With the rise of the eCommerce industry in China, one might wonder how newcomers perform, especially in the face of competitors with a stranglehold of the market.

Therefore, the tale of Pinduoduo vs Alibaba is one that many merchants are watching out for. With its unique business model and appeal to price-conscious consumers, how exactly does Pinduoduo fare against its biggest rival? And can you use this platform to expand your brand?

In this guide, we’ll show PDD’s features and compare them with Alibaba to help you determine if this platform is for you.

What Is Pinduoduo?

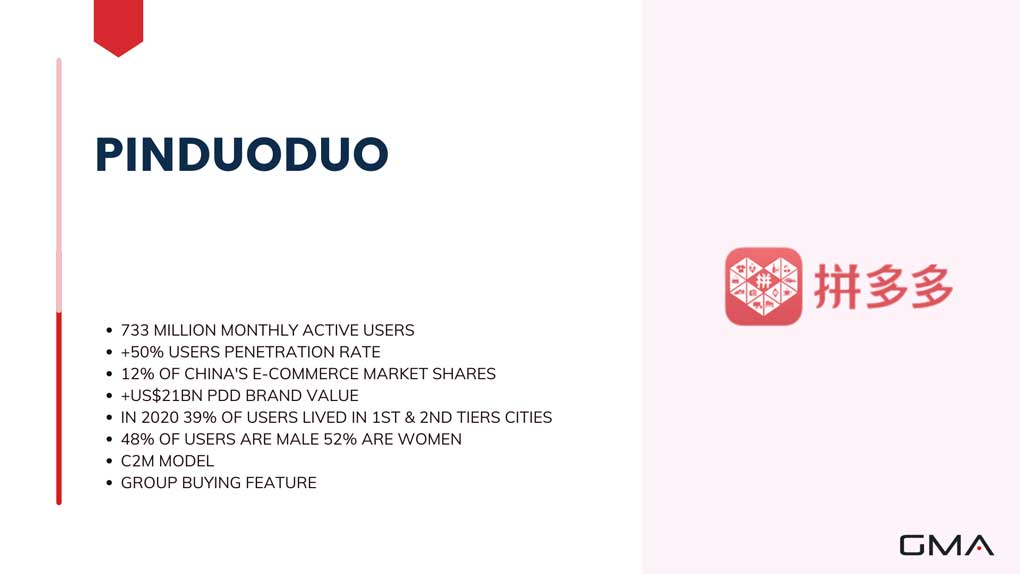

Pinduoduo or PDD is the 3rd largest eCommerce platform in China. This 5-year-old platform offers a unique shopping experience for its users.

Unlike its two largest competitors, Alibaba and JD.com, PDD allows users to buy in groups to reduce the price of their target product. This means that as more people decide to buy an item, the item’s price goes lower. This has become PDD’s main competitive advantage that contributed to its rise in the Chinese eCommerce space, becoming the most-preferred shopping experience by the more price-conscious citizens in the Chinese market.

What Are Pinduoduo’s Features?

Social Media Integration

Pinduoduo eCommerce not only uses a unique business model but also takes advantage of the large social media platforms for their customer acquisition efforts.

WeChat, a vital everyday social media platform for many Chinese, integrates PDD into its system. This means that WeChat users can use Pindudouo’s Wechat affiliation program to get discounts but also open Pinduoduo links within Wechat. This same level of integration can also be seen on QQ, another Chinese social media platform.

The seamless access from social media to their eCommerce app makes it easy for many people to use Pinduoduo eCommerce. This low barrier of entry is one of the reasons why PDD has steadily increased its user base over the years.

Group Buying (C2M): the strength of Pinduoduo

As we said before, PDD allows its users to buy in groups.

Merchants within the platform have two listed prices for their products:

- The first one is for buying the item individually

- While the second one is for groups. These prices are generally lower than the first one to encourage as many users as possible to buy the item.

This is what Pinduoduo eCommerce calls “social shopping.” This means that users should invite their friends, families, and other users to form teams of buyers. These teams will then purchase that product to take advantage of the discounted rates.

This model is called the customer-to-manufacturer (C2M) model, which allows consumers to become the very indicators of what manufacturers and retailers should offer them. This has two benefits:

Firstly, manufacturers will no longer have to heavily rely on R&D and marketing to gain consumer insights. Shifting to a consumer-driven process, manufacturers will now utilize consumer behavior in PDD to determine the products that they need to manufacture and sell.

Secondly, because of the social element of the platform, more people are drawn to the app. Existing users will advocate for other people to join the app and make a purchase with them so that they can avail of the lower price tags on items. This is made easier by its integration with WeChat and QQ. As a result, more and more people are joining the platform every single day.

Other Interesting Pinduoduo Features

Of course, PDD has a lot more features than social shopping and social media integration.

All these features are geared towards making online shopping more experiential than their competitors, such as Alibaba and JD.com. For instance, instead of having a search bar in their interface, PDD opted into forcing their users to scroll through the products. This gives the user the familiar feeling of sifting through a bazaar store to see if there are any good purchase hauls.

Their other features include:

- Short-term coupons for flash purchases

- Red cash envelopes for successful invites

- A lottery game where users can have a chance to win a range of products in exchange for a small fee.

How Does It Compare With Alibaba?

While Alibaba remains the top group with its eCommerce platforms (Tmall/Taobao) in China, Pinduoduo has contributed to the sharp decline of the former’s growth.

But what exactly sets these two apart? Are there any steps that Alibaba is taking to stifle its competition? Let’s get into Pinduoduo vs Alibaba.

Number of Users

While Alibaba continues to be the top dog of Chinese eCommerce with as many 711 million users in 2019, PDD isn’t that far behind with 585.2 million users shopping on their platform. This sharp growth in PDD’s user base is largely attributed to the ease of access to the platform. Unlike its rivals JD.com and Alibaba, PDD uses WeChat and QQ as their gateways for many of its new users. WeChat users can even use the platform to settle their payments with PDD.

So, if it’s just a numbers game, in terms of users, Pinduoduo vs Alibaba is a close one.

But let’s give this user population more nuance.

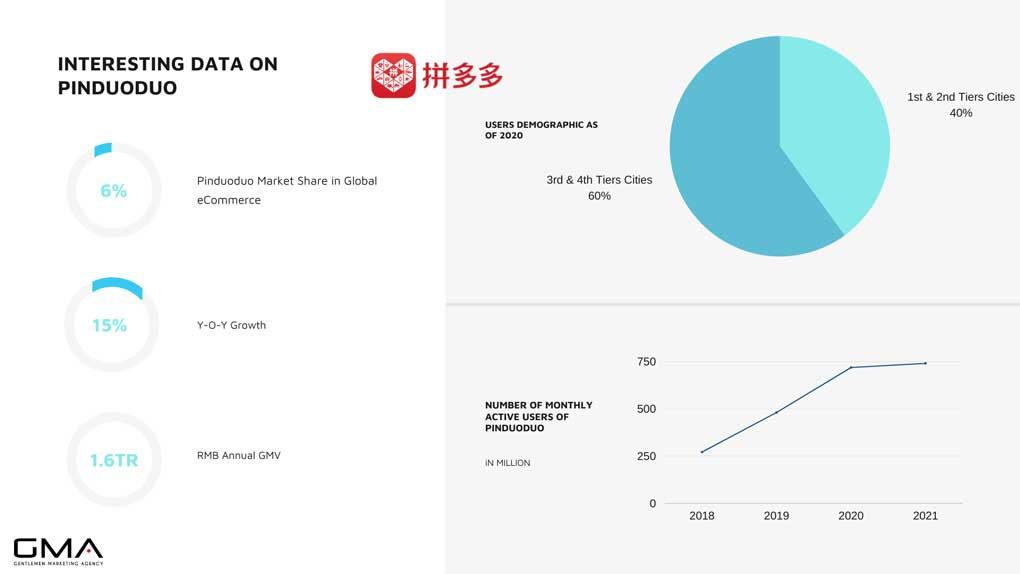

Most of Pinduoduo’s users are residents of smaller cities, which are tier 3 cities and below. 55% of their general merchandise value came from these cities. On the other hand, Alibaba still has a strong presence in Tier 1 cities such as Shanghai and Beijing. The reason for this difference lies in the affluence of their demographic. Citizens in Tier 3 cities are generally more price-sensitive, which explains the heavy preference for PDD’s group buying scheme. Tier 1 cities, on the other hand, prefer Alibaba’s superior logistics efficiency even if it comes with a higher price tag.

Logistics

Given the established position of Alibaba, it has a superior logistics capability compared to Pinduoduo. It has large stakes in almost all the logistics companies in China. To cover this ground, however, Pinduoduo has made strides in improving its own logistics platform by developing its own logistics system and even partnering up with local merchants across rural communities in China.

Purchase Model

Of course, the main difference between these two platforms is how they handle their purchases.

Alibaba follows the traditional way of eCommerce which is to offer products to buyers and then let them decide whether to purchase them or not. Of course, there will be sales and discounts here and there, as brands vie for consumer favors.

This is where Pinduoduo vs Alibaba showdown gets interesting. While PDD undoubtedly still integrates a bulk of these strategies in its platform, what sets it apart is its unique C2M model which encourages a community of consumers to dictate what products will be sold by the platform’s merchants.

Furthermore, the shopping experience in Pinduoduo is centered around the idea of encouraging groups to buy together. Pinduoduo means “together, more savings, more fun” in English. This, along with the reduced friction of buying products, makes Pinduoduo desirable to many users, especially those that reside in Tier 3 cities and below.

Pinduoduo’s Steady Rise

Pinduoduo may have just given birth to a whole new genre of online shopping.

While Alibaba is certainly one of eCommerce’s pioneers, Pinduoduo elevated the game by introducing a radically social aspect for buying products online. Users can invite other people to make a purchase and get discounted rates. These newly-invited users will then realize the money that they can save and invite even more people to the platform. This new breed of eCommerce is what we call social eCommerce, and this is what has driven PDD’s exponential growth in the past 5 years.

Many eCommerce platforms tried to import this feature into their system with very limited success. One example of this is the Alibaba-backed Lazada.

Of course, the team purchase feature is not the only reason why PDD is rapidly growing in the Chinese eCommerce market. You can also attribute this growth to the seamless integration of the platform on top of WeChat’s ecosystem. WeChat contributed to PDD’s virality since this app is a staple for every Chinese user. Team purchases are also very easy to execute since WeChat revolves around making communities of people as well.

While there is still no clear winner between Pinduoduo and Alibaba, one thing is for sure. PDD is closing in fast to become China’s largest eCommerce platform because of its easily accessible platform and the fact that retail prices are much lower compared to the average retail price in Alibaba.

Sure, there are efforts on the part of Alibaba to integrate the C2M strategy and social shopping experience, but PDD remains to be the best at what they do now.

Leveraging Pinduoduo To Excel in China

PDD offers a lot of value for many users in China with its unique social shopping experience and cutthroat affordable prices. Furthermore, PDD has filled the gaps left by Alibaba and even JD.com in Tier 3 and below cities by offering a quality shopping experience without breaking someone’s bank.

These features, along with the C2M model, present fashion and luxury brands with a great opportunity to expand their reach to more than just Tier 1 and 2 cities.

PDD has shown us that there is a large, untapped market beyond Beijing and Shanghai. PDD is the key to unlocking the potential revenue growth and brand expansion in these cities.

If you are looking for a platform that can help you touch as many demographics in China as possible, then Pinduoduo is a great choice. After all, PDD is still the 3rd largest eCommerce platform in China, just behind Alibaba and JD.com.

Can’t make a choice between Alibaba & Pinduoduo?

Send us a message so we can help you integrate either of the platforms!