“You keep your age at the moment you have started to use anti-aging cream,” a Chinese customer said. She didn’t invent it by herself but someone else has told her this before. In fact, “anti-aging” is one of the top keywords searched by Chinese female customers. This consumer group is leading many sectors of the Chinese market. In fact, Chinese Millennial female shoppers are believed to be China’s most important consumers.

Although it is said that ‘women hold half the sky’, in China it’s actually not entirely correct. According to a report by HSBC Bank, women account for three-quarters of household purchasing and they spent $1.2 trillion in 2022, with much of this number being spent on themselves. In this blog post, we will take a look at the she-economy in China, trying to understand the phenomenon of female shoppers.

The Overview of the ‘She-Economy’ in China

Young Chinese women spend more on themselves than ever before, pursuing self-improvement and a positive lifestyle. Most Millennial and Gen Z women in the biggest Chinese cities work, earning good salaries for themselves. According to Dao Insights, more than half of the total purchases made by women go towards those intended to please female buyers.

According to a report from Quest Mobile, Chinese female consumers have an 84.3% online shopping penetration rate. Apart from being responsible for household purchasing decisions, they also want to improve their personal lives, spoiling themselves with high-quality cosmetics, luxury clothes, gym memberships, and education.

In fact, according to JD’s report released on International Women’s Day in 2021, 75% of purchasing decisions in China are made by women, and they are not reserved only to ‘women’ products, but also in those industries typically dominated by male consumers before, for example; strength training equipment.

What are the common phrases among Chinese women?

For people who work in marketing and advertising, it is important to know Chinese women’s preferences and expectations to succeed in China. They are known to have an important purchasing power but you have also to keep in mind what demanding consumers they are.

- “A woman must be good to herself”

- “Smart women live for others and live for themselves”

- “There are no ugly women in the world, only lazy women”

- “Don’t rely on anyone else, only on yourself”

- “ To be capable of being independent thinking, independence emotionally and financially”

Those pieces of advice, or values, have been spreading among Chinese women for years and it is translating more and more into action nowadays. Female consumers in Mainland China want to invest in themselves, far more than their male counterparts.

Why the She-Economy is Growing in China?

Women in their 20s and 30s now are less hesitant to spend than the previous generation. Most of them get a tertiary education, even the ones in lower-tier cities, and they want to invest in themselves, purchasing luxury goods, fitness, health, and beauty. There are some reasons related to this fact;

The need to become self-sufficient

Actually, they are not all the same (it would be too easy). Chinese Women nowadays are becoming more and more independent. They chase after the feeling of safe but they don’t only rely on a man. Having the capacity to buy what they want, to full their everyday needs, and live the way they want are very important things for a lot of Chinese women. They have financial independence and they don’t want to be associated with gender stereotypes, living the life they want instead.

Cosmetics and beauty products are sometimes pricey, but they think of it most as an investment in themselves. Many of female consumers are dropping 40% of their annual salary on high-end skincare products such as Lancome, SK-II, Clé De Peau, and La Mer. As they say: “It’s not your fault if you are not pretty before you are 20 years old. After 20 years old, if you are still not, then it’s your own fault !”

They want to invest in themselves to look young

According to a joint report released by Tmall and Kantar, Women from 20 to 29 spent 2.6 times more than last year on eye gels and creams. The new Chinese women have become the biggest consumers of cosmetics and skincare. They invest more in anti-aging, and anti-pollution products, they take care of the skin of their babies, and they also buy dietary supplements for skin and hair.

In fact, the societal trend has changed a lot. Young people nowadays have better living conditions and are more informed about products on the market. They want to purchase the best, or at least the one that is considered as good.

Higher disposable incomes

Along with economic development, and social evolution, women are earning more than before. If the previous generation always wanted to set money aside for their children, worrying about the future, and not engaging that much in consumer spending. Now young Chinese see more spending as “investments”. The family’s situation has also increased for a lot of these young people, allowing them to have fewer economic difficulties.

Increase in health-conscious

The trend shows that Chinese women nowadays value health-related products over branded luxury goods. The data from the Kantar report showed their investment in health products was significantly higher than what they spent on handbags priced at more than 1,000 RMB. Chinese tradition equates beauty with white and fine skin, giving a good complexion.

Female consumers invest in natural cosmetics and dermo-cosmetics, dietary supplements, wellness, and yoga, or other activities. They also spend more on good-quality healthy food.

A mentality of “starting early”

As we said before, this idea is well-shared among young Chinese women. The earlier you start taking care of your body and mind and the less worried you will be when you grow old. This is why female consumers in China invest in anti-aging products before 30, they train, eat healthily, and educate themselves as early as they can afford it so that they don’t lose any time.

Although it’s similar now in the West, the fact that China is a very competitive country and the beauty ideals nurtured for centuries push this trend way further than in the West.

Millennial celebrities

We can also call them KOLs which means Key Opinion Leaders, which are Chinese influencers. They are very popular on Chinese social media and are leading the trends in today’s China. They share tips, products, advice, or reviews with their followers.

Chinese influencers have huge power over the shopping decisions of Chinese society, especially female shoppers who spend a lot of their time scrolling WeChat, Xiaohongshu, or Douyin in search of inspiration. KOLs are the driving force in e-commerce nowadays and they are also responsible for the rapid growth of easily-influenced female consumers with financial autonomy.

Which Product Categories Have the Greatest Potential When it Comes to Chinese Female Consumers?

Although the potential is almost everywhere when it comes to Chinese female consumers, we will list some sectors with the greatest opportunities;

Jewelry and accessories

Jewelry is one of the most promising markets in China and it’s all thanks to female consumers, who buy a lot of pieces for themselves. Although before jewelry was bought only for special occasions, now women invest in it just to feel good, treating it as an accessory to their outfit.

And we are not talking only about high-status women, like managing directors, doctors, and so on. In the past years, thanks to social stability, female consumers from lower-tier cities also joined the market, engaging in jewelry consumption.

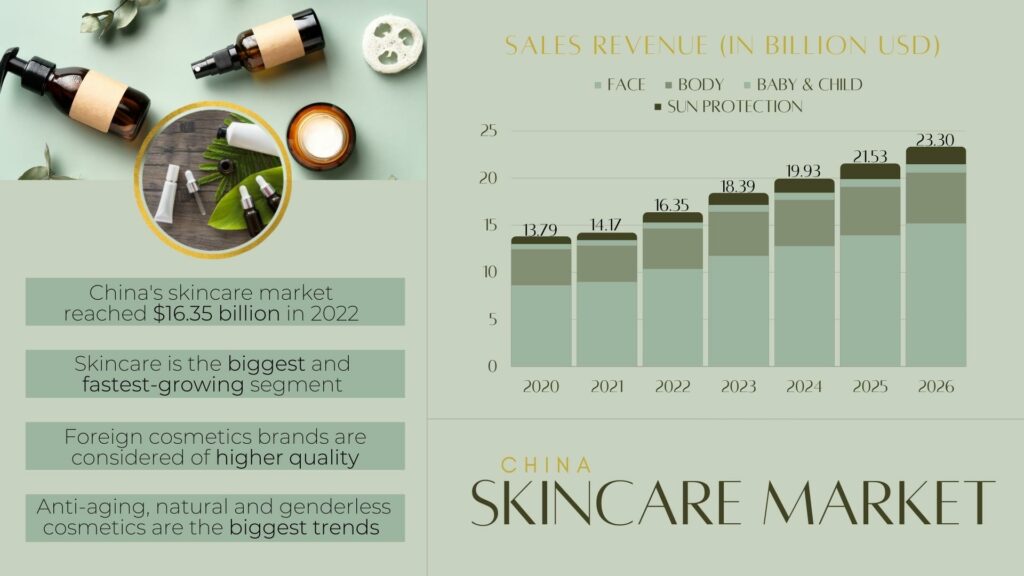

Beauty and cosmetics

We mentioned cosmetics earlier, it’s one of the sectors that has seen sales rise even in the past year, despite the COVID-19 pandemic. Chinese people are more health conscious, and they want to invest in their looks. They buy a lot of premium skincare, willing to spend more on cosmetics, especially dermo–cosmetics, that can improve their skin.

Another industry in the beauty sector are perfumes, which has been on the constant rise in recent years. Perfumes in China are also a good market for niche brands, as Chinese people are looking for novelty and want to be unique.

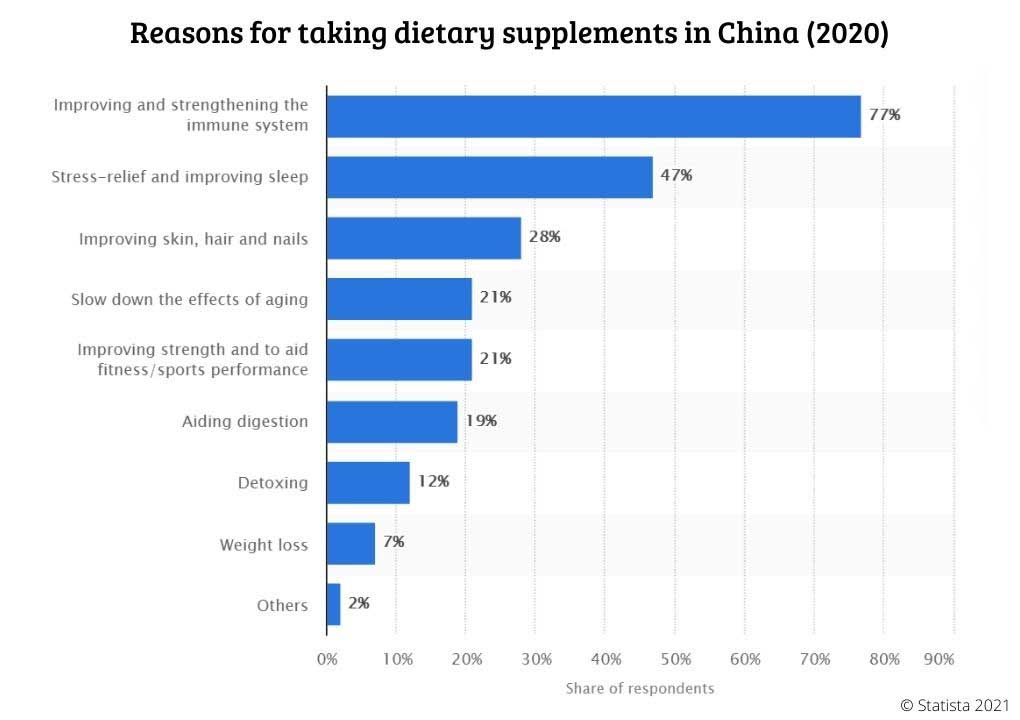

Dietary supplements and beauty drinks

As part of being more health-conscious thanks to the COVID-19 pandemic, health and dietary supplements are also seeing explosive growth, reaching 299 billion yuan in 2022. Chinese women buy dietary supplements to lose weight, improve their strength and immune system, improve their skin, hair, and nails, release stress and improve the quality of sleep.

They invest in tablets but also nutri-drinks, especially those that do some fitness or other sports. They are shifting towards preventing diseases instead of just curing them, taking probiotics, and living a healthy life.

Maternity and baby products

As many of those female consumers are mothers or are planning to become mothers soon, they invest in maternity and baby products. Many of them have only one child, whom they want to spoil with the best care and products, investing big amounts of money in baby skincare, imported infant formulas, baby clothes, and toys. They are willing to spend more for foreign products, that are trusted to be safer and better quality than domestic ones.

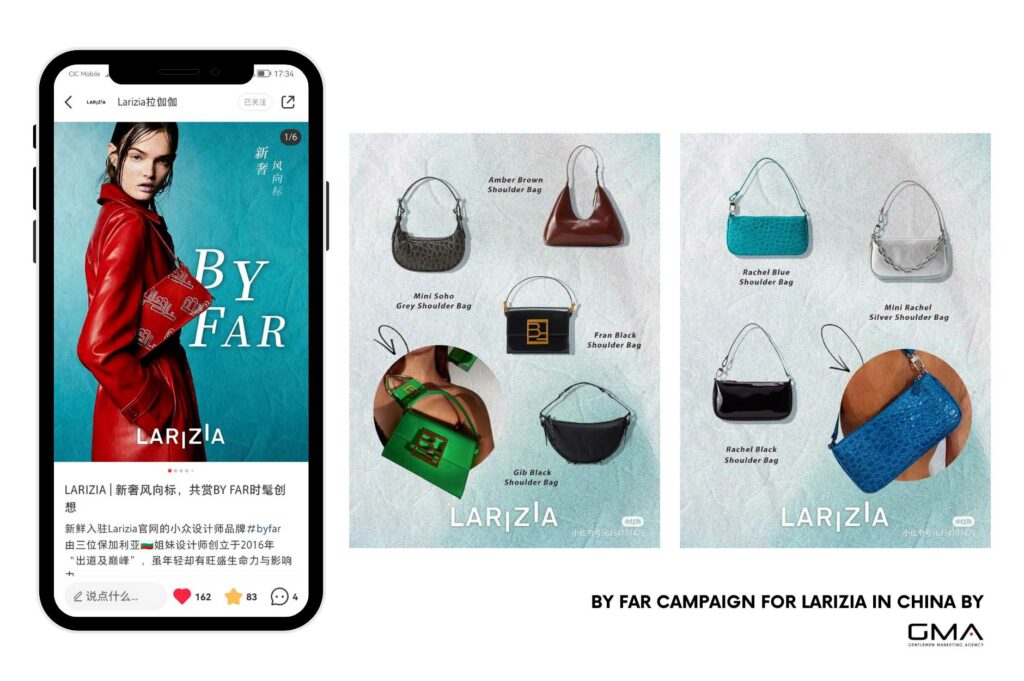

Luxury fashion, athleisure, and sustainable clothes

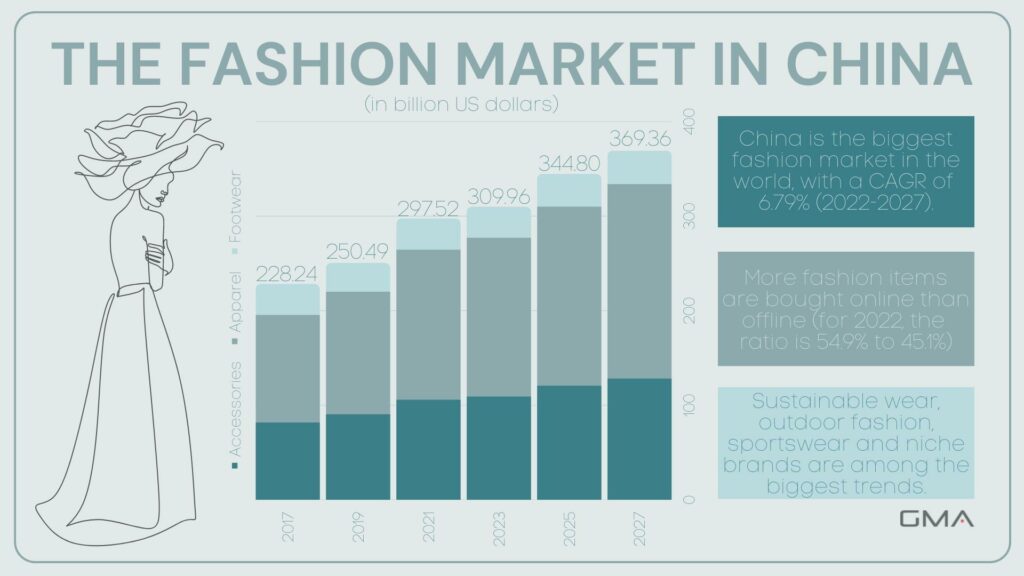

The Chinese fashion market is the biggest in the world and all fashion brands dream to become big in Mainland China. Chinese women value good quality and they love to spend on luxury clothes and handbags that can show off their status.

But nowadays there is also a shift visible among younger generations, that are turning towards sustainable fashion and second-hand clothes, a market that is only at its beginning, ready to be tapped.

Another trend, also seen in the West thanks to the pandemic and home office work is athleisure and comfortable, casual wear. Female consumers buy more sports clothes and sneakers than ever before, partially due to the fact that they train more, doing yoga, pilates, weight lifting, jogging, and so on, but also due to the fact that it’s more comfortable and casual, preferred by young generations.

How to Reach Your Female Consumers in China?

Your answer is definitely: ONLINE. Chinese people are very connected online. They use a lot of social media to be informed about the latest trends. When it comes to female consumers, there are two applications you must know about.

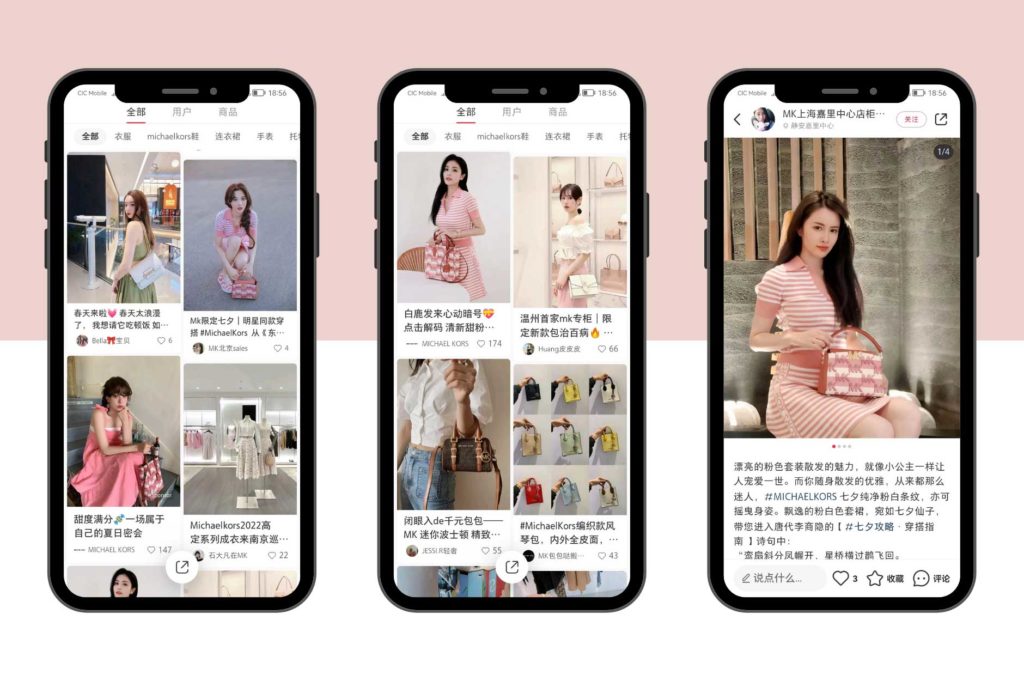

Xiaohongshu

Xiaohongshu also called “Little Red Book” is a Chinese platform focused on user-generated content. It is an application of social e-commerce created in 2013 by Charwlin Mao. It provides its users with a platform to buy products, and share shopping tips, and promotional offers. This creates a community of trust sharing the same ideas.

The target heart of the app is a female target in search of the best deals. The segments bearing on the application mainly concern beauty products and ready-to-wear. It’s also one of the best platforms for Chinese influencers.

WeChat is the main app for communication in China. A lot of brands, even luxury brands are leveraging wechat for their business in China. It’s an unavoidable app where users can share their activities, and follow the news from the brand account they have subscribed to. As clients, they can ask for services or information about their brand. As a company, it allows them to be in touch with their target consumers and to promote in a more efficient way.

It is important to go digital as Chinese people are more present nowadays online than in physical stores. In order to build your awareness and reputation, which are very important to get more leads than consumers in China, you will need to ensure an online reputation and manage your SEO.

Need Help with Attracting Female Consumers to Your Brand?

We are China digital agency with more than 10 years of experience in the market. We helped over 600 small and big brands in their growth in the market in China. We can help you reach Chinese women and prepare the best marketing strategy for your brand.

Here are some of our case studies in the fashion industry:

Don’t hesitate to leave us a comment or contact us to discuss your project in China. We offer a free discovery call with our expert, where we will learn about your brand and prepare an offer of the best options for the growth of your business in China. Let’s keep in touch!