China is the 2nd largest economy in the world and has been one of the fastest-growing markets for children’s clothing. In China, parents are willing to spend more on kids’ clothes than they would for themselves because it reflects their social status. The global children’s wear market is expected to reach $326 billion by 2027. With so many Chinese consumers buying into this trend, your brand can reap big benefits if you start marketing there now.

In this blog post, we will take a look at China’s childrenswear market and examine the trends to see how foreign companies can enter this lucrative market.

China Kidswear Market: Overview

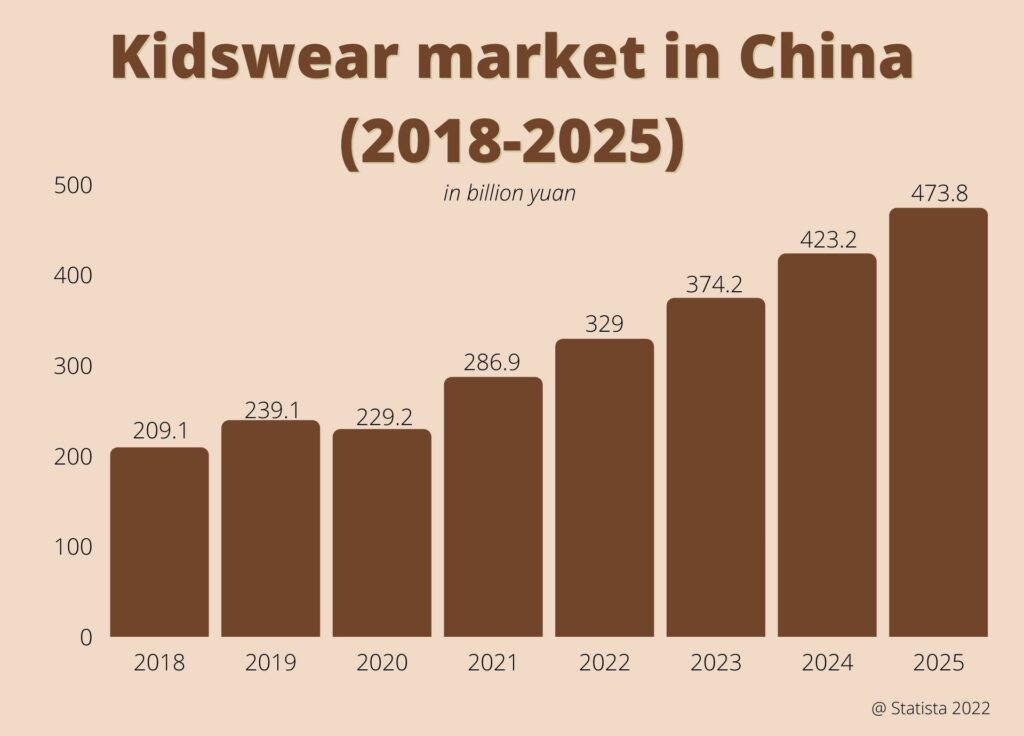

Sales revenue of the kidswear market is expected to reach 329 billion yuan in 2022 and 473.8 in the next three years. According to market research done by Statista, although women’s wear is the biggest segment of apparel in China, kidswear and sportswear are the segments that record the fastest growth, presenting huge opportunities for childrenswear and sportswear brands, especially when it comes to luxury clothing.

The apparel market for children is not as large but it’s still one of the most promising consumer goods industries. In China, per capita spending on childcare-related products like baby clothes was increasing at a rapid pace of 12% in 2021. Baby and toddler clothes were purchased the most, as those need to be replaced fast, as the children grow, generating big sales numbers.

Rising purchasing power leading to the growth of the Chinese childrenswear market

The Chinese are spending more and more on their children, which is a trend that has been going on for quite some time now. Study shows the average annual disposable income went up, giving parents much more freedom to spend money. This especially applies to urban areas of China where people tend to spend substantially higher than ever before when it comes down to providing things like education and health care for their kids.

Additionally, although the Chinese government already announced the three-child policy, as an answer to demographic problems in the country, many parents are still deciding to have only one child, just like during many years of the one-child policy. Having kids in China is very expensive, so many families prefer to have just one kid that they can later ‘spoil’ with good education, luxury clothes, and other childcare-related products.

China Children’s wear market trends

China market is a very dynamic one and all the companies interested in selling luxury childrenswear to Chinese mothers or fathers should be on top of the latest trends in the industry;

Luxury brands of children’s clothes are popular among the rising middle class in China

The overall clothing market in China, particularly the luxury childrenswear market is one of the markets with the highest market growth and development potential in China.

Social media in China is now full of blogs, posts, and videos from Chinese parents and hot mammas like Renee offering style tips, brand choices, and advice. Childrenswear is now a serious part of Chinese parents’ social currency, and some see this sector as 骗你生二胎 or “the persuasion to have a second child.”

According to Euromonitor, the sector outperformed womenswear and menswear in 2019, reaching almost $37 billion, representing a year-on-year increase of 14.4 percent. After the opening of China’s two-child policy in 2016, data from the National Bureau of Statistics show that in 2019, there were around 250 million children under the age of 15 in China. Since then, a further 14.65 million babies were born.

Most popular luxury childrenswear fashion brands in China

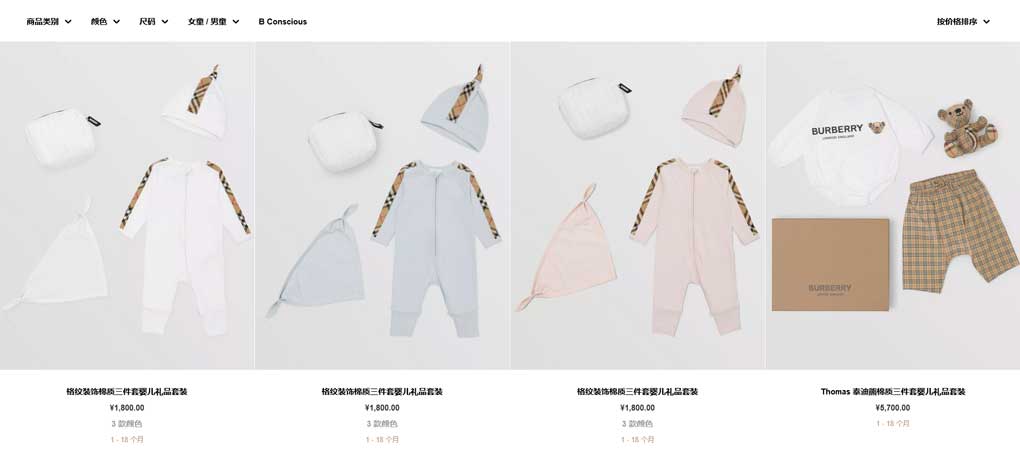

- Burberry Children: Burberry is the precursor to luxury childrenswear, indeed it was one of the first luxury brands to launch a luxury children’s line. It was after that, that big brands like Armani, Gucci, and Fendi Kids followed the trend. Burberry now has many offline stores in major Chinese cities as well as all online distribution channels.

- Bonpoint: Founded in 1975 by Marie-France Cohen, Bonpoint is the first Parisian children’s clothing house. The brand’s strong point and main aim are to deliver an innocent look that better fits the nature of children. Another mark of distinction for Bonpoint is its children’s skincare line, which is particularly popular in China.

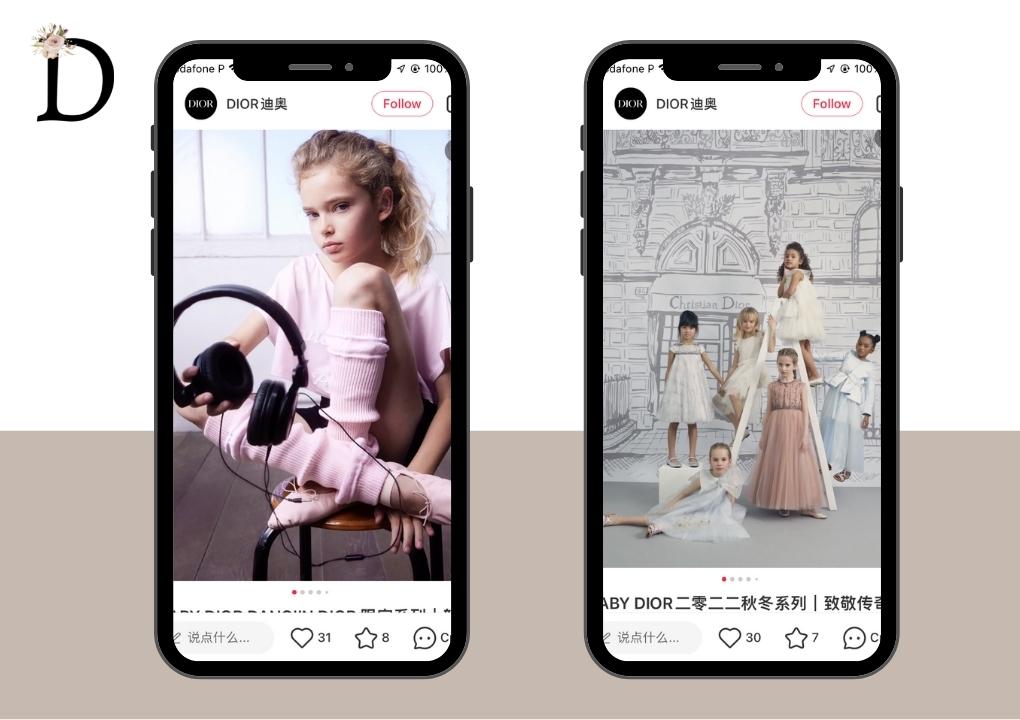

- Dior Baby: Dior launched its first line of children’s wear: Dior Baby, the children’s collection is almost identical to the adult collection and is available in all Dior physical stores worldwide.

- Gucci Children: Gucci children’s wear was introduced for young kids, the collection is almost like a miniaturized version of the adult collection, of course, the brand includes shoes with a prominent red-green tricolor band.

Adult-like clothing is popular among Chinese consumers

The world of children’s clothing is a fierce battleground these days, with mid-tier companies struggling to stay competitive. There are two types of markets: the designer market and the value market, which leaves no room for any middle-ground company in between.

Children have become more fashionable themselves as they’ve begun wearing clothes that imitate adults’. As parents buy their kids new outfits often because trends change so quickly nowadays just like adult fashion does too!

Just like in the West, girls clothing and boys clothing that looks like the smaller versions of adult clothes are a new trend that can be seen across offline and online stores of kids’ clothes. As the mother-child influencers number is growing, matching outfits (like the same dress for a girl and her mother) are a new trend across Chinese social media.

What demographic buys childrenswear in China?

Chinese moms and dads are adamant about distinguishing themselves by any means possible. Despite the impact of the Covid-19 pandemic, children’s clothing sales in China grew at a fast pace in recent years.

Hot Mamas, a term coined to describe the new generation of post-90s mothers in China who are breaking away from traditional parenting. Hot mamas think and raise their children differently than previous generations have: they turn to peers for advice rather than parents; look more at product safety and quality over price when shopping; prefer high-quality products imported via cross-border eCommerce.

According to China’s National Bureau of Statistics, more than 30% of Chinese urban household income is spent on children, in most Chinese families mothers are more intent on buying items such as clothes and toys. Much of this spending is concentrated on what babies and small children eat, and wear, for their everyday use. Projections indicate that growth in the childrenswear and accessory market will still be strong in the future years.

What is the local competition for kids’ fashionwear in China?

For a long time, national brands were the market leaders when it comes to the kidswear market. But in recent years domestic brands have fallen behind and they’ve been caught up by international brands, this is especially true for citizens living in top-tier cities.

At the same time, Chinese consumers in third and fourth-tier cities are still quite loyal to local and domestic Chinese brands. However, international brands have been trying to accelerate their entry into lower-tier cities by offering lower pricing. As a result, it seems that the childrenswear market in China is facing a face-off with both domestic and international brands wanting their share of the market.

How to promote your children’s clothing brand in China

The first step for any kidswear brand looking to sell to Chinese consumers is establishing a digital presence to increase its visibility and e-reputation. This is true for any type of business entering the Chinese market but is especially applicable for luxury brands that are reliant upon the way in which consumers view them.

Here are the best ways to create or improve your online reputation in order to attract Chinese consumers:

Chinese Social Media are key for kidswear brands

1. Wechat

Launched in 2011 and with more than 1.26 billion users, WeChat is the most popular app in China. Thus, it has become a powerful marketing tool for both individual entrepreneurs and international companies.

You can create your brand’s account on WeChat to keep in touch with your Chinese consumers. A WeChat official account is kind of like a micro-website, where you can post news, put your contact information, create an event, and even open a WeChat Store for selling.

What makes WeChat better than any other social media platform is that when you put new things, there is an alert on the main page of WeChat. Every person that followed your account will be notified. In addition, everyone in China uses WeChat in their daily life, all day long. So if you want to promote your sportswear brand in China, WeChat is a must-have.

2. Weibo

With 650 million registered users, 129 million user visits every month, and a reach across 190 countries, it is no wonder Weibo has become one of the most popular social media platforms in China. And with its similarities to Twitter and Facebook-like functionality – such as posting photos or videos on your feed or liking other people’s posts – you can bet businesses are taking advantage of this opportunity for marketing success!

Weibo is a powerful tool for brands to engage with their followers in the Chinese market. It provides users with an interactive platform that not only helps increase brand awareness but also creates ad-hoc communication opportunities through user-friendly content and allows them to link out to eCommerce sites. Unlike other social media channels where word of mouth can be difficult because of its open nature.

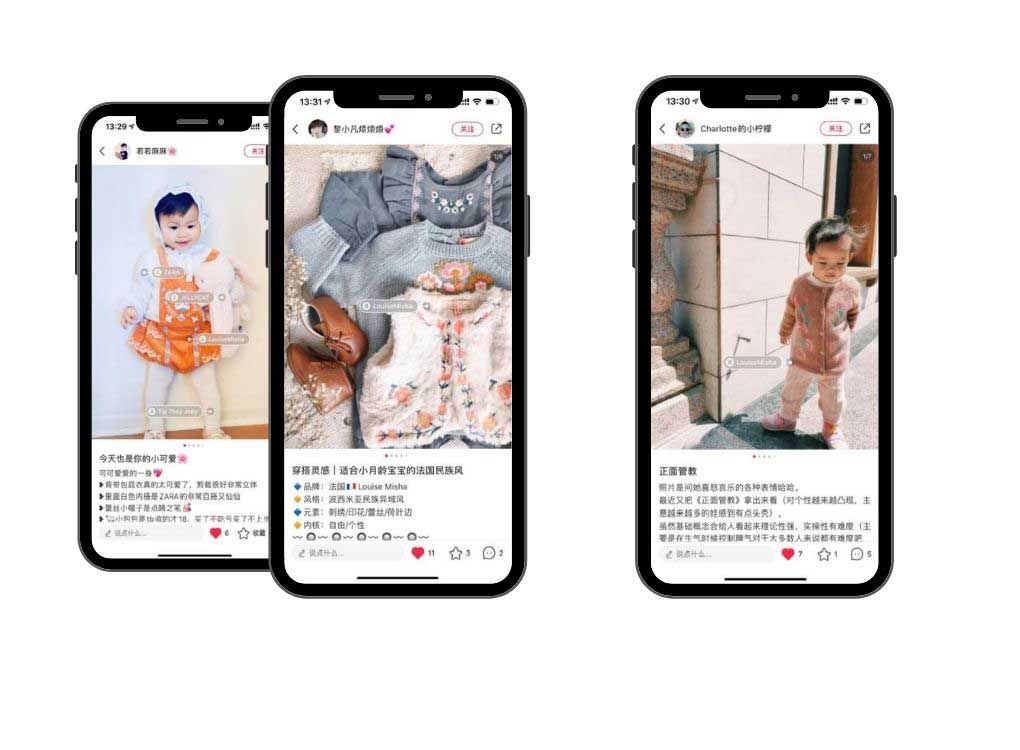

3. Xiaohongshu / Little Red Book (RED)

Xiaohongshu literally means “Little Red Book”. It is the Chinese Instagram where users share photos, videos, and shopping advice. Compared to Instagram in the West, shopping on social media is way more used in China. On average, Chinese netizens spend 6 hours per day on their phone, and a lot of this time is spent on RED.

The store incorporated on Xiahongshu is an easy way to maintain your premium image and increase your sales. This platform is particularly useful to target buyers (mothers) in 1st tiers cities.

4. Promote your kidswear brand with short videos on Douyin

With more than 600 million daily active users in China as of 2021, Douyin, known as Tik Tok in other parts of the world, is one of the most lucrative and promising apps in China. In March 2021, Douyin launched its flagship stores, available for brand accounts on its platform, marking a major step into e-commerce.

Moreover, it is also possible for companies to send vouchers to their followers and add links to e-commerce platforms such as JD.com and Taobao. However, these flagship stores allow fashion brands to directly promote, advertise and sell their products on the platform.

Livestreaming & Kols: to strengthen your reputation once you are all set up in China

KOLs (Key Opinion Leaders) are the best ambassadors of your brands, they act like influencers. If you want to promote your brand, you can collaborate with KOLs who will promote your products to their community. Some KOLs are even more famous than celebrities and they have more impact when it comes to sales. Many brands collaborate regularly with KOLs, the more they have followers, the more expensive their fees will be.

Chinese website & SEO strategy

In China, brands should see websites, not as a separate hub of information but as a part of the digital ecosystem that consumers would pass till they reach the buying stage. When you create a Chinese website, you need to look at all the points at which Chinese social media can be utilized. For example, WeChat or QQ should be used for logins to a website built for China.

While virtually every Chinese netizen has an email address, it is used far less than you might expect. Inputting a mobile phone number and receiving a unique SMS confirmation, is much more widespread. Youku or QQ video should be built into a Chinese website for embedding videos, and WeChat pay and/or Alibaba’s Alipay should be the payment method integrated.

Any company wishing to set up in China must take into consideration the implementation of a suitable SEO strategy. Adopting the same SEO strategy for Baidu as for Google, isn’t a good idea, in fact despite their similarities, the Chinese search engines own some secrets, and these are important for establishing relevant and effective actions.

Selling childrenswear on Chinese online marketplaces

Selling your items on Chinese e-commerce platforms, such as Taobao, Tmall, JD.com will give your brand the biggest visibility, but it also costs a lot, so it’s best for well-known brands with an established presence in China.

But there are other online marketplaces in China that are less expensive and still work miracles. You can try opening stores on China social media platforms, like WeChat, Douyin, or Xiaohongshu, where it’s also easy to attract customers via a good marketing strategy.

A large number of young people prefer to buy products from Taobao. Tmall is considered representative of China’s e-commerce platform B2C. Indeed it hosts thousands of sellers and many brands from all around the world, in order to ensure the quality of online shopping products, which is one of Tmall’s main advantages. Jingdong is also another famous Chinese e-commerce platform.

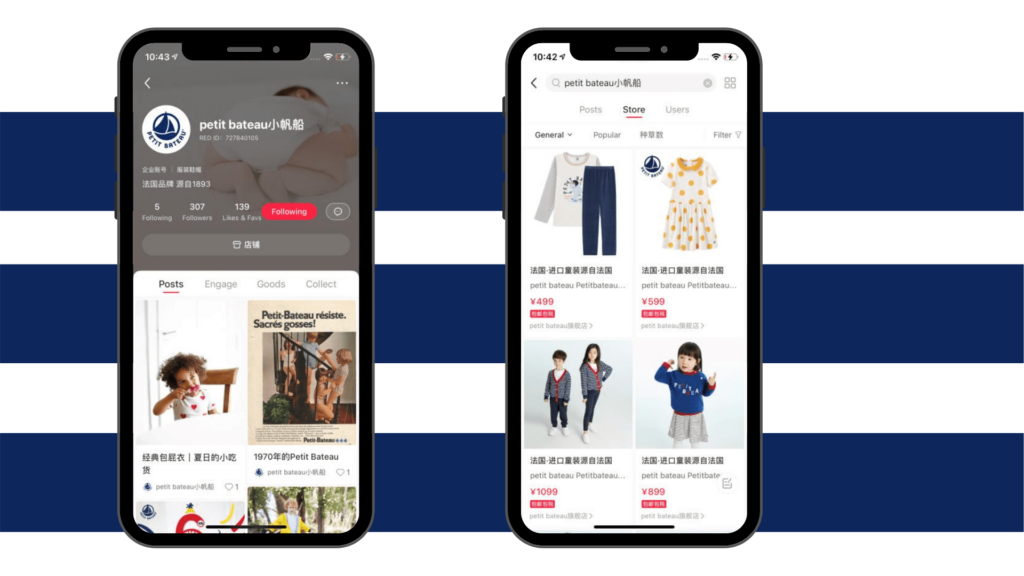

Petit bateau: success story of a kidswear brand in China

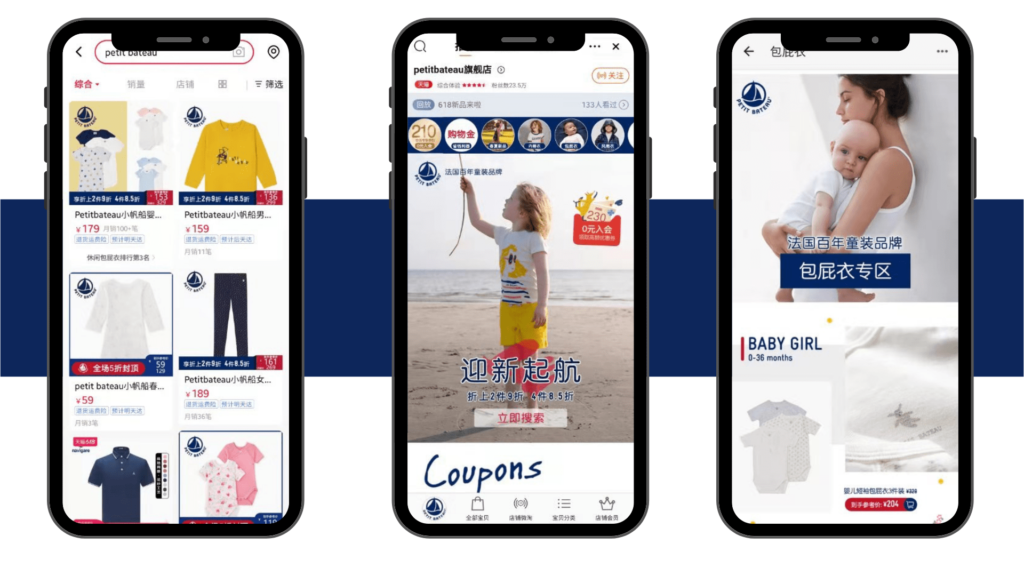

Petit Bateau’s success is mainly due to the use of multichannel and having an official account on a wide variety of Chinese social media.

Petit Bateau is a french childrenswear high-end brand of clothing and underwear designed for children, the brand was founded in 1920 (101 years ago) in Troyes by Pierre Valton. Petit Bateau is originally a children’s brand but it became popular among consumers of all ages thanks to the launch of the adult collection. Petit Bateau has 53 physical stores all over mainland China (including 9 in Beijing).

Petit Bateau established its presence on multiple platforms and online places in China, as you can see in the photos above. They have their own Chinese website, accounts on Wechat (with their own WeChat Store in mini-program), Weibo, Xiaohongshu and flagship stores in Chinese e-commerce platforms.

It’s safe to say that they already have an established position in China and many Chinese parents treat them as their first choice for all children’s clothes.

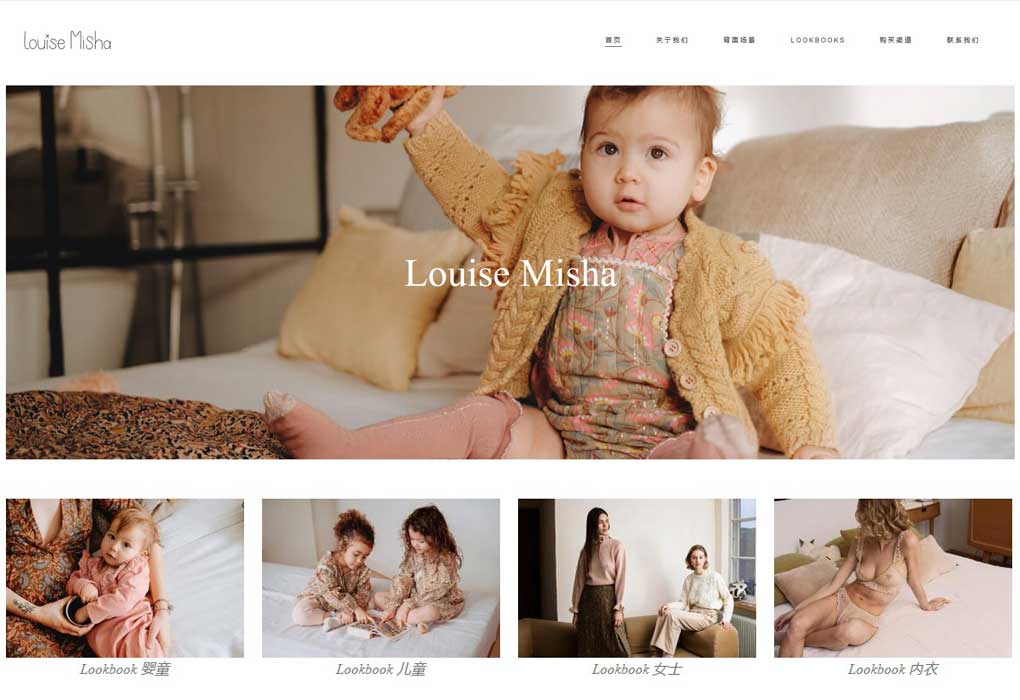

Kid Wears Case study by GMA: Louise Misha

Louise Misha is a french childrenswear brand that was created in 2012. Louise Misha’s style has been inspired by bohemian and natural designs, catering to women, babies, and children exclusively. Recently the company wanted to enter China’s market but lacked consistency on social media platforms like WeChat or Little Red Book for example.

In order to remedy the lack of presence in China’s childrenswear market, Louise Misha contacted GMA and worked together on promotion. Through WeChat, Little Red Book, and Weibo we were able to promote their brand successfully while catering exclusively to women, babies, and kids.

- WEIBO: 12 Posts, 1650 New Followers, 140000 Reads, KOL advertisement

- WeChat: 2 Posts, 380 New Followers, 1255 Views

- Little Red Book: 11 Posts, 301 New Followers, 8500 Views

Want to sell your kidswear brand in China?

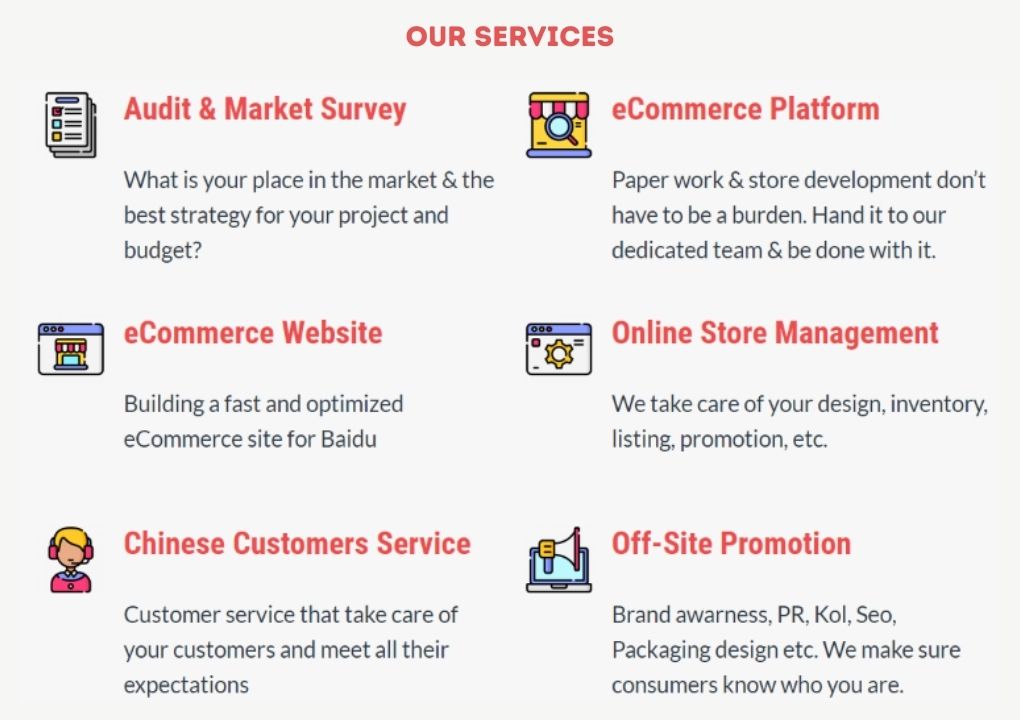

Childrenswear is a very lucrative market that will see rapid growth in the next years, as more and more Chinese parents are willing to spend big money on their kids. There are many great opportunities on the market and the time to grasp them is now! We can help you achieve your goal by working on the best marketing strategy for your brand in China.

We are China digital agency with more than 10 years of experience in the market. We worked with more than 600 brands from many different industries, assuring their easy and successful entry into the Chinese market. We offer many services, from market research and audit, through web design, to marketing strategy and branding.

Don’t hesitate to leave us a comment or contact us to schedule a free consultation!

5 comments

Sofia

*Hi This is Sofia, we are interested in your services

Can you share your catalog to our email below Contact

Regards Sofia

mathilda

What are famous Kidswear brand in China?

I cant find good info online

Katy

The prospects for growth of China’s childwear market is positive as the investment will exceed 12% over the next five years.

A major factor that determines a country’s economic growth, such as childwear production and consumption, is its economic structure. China has an industrial economy with some agricultural sectors; thus, the country may invest more resources and attract more investors than other developing countries with high levels of poverty. Aside from revenue and export opportunities, child clothing depend on children’s tastes and preferences – they are usually more cooperative at this stage so it becomes easier to establish contacts with their parents. This makes further development in this field relatively easy to accomplish than in other areas such as foodstuff or household items..

Bee Chen

Nowadays more and more luxury brands are developing real children lines of apparel, this is so diversified and deserved to be considered for new brands entering the Chinese market.

Cindy

Who are China’s biggest distribuution companies for Kids Apparel?