With the 1st population and 1st GDP in the world, the Chinese fashion market has been a key market for fashion brands with its significant volume and great potential. With the recovery from the Covid pandemic, the Chinese market is growing again in the 2020s. In 2022, how to win the Chinese fashion market has been a question for the majority of fashion brands.

Contents

The Chinese Fashion Market

China is the Largest Fashion Market in the World

According to Statista, China is the largest fashion market in the world with 312.20 Billion USD in revenue in 2022. To better realize how significant it is, the following ranked markets are the United States with 207.70 Billion USD, the United Kingdom with 60.56 Billion USD, and Japan with 54.39 Billion USD. From a different perspective, the Chinese market almost equals the sum of the second, third, and fourth markets in the fashion industry.

Compared to the worldwide fashion market with 0.99 Trillion USD in 2022, China accounts for more than 30% of the market share. This leads to a question for all fashion brands:

- Why not enter the Chinese market yet?

- Why have missed it when it has the same size as the sum of the US, UK, and Japanese markets?

- Why favor the US or Japanese market over the Chinese market?

If we still need to answer this question today: China is definitely the key market for any fashion brand that wants to grow its business in 2022.

The Preference of Chinese Customers on Distribution Channel

The most preferred distribution channels in China are different from other countries because of the rapid development of e-commerce. Back in 2017, when 79.1% of the world fashion sales were done offline, the percentage of online fashion sales in China has already reached 49.3% of the total revenue.

This pattern was boosted by the Covid pandemic in 2020 and once reached 59.4% under the Covid regulation. Even though there is a strong willingness for offline shopping to bounce back after Covid, online fashion sales in China still count for 54.9% in 2022, and it is expected to grow to 56.5% in 2025. Fashion brands need to know this difference by heart if they want to really win the Chinese market.

The TOP 5 Fashion Industry Trends in China

Womenswear is Still the Main Category

Women’s wear is the mainstream category in the Chinese fashion market with more than 6 times of the volume of men’s wear. According to CBN Data, the sales volume of women’s wear shows a growth of 150.76% in the first half year of 2022. With this continuing growth and the huge volume, womenswear has huge potential in the Chinese market.

If you want to know more about the material and design trends of womenswear, you can watch this video:

The Rising Demand for Menswear and Kidswear

Although men’s wear owns only a small market share of fashion products in China, we can still hold a positive attitude towards its potential. Compared to the sales in the first half year of 2021, menswear grew by 158.97% in the first half year of 2022. This growth rate is even higher than the growth of women’s wear, so we can still see men’s wear with high expectations in the 2020s.

The same situation is occurring with kidswear, which is having strong growth. All Chinese distributors are currently looking for kidswear brands from overseas. International brands are still the firm favorite for Chinese consumers in this category, due to their high-quality and unique design. The Chinese government switched the child policy. They now encourage couples to have 3 children. Hence, the increased demand for kidswear fashion.

The Fix Gender on Fashion Products is Getting Blur

In 2022, Chinese customers are no longer willing to be limited by the fixed gender of fashion products. The new fashion trend in China is pushing customers to pick their fashion products among both menswear and womenswear. Female customers can pick men’s wear by their taste to be cool and stylish while male customers can also wear women’s wear in a masculine way if they can handle it.

On Little Red Book, the hashtags “unisex” and “genderless” are among the hot topics. Several shopping notes and users posts are promoting genderless collections and unisex brands.

Designer Brands and Niche Brands are Favoured by Chinese Customers

Designer brands are getting their own category in China called “DFashion” with a strong expression of their style and better delivery of their design concept. By the end of 2022, there are more than 10% of fashion customers who decided to purchase DFashion products, with a YoY growth rate of 294%.

Recent research of CBN Data shows that 64.4% of customers think that compared to luxury products with too high a price, DFashion products have a better cost performance and are easier to mix and match with other products. 57.6% of customers think that DFashion can better show their personality and identity. 41.7% of customers think that DFashion products have better design and faster launch of new products.

Gen Z: We Need to Be Special

The new generations in China are looking for special items that can show their personality. Chinese Gen Z, as the main fashion audience in the next 20 years, is sharing a common demand for customization and uniqueness. They are tired of similar and classic designs. They hate to dress similarly to their friends.

Under this demand and consumer attitude, Chinese customers like niche brands and designer brands. More designer brands are facing growth in China than long-installed brands. Fashion brands should also pay more attention to this trend and make their product line more diverse. The unique design and unique history of the brands are USPs worth considering by Gen Z.

The Righ Way to Market Your Fashion Brand in China

Promote More Than a Product, But a Lifestyle

Today, China reached a large production volume of high-quality fashion products. With the Guochao trend, the Made in China is back on track. New international brands entering the market will need to show their unique quality to seduce Chinese consumers.

This is why you need to promote more than a product, but a lifestyle. A very successful example can be the brand Supreme. Chinese customers were crazy about the lifestyle Supreme had drawn for them. In a word, they liked Supreme more because they think wearing Supreme can bring them a cool and fashionable lifestyle than a nice-looking fashion product.

Target the Right Audience is The First Step to Your Success

Using the right tools will be the key to targeting your audience. Do you have a luxury, premium, niche or mass positioning? Do you have a specific buyer persona in mind? Are you targeting men, women, or mothers for kidswear? Depending on your objectives, you will need to understand who is your audience first.

Although brands usually already have their main targeted audience when they are created, the Chinese market can change the rules. Since Chinese customers are trying to be creative in their mix and match, you would better do previous research on the market. Posting your products and design on social media and seeing how it works for different customer groups can rapidly tell who is attracted by your brand. With a clear mind of your audience, you can use the right tools:

You can work with a local partner to save time:

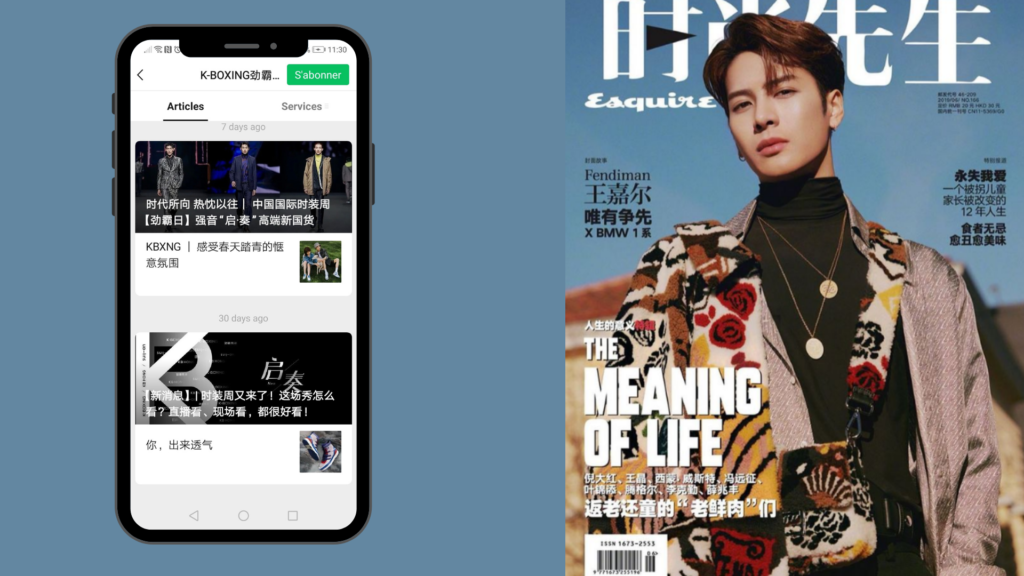

- Use the right PR magazines such as Vogue China, GQ China, Esquire China, or MILK

- Get featured on the right blogs and forums such as Zhihu, Baidu Tieba, or Dianping

- Select the right influencers from KOCs to KOLs to reach your core audience

You Cannot Survive in China without E-commerce

If a nice fashion brand only has a boutique in Europe it might still operate well, but it cannot even survive without e-commerce in China. Many people might not believe how much e-commerce and digital tools are developed in China. But when you are told that 54.9% of fashion sales are done online, you will definitely open your e-shop on any e-commerce platform. If you don’t want to miss any sales, we suggest to select the right platform:

- TMALL – We recommend this marketplace for luxury, premium, and niche fashion

- JD – We recommend this one for more innovative or technical fashion (e.g. techwear)

- Douyin – You can maximize your chances with a lower price positioning

- Little Red Book – You can maximize your sales with a niche assortment and strong KOL campaign

The biggest e-commerce platforms in China are Tmall, Taobao, and JD. Selling on these platforms can not only appear in front of 1 billion potential customers but also assure your customer that they are not buying fake products by launching your flagship store. Some social media also act as e-commerce platforms with a large volume such as Douyin (Tiktok) and Xiaohongshu. Depending on the above, you can pick the most suitable platform for your brand.

Build an O2O Strategy Combining Distribution and E-Commerce

Selling in another country is always depressing the brand creators with complex daily operations and logistics. However, this problem no longer exists in China if you find the right solution. Combining your distribution with e-commerce can greatly save you time, energy, and money. You can also offer a better customer experience if your distributor is also an importer with a local warehouse. Your products can be directly sent to your customer once they placed the order on different e-commerce platforms.

Still, sounds tough and complex? You can find support with third-party operation teams such as Tmall Partners. With your demand and budget, you can cooperate with them and their team will help you build up your e-shop as well as manage your daily operation and distribution. Single solution for all your troubles.

Use Social Media to Increase your Visibility and E-Reputation

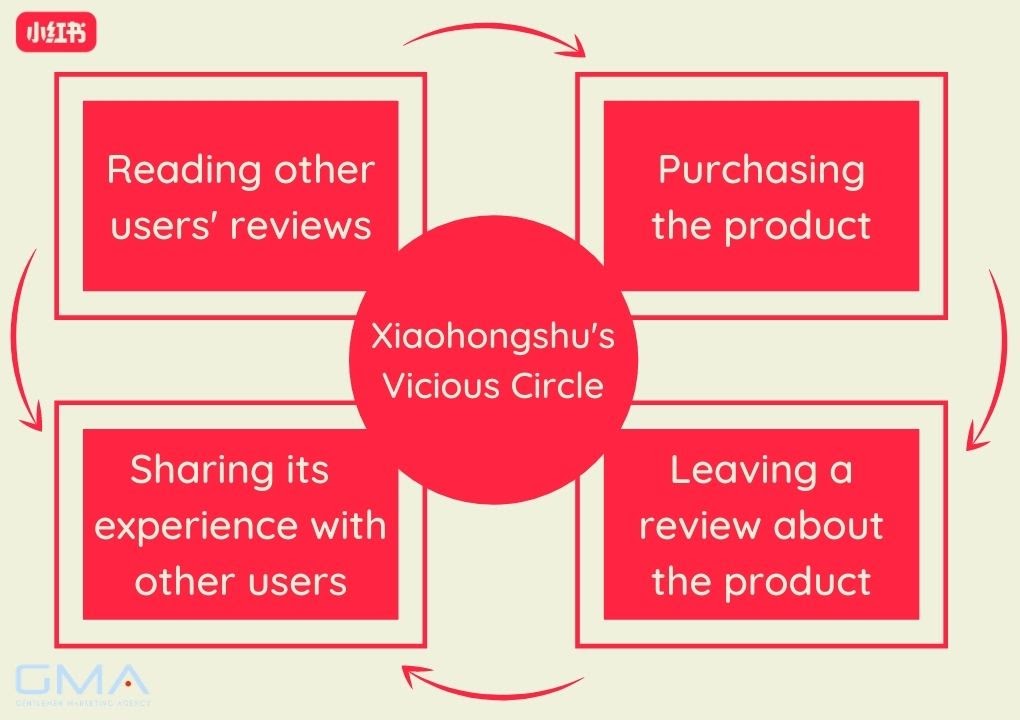

Chinese customers are used to searching for information on social media before making a purchase. On average, they spend 6 hours and 22 minutes per day on their phone. Since the mobile phone is used for daily life in China: paying in shops, ordering food, booking tickets, organizing business meetings, etc they also used it for their consumer journey.

This means staying visible and maintaining a good reputation is very important for your fashion brand. For this, you can use a specific Chinese social media such as Xiaohongshu, Douyin or WeChat. You can gain visibility on the Chinese market and boost your brand image in China.

Xiaohongshu is The Leader Social Media for Fashion

Among different social media in China, Xiaohongshu is the most important one for Fashion brands since Xiaohongshu is becoming the fashion leader in China. With 85% percent of female users, there are a lot of customers sharing their experiences and discussing fashion brands. You can also cooperate with Fashion KOLs to explore more audiences with their fan base and an excellent campaign. However, choosing the right KOL and operating with the right campaign is essential for better performance and cost performance, so make sure your KOL promotion strategy fits your brand and your demand.

Baidu SEO: Raise your Ranking on the NO.1 Search Engine in China

Maybe you are doing a great job on Google SEO, but unfortunately, that makes no effect on your brand image in China. Why? Because Google is blocked in China. Why not try to work with Baidu, the NO.1 search engine in China? Investing in SEO on Baidu can help increase your visibility in China and help your official website to be recognized. Customers are more likely to trust your brand when they can see your well-designed website in the first place when they search for your brand name.

GMA: Your Best Choice in Digital Marketing

About Us

You are currently introduced to the best digital marketing agency in China! GMA is an experienced expert in helping brands to do better marketing and branding in China. We have been trusted by hundreds of partner brands over 10 years of operations. We don’t only know the business, we also understand the Chinese market and customers. Let GMA walk you through your success in China and help your brand to grow.

How can GMA Support Your Brand?

- A complete market research to build your strategy and operations in China

- Dedicated copywriting and design team to boost your social media

- Experienced e-commerce team with the TP (Tmall Partner) label

- Strong PR team to support your press, media, influencers, and events campaigns

- … and a coffee

Professionals in Branding and E-commerce, ROI Focused

Digital marketing tools are our best weapon for winning you the Chinese market. We have a professional team with 70+ experts in different fields who will support you during your project in China. GMA is cooperating with all social media and e-commerce platforms in China with a long-term contract and the right to do the daily operations for you. We are not working for the contract, but ROI-focused. Your ambition is our direction.

Some of our Fashion Case Studies

SSENSE

SSENSE is an international fashion E-commerce website that sells selective designer brands in luxury, streetwear, and fashion. SSENSE produces its own original editorial content in its streetwear and modern-inspired website. Founded in 2003, SSENSE is pacing the vanguard of directional retail with a mix of luxury, streetwear, and avant-garde labels. Based in Montreal, Canada, this e-Commerce platform wants to develop its business in China with a Chinese Independent website. SSENSE wanted to develop its presence on Baidu and contacted GMA for support in better understanding the Chinese market and increasing its SEO.

Results:

- Increased SEO & online presence

- Increased traffic on their Chinese website

- Build up of Weibo account

ISLA & CARAIBICA

Isla & Caraibica is a luxury brand, with products ranging from fashion to cosmetics and jewelry. Its founder draws his inspiration from his Caribbean origins and works with French, Italian, and Portuguese creators. The passion and know-how Isla & Caraibica pour into each product leads to the creation of unique items combining modernity and elegance. I&C made their first step in the Chinese market in 2015 when they attended the “Luxury China Exhibition”. They contacted GMA to take care of their media coverage, press relations, and social media campaigns in China.

Results:

- Exposure of 100K views per month

- Negotiation with 18 distributors to place orders

- Successful brand launch with 1 exclusive distributor and strong marketing

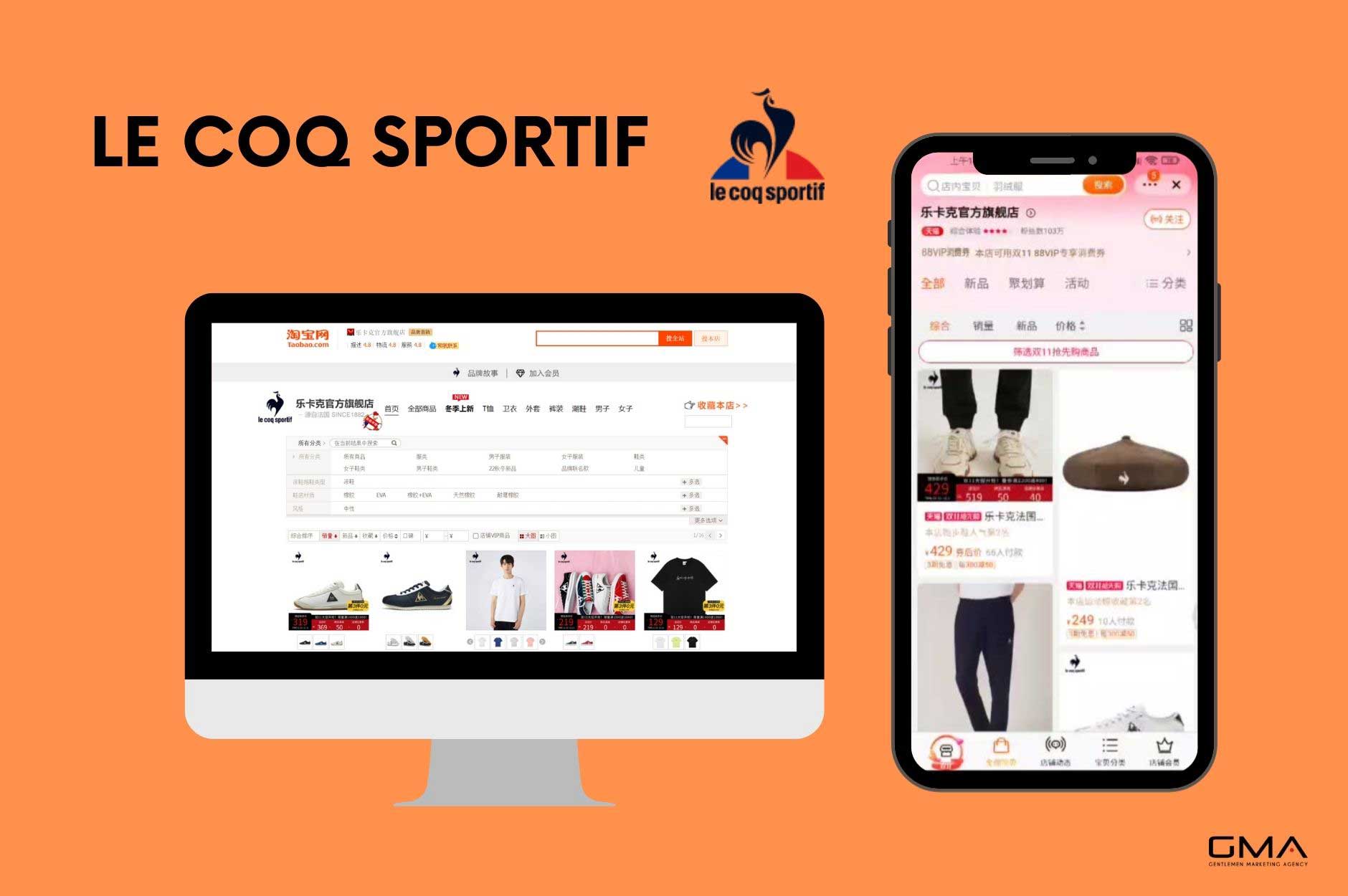

LE COQ SPORTIF

Le Coq Sportif is a French producer of athletic shoes, activewear, and sporting accessories. Founded in 1882 by Émile Camuset and located in Entzheim, France, the company first issued items branded with its now-famous rooster trademark in 1948. The company’s name and trademark are derived from the Gallic rooster, a national symbol of France.

To grow better in China, LE COQ SPORTIF contacted GMA for e-commerce consulting on the Chinese e-commerce platform TMall, the “French Touch” event organization, and the community management on Weibo for the 2013 “Tour de France” in order to reach the biking community.

Results:

- Organization of the “Tour de France” event on Weibo

- Organization of the “French Touch” event

- Increase of traffic, visitors and conversion on the Tmall page