As the Chinese middle-class is rising, its demand regarding “expensive but no too expensive” luxury products will grow.

The Booming Premium fashion Market in China

Premium brands like Michael Kors, Ralph Lauren, Coach and Swatch are expected to do fairly well on the Chinese market, as the Chinese ascending middle-class will have about 119 million new households between 2012 and 2022. Michael Kors, the New York city based luxury fashion brand is offering fairly affordable luxury clothes and handbags. The company reported (on June 1st) that the sales already went up by 7.8% to $4.7 billion this year.

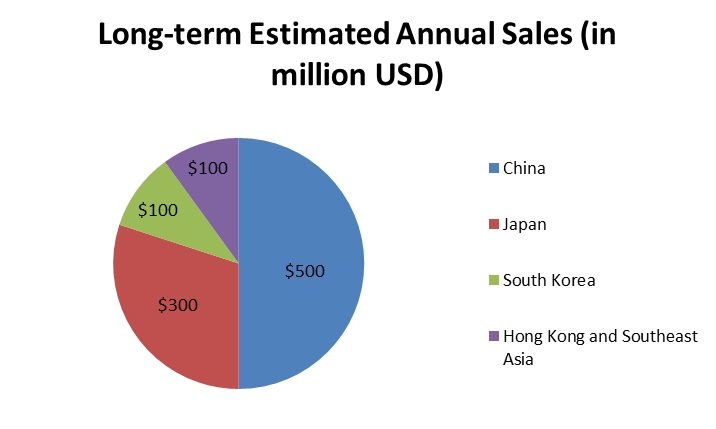

John Idol, Michael Kors’ Chairman and CEO talked about two new strategies. First off, the brand Michael Kors is intentionally backing off a bit on its wholesale business to traditional department stores. On the other hand, the company is shifting up its business in Asia, especially in China. The two strategies are quite obviously intertwined. The group has reported impressive fourth quarter sales in China; reaching $65.5 million (jump of 216.4%). In the greater China (Hong Kong, Macau, Taiwan, sales for the full year reached $197 million. This success did not come overnight, the brand has been known to invest through its licensee Michael Kors (HK) Ltd. building a network of 91 retail stores and six travel retail spots operated by the licensee. As the licensee is having a great success overseas, John Idol decided to acquire it for $500 million and closed the deal, assuring that “Asia will ultimately be a $1 billion market” (see chart below).

This deal allows the American brand Michael Kors to receive full control of its retail network, in addition it is well positioned to capitalize. Reports show that Chinese consumers have spent a little less on high-end products in the recent years. However the middle class is burgeoning.

According to Morningstar Inc. “not too expensive” luxury brands such as Ralph Lauren, Coach and Swatch will be the beneficiaries of this ascending middle-class consumers. Michael Kors was not officially stated, but the company has some potential room to grow as it is less likely to face pricier labels sales drop like Prada and Gucci.

Very high quality at affortable price

These Premium Brand “not-so-expensive” brands played the same role in the U.S with the middle-class consumers, focusing their business on department stores. Although, department stores are suffering, brands like Coach Inc. are starting to make their way out. John Idol stated that department stores focused too much on discounts, which reportedly altered Michael Kors brand image as well as its margins.All these brands are investing in their communication in China, specially online Advertising.

Nevertheless, the New York based brand sales remain strong in the Americas, growing by 4.6% in the fourth quarter (reaching $879.1 million). Idol even countered some press critics stating that the brand was losing ground. Even though the brand expects a lesser revenue from traditional brick-and-mortar retail stores, it expects the e-commerce sales in the U.S and China to grow.

1 comment

Frank Hung

Super interesting one! With the emergence of the middle-class in China, luxury is not the most affordable way to do shopping, even if Chinese luxury brands consumers are numerous. Premium is more affordable for this type of consumers, they don’t want to buy fast fashion anymore, there is a new of differentiation, this is why high-end brands are more and more popular!