Humanity has a long history of the pursuit of fragrance. Modern perfume originated from Europe, with the local presence of Noses who can create wonderful scents for the perfume industry. In ancient China, there is also a strong history of fragrance brought by the Wei Dynasty and reaching a peak with the Sui Dynasty and Song Dynasty. In recent years, China was often left behind compared to the use of perfume in Europe, especially in France and Russia. The majority of international brands left this market aside. But what if China was the next market of opportunities for perfume?

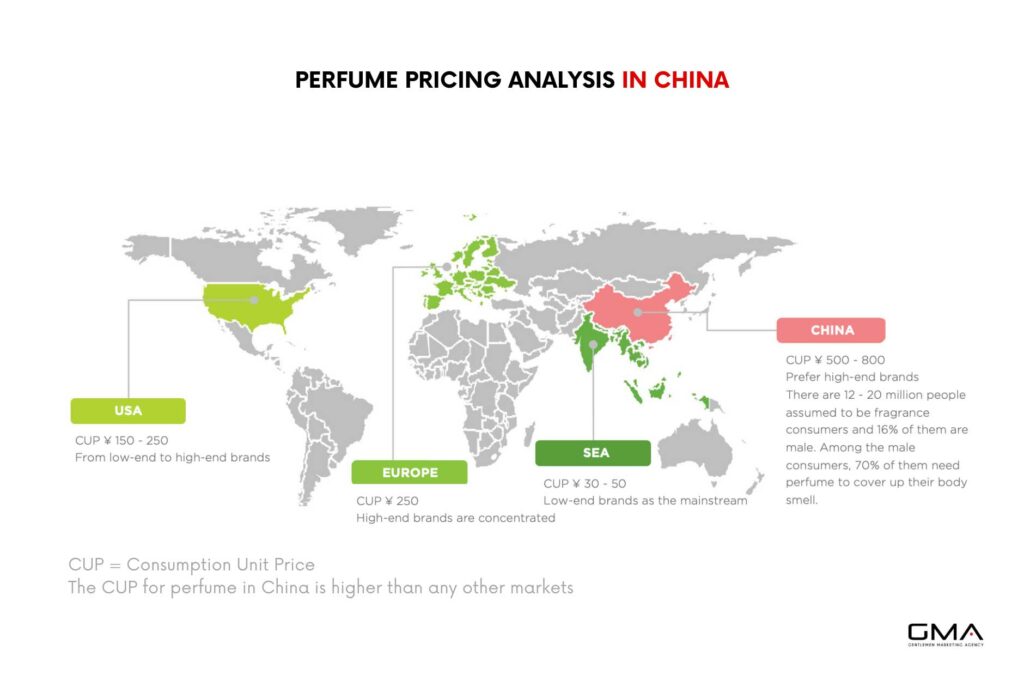

The Consumption Unit Price (CUP) is the Highest in China

The latest reports show that the Chinese fragrance market is growing at a CAGR of 14.9% from 2015 to 2020. In 2022, perfume sales in China are expected to reach up to RMB 16.9 billion. Compared to other markets, Chinese perfume consumers are fewer but purchase at a higher consumption unit price. This consumer behavior is very different from Europe where the concentration rate of consumption is high, but the consumption unit price is low.

In China, perfumes have become one of the hot commodities on the annual Double 11. Both on e-commerce and offline, distributors and retailers propose perfume collections with offers. The Chinese government even feels that China is ushering in its own olfactory economy. Hence, the country is supporting the rising Chinese perfume brands in their local development and overseas.

Read more on the The top 5 Chinese fragrance brands to know in 2022

Rising Trends in the Chinese Perfume Market

Young Generations are Driving the Fragrance Consumption

The perfume market is entering a period of rapid growth, and one of the core aspects of this is the youthfulness of consumers, especially the trend-loving and trend-chasing Generation Z who is beginning to inject new energy into the perfume market.

Among them are mainly female consumers, with age levels of post-85, post-90, post-95 and other young consumers, and even post-00 consumers are on the rise. The young generation is awakening to self-awareness, and fragrance with its delightful aroma, representing the tone of sophisticated life, which teases the nerves of young people and attracts more and more young people to be obsessed with fragrance products. They mainly drive the market with genderless and niche fragrance brands.

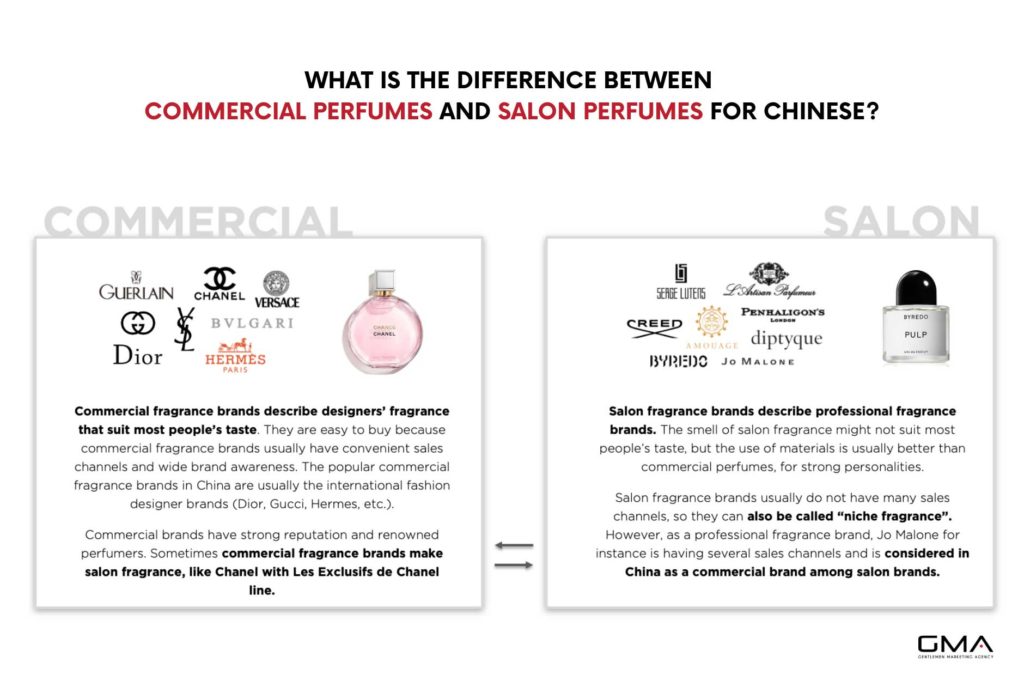

Commercial Fragrance vs Niche Fragrance in China

Today in China, local perfume consumers are from a generation that seeks individuality in consumption. The major leaders in the fragrance industry such as Dior, Chanel, Armani, and Givenchy are considered to be “commercial perfumes”. The Chinese term of “commercial fragrance brands” describes designers’ fragrance that suit most people’s taste and that can be easily purchased in the majority of retail sales channels. The notoriety and success of these brands reach a tipping point: for Chinese consumers “宁愿撞衣,不要撞香”, meaning “it is better running into people with the same clothes than running into people with the same scent”.

In China, the Gen Z does not want to be like everyone else, and are looking for a way to differentiate themselves. The core criteria behind purchasing a fragrance is not the notoriety but the personality. The less people know about a perfume, the more people will buy it. Compared to the uniformity of international brands, Chinese people are becoming more interested in woody, maritime, and herbal niche fragrances. International brands from France, Italy and Switzerland are still their favorite countries of origin but they are also enthusiastically purchasing Chinese perfume brands.

The Guochao trend is driving the Chinese perfume brands, with a tough competition between local and overseas brands. In general, Chinese perfume brands are known for their poetic and oriental names, incorporating traditional Chinese plant fragrances such as jasmine, gardenia, white magnolia, and bamboo. Some of them are mixing the Western and Oriental worlds with niche fragrances made of ink and incense, which are sought after by many Chinese consumers.

The Strong Appeal of Perfume Samples

Perfume samples have become a trend in the Chinese fragrance market. International brands such as Creeds and Maison Margiela generate at least 50,000 to 250,000 RMB in sales only with their samples.

The fact that the Chinese love perfume samples is a good indicator that shoppers are increasingly looking for value for money. Before purchasing a full size bottle, Chinese consumers will always try out samples. This local consumer behavior is due to the importance of e-commerce in perfumes sales. When they purchase online, Chinese netizens purchase several samples to try at home. Depending on their preference, they will then commit to purchase. The consumer journey is different due to local habits and the non-returnable nature of the perfume on Chinese e-commerce platforms.

How can Perfume Brands Rise in China?

1. Understand the Chinese Perfume Consumer

Most Chinese perfume users, more than half, use perfume every day. The main occasions are during weekdays or important times for school dates, where perfume holds everyone’s name like a social business card. So, for TA of perfume users, should represent their own personal style and highlight their unique taste. Whether you are marketers, CEO or business executives, you need to understand your local TA (target audience) and share unique storytelling on the conception and universe of the fragrance.

2. Highlight Genderless Fragrance on Social Media

Both Chinese men and women are likely to purchase the same fragrance, despite the gender written in your collection. Chinese perfume lovers are no longer bound by the traditional male and female fragrance labels. Genderless or unisex perfumes with blurred gender lines and minimalist packaging are the new hero products in China.

In the meantime, the popularity of the national trend culture called Guochao has encouraged perfume brands to use oriental concepts to cater to Chinese consumers’ quest for Chinese elements. If you want to engage better with your Chinese audience, you can incorporate tradition into creativity and drawing on traditional Chinese culture. You can implement such campaigns for Chinese festivals such as Chinese New Year.

For instance, Bvlgari has a customised add-on, with five precious fragrance materials as the main body. Local consumers can change the order and number of sprays of fragrance through any add-on combination, presenting a personalised taste level.

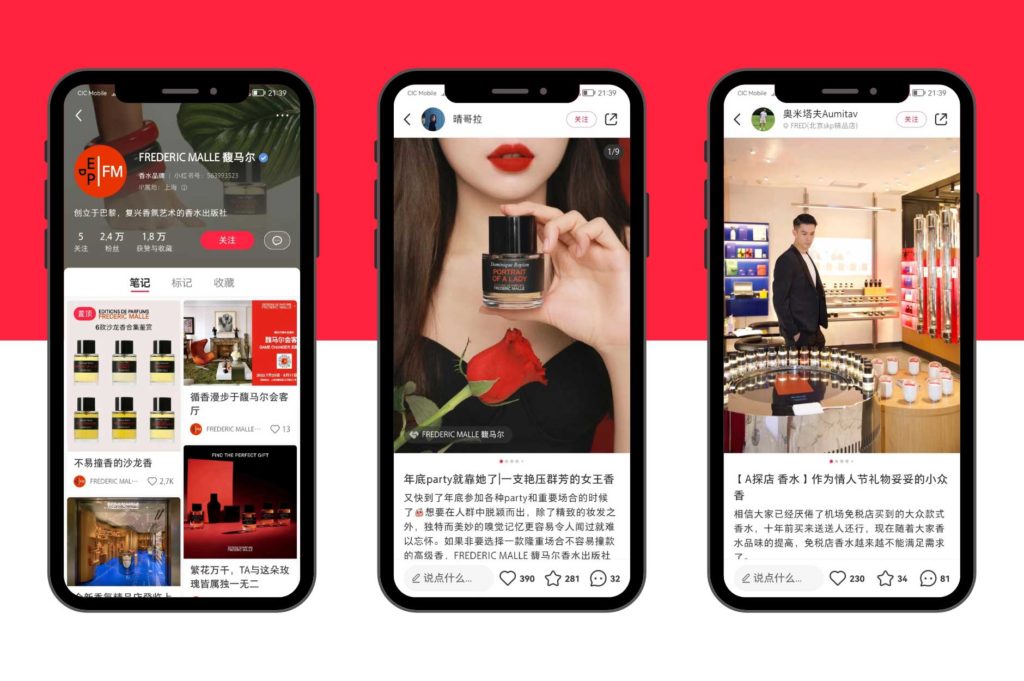

3. Boost your Online Reputation with Little Red Book

Little Red Book is a key social media in China to promote perfume. You can put emphasis on KOL content from pictures to videos. The microblogging function can also encourage users to highlight their buying experience, offline installation photos, sharing, interaction and communication between consumers, invariably for the brand to do promotion. The key feature to use is the SEO (Search Engine Optimization) on Little Red Book by using the right keywords and the right hashtags to appear on users’ feeds.

4. Propose Samples on your Tmall Store

Among the different e-commerce platforms in China, Tmall is the main platform where Chinese perfume consumers make their purchase. Before starting on this platform, you will need to register your store and follow the audit process of Tmall. We recommend to open a Tmall Global store instead of a Tmall store to avoid the product registration that could be complex in China. You can also benefit from the logistics partner of Tmall that can handle “dangerous products” containing alcohol, such as perfume. We are TP (Tmall Partner), we can help register your store, from the setup to design and management.

If you want to increase the traffic of your official flagship store, you should display your China assortment including product pages dedicated to samples. The registration and the logistic process for samples is different from regular products. To implement this strategy, it is recommended to find the right TP who knows how to setup, register, and organize samples sales.

5. Find the Right Partner

So to enter the market it is advisable to focus on educational campaigns for now, less abstract than those that can be seen in the West they tend to work better. Note also that as new consumers, the Chinese are reluctant to wear strong fragrances. So at the moment, the lighter the better.

If you have a project to launch your perfume brand in China, you can contact us

Read more: