During the lockdown, the luxury watch industry dropped in China. A retailer in Shanghai even confessed his watch sales dropped by 90%. Chinese people no longer have enough money to invest in luxury watches and prefer to delay their purchases.

Since May 2020, the market is recovering. Chinese luxury shoppers are heading towards watches as a smart way to invest. Any premium and luxury watch brand in China should benefit from the market relaunch. But for that, you need to understand the trends that are currently influencing the watch market. Let’s take a look at some of the main trends shaping the watch market in the past two years.

Key Figures of the Watch Market in China

The luxury watch market in China was worth $10.36 billion in 2022. The Chinese always have a firm favorite for watches among luxury items as it is a symbol of maturity and social empowerment. The Mianzi, which means the face, is very important in China.

In order to highlight personal success, it is common to wear luxury Swiss watches. For 73% of Chinese watch lovers, Switzerland is their favorite country of origin. An imported watch from Switzerland is a must-have in China. Thus, Asia accounted for almost 50% of the Swiss watch export market share in the first half of 2023.

In China, watch consumers will prefer an omnichannel purchasing journey. They often tend to find information online but prefer buying luxury watches in physical stores. They have great taste in famous brands and elegant designs. At least 60% of luxury watch shoppers in Mainland China purchased a Rolex in their life.

Top 10 Luxury Watch Trends to Follow in China in 2023

#1 UNIQUENESS – The Unending Quest for Differentiation

In China, people often feel lost in the crowd. Just imagine, how could you claim to be unique among 1.4 billion people? A tough one. Chinese often aim to differentiate thanks to the products and brands they purchase. Indeed, luxury purchases are perfect to claim they have a different lifestyle and they have succeeded in life. But even among them, they need to rely on niche brands with unique designs.

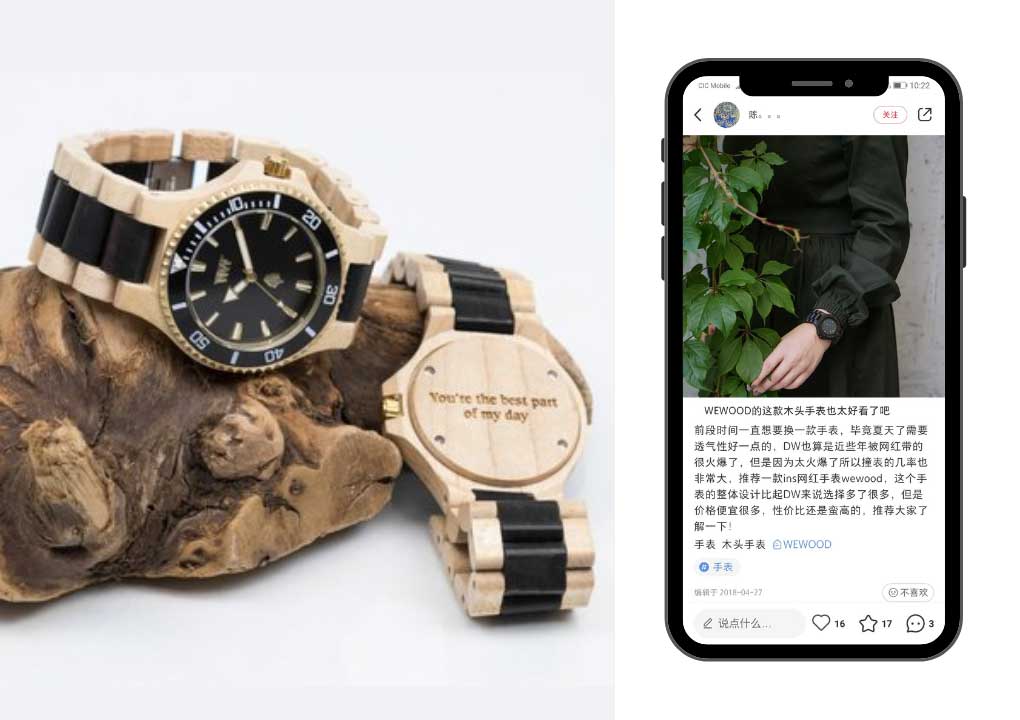

WeWood Case study

WeWood Watches is a premium company with a key differentiation from watches made of wood. The brand uses 100% natural wood from various varieties over the world. The marketing strategy is clear: “For one watch sold, one wood is planted”.

The design is very attractive to Chinese people because it is rare and unique. It’s especially appealing to young consumers, that appreciate those environmental movements and pay bigger attention to businesses that are ecologically and ethically aware.

WeWood worked closely with GMA to raise its online presence to be visible to its target consumers. The social media campaign is aimed at increasing the e-reputation of the brand and promoting the e-commerce platforms. The articles created on WeChat reached 5.9K views per month while the Weibo account reached 1.2K new followers. Today, the brand benefits from a strong e-reputation and visibility thanks to user-generated content on Weibo and Little Red Book.

#2 INVESTMENT – Spending Cautiously and Investing in Watches

The Covid-19 pandemic hurt deeply the watch market. Back in 2020, Chinese watch shoppers had to delay their purchases from January to May. In China, people often purchase watches for the Chinese New Year. It has been 2 years in a row that CNY is affected by the pandemic. While they delay their purchase, the Chinese have more time to think about it and prepare for their future bigger purchase.

The current trend among the Chinese is to see a watch as an investment. They want to purchase a watch that would be considered heritage. On average, Chinese shoppers spend 88,000 RMB on luxury watches, which is 11,000 USD. Luxury brands like Rolex, Patek Philippe, Vacheron Constantin, Audemars Piguet and the Swatch Group play the card of a never-ending value.

While entering China, watch brands have to show Chinese consumers their watches will keep their value over time and can be treated as timepieces.

#3 MADE IN CHINA – The Growing Success of Domestic Watches Brands

Switzerland used to be the reference for watch lovers with Swiss watch models being well-known across the country. In China, watches are a specific market. The country of origin is often a synonym for the quality of the product. Chinese people used to rely on Swiss-made watches only as a key to quality. In comparison, Chinese watch brands used to lie behind because they suffered from quality, manufacturing, and brand awareness issues. But the market has shifted!

Surprisingly, in recent years Chinese consumers tend to favor local consumption. They are more and more proud of the products created on their soil, which often have more affordable prices. They want to find local high-end luxury brands with a domestic identity and interest. Even if China is the first producer of watches in the world, it is late on the market for manufacturing, innovation, and quality. While watch manufacturing started in the 15th century in Europe, it only started in the 20th century in China.

China is now up-to-date with watchmaking. The Chinese watches use the high-end tourbillon movement with a delicate design. China developed true know-how and is now selling its pieces globally… even to Swiss watchmakers!

#4 QUALITY – The Major Criteria for Luxury Watch Shoppers

The purchase of high-quality watches is very important in China. For 68% of Chinese luxury shoppers, craftsmanship is the most important factor that could affect their purchasing decision. They will prefer to spend on expensive and qualitative products rather than cheap watches. The price is often associated with the quality in China. Especially for watches, Chinese shoppers have no obstacles to buying expensive products.

Why are they likely to purchase a high-quality watch? Because wearing a watch “would give an impression of maturity, stability, and punctuality to others”. And if your watch is of poor quality, you immediately lose this social status. This is why the Swiss-made factors we explained earlier are important. Having a watch made in Switzerland was enough to prove they wear a high-quality watch.

#5 GEN Y & Z – The World Youngest Luxury Watch Consumers

This is the main difference between the West and China. For instance, we have the image of a man who will buy a luxury watch for the first time at the age of 50. In China, luxury watch purchasing starts earlier as the main watch consumer is men who are aged between 25 and 40. Generation Z works hard and wants to pursue a happy life. The watch is clearly a symbol of a successful life.

Luxury brands have noticed the recent switch in China towards the younger generation. Any marketing strategy will target Generation Z or Y instead of older generations. This is why they use more and more social media and young KOLs. For instance, Cartier attested that its youngest consumer base is in China with 65% of Gen Y and 25% of Gen Z consumers. If you plan to market your watch brand in China, you should definitely target young consumers from 25 to 40.

#6 CHINESE ELEMENTS – Promote the Creativity and the Uniqueness of Watches

Chinese shoppers expect to have more customized services. They are more confident about purchasing a product that embeds a Chinese element. Having a Chinese element embedded in the product or service is important for 72% of Chinese luxury shoppers. If they look for Chinese elements, they are very selective on elements they prefer:

This is a great misconception of Chinese culture. When a brand wants to target China, the easier manner is to create a limited edition with the animal of the year for the Chinese New Year. As you can see, only 24% of luxury shoppers enjoy having the animal of the year on their luxury watch. Why? Because Chinese shoppers are more and more into a timeless design. They want to invest in a product that will last. And the “animal of the year” comes back every 12 years…

#7 TIMELESS DESIGN – Chinese Shoppers Look for Elegance Over Time

Design is a very important factor for the Chinese when they purchase a product. In China, 50% of people wear a watch to bring out their personal taste and image. What if the design they chose is out-of-date tomorrow? They want to differentiate but in the meantime, they want to showcase their social status and identity.

For any watch brand that wants to perform in China, the branding will be as important as the design. You need to prove to your Chinese consumers you share a timeless piece. They need to find your brand reliable and trust your design. For instance, the branding on WeWood was following this strategy. Any Chinese consumer could have thought a wood watch would lose its success over time. You need to build your brand image among your target consumer as a timeless and eternal luxury piece.

#8 LIVE STREAMING – Luxury Watches Embrace Digital in China

The watch industry is the slowest to embrace digital. Indeed, the universe of a luxury watch and the universe of social media always seemed far from each other. The digital era was threatening the image of exclusivity and craftmanship that luxury watch brands always defended. Since the Covid-19 crisis, live streaming made its way through and seduced international brands.

Livestreaming is a unique opportunity to connect and share with Chinese consumers. Luxury brands implemented live streaming sessions to showcase live their catwalks or their new collection drop. The watch industry could not stay out of the trend anymore. The famous fair and trade show Watches & Wonders have taken the lead.

Watches & Wonders case study

The watch exhibition went online, with a live streaming session on Tmall Luxury Pavilion. The event benefited from an exclusive list of VIP clients to generate exclusive sales. The live stream session was hosted by KOLs and aims at offering a presentation on craftmanship. The objective was to create a unique connection between Chinese consumers and luxury watch brands.

Watch & Wonders decided to launch the hashtag #OpenTheDoorOfWonders (#打开奇迹之门#) to increase the event’s visibility on Weibo. The hashtag generated 120 million views. Chinese people definitely had the feeling that luxury watches are opening their doors. They do not have the feeling to step aside anymore but they can create a meaningful connection with luxury brands.

#9 KOLS & CELEBRITIES – Give a Face to Luxury Watch

Compared to other luxury items, watches are often considered to be impersonal items. Chinese consumers can recognize brand ambassadors for fashion or bags but never for watches. By 2024, luxury watch brands are taking over the KOLs and celebrities’ success to give a face to luxury watches. This is a key opportunity in terms of visibility and e-reputation. With a wisely selected KOL, you can reach your target consumer.

For instance, Michael Kors decided to name Gao Yuanyuan a global brand ambassador. With 49 million followers on Weibo, Gao Yuanyuan benefits from a strong community. She is a famous actress in China among Generation Y and the oldest.

The decision to name a Chinese celebrity as a global ambassador is a symbol that China is very important to Michael Kors. The hashtag #Gao Yuanyuan Michael Kors Global Brand Ambassador# reached 66 million views on Weibo.

#10 DOUYIN / TIKTOK – Open the World of Luxury Watch

Since 2016, short-form video apps are gaining popularity in China. The apps Douyin, Kuaishou, Xigua, and Bilibili have shaken the social media landscape with fast-consuming content. In a few seconds, netizens can learn and discover new products or tips. With more than 700 million daily users, Douyin (or TikTok) is the first short video platform. The success is huge. Douyin has proven to be an effective communication tool to increase brand awareness and visibility.

Cartier in China case study

For the relaunch of Pasha de Cartier, the luxury brand dedicated an impactful communication campaign called “Make Your Own Path”. The campaign was mainly based on User Generated Content (UGC) and Douyin. In a word, the brand did not want to spam its potential customers with bland content. They wanted to create an impact with creative and unique content.

The concept? People can show their best dance moves with a Cartier filter on short videos. They must publish it on Douyin with the campaign hashtag #MakeYourOwnPath. The campaign hit 1.1 billion views. How? Douyin algorithm noticed a wide use of the hashtag and always promote trends or challenges on the platform. Chinese consumers were flooded with creative, unique, and qualitative dance videos sponsored by Cartier. And they wanted to join the community!

How to market your luxury watch brand in China?

China is the most competitive and evolving market in the world. Since the Covid-19 crisis, the watch industry needed to adapt to the Chinese market with digital tools and marketing trends. If you are a premium or luxury watch brand, you will need to understand your core target in China. Generation Y or Z? First-tier cities or lower-tier cities? Men or women?

You will need to work closely with a reliable local agency that will help you navigate the numerous solutions you can find on the market. At GMA, we are a team of +70 digital experts based in Shanghai. We can discuss your project in China and find the most suitable solution for your brand:

- Branding

- E-reputation

- KOLs

- Livestreaming

- Social media (WeChat, Weibo, Little Red Book)

- E-commerce (Taobao, JD, Tmall)

- And many more