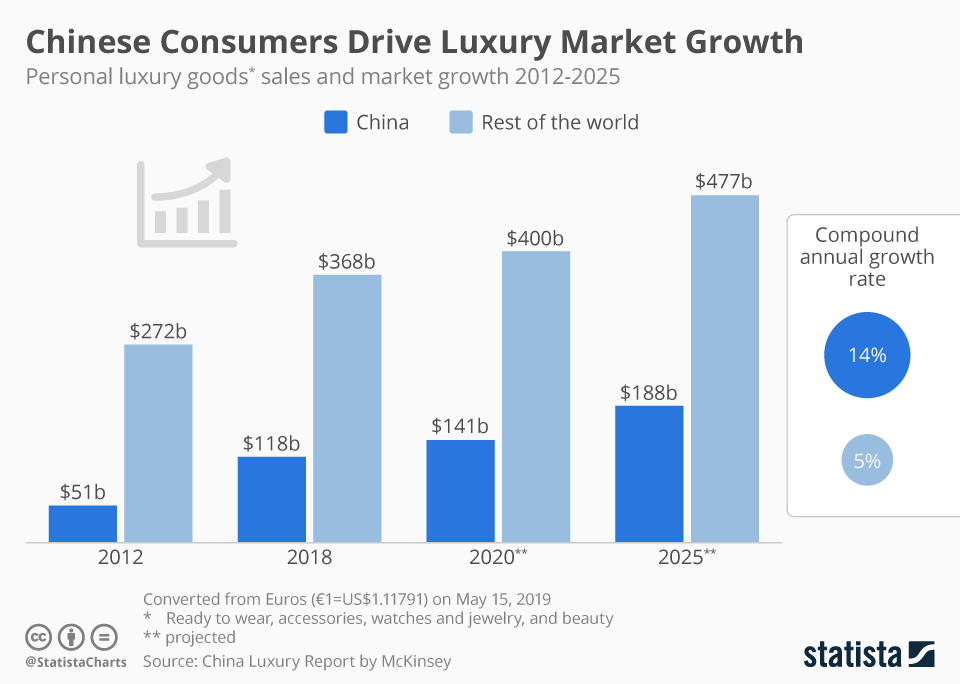

China is expected to account for 50% of the global luxury market by 2025. The demand for luxury goods amongst Chinese consumers is skyrocketing and has been brought about by a rising wave in the socio-economic standing of many Chinese luxury consumers. This increase in numbers amongst the wealthier and upper-class demographic in China along with a taste for luxury goods as a status symbol creates a large market ready to be targeted by luxury brands.

Understanding Chinese Luxury Shoppers

Understanding the wants and desires of the luxury shopping market in China along with the incentives and motivation behind purchasing decisions is the first step for luxury brands in creating a comprehensive marketing strategy. Also critical is a knowledge of how the luxury market in China is segmented.

Luxury brands as a status symbol in China

Modern Chinese culture sees luxury goods as a status symbol, even more so than in the west. As the Chinese economy continues to grow, more Chinese consumers enter higher levels of income. These consumers are eager to show off their wealth and, in a way, elevate themselves from the rest of society.

This way of viewing socioeconomic status and the desire to present one’s self as being part of a high social class is consistent with the hierarchical nature of Confucian beliefs that is foundational in Chinese culture even in the modern era. The consumption of luxury goods is a natural byproduct of this facet of Chinese culture and is explanatory of the massive growth within the industry. It is advantageous for global luxury brands to focus on how they can fulfill this need.

Chinese Luxury Consumers: Generational differences

The largest and most obvious segmentation within the luxury goods market in China is between the newer and older generation. The older generation of Chinese luxury goods consumers is used to traditional methods of purchasing products which include in-store purchases or stockpiling goods when traveling overseas. Their tastes also lean more toward the older style trend of a more in-your-face presentation of branding.

The younger generation is much more comfortable with online purchases and expects to be able to research and interact with brands online before making a purchase. The taste of the younger generation in regards to style and branding also differs in that they prefer a more subtle brand presentation which is a bit more timeless than the gaudy and flashy luxury styles of the previous few decades.

Visibility and eReputation in China

The first step for any luxury brand looking to start targeting consumers in China is establishing a digital presence to increase their visibility and reputation. This is true for any type of business entering the Chinese market but is especially applicable for luxury brands that are reliant upon the way in which consumers view them.

Reach out to Chinese Luxury Shoppers on Social Media

Social media is so ingrained in the daily life of Chinese consumers that it is an incredible tool for increasing visibility and gaining more exposure in the market.

- WeChat: You have to be on this app if you want to be taken seriously. Since you are at it, make good use of its many tools and gain the trust of your target audience.

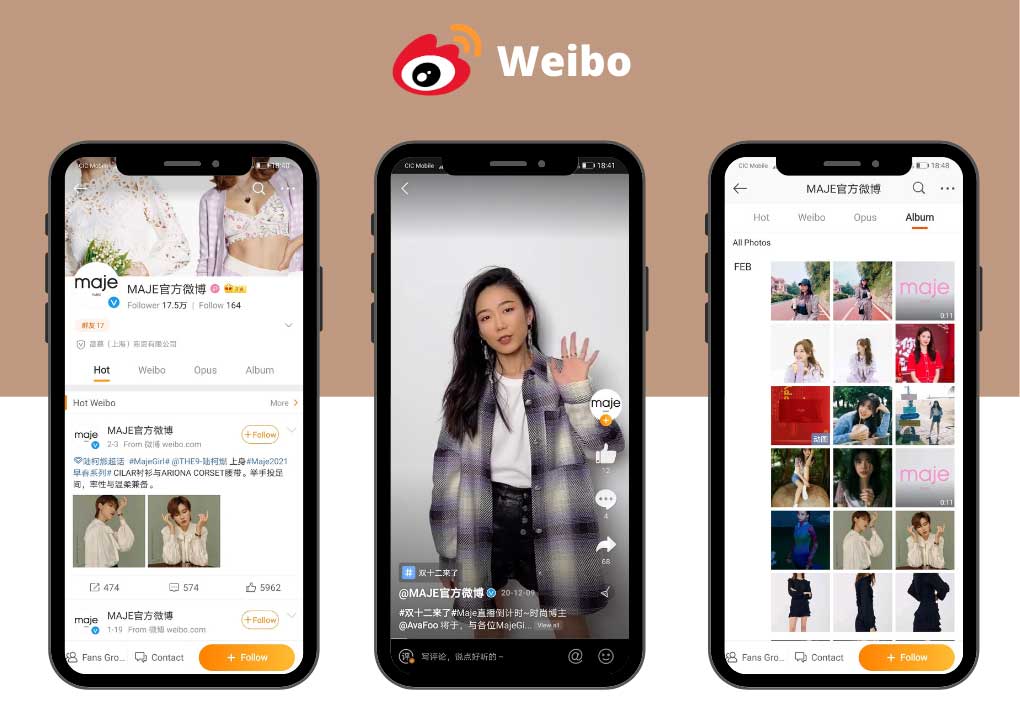

- Weibo: paid ads? Check. Buzz campaign potential? Check. Huge Following? Check etc. Clearly, the app to be to get more visibility.

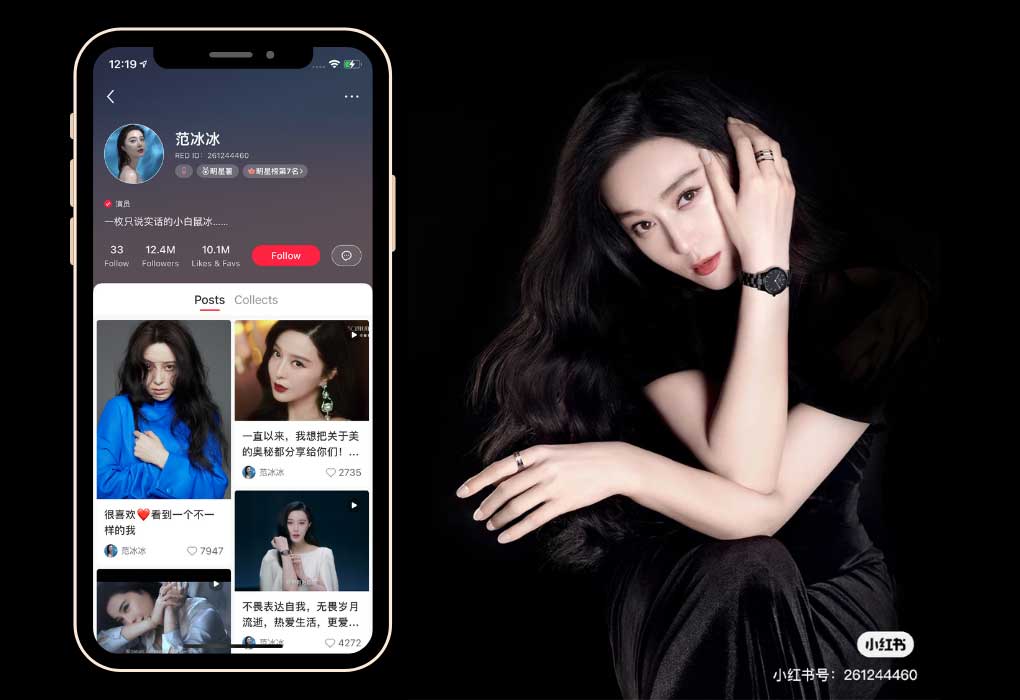

- Xiaohongshu: social e-commerce, UGC reviews app. Also known as RED, this app is a must for high-end & Luxury brands in China.

Navigating these foreign social media platforms requires skill and knowledge of the landscape.

China Cross-border E-commerce an entry door for Luxury Brand

Cross-border eCommerce grants luxury brands the right to sell directly to consumers without the need to establish operations within China. This allows brands to save on operating costs and forego the time, energy, and hassle of finding solutions for storage, fulfillment, and logistics. With the growth of CBEC platforms such as TMall Global and JD Worldwide (sub platforms of the two largest eCommerce platforms in China), CBEC is now more accessible and simpler than ever.

Both TMall Global and JD Worldwide have an application process for brands to sell on their platforms. This process allows the platforms to make sure that only real, established brands are on their site. As a result, consumers who use these platforms are put at ease knowing that they don’t need to deal with fake goods or scams. While there is still a process and related fees for brands to start selling on these platforms, the potential profit gained from being listed on these sites is immense. The ability to sell on these sites instantly increases the credibility and eReputation of a brand.

Work with Chinese Key Opinion Leaders

Key Opinion Leaders (KOLs) are individuals with a substantial following who are able to influence the consumer decisions of their followers. As is the case throughout the world, people respect the opinion of those that they admire such as their favorite musician, actor, or athlete.

The implementation of KOL marketing has been found to be incredibly valuable for luxury brands since consumers of luxury brands in China are highly responsive to the voice of KOLs that they follow. KOLs use social media and eCommerce platforms to share their opinions on certain products. An increasingly popular tool for KOLs is live-video streaming which seems to have struck a powerful chord within the hearts of many Chinese consumers. The world’s top luxury brands such as Louis Vuitton, Gucci, and Cartier all treat KOLs as an integral part of their marketing tactics.

Contact us to learn more about reaching out to Chinese Luxury Shoppers

Let’s have a chat about your brand and its potential in China 😉