Are you curious about how e-commerce is impacting fashion brands in China? In this blog post, we’ll explore how Chinese consumers are shopping for clothes online and what that means for the future of fashion consumption in China. Stay tuned!

Comparison of retail media markets in China and the US

40.7% of China’s digital ad spend is directed to the e-commerce channel in 2022. This includes ads sold by retailers such as Alibaba and JD.com. This is more than the US share of 14.5% of digital ad spend. This spending will be on e-commerce channel ads from retailers such as Alibaba and JD.com.

Key trends in Chinese e-commerce in 2022

Sustainability, Generation Z consumers, and live streaming are the keywords for e-commerce this year.

As the impact of climate change affects consumers’ shopping habits, sustainability is at the forefront of retailers’ minds.

Alibaba Group, an e-commerce platform, said it would reduce its carbon emissions by 1.5 gigatonnes by 2035 through partnerships with merchants. Cainiao Network, a logistics company, aims to ship packages in more environmentally friendly packaging and encourage box recycling.

Many second-hand markets are thriving, such as Idle Fish, which sells everything from second-hand designer clothes to used electronic gadgets.

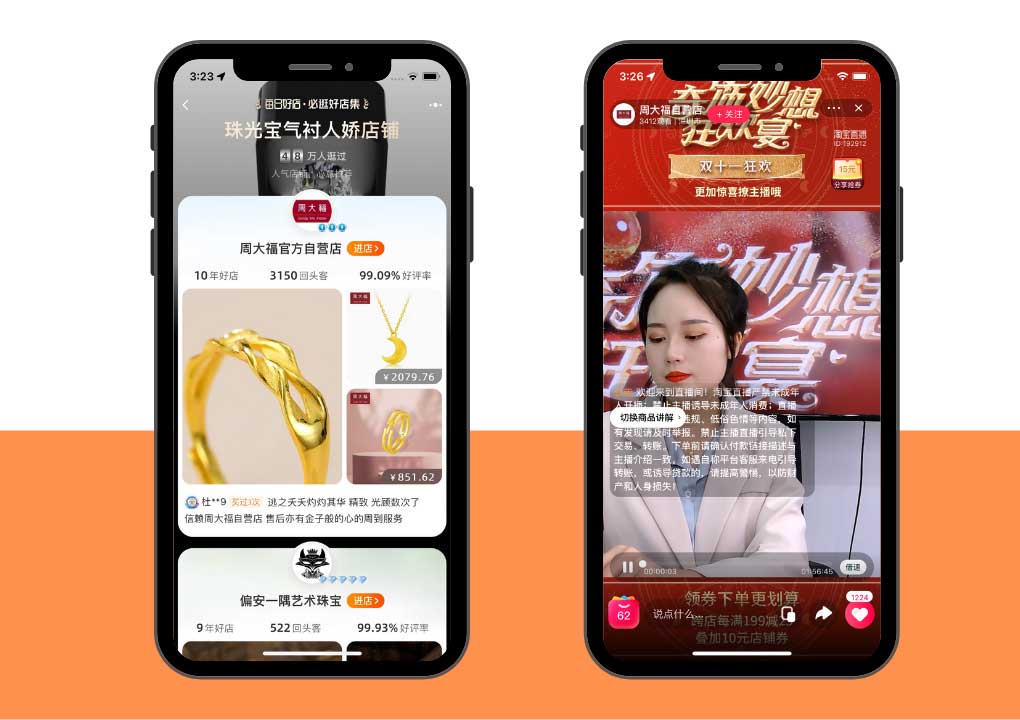

When the coronavirus pandemic devastated their markets, international brands turned to China. We showed how retailers such as Cartier, a French luxury jeweler, and Tod’s, an Italian designer of high-end moccasins, were able to overcome language and cultural barriers and expand into China’s second-largest country using tools such as live streaming and Hey Box.

In 2021, Generation Z and Millennials were the trendsetters in e-commerce, driving a wave of innovation in subculture fashions and gender-neutral fragrances.

Readers’ imaginations were captured by digital tourism and travel during this pandemic. Livestreaming was used by cultural institutions around the world to preserve their reputation. Spectators were not allowed to attend the Tokyo Olympics, and they were not allowed to travel to Beijing in February. The world’s biggest sporting event is moving online, and Beijing 2022 is the most digital Game ever.

With the increase in the gross value of goods, shopping holidays such as 11.11 or 6.18 remain important dates in the retail calendar. As e-commerce became more important in the world’s second-largest economy during the pandemics, retailers sought to build customer loyalty throughout the year.

Key trends developing among China’s young and connected consumers

Although they represent only 15% of the Chinese population, Zoomers account for 25% of spending on new brands.

China’s young, affluent urbanites are shaping the country’s future consumer market. What they want today will become a mass-market tomorrow.

Based on data and insights from the Alibaba Group ecosystem, we have compiled the key trends that international retailers should pay attention to.

A number of brands have been successful in the second largest country due to the rise of wellness and self-expression products.

Because of their strong influence on consumer trends, we have focused on the buying habits of Generation Z (also known as Zoomers). Zoomers account for 25% of all new brand spending, yet they only constitute 15% of the Chinese population.

Alizila scoured the halls of Alibaba’s annual offline event, the Taobao Maker Festival. (TMF) for the retail entrepreneurs who embody our Top 5 emerging trends.

Due to the pandemic, glamping in China has become a common phenomenon.

Many people are choosing to travel within the country this year due to restrictions on international travel. The 2018 TMF was highlighted by a high-tech glamping tent. It offers a more luxurious experience than traditional camping and even an outdoor movie night.

This trend was also apparent online, with people buying all sorts of glamping-related gadgets and items on the B2C marketplaces of Alibaba, Tmall, and Taobao. These range from retro gas lamps to fancy barbecue sets. Glamping saw a 130% year-on-year increase in sales during Alibaba’s 6.18 mid-year shopping festival.

Fishing is also very popular this year. More than 300,000 people ordered fishing items on an average day on Alibaba’s e-commerce platforms between June 18 and June 19. According to the latest statistics from Tmall, more than 2 million people aged 26 or younger bought fishing gear last year.

Surfing is another outdoor activity that became very popular last year. This year there has been a 40% increase in the growth of the category for this year’s 6.18. Recent social media trends have made taking photos from a surfboard a must-do activity for young people.

Young consumers are more likely to eat snacks than traditional meals and are constantly on the move.

According to a 2020 survey by Dingxiang Doctor (an online health information platform), 89% of Chinese consumers are open to meal replacements.

According to CBNData, a joint study by Tmall and the Shanghai-based industry research firm, the top three reasons people buy meal options are convenience, weight loss, and nutrition.

“Many consumers are now health-conscious. They want a healthy product, something they can enjoy, but that is also low in fat and calories,” said William Wang, founder, and CEO of Nice-Cream in Beijing. The brand focuses on healthy desserts and snacks.

Wang believes that consumers will continue to demand healthier foods and better ingredients. His start-up’s broccoli-flavored ice cream was one of the most delicious and nutritious treats at this year’s TMF.

Young female shoppers find gender-neutral flavors both empowering and appealing.

The gender-neutral flavors developed by Shanghai-based Boitown were a hit at the event, especially with the female audience. The brand plans to offer its customers more mixed options.

Boitown has noticed that fragrance trends in China are shifting from a tool for masking body odor to a way for people to express themselves. Yang Mengting is Boitown’s brand and marketing director.

We have launched a range of fragrances that reflect five distinct but fun personalities. Yang explained that each type of fragrance evokes the emotions of being single, falling in love, or the smell of money and success.

Four years ago, China accounted for only one percent of global fragrance sales. Today, market research provider Euromonitor estimates the Chinese market to be worth RMB 10.9 trillion in 2020 and RMB 30 trillion in 2025.

“Generation Z is a unique demographic. This generation of young buyers is very much about self-expression. Yang explains that they look for variety and versatility in fragrances to set themselves apart from others.”

Boitown’s products cost less than those of international competitors. The brand has successfully leveraged e-commerce platforms such as Taobao or Tmall to reach digital-savvy consumers, especially female shoppers aged 20 to 28.

Nutricosmetics is a growing trend in the beauty and food industry

Traditional Chinese Medicine (TCM), which includes goji berries, dates, and motherwort, was strongly represented at the event. These ingredients were used in tea, coffee, cakes, and edible jellies.

TCM has been practiced for thousands of years. Young Chinese consumers are increasingly aware of the benefits of TCM for holistic healing.

Nutricosmetics is a growing trend in the field of beauty and food. It uses natural ingredients and TCM concepts to improve your appearance. To appeal to Chinese customers, even major international brands such as LVMH are investing in TCM-inspired beauty products.

TMF was founded by Tong Ren Tang, an ancient Chinese pharmaceutical company dating back to 352, and they have infused their heritage brand with coffees and lattes made from several of their signature herbs.

The most bitter tonic, a combination of Indian echinacea and iced Americano, was very popular with those with more adventurous palates. Although this drink is anti-inflammatory, it has a bitter aftertaste that appeals to the Chinese belief that all good medicine tastes bitter.

Subcultural fashions are becoming increasingly popular among young fashionistas.

The young Chinese generation is looking for alternative fashion options and is increasingly interested in boutique brands and niche products. The number of merchants joining Taobao has seen record growth between 2017 and 2020.

Many young people showed up at TMF in Hanfu, which was the largest and most visible subculture of TMF.

New fashion trends emerged online due to their passion for the roots of Chinese culture. According to Alibaba’s statistics, annual sales of this category on Tmall grew by almost 500% in 2020. In the same year, more than 1,200 brands on Tmall began incorporating Hanfu elements into their designs.

Fashion styles from the 2000s are making a comeback for more striking looks: crop tops and low-rise jeans are making a comeback, as well as unnecessary layering, pink, and neon glitter.

Many Gen Zers and millennials can now relive the “good old days” with Y2K fashion.

Alibaba’s Taobao deals are gaining popularity with China’s army of bargain hunters

China has 286 million rural migrants like Dai, and many are turning to e-commerce to buy quality goods on a budget. These workers are among the more than 600 million Chinese internet users who have a monthly income of between 1,000 and 8,000 RMB (£157 and £1,254).

Migrant workers are not the only ones using bargain apps. To save money, consumers in China’s smaller cities are turning to e-commerce.

Taobao Deals launched in 2020 and has since amassed more than 240 million annual active users as of September. According to Beijing-based internet intelligence firm QuestMobile, it was the fastest-growing smartphone app in China in terms of user growth last year.

- Shaking up the supply chain

Because of China’s size and importance, trade relies on a complex network of wholesalers and distributors to deliver goods to consumers.

Trudy Dai, president of industrial e-commerce and community e-commerce at Alibaba, said that “the only way forward is to radically streamline and transform this inefficient circulatory model.”

Enter Taobao Deal’s manufacturer-to-consumer (M2C) model, which connects factories to buyers more efficiently and less expensively than traditional supply channels to bring affordable quality goods to market.

Daniel Zipser (senior partner in McKinsey’s Greater China office) explained to Alizila that there is direct connectivity along the entire value chain. It’s both exciting for consumers and interesting for manufacturers, especially in terms of reducing inventory.”

Wang Weiping is the founder of Changsha Jianbu Daily Necessities, a platform that sells basic necessities in central China’s Hunan province. He initially sold his goods through an intermediary but struggled to gain exposure until he joined Taobao Deals 2020. He was able to sell directly to customers and can focus on production while the platform takes care of logistics, marketing, and customer service.

He noted that Taobao Deals is easier than other platforms to manage operations, which is very important for factories.

This entrepreneur has reduced his overhead costs by selling directly to customers. He also saved money by using bonded warehouses managed and maintained by Taobao Deals as well as by Cainiao Network, the logistics arm of Alibaba.

Wang’s first product was a bleaching powder. He sold over a thousand boxes a day on Taobao Deals. The company reported 100,000 RMB. In the first month, it had 100,000 RMB. During China’s biggest shopping festival on 11.11, it recorded RMB 600,000.

- Driven by demand

Zhang Bo, the general manager of Jin Ye Paper in north China’s Hebei province, said the platform has helped him identify changing consumer trends and create the right products.

For example, Taobao Deals led him to make tissues from paper towels. Data analysis showed him how to make tissues in packs of ten instead of packs of eight.

You can also reverse the product development. The Taobao Deals operations team identifies a trend and contacts manufacturers to quickly change the direction.

The platform and manufacturers have co-developed products, including a RMB 14.9 electric toothbrush, ideal for people looking for value for money, and a high-voltage charger for rural areas without power outlets.

Dai, president of industrial and community e-commerce, said Taobao Deals are being adopted by more and more manufacturers.

For the 12 months ending 30 September 2018, M2C orders for factory-direct products were 1.1 billion and 180 million respectively.

- An emergency home

Dai, a construction worker, spends most of the year in Shanghai. He is away from his family. Dai’s five-year-old daughter spotted a princess-themed bag earlier in the year. Her father saved up some money and delivered it to her village.

Dai often makes small purchases on Taobao Deals to support his family. His wife can share links to products that interest her – like a bottle of perfume for 90 RMB – and Dai is quick to respond.

The platform’s statistics show that the average Taobao Deals user places small but frequent orders, up to four times a day. The most popular items on Taobao Deals are fast-moving household items, food and consumer goods. Dai bought the 170 RMB rice cooker for his wife.

Alibaba’s Dai said, “We encourage sharing and interaction between users to increase conversions and repeat purchases.”

The platform offers more than just orders placed and fulfilled. It also allows Chinese families to share their daily experiences, even if they live thousands of miles apart.

Poizon, China’s latest e-commerce platform

An emerging content-to-commerce marketplace, Poizon is a gateway for young Chinese shoppers.

The digital landscape has seen a rise in rivalries. Local e-commerce platforms and giants are diversifying their business models to maximize revenue streams. Some early adopters in the luxury sector have expanded their presence beyond WeChat and Weibo. Social commerce is evolving. That’s why emerging platforms are important. Poizon is a great place: it’s home to China’s largest online streetwear community. It is possible for luxury houses to navigate in the best way.

Poizon is a fashion marketplace that sells authentic shoes, clothes, bags, and watches from luxury brands as well as art. Poizon was originally a content-sharing platform with a focus on streetwear. The platform moved into e-commerce two years later and introduced dedicated authentication. This journey allowed the platform to create its unique business model. It allows for a closed-loop between content and commerce that is clear and efficient. It is based on two pillars: community and shopping.

Every order placed on Poizon must go through an inspection and quality verification process. The seller must submit the products to Poizon’s professional authenticators. Items that pass this process receive a Poizon branded packaging package, which includes an exclusive certificate, tamper-evident cable tie, and custom packaging. Poizon also has the largest collection of AR shoe designs in the world. According to Poizon’s data, 30% of customers use the virtual reality trial function every day. Consumers can feel the size, detail, and effect of the product with their phone camera.

Poizon targets the younger generation and is only available via mobile applications. The posts direct users to order on the spot via purchase links. Users can also share their real-life experiences and style inspirations once they have received the products. This allows brands to build brand equity and create loyal communities.

Almost 90% of Poizon users are members of Generation Z. This generation tends to have a broader view than older generations and a greater interest in quality. They are open to new ideas and like to share their ideas and products with other like-minded people. Poizon is not only an online shopping destination but also a virtual space where you can make emotional connections with other people.

Poizon brands are able to launch their products with a high degree of efficiency, which sets them apart from other platforms. Poizon manages the day-to-day operations, which are often outsourced to third-party agencies. This sets Poizon apart from other social networking platforms. Branded merchants do not have to pay a registration fee, which is a significant advantage over Tmall. All marketing and promotional materials are provided free of charge.

More than 10 global brands are now partners on the platform, including Coach, Kering Eyewear, and Zenith. Coach announced its collaboration in May 2021. The partnership will sell handbags, leather goods, and accessories. It will also offer its range in-store and on the app. Prior to the official launch, limited edition products have also been launched by the American luxury brand. In July 2021, ZENITH, a luxury watchmaker owned by LVMH, unveiled an exclusive set.

There have been a few one-off drops. Moncler’s collaboration with POP MART’s MEGA collection was launched in January 2022. It featured extra-large collectible toys on Poizon as well as its WeChat Mini program. However, the brand has not yet opened an official account.

Most of the products on the platform have been resold. This has led to price variations and questions about authenticity, despite the fact that there is a verification service. However, luxury can help to consolidate brand equity. This has been demonstrated by iconic collaborations such as Louis Vuitton x Supreme or Dior x Air Jordan.

There are many untapped opportunities, given the platform’s young user base and resale potential. According to the market portfolio, the majority of luxury brands are reluctant to open official accounts.

1 comment

Harold

It changes so many things yes…

We prefer to buy online for daily stuff for sure