In 2022, the traditional sales channels for watches brands faced a great evolution from a structural and cyclical perspective. Chinese consumers have been engaged in a highly competitive market with tons of domestic and international brands fighting for market shares. Based on our daily experience, these are the latest 3 trends changing the face of the market:

1. DTC Model is taking the lead over B2C

For fashion watch brands, the traditional distribution model is not working as well as DTC (direct to

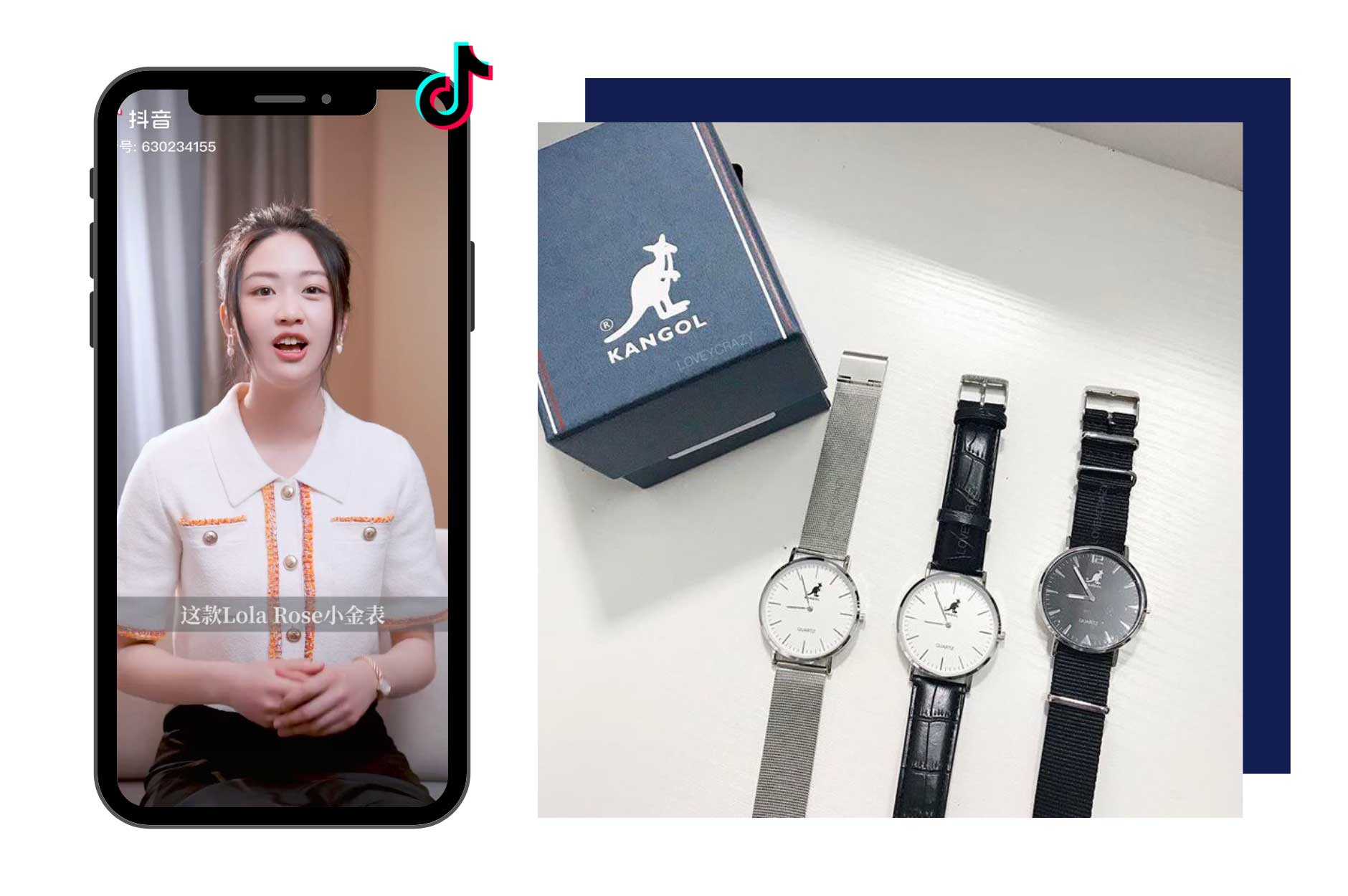

consumer) model. Those brands taking traditional distribution model with wholesalers, importers, and distributors are facing several issues such as low or no sales increase, cheap copycats (sometimes by distributors), and lack of quality control (some distributors resell the defectives again to the market) which will over straw the brand reputation. As for the successful brands in China today, they are mostly DTC models, such as Lola Rose. They have strong branding control on each channel, from pricing to quality.

2. E-commerce dominates the market and Douyin is taking the market from Tmall

According to the magic mirror market intelligence data, during the Tmall 618 promotion period, European and American watches recorded a turnover of 151 million RMB. In 2021, they recorded a turnover of 277 million RMB in the same period, with a year-on-year decrease of 45.5%. The Tmall fashion sees that the top 20 European and American watch lists in 2022 and 2021 have not changed much. Most of the European and American watch brands such as Armani watches, Daniel Wellington watches, and Lola Rose watches all decreased in this year’s promotion.

In the meantime, according to data provided by Nint Rentuo, a digital retail data service provider, the

sales of watch brands in the top 20 watch brands in terms of turnover on the Douyin platform during the 618 shopping season this year almost doubled compared with the previous year. The number one watch brand is called Clarence Mok, which originated from Malaysia, this brand reached a turnover of 97 million RMB, becoming the watch brand with the best performance on Douyin during 618 this year. Compared with Kangol, the watch brand ranked first in Douyin in 2020, and the turnover during the Douyin 618 promotion last year was 15 million RMB.

3. Smartwatches are taking the share of the market

For traditional watch brands, the market share remains important with automatic and quartz watches.

Chinese consumers are favoring unique patented technology in traditional watchmaking and smartwatches. Compared to previous years, smartwatches are getting more popular with a strong interest in health-related features.