is the biggest platform used in China. If you do not have an account, you will not have any existence in China for local consumers. This social media will help you to attract new clients and to share content with your community. In addition, you should also create a mini-app to redirect your follower to the e-commerce platform.

Then, you can create an account on Weibo or Douyin to increase your brand awareness. You will have higher visibility and increased brand loyalty because Chinese users will have the impression they can connect with your brand on a daily basis.

Perform with a Baidu SEO & SEA strategy

Your online visibility is also important to promote your brand. You will need to help the algorithm with a strong SEO (Search Engine Optimization) and SEA (Search Engine Advertising) to stand out from the crowd.

The more you create a strong SEO strategy, the more Chinese consumers will know about you.

In the Bottega Veneta case, it would have been crazy to think they could close their Weibo or Xiaohongshu accounts… If they delete all their Chinese social media, how Chinese people would know the brand still exist? How would they know where they can buy it?

China is an immense country. Many of them do not have any stores around them and have to buy online. As a result, the majority of Chinese luxury consumers used to travel to buy the fashion items they were looking for. After Covid-19, travel has become complicated. So if they cannot go to your brand, your brand should come to them.

If you are looking for a business in China, you need to create your Chinese website. Your content must be written in correct Mandarin and follow the recent trends to stay up-to-date with the Chinese mentality. The more wisely you select your keywords, the more you will increase your brand visibility.

Engagement & Visibility: Create impactful content with Chinese KOLs

KOLs: The art of influencing purchase

In China, Key Opinion Leaders (KOLs) are significant for a marketing campaign. They will increase your visibility, your brand awareness… and obviously your sales!

The market of social influence in China is the world’s biggest. On average, the top KOLs in China reach 1 million daily views and 10K engagements per day. Influencers who used to start with Weibo and WeChat, now reach new social media platforms like Douyin, Xiaohongshu, and Bilibili.

If you are a fashion brand, you should not go with the flow of the most important KOL or the most recent successful KOLs. Why? Because they have already make the job for others. Chinese consumers give credit to KOLs for their review and KOCs for their recommendations.

A KOC (Key Opinion Consumer) is a micro-influencer. They can help you build your audience and improve your brand to build trust among consumers. People will trust their recommendations because they showcase a limited number of brands. You will get more visibility and a higher ROI.

We can help you choose your KOC for your next campaign

Luxury & Livestreaming: The key to success in China?

This trend is growing in China since 2018 but has only made its way through at an international scale this year. The spread of Covid-19 triggered the need for new business opportunities linked to digital.

In China, the live-streaming market reached 613 million people in 2020. After all, it seduced +28% of people compared to 2019. The international luxury brands are joining the movement to propose real-time recordings of their fashion shows and their new collections. This is where the importance of choosing wisely your KOL or KOC lies: the host of the Livestream event is often an influencer.

For a fashion brand, live streaming could be used towards 2 main goals: image or sales. If you want to improve your brand awareness you can create a qualitative and interactive live stream with a KOL around your last collection or your last brand event. If you plan to increase your sales in China, you would better choose a KOC explaining to its community the uniqueness of your brand to promote the “See now, buy now” model.

Sales: Boost your business in China with social e-commerce

Xiaohongshu: the fashion app

Little Red Book, also called Xiaohongshu, is often compared to Instagram. Except that the main difference lies in the use of the app. On LRB, the Chinese are chilling, discovering pictures but also buying.

This specificity explains why Bottega Veneta deleted its Instagram account and not its Xiaohongshu account. Indeed, shutting down an Instagram account impacts visibility but not automatically sales. With LRB, you impact your brand awareness, your brand visibility, and your online sales.

If you are a fashion brand entering China, you should create a Xiaohongshu account to increase your brand awareness. Chinese are sensitive to KOLs recommendations and consumer feedback. The app enables KOLs to expose the brands they love and users to share “shopping notes” on their favorite items. You will not be the only one to build creative content around your products. As a user-generated content app, LRB will promote the content created by users around your brand too.

Tmall Luxury Pavilion: the quintessence of exclusive fashion

The Luxury Pavilion is an “app within an app” to propose a more high-end experience for luxury brands. In the meantime, the Covid-19 crisis accelerated the success of the Pavilion by increasing luxury brand inscriptions by 30%, reaching 200 luxury brands.

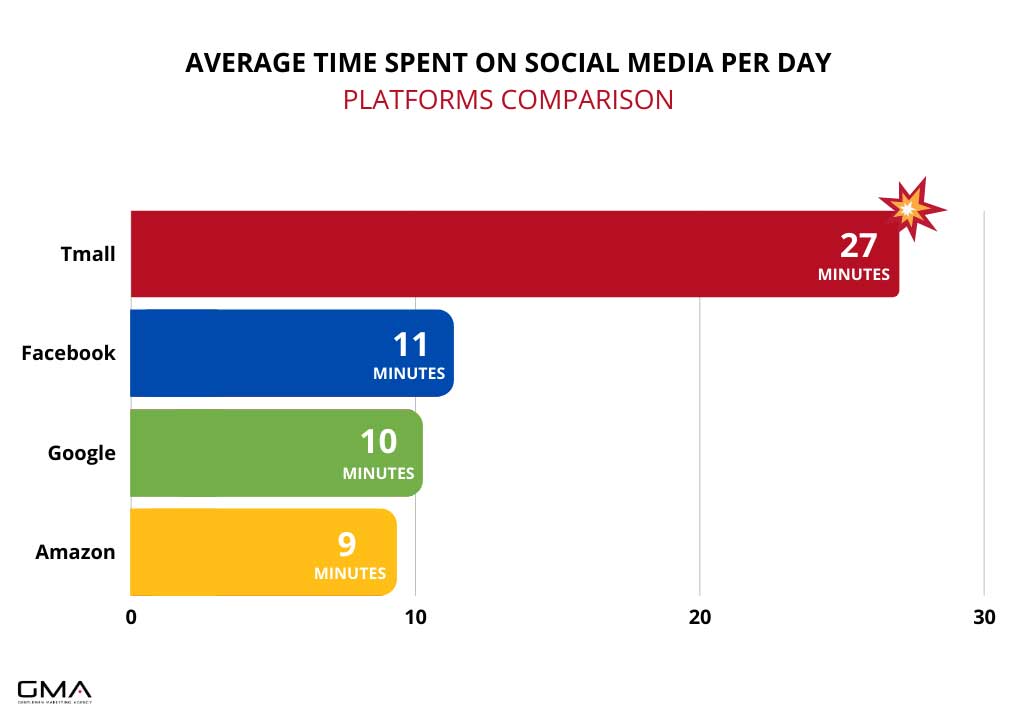

Today, you can find Balmain, Ferragamo, La Mer, Baccarat, Guerlain, Burberry, and more recently Gucci (link). The New York Fashion Week was even live-streamed on Tmall platform, reaching a 900 million people audience. (link). The impact of Tmall is tremendous. Especially when you compare it to international digital tools.

If you are a luxury brand, the Tmall Luxury Pavilion is the best option to engage with Chinese consumers by sharing their experiences, storytelling, and values. Coupled with the selection made by the algorithm and the invitations, you will only have the wealthiest and luxury-sensitive clients to increase your ROI.

You can use the Luxury Pavilion to build a high-end customer experience. You will have 100% control over everything: the price, the merchandising strategy, the communication, the marketing. In a word, this luxury app is considered to be your online flagship. On Tmall, you do not depend on the retailer, you ARE the retailer.

You could find in Tmall Luxury Pavilion the best option to reach more premium and more exclusivity. Do you know how to enter the Tmall Luxury Pavilion?

We can help you enter the Tmall Luxury Pavilion

Discover GMA: Top Digital Marketing Ageny for Fashion & Luxury Brands in China

GMA stands for Gentlemen Marketing Agency. We are the most visible web marketing agency in Shanghai, China. Enriched with more than 7 years of experience, we help companies enter the Chinese market. Take a look at our case studies!