Ever wondered why the Chinese eCommerce market is taking the world by storm, especially the fashion sector? It’s something we’ve thought long and hard about, especially considering that it’s one of the country’s biggest e-commerce categories.

In this blog post, we’ll overview China’s booming market space, analyzing popular platforms, consumer behavior, and future trends.

Key Takeaways

- Fashion e-commerce in China is experiencing rapid growth, fueled by market development, the influence of technology and digital innovation, and the impact of COVID-19 on online retail.

- The fashion e-commerce industry in China is projected to reach a market size of US$336 billion by 2023, with an annual growth rate of 25%.

- Chinese consumers are increasingly embracing online shopping for apparel, but offline retail still holds a significant market share.

- Technology and digital innovation have played a crucial role in driving the growth of fashion e-commerce in China, with mobile shopping apps and social media platforms leading the way.

- The COVID-19 pandemic has accelerated the shift towards online fashion retail in China, presenting challenges and opportunities for brands.

- Tmall Global is one of the major players in the Chinese e-commerce market, providing international businesses with access to a large customer base.

- Niche platforms targeting specific customer segments have succeeded in the Chinese domestic market by offering specialized products and services tailored to their target audience.

Factors Contributing To The Rapid Growth Of Fashion eCommerce In China

China’s e-commerce business is blasting with its amazing breakthroughs and advancements. The fashion industry in China is witnessing this remarkable growth surge.

Part of this escalation stems from the increasing use of mobile devices for online shopping. It seems everyone has a smartphone in their hand these days, isn’t it so? This trend certainly gives an upward push to our beloved fashion e-commerce market.

Another booster behind the scenes is high disposable income among Chinese consumers – more money simply means more shopping! Indeed we have seen a boom unlike any other before in terms of e-commerce transactions as China leads globally by generating nearly 50% of them worldwide.

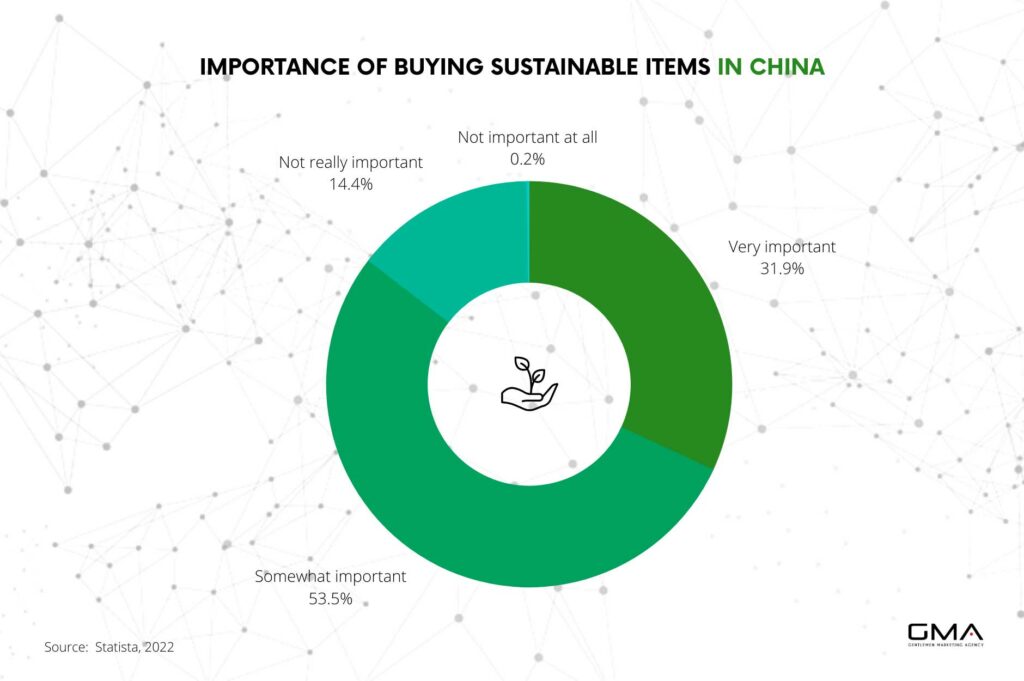

A rather interesting factor contributing to this expansion is also emerging – sustainable fashion trends driven by young urbanites who are conscious about their environment. Now that’s something you can leverage upon! We’ve got all these key ingredients together creating just the right conditions for rapid growth indeed!

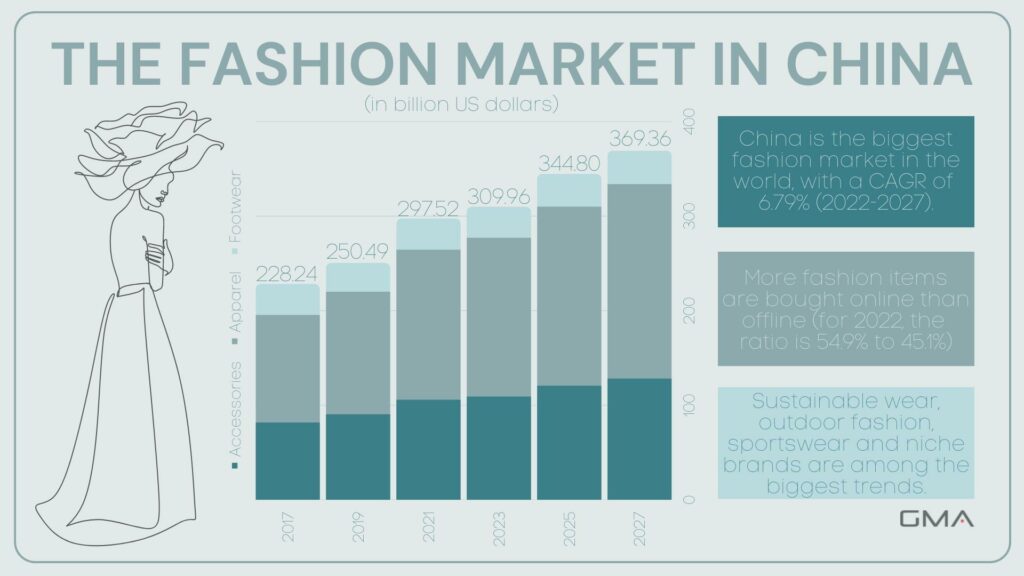

Overview Of The Fashion E-Commerce Market In China

The fashion eCommerce industry in China is currently a hotbed for growth and opportunity. With an estimated market size of US$336 billion by 2023, it’s a retail sales force to be reckoned with. The rate of growth is also impressive; currently, the market is growing at a rate of 25% per year. Let’s delve deeper into these figures using the following table:

| Year | Projected Market Size (in US$ billion) | Growth Rate |

| 2021 | 268.4 | 25% |

| 2022 | 302.4 | 25% |

| 2023 | 336.8 | 25% |

These figures highlight the outstanding growth of the Chinese fashion eCommerce industry. Furthermore, it’s important to note that China is the largest e-commerce market globally, accounting for almost 50 percent of the world’s transactions.

We can’t overlook the role of the younger generation in this growth either. Gen Z and Millennial consumers in China accounted for about 60% of the population in urban areas in 2019, and this figure is predicted to rise to 65%.

Comparison Of Online Vs Offline Apparel Purchasing

In China, the fashion industry has seen a notable shift in consumer behavior toward online shopping. However, offline apparel purchasing still holds a significant share of the market. Here’s a comparison between the two:

| Online Apparel Purchasing | Offline Apparel Purchasing | |

| Market Size | Online shopping is one of China’s largest e-commerce categories, accounting for a significant portion of the $668 billion industry. | Despite the surge in online shopping, offline shopping still attracts a sizeable portion of consumers, especially in smaller cities and rural areas. |

| Consumer Behavior | Chinese consumers have embraced an omnichannel approach, heavily relying on online platforms for purchasing apparel. | In offline retail, consumers enjoy the tactile experience, immediate gratification, and personal service. |

| Return Policy | Chinese online retailers prioritize customer satisfaction by offering hassle-free returns within seven days of purchase. | Offline retailers also have return policies, but the process may take longer and require more effort from the customer. |

| COVID-19 Impact | COVID-19 significantly increased the demand for online shopping, with global fashion e-commerce sales reaching $4.2 trillion in 2020. | The pandemic has hit offline retail hard, with store closures and reduced foot traffic. |

The above comparison sheds light on the current state of fashion e-commerce in China. It underscores the rapid growth of online apparel shopping, yet highlights that offline retailing is still key in the Chinese fashion industry. Thus, both channels are crucial for the successful marketing strategy of a fashion brand in China.

The Influence Of Technology And Digital Innovation On Fashion eCommerce

Technology and digital innovation have significantly influenced the fashion eCommerce industry in China. As the market continues to grow, businesses are adapting to new technological advancements to meet changing consumer preferences.

This includes integrating technology into online retail platforms, enhancing customer experiences through digital transformation, and developing a commerce ecosystem for seamless transactions.

The rise of mobile shopping apps and social media platforms has also played a crucial role in driving the growth of fashion ecommerce in China, particularly among young consumers. With the increasing importance of technology, it is essential for brands to stay up-to-date on the latest trends and utilize innovative strategies to thrive in this dynamic market.

Popular Fashion eCommerce Platforms In China

When it comes to fashion ecommerce in China, Tmall Global is one of the biggest and most prominent players in the market. It’s the most popular cross-border e-commerce platform in the Chinese market. But, there are other major platforms that should also be on your radar when entering this industry. Here are some of the other key players:

- WeChat – WeChat is a crucial app for any brand looking to succeed in China’s digital ecosystem. Its “Mini Programs” allows brands to create mini-apps within the platform for seamless shopping experiences.

- Taobao – Alibaba launched Taobao, it is offering a vast range of products at competitive prices.

- JD.com – It has primarily focused on electronics and home appliances but has expanded to include luxury fashion and luxury goods.

- Pinduoduo – It has a group-buying model. Customers can get discounts by purchasing items together with friends or family members.

- Xiaohongshu (“Little Red Book”) – It is a social commerce platform, that has been gaining traction among consumers. It features user-generated content and allows users to buy products from influencers’ posts.

All these platforms have unique strengths and target audiences. So consider your campaigns before making a decision on where to focus your efforts.

Social commerce platforms have emerged as key players in China’s e-commerce industry. Consumers shift towards online sales and mobile commerce. Pinduoduo, Taobao/TMall, and JD have incorporated social media features into their platforms. This changed how many brands market themselves by creating viral content that fosters engagement among users. Also, Key Opinion Leaders (KOLs) play significant roles in the promotion of their products.

Fast-fashion brands (like Shein), are popular in China. Platforms like Weibo and WeChat have become key channels for foreign and domestic brands. They connect with Chinese consumers and promote their products.

Niche Platforms Targeting Specific Customer Segments

There is a growing trend in the Chinese fashion e-commerce market towards niche platforms that specifically cater to certain customer segments. These platforms are designed to meet the unique needs and preferences of their target audience, providing a more personalized shopping experience.

In fact, there are at least 12 platforms in China that operate similarly to Shein, focusing on specific operational models and target markets. This shift in consumer behavior is driven by factors such as live-streaming shopping and social e-commerce platforms, which have enabled niche platforms to thrive.

By offering specialized products and services tailored to specific customer segments, these platforms have found success in a highly competitive market. Their ability to deliver low-priced fashion options while targeting specific audiences has been key to their growth and popularity amongst consumers.

Consumer Behavior In Fashion Ecommerce

Challenges And Opportunities In Fashion Ecommerce

In the fast-growing fashion ecommerce market in China, there are both challenges and opportunities to consider. One challenge is navigating through regulatory hurdles and competition from local players.

These factors can make it difficult for international brands to establish a strong foothold in the market. Additionally, as the middle class in China becomes more brand-conscious, retailers need to understand their purchasing decisions and preferences to effectively target this growing consumer group.

However, amidst these challenges lie several opportunities. Sustainable fashion is gaining traction in China, driven by young, urban, and environmentally conscious consumers. This presents an opportunity for brands that prioritize ethical production practices and offer eco-friendly products.

Furthermore, with China being the largest e-commerce market globally, there is immense potential for growth in online shopping for clothing and other products.

The Rising Second-Hand Clothing Market

The second-hand clothing market in China is a booming industry. Fashion brands and insiders are taking notice of this rapidly growing sector. It’s not just limited to low-income consumers either – the high and medium-income groups in China account for a significant portion of second-hand clothing buyers.

In fact, more than half of urban Chinese consumers purchase second-hand goods. This trend has fueled the growth of the second-hand e-commerce market as well, with the resale market experiencing a 24% increase in 2022 alone.

Experts project that it will continue to expand and reach a $218 billion market size in the near future. It’s clear that buying pre-owned fashion is no longer seen as taboo but rather embraced as a sustainable way to shop while still being fashion-forward.

Capturing E-Commerce Opportunities in Low-Tier Cities

Low-tier cities in China are quickly becoming a focal point for e-commerce growth. With more and more consumers in these cities embracing online shopping, there is tremendous potential for businesses to tap into this emerging market.

In fact, consumers in low-tier cities contribute significantly to the overall e-commerce market, surpassing their counterparts in high-tier cities. However, limited e-commerce penetration and inadequate last-mile logistics have been obstacles that hindered opportunities in lower-tier cities.

By addressing these challenges and leveraging the growing interest of consumers in online shopping, businesses can seize the opportunity to capture the untapped potential of low-tier city markets.

The Rise of Live-Streaming

Live streaming has become a game-changer in the world of fashion e-commerce. In China, the livestream e-commerce industry brings in an impressive $60 billion annually, with a projected growth rate of 197%.

It’s no wonder that live streaming is gaining traction worldwide. This trend has taken off because it generates significant revenue; $300 billion in 2021 alone, growing by 85% from the previous year.

In fact, retail apparel sales through live-stream commerce have surpassed traditional e-commerce methods. The power of live streaming cannot be ignored when it comes to capturing and engaging consumers in the dynamic world of fashion e-commerce.

The Future of Fashion Ecommerce in China

Targeting Millennials

Capturing the attention of millennials and Gen Z consumers is crucial, as they form a significant portion of the urban population and are heavily influenced by digital marketing and social media.

Sustainable Fashion

Sustainable fashion is gaining traction among young, urban, and environmentally conscious consumers, presenting opportunities for brands to tap into this growing market segment.

NFTs in the Fashion Market

Chinese tech giants like ByteDance and Tencent are experimenting with NFTs and digital collectibles in the fashion metaverse, providing new potential for the industry to engage with customers and enhance their shopping experiences.

Online Sales and Growth

The Chinese fashion market is growing rapidly at 25% per year, making it highly lucrative for businesses. Selling online provides global reach and convenience for Chinese consumers, ensuring brands can capitalize on this thriving market.

Environmentally Responsible Brands

Brands are embracing ethical practices and green manufacturing to make a positive impact on the industry’s environmental footprint and cater to the demand for eco-friendly options.

Shein’s Popularity

Shein has become popular among Gen Z consumers due to its low prices and savvy social media use, showcasing the potential for brands to leverage social media for success.

Expand Your Brand’s Horizons by Engaging with Us for Chinese Fashion Success

The fashion e-commerce market in China is a flourishing landscape of endless possibilities. With exponential growth, evolving consumer behavior, and the rapid advancement of technology, the Chinese fashion industry presents a remarkable opportunity for brands worldwide.

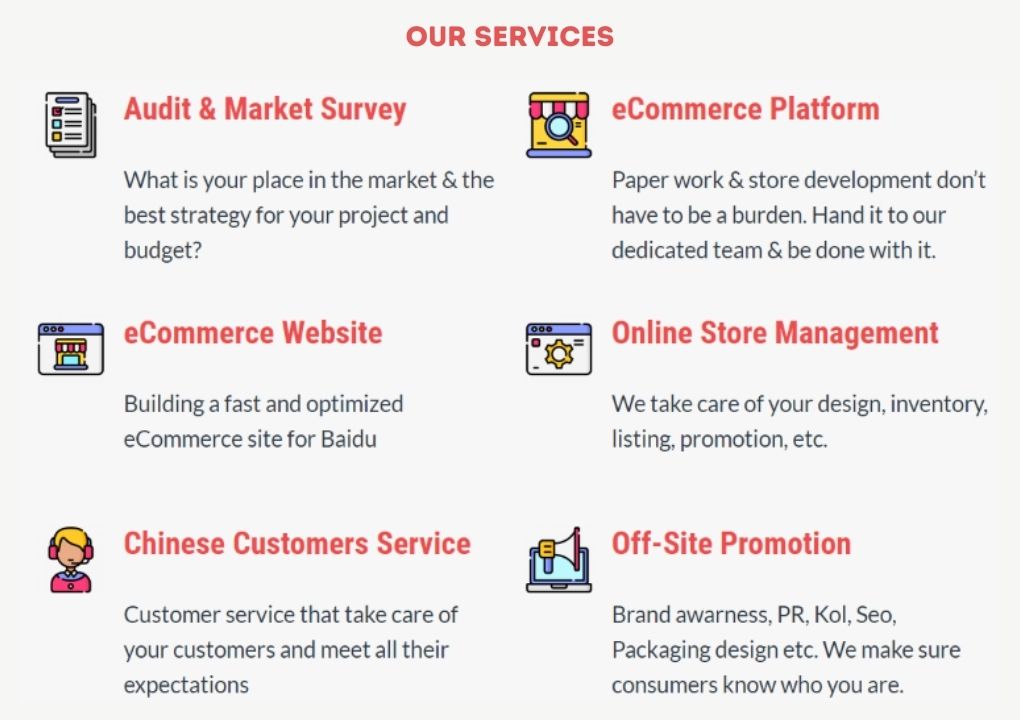

At our agency, we understand the intricacies of the Chinese market and are equipped with the expertise to help foreign brands successfully enter and thrive in this dynamic space. From market entry strategies to branding, marketing, and beyond, we offer comprehensive solutions tailored to meet your unique needs.

With our assistance, you can tap into the vast potential of the Chinese fashion ecommerce market, connect with the right audience, and establish a strong brand presence. We have a deep understanding of the local culture, consumer preferences, and the most effective digital platforms to leverage for your success.

As the Chinese fashion industry continues to grow and evolve, we are committed to guiding you every step of the way, ensuring your brand stands out and prospers in this thriving market. Let our agency be your trusted partner in navigating the intricacies of the Chinese fashion ecommerce landscape.

Contact us now to embark on this exciting journey and unlock the boundless opportunities that await you in the ever-expanding world of fashion ecommerce in China. Together, we will create a remarkable success story that resonates with Chinese consumers and establishes your brand as a leader in this dynamic market.