Ever wondered what it takes to make your fashion brand not just survive, but thrive in one of the world’s largest and most dynamic markets?

China, with its burgeoning middle class and insatiable appetite for luxury and style, presents a tantalizing opportunity for fashion brands looking to expand their global footprint. However, cracking the code to successful branding in China is no small feat. It requires a unique blend of cultural sensitivity, digital savvy, and a deep understanding of the evolving tastes of Chinese consumers.

In this article, we delve into the labyrinth of China’s fashion landscape, where tradition meets innovation, and ancient values harmonize with modern aspirations. We’ll explore the strategies that can help you elevate your fashion branding in this captivating, complex, and ever-evolving market.

Why Invest in Your Branding Efforts in China?

Chinese consumers tend to be more careful shoppers when they buy things online. They know how to spot fake or low-quality products, so they’re choosier about what they purchase. In China, there’s something called the “queuing phenomenon.” It means people are willing to wait in long lines for something they think is good. You might even see them queuing up for a chocolate. Why? Because a crowded place usually means it’s a great place, and the longer the line, the better the product must be.

This also applies to brands. When a brand does well and sells a lot, more people notice it. It becomes a topic of conversation, which is a good thing, as long as people say positive things. Well-known successful brands are usually associated with high quality.

Chinese people now want better quality products rather than just buying a lot of stuff. They care more about their health and the environment. So, if your foreign brand is trusted for its quality, it can really succeed in China.

Surveying China’s Fashion Market Landscape

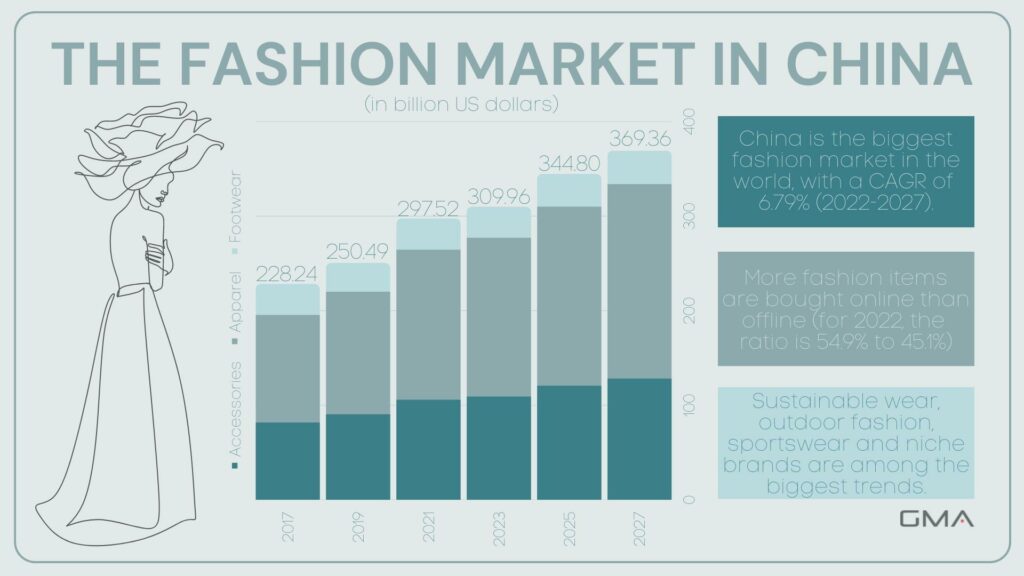

In 2020, China outpaced the USA in the Fashion and apparel Market, marking a significant milestone. Over the past decade, this market has nearly quadrupled in size, reaching a staggering $266 billion in 2022. Impressively, China’s fashion market is continuing to expand at an impressive annual rate of 25%.

What makes China even more enticing for brands is its promising future. According to McKinsey, Chinese consumers are projected to make up 40% of global luxury spending by 2025. With this vast potential market, global brands have the opportunity to engage with over a million consumers by focusing their marketing efforts on China.

The growth in China’s fashion market can be attributed to three key factors: high disposable income, evolving fashion trends, and Chinese consumers’ willingness to invest in high-quality products. These factors have contributed to the remarkable expansion of this market.

Current Trends in China’s Style Scene

Streetwear and Sportswear

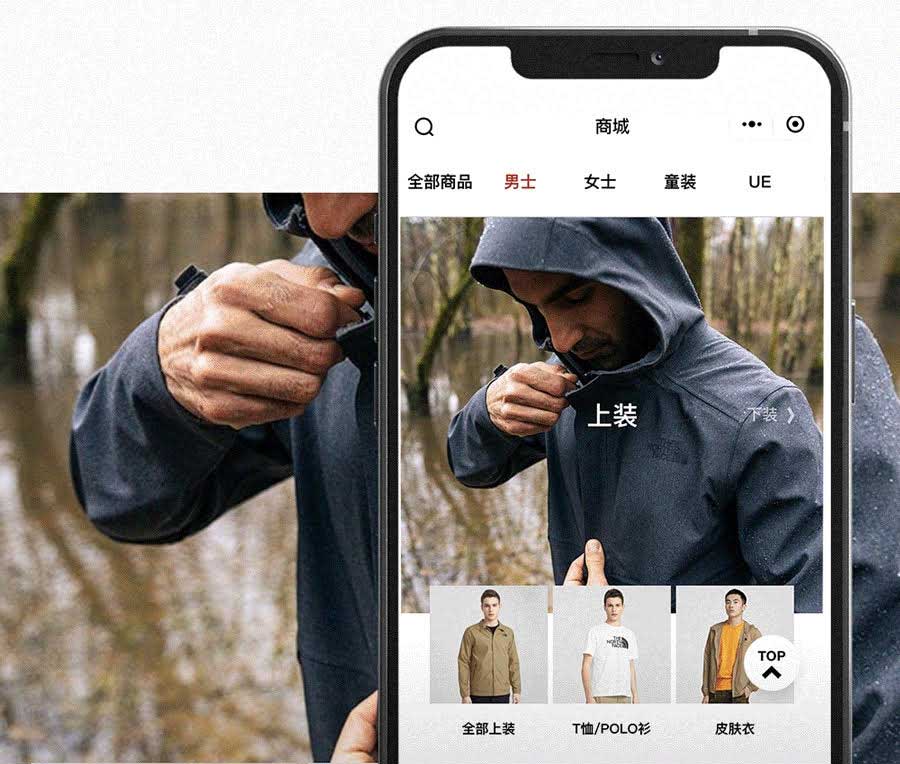

China’s Gen-Z consumers are gravitating towards streetwear and sportswear. This shift reflects a move away from class-based fashion choices and is partly attributed to the comfort-focused fashion adopted during the COVID-19 pandemic.

Fashionable Shoes

Fashionable footwear is a wardrobe essential, and the fashion shoe market in China reached approximately $90.4 billion in 2022. Notably, 60% of consumers contributing to this growth are male, indicating a strong demand for men’s fashion shoes.

Korean Fashion Influence

Thanks to the popularity of K-dramas and K-pop, Korean fashion styles have gained substantial traction in China. A survey found that 47% of respondents consider the Korean style to be very fashionable, making it a consistently trendy and fresh choice.

Gender-Blurring Fashion

There’s a noticeable trend towards gender-blurring fashion in China. Women are increasingly buying suits and oversized blazers, with a 140% rise in sales. Baggy and oversized clothing is also among the top search requests among women, reflecting a broader global trend of unisex fashion.

Sustainable Fashion and Second-Hand Shopping

Chinese consumers are becoming more environmentally conscious. They are buying less and prioritizing quality and sustainability. The popularity of second-hand shopping is on the rise, with influencers and social media accounts promoting this eco-friendly trend.

Luxury Fashion

The luxury fashion segment in China continues to thrive, with a revenue of US$10.54bn in 2023. The market is expected to grow annually by 4.81%. While established luxury brands maintain their popularity, smaller luxury brands are also striving to gain a foothold in the market.

Traditional Chinese Clothing (Guochao)

A return to Chinese cultural heritage is a notable trend. “Made in China” is shedding its negative connotations and becoming a source of national pride. Chinese consumers are embracing traditional clothing with a modern twist, incorporating patterns from the Qing dynasty, traditional qipao dresses, and other elements of Chinese culture. Chinese designers are gaining recognition and offering traditional clothing with contemporary appeal, catering to younger consumers.

These trends collectively reflect the dynamic and diverse nature of the Chinese fashion market, influenced by cultural shifts, technology, sustainability concerns, and changing consumer preferences.

How to Establish Your Brand’s Presence in the Chinese Market

Building a Powerful Baidu SEO & SEM Strategy

To boost your online visibility, start by creating a website in Chinese. It’s essential to host it within China or Hong Kong. These may seem like small details, but they significantly impact your search engine optimization ranking.

In the Chinese market, Baidu reigns supreme as the most widely used search engine, handling over 70% of user queries. In simple terms, if your website is in a foreign language and hosted on a server outside China, it won’t rank well. To establish a connection in China, your online presence should have some relevance to the country.

Maximize Baidu SEM Tools

Explore these 4 Baidu SEM marketing campaigns for a successful branding strategy:

- PPC Campaigns (Pay-Per-Click): Similar to Google Ads, pay only when users click on your ads.

- Brand-Zone Campaigns: Ideal for both big and small brands, offering personalized, high-impact ads on the search page.

- Baidu Tuiguang: The Chinese counterpart of Google Adwords, encompassing search and display options within the Baidu network.

- Baidu Display Network Advertising: Invest in banner ads that appear on external sites, earning money based on clicks.

While Baidu ads may initially be costly for new brands and foreign companies, they become a valuable marketing strategy as your business grows, enabling you to reach new customers beyond existing networks.

Establish Your Presence on Chinese Social Media

In China, having an online presence is crucial for reaching Chinese consumers. Just having a Chinese website isn’t enough; you should also create professional accounts on popular Chinese social media platforms.

WeChat: China’s Top Social App

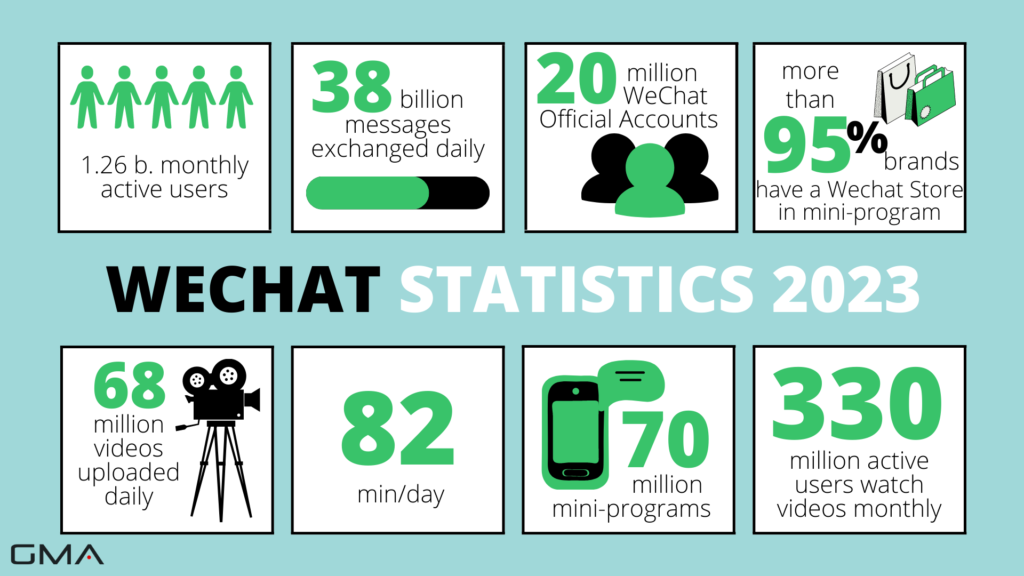

WeChat boasts over 1.2 billion monthly active users, making it China’s most popular app. Initially a messaging app, WeChat evolved into a comprehensive ecosystem of services under Tencent’s umbrella in 2011. Today, it’s a must-have for individuals and businesses, playing a significant role in e-commerce.

With WeChat, you can post articles on the latest fashion trends to keep your customers stylish. You can also share posts and run interactive shopping experiences through mini-programs, helping customers discover new wardrobe additions.

It’s no surprise that renowned big brands like Louis Vuitton, Prada, and Gucci leverage WeChat as a vital marketing tool to connect with shoppers on a personal level, creating a personal relationship with each of them.

Key Tip: Establishing an Official Account on WeChat is essential. While it may seem complex, our experienced team can guide you through the setup process, ensuring you don’t miss a step and helping you manage your account effectively.

Weibo: China’s Powerful Social Media

Weibo, launched in 2009 by Sina Corporation, is one of the biggest Chinese platforms. Named after ‘micro-blog,’ it started as a Twitter-like service but has since incorporated elements from Instagram, Pinterest, Reddit, and YouTube.

Most brands in China commonly use Weibo to share content, promote their brand, and showcase new collections to their followers. Weibo provides access to a vast Chinese audience, enhancing your marketing prospects.

Establishing a presence on Weibo is a crucial step in shaping your desired image, leaving a lasting impression, and showcasing your fashion brand’s unique qualities. However, this is just the beginning. To be effective, your website or official accounts on WeChat and Weibo must be easily discoverable and compelling to Chinese consumers.

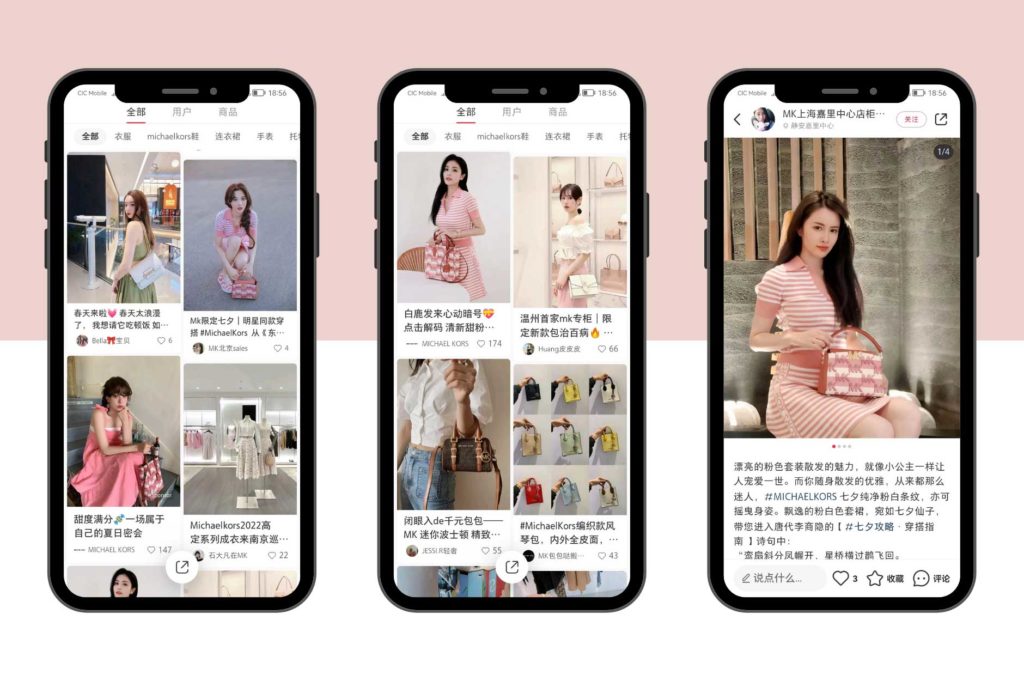

Xiaohongshu (Little Red Book): China’s Instagram

Xiaohongshu, often dubbed ‘Little Red Book,’ is a trendy platform, frequently likened to Instagram due to its content and audience. It primarily features user-generated content, with young women sharing product and service tips and reviews.

For fashion and beauty brands, Xiaohongshu is a valuable platform for brand-building, cultivating a positive reputation, and leveraging word-of-mouth marketing. It’s also the go-to platform for influencer marketing, where influencers can swiftly elevate your brand’s reputation, sometimes within just one day.

Douyin: Short Videos for Brand Promotion

Douyin is a relatively new platform in China, yet it’s already a hit with over 500 million daily active users.

Douyin is all about short videos on various topics. Chinese users love it for quick stress relief, as these videos can be enjoyed anywhere. What’s fascinating is that Douyin now allows you to open a store. Influencers can directly guide potential customers to your store for example through live streaming, making it a valuable marketing opportunity.

Seizing the Chinese Apparel Market with Key Opinion Leaders (KOLs)

In the realm of Chinese fashion, the sway that influencers hold over millennial consumers’ buying decisions has shifted away from traditional media to individual brand ambassadors. These brand advocates are known as Key Opinion Leaders (KOLs) or influencers.

KOLs wield substantial influence over Chinese consumers’ purchasing preferences and can be enlisted by brands for promotional activities. In fact, 72% of Chinese brands express their intent to maintain a strong focus on social media marketing.

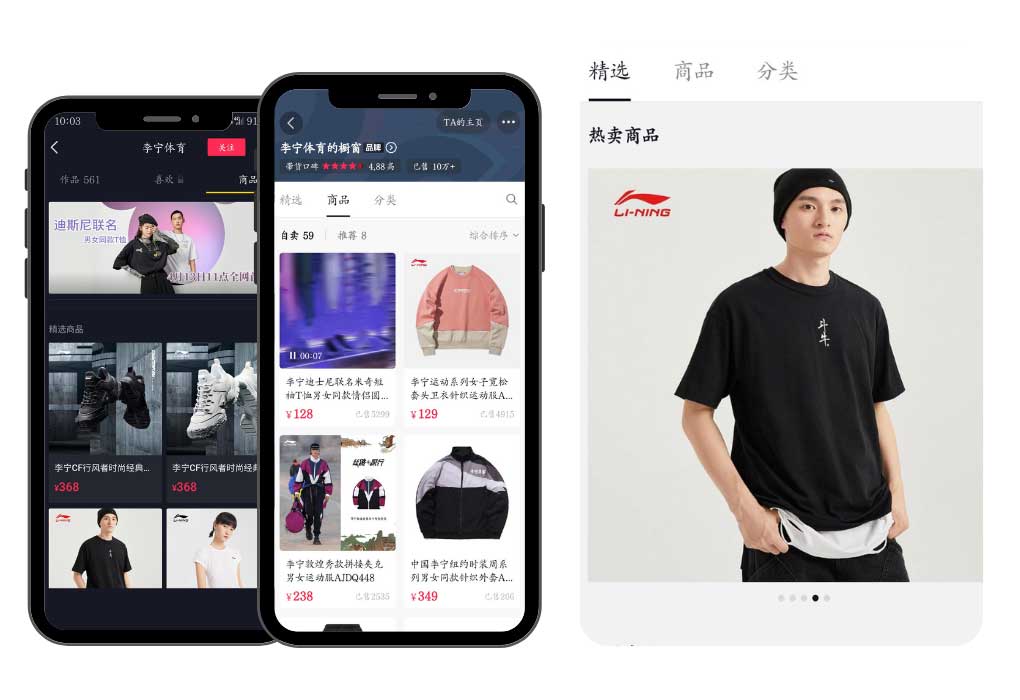

Entering the Chinese E-commerce Scene

A significant factor driving the democratization and popularity of fashion in China is the widespread presence of e-commerce platforms. These platforms have become an integral part of daily life for Chinese people, offering access to millions of fashion items that can be delivered to their doorsteps within days.

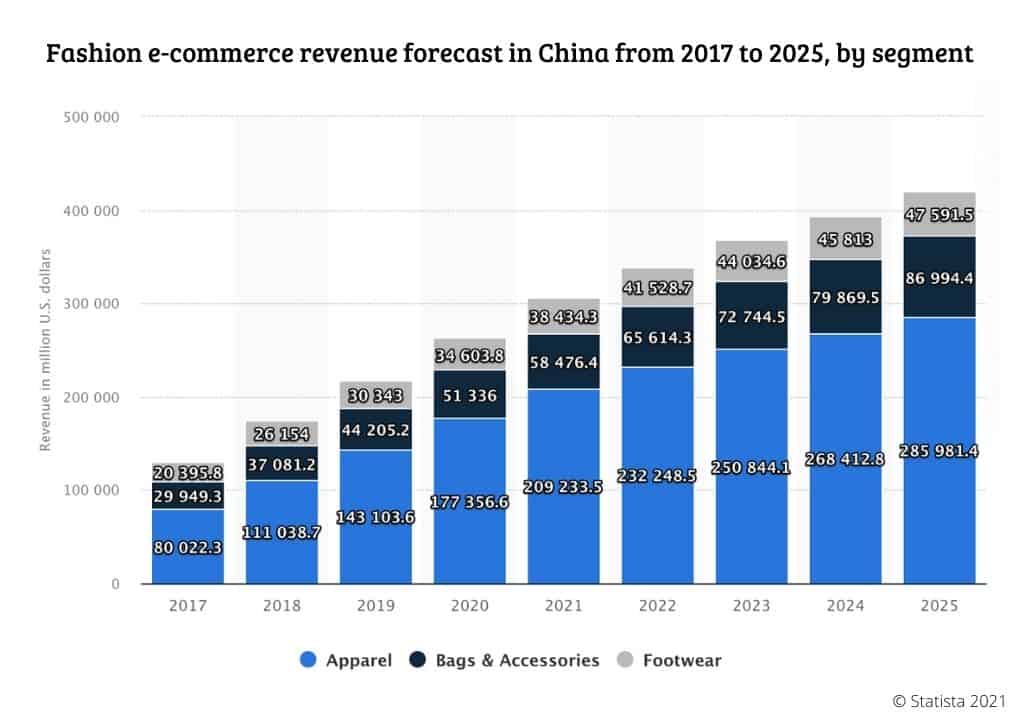

E-commerce has played a pivotal role in the thriving Chinese fashion market, leading to substantial revenue growth. Several factors contribute to this surge in online commerce profits, including the availability of higher-quality products and a shift away from traditional brick-and-mortar stores. According to the Digital Market Outlook report, the Chinese online fashion industry is projected to grow by approximately $285.98 billion by 2025.

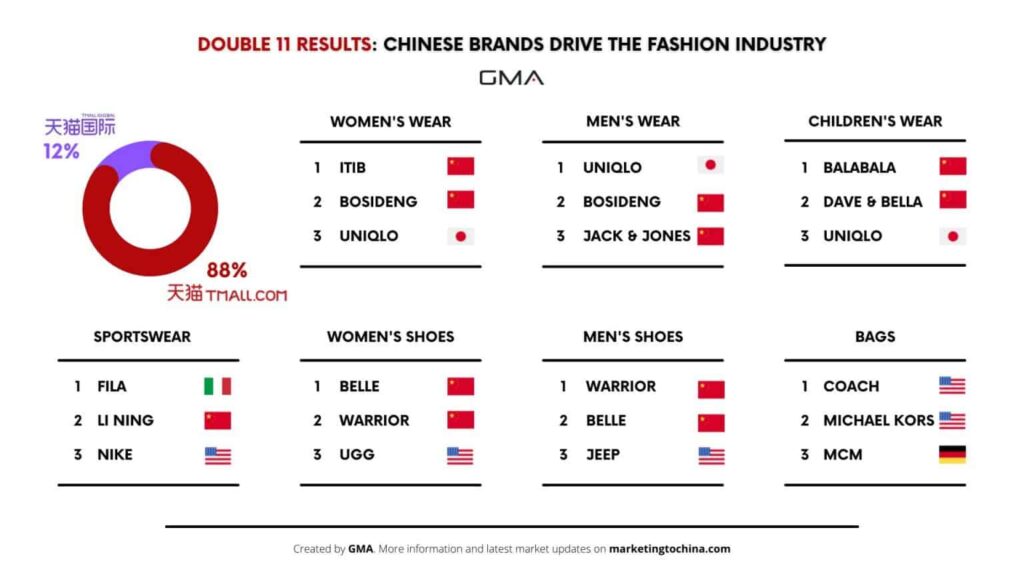

Analyzing the data, we observe that the most dominant segment in the fashion category on e-commerce platforms is apparel, followed by bags and accessories, and footwear. The apparel segment holds particular promise, as fashion trends continually evolve, encouraging frequent purchases.

Tmall or Tmall Global

While many Chinese shoppers use Taobao, it’s primarily for small brands and individuals, often less professional. It’s a C2C platform.

As a reputable apparel brand, it’s advisable to consider Tmall and Tmall Global for larger future sales. Tmall Global is a suitable choice for foreign brands, as it allows direct sales without requiring a Chinese business license. However, it can be costly.

Here’s the process:

- Apply in advance, where they assess your reputation and recognition (emphasizing reputation is vital).

- Pay the deposit, enabling you to design and manage your store.

- Once potential clients show interest, communicate with them on the platform.

- Expand your reach to a broader audience.

It’s worth noting that Tmall Global, JD Worldwide, VIP Shop, and Kaola are top cross-border platforms for entering the Chinese market.

Looking to Tap into the Chinese Fashion Market?

The Chinese fashion market is teeming with potential opportunities, catering to both small companies like startups and larger international brands. However, success in this market requires thorough research and a willingness to navigate the challenging and time-consuming process of selling on e-commerce platforms.

That’s where partnering with experienced specialists can make all the difference between success and failure. If you’d like to become a popular brand in China, contact us, we are the most visible digital agency in the Chinese market.

At Gentlemen Marketing Agency, we offer a unique blend of Western and Chinese perspectives to help you navigate the complexities of the Chinese market. Our agency has guided numerous companies as they ventured into China through platforms like Tmall, JD.com, Kaola, Vip.com, Taobao, Pinduoduo, Xiaohongshu, and more.

We take pride in the success stories of the companies we’ve worked with and are ready to assist any business looking to enter the Chinese market. If you’re considering doing business in China, don’t hesitate to get in touch with us. We guarantee a response within 24 hours.

1 comment

Qi Liu

Feel like the luxury market in China is an endless subject! Can I read more about this?