As Chinese luxury consumers become increasingly sought-after by global brands, there is a lot of discussion and speculation about who these shoppers are and what they want. Are they all brand-loyal and looking for status symbols? Or is there more to their shopping behavior than that? In this post, we’ll explore some of the myths about Chinese luxury consumers and look at the reality behind them.

China’s Luxury Market Consumers: Truth vs False

Here is a list of 6 Myths about Chinese Luxury Consumers and their reality.

Chinese luxury consumers are not quality conscious

- Myth: not quality conscious: China, a popular destination for low-cost manufacturing, products has acquired a reputation, as a source of counterfeit products as well! An estimate by the UN revealed that of all the counterfeit products caught in the world, 70% are manufactured in China. Such low quality and fake products from China have flooded the global markets, giving the world a negative impression of the Chinese, as having little regard or respect for Quality.

- Reality: Chinese are equally quality conscious and such news only makes them even warier of the fake products, low quality available in the domestic market. Also, the high luxury taxes in China force the Chinese to shop abroad, giving them assurance of quality and reasonable prices.

Chinese luxury consumers do not have a proper fashion style

- Myth: no individual style: China still has a strong family system, with emphasis on the whole, and not individuals, unique in the western societies. Society determines and dictates individual behavior and lifestyle.

- Reality: With the advent of the internet, fast improvements in technology, and the shifting age of luxury consumers, this is changing rapidly. The youth of China are expressing their opinions, and voices on many social platforms available. All this has resulted in the growth of individual preferences, tastes, etc among Chinese, youth in general.

Implications for luxury players => Consumers of luxury in China are getting younger, and you need to adapt your communication to their needs and channels of predilection, especially as outbound travel for shopping purposes dwindled while domestic spending is taking off rapidly.

Chinese luxury consumers are not informed well about luxury products

- Myth: not informed about luxury products: As Luxury products entered the Chinese market only recently, the world started misinterpreting this in a negative way, that China does not have a market for luxury products.

- Reality: In reality, consumers have a passion for luxury goods and are seeking the luxury experience; they conduct in-depth research (mainly online content) on every brand and every product that is available for sale. They research brands & products online and offline. Finally, it depends to a large extent on the brands to offer education on brands to consumers for better market penetration.

The Chinese society dictates luxury consumers’ choices about brands

- Myths: society dictates brand choice: In China, it is strongly believed that personal preferences and choices are believed to be determined by society, as there is a strong social hierarchy. People value and care for social status and go for brands that have a high price.

- Reality: People make conscious choices based on many factors, not just determined by society, as against the belief they prefer high price, costly brands for social pride. Research by Management consulting firm McKinsey revealed that Chinese consumers prefer understated luxury items that are affordable.

Implications for luxury players => don’t be afraid to market lower-priced luxury items. The post-90s generation & post-00’s generation will thank you with their wallet.

Chinese luxury consumers are obsessed with foreign luxury brands

- Myth: Chinese consumers are obsessed with foreign brands: It is a popular belief that the Chinese prefer Western brands and products, as they trust their quality.

- Reality: Luxury connoisseurs are slowly realizing that domestic luxury companies also offer the same quality and functionality. This is especially true with the rise of Chinese luxury brands

Luxury buying experiences is a face to face one

- Myth: The luxury world is not fit for online sales and needs to happen offline. This fact is the truth for most brands internationally.

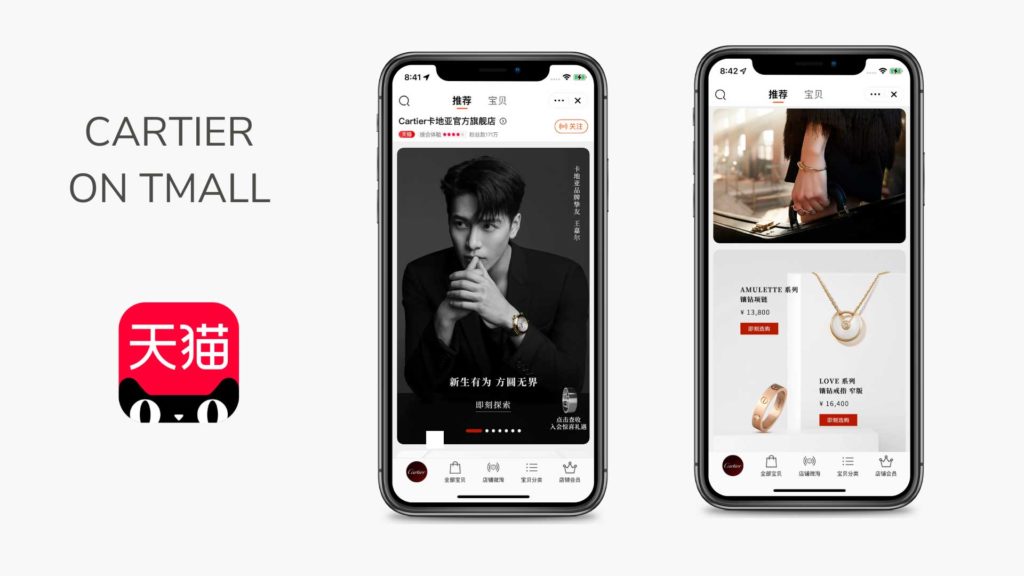

- Reality: China is showing us that luxury brands also have to be online. The rise of online luxury spending is one of the best proof of this fact. This as well as the multiplication of “platform” within platform dedicated to luxury brands such as Tmall Luxury Pavilion. Chinese consumers still go to department stores to see products by themselves but will purchase online where they can find the best luxury goods sales and deals.

Myth-busting is happening!

These myths are slowly being busted, as more and more luxury brands are growing popular with a huge Chinese customer base. The success of luxury stores such as Hung Huang’s Brand New China, Dong Liang Studio, etc reflects the changing attitudes of the Chinese towards Luxury.

Once you are well aware of what is true about China you need to understand how to be seen by Chinese consumers. Go and take a look here to have more insights into china’s passion for luxury goods.

Beyond the myths, Let’s answer some questions about the Chinese Luxury Market

Why are luxury goods so popular in China?

First, China is a newly-wealthy country and many people are eager to spend their money on luxury items. Second, there are a lot of statuses associated with owning luxury goods in China, and people view them as a way to show off their wealth and power. Finally, Chinese luxury brands are often seen as being of higher quality than Western brands, so people are more willing to spend money on them.

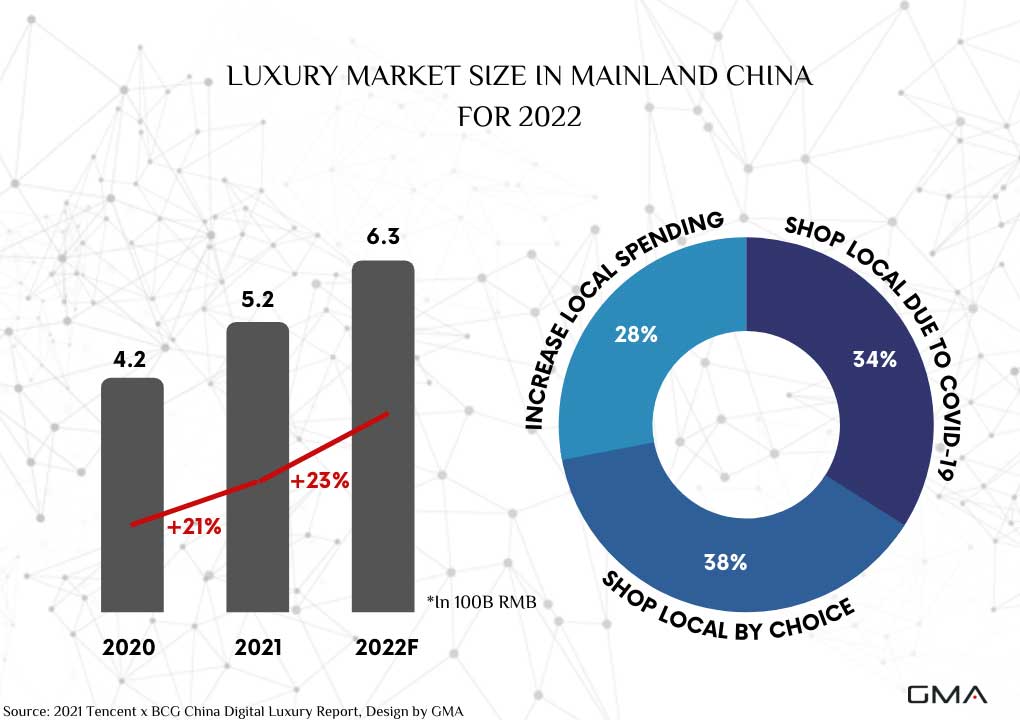

The Chinese luxury sector is steadily growing, what are the main drivers of luxury goods sales?

There are a few key drivers of the Chinese luxury market. One is that there has been a growing affluent class in China in recent years, and these consumers are increasingly interested in premium brands and products.

Another driver is that Chinese consumers are becoming more sophisticated and discerning, and want to buy products that reflect their unique sense of style and individuality.

Many luxury brands have been expanding their presence in China in recent years, which has helped fuel demand among Chinese consumers. Lastly, with brands available online there is better access to luxury goods.

What is the average age of luxury buyers in China?

Luxury consumers in China are an average 10 years younger than their counterparts elsewhere. In fact, the age of luxury consumers on the mainland is 28 years old.

The next big growth in luxury consumption is expected to coincide with the increasing household income in China’s Genz which are already some of the biggest spenders in this sector.

One of the buying behaviors observed with China Genz is the purchase of an expensive luxury item that they can often not afford with their current income.

What are key criteria luxury companies need to keep in mind when selling in China?

- Brand recognition if you are targetting luxury newcomers

- Chinese consumers seeking status are not loyal to a specific brand.

- Timeless styles are always a winner

What are the best-selling categories of luxury goods in China?

The following luxury categories are on top of Chinese luxury sales and trends

- Fashion & Accessories

- Bags & Leather Goods

- Watches & Jewelry

- Cosmetics

- Bonus trends: luxury sneakers & luxury streetwear

What challenges do luxury companies face when entering the Chinese market?

Although the demand for luxury goods and growth in luxury spending is all-time high; there are a number of challenges that international luxury brands have faced when entering the Chinese market. China has a reputation for being a knock-off culture, which can devalue the perceptions of luxury brands.

There is a growing middle class in China with more disposable income, but they may not have the same brand awareness as consumers in other markets.

Chinese consumers tend to prefer localized versions of luxury brands, so international companies need to be able to customize their products and marketing strategies for the Chinese market.

Luxury import taxes can be daunting for some smaller brands.

Lastly, There is fierce competition among luxury brands in China, so companies need to be prepared to invest heavily in marketing and advertising to stand out from the crowd.

Contact us to reach out to Chinese luxury consumers

We have solutions for you, let’s schedule an appointment

3 comments

Bee Chen

Hello! I am interested in a collab for copy writing, who should I contact for this?

DOLY

As usually, Olivier gives us a remarkable analysis on myths and reality about Chinese luxury consumers. Naturally Chinese Luxury firms have to make more efforts in the quality of their luxury products, il will allow too increasing their sales abroad. This improvement does not date to recently. In 1987 I remember having visited an excellent factory of suits and blazers in Shenyang, with American quality controllers on site, their products where sold in that time in Washington DC and Fifth Ave in NYC. And in the following years French luxury firms were already producing in China to sell in France and Europe. Good luck to Chinese luxury firms!