New macro-economy trade context in regards to the industry: increased caution

We can currently observe a potential turn in the economic cycle in China, which is prompting concern among industry executives. The global growth has averaged above 2.5% in the past years since the financial crisis but there are signs of celling. After a quite long period of accommodative monetary policy, the US Federal Reserve among others is starting to raise interest rates.

Forecasts from the World Bank, IMF, and OECD show slower growth in developed markets through 2020 and a flattening of the growth curve in developing markets. Europe, Latin America, and the Middle East could be most vulnerable to a deceleration, but the US bubble and China could also face a slowdown. Finally, the trade dynamics (tariffs among others) could impact consumer spending and fashion & luxury sectors’ growth in both.

Customers are getting woke about causes support such as sustanability, gender fluidity, femininism, racism…

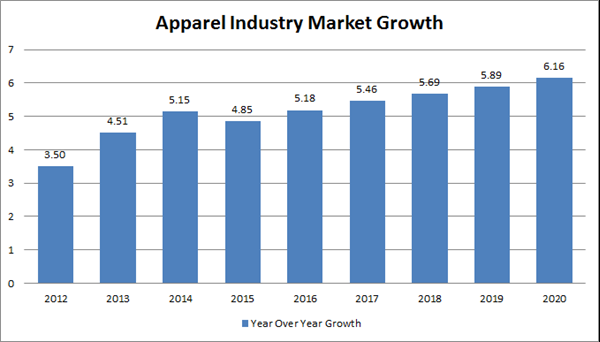

Some key context data at the fashion industry level

The strong performance of the global economy over recent years has generated rising investments by fashion industry players. 2/3 of companies’ costs bases have risen over the past 5 years. The average sales general & administrative expenses grew from 34% to 36% of sales in 2017. The priority investments in sales growth in omnichannel e-commerce and CRM, improving off-line retail environment and brand building. Cost of good sold to revenue increased by 0.5% for half of the companies and by over 2% for 25% of companies (due to markdown pressure).

Fashion is sensitive to policies and politics that define cross-border trade

The US is renegotiating some of its agreements with key trading partners and that is creating concern. This needs to be taken into account by players when defining, for instance, their sourcing or pricing strategies. In the US, the fashion industry imports amount to 6% but they do amount to more than half of duties, while more tariffs are coming into force for goods from China. While China is fighting with the US, it is trying to make some imports cheaper, including textiles, but it has excluded US companies from the deal.

Consumer changes & new trends affecting the Chinese market

The lifespan of fashion products being stretched: pre-owned, refurbished, repaired… and rental business models continue to evolve. Across many categories, consumers have demonstrated an appetite to shift from classic ownership to newer ways in which to access products. One customer today buys 60% more items of clothing than 15 years ago, but they keep it for half as long according to recent surveys. At the same time, luxury brands are raising prices significantly: prices of fine watches and jewelry have nearly doubled since 2005.

46 tracking global prices of Louis Vuitton’s Speedy handbag suggests an increase of approximately 19%

3 trends to consider in the upcoming 2 years on the Chinese market

- A sharp increase in the number of brands getting into the rental, resale and refurbishment models

- Rental native brands: brands born with a rent business model for short-term activity

- A growing proportion of customers wardrobes made up of pre-owned or rented products, especially for high-value items and accessories

Consider the customers’ rising interest in social and environmental causes

Younger consumers are seriously concerned with social and environmental causes, which many regards as being the defining issues of our time. They increasingly back their beliefs with their shopping habits, favoring brands that are aligned with their values and avoiding those that don’t. 90% of Gen Z consumers believe companies have a responsibility to address environmental and social issues (#metoo, #blacklivesmatter…). The above generation accounts for 40% of global consumers by the end of 2020.

Using new trends as marketing weapons for fashion & luxury brands in China

Consumer changes: “getting woke”

Signs of this evolving agenda can be found beyond consumer sentiment too. Fashion companies are showing signs of “getting woke”; for instance, a recent data scrape of the word “feminist” in retailers showed that it has been multiplied by 5. Other recent examples include Fast retailing like Asos, H&M, Balenciaga, or Moschino (fast-fashion). Keep in mind that not all causes that fashion brands advocate are universally popular, and these can come with significant risks.

Consumer changes: “I need it now”

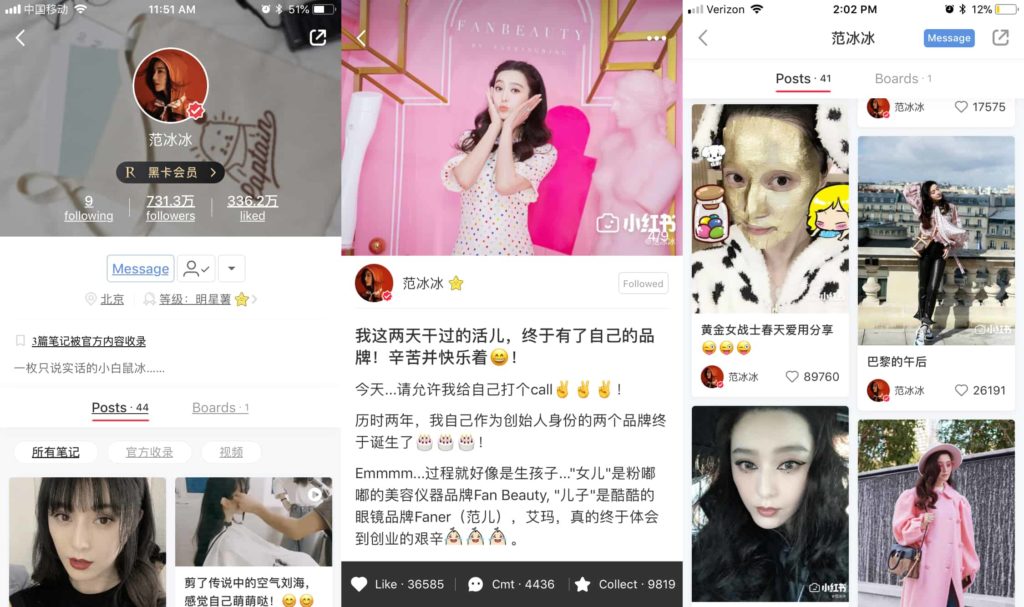

The time lag between discovery and purchase is a pain point for customers who continue to expect better experiences. Companies are increasingly focusing on reducing this source of friction and launching new technologies to enable a smooth and increasingly diverse nature of inspiration can be a source of confusion for some because it removes the direct connection between the idea and the item. From a brand perspective, more fragmentation and degrees of separation create roadblocks in converting.

Consumer changes: “I want to know where this is coming from”

We can observe an increasingly distrusting consumer expects full transparency across the value chain. Customers need to know about creative integrity, sustainable supply chain, value for money, treatment of workers, data protection, and authenticity. Customers are more and more willing to pay more for sustainable goods since global environmental warming.

Focus on China: key trends and developments to target for fashion marketing

Digital transformation in supply chain

Supply chain transformation enables apparel retailers to shorten replenishment times, optimize deliveries, match supply with demand, and ultimately boost values and revenues. Apparel players are embracing a data-driven approach in their manufacturing processes, tying their business decision to analytics insights.

Cross-sector expansion

Cross-sector collaborations and partnerships are becoming more prevalent in the apparel market. Many major apparel players have expanded beyond the fashion sector to pursue cross-sector growth, which enables them to reach out to new customers and seek business opportunities, making cross-sector expansion a key to driving sustainable development. Apparel players expand to the household sector; for example, in September 2018, Peacebird opened 5 lifestyle and product stores.

Change in timing and impact of digital

Some established brands are embracing disruption by launching accelerators and incubators to test new approaches in a more controlled environment. These are more flexible and less risky than mergers and acquisitions, enabling experimentation and offering the opportunity to accelerate business model innovation where necessary. The impact of Plug & Play or La Maison des Start-Ups concepts are leading to 3 major disruptive developments in China: innovation, streamline, and new supply chains.

Understanding the Chinese fashion market is the first step to establish your fashion brand

The Chinese marketing system is lead by self-disruption, represented through some factors

- Social media growth engagement level

- Established brands need to disrupt to differentiate

- Brand makeover expressing renewal

- Established brands and collabs

- Streetwear talent to crave originality

- Disruptive communication to mark customers’ minds

Get to know the latest Chinese trends in China to know how to sell your products

The Chinese market is unique, whether it is about its digital ecosystem, its cultural impact on customer behavior or its new trends impacting all kinds of industries. From fashion to luxury, our agency can help you set your strategy in China from the creation of your business model to the promotion of Chinese social media.

Contact us to get advice from professionals and implement your brand in the Chinese market. Learn how to use the latest trends to take advantage of and disrupt your target market; it will be the best way to differentiate yourself from the Chinese highly competitive fashion market!

Read more about Fashion and Luxury in China:

1 comment