China is currently the biggest market for accessories. The huge market and its great potential are attracting brands from different countries including the USA, France, Italy, UK, Spain, Greece, and many more countries. But before brands enter this market, they need to have a complete understanding of the local specificities. Accessories that work overseas may not encounter success in China. On the other hand, accessories with poor performance abroad can actually be a hit in China. How is the market working in 2022? What are the current trends? How should I do marketing in China?

Contents

Chinese Accessories Market Overview

China is The Biggest Accessories Market in the 2020s

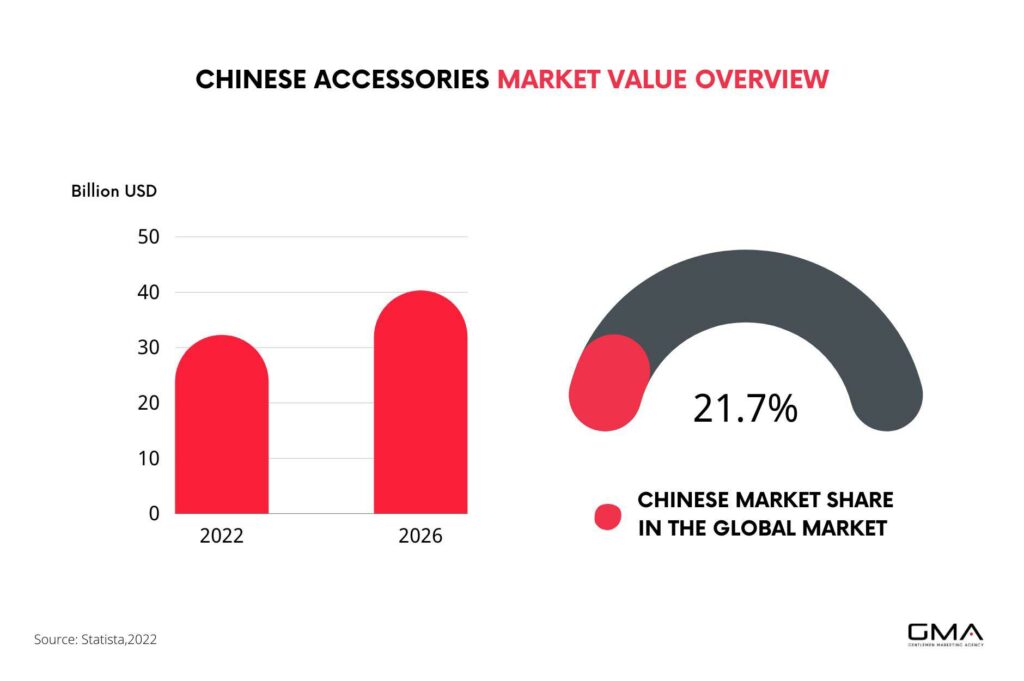

According to Statista, the Chinese accessories market value has reached 32.25 billion USD in 2022. This figure is expected to grow to 40.27 billion USD in 2026. Compared to the worldwide accessories market, the Chinese market has taken 21.74% of the global accessories market share. Comparing to entering several markets with a lot of effort and cost, entering the Chinese market become a better strategy for your growth.

Feature of the Men’s, Women’s, and Children’s Accessories Market

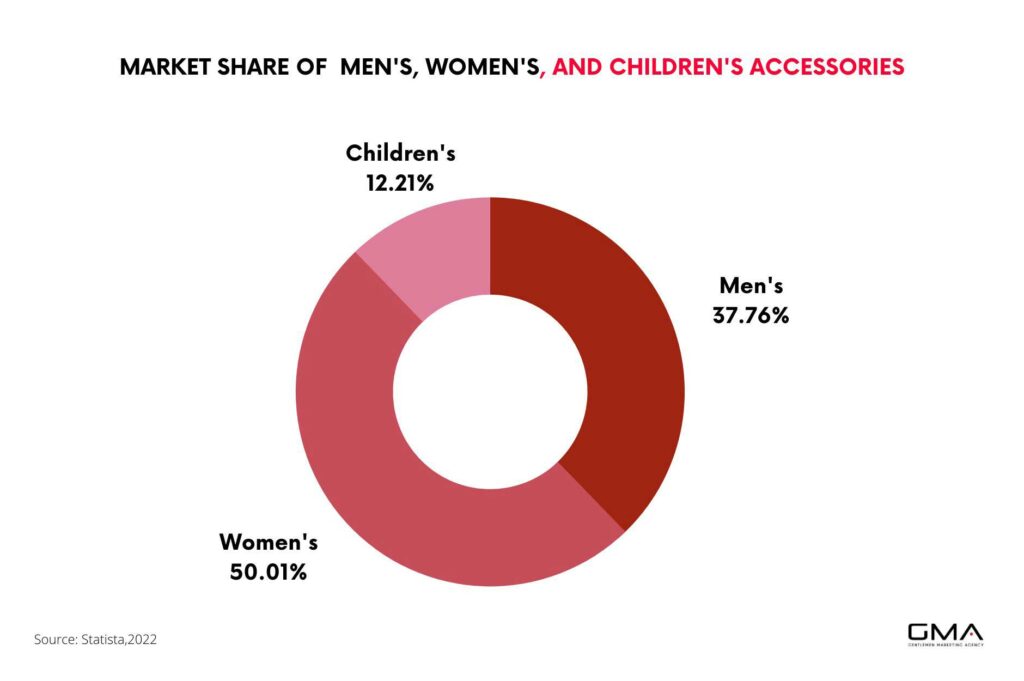

Without a doubt, the women’s accessories market is taking the biggest market share in China, just like how it works in most markets. In 2022, women’s accessories took 50.01% of the Chinese accessories market share, exceeding half of its market value. Followed by men’s accessories with a 37.76% market share and children’s accessories with a 12.21% market share. Compared to the global market with 34.9% of men’s accessories, the men’s accessories market in China shows a stronger consumption power.

What are the Top Accessories Categories in China Today?

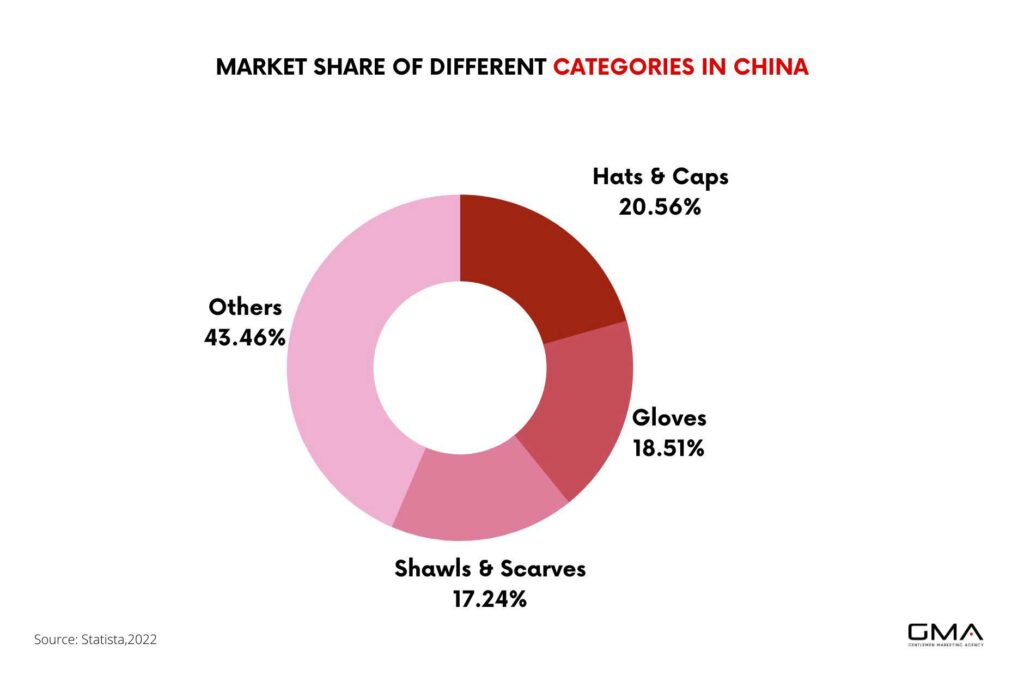

No matter if it’s the men’s, women’s, or children’s accessories market, the “felt, fur & other clothes” category is taking the biggest market share. But since this category is a combination of several sub-categories, we can still put our emphasis on “Hats & Caps” which is the second biggest category in China with 20.56% market share. Followed is the “Gloves” category with 18.51% market share and the “Shawls & Scarves” category with 17.24% market share. Overall, “Hats & Caps”, “Gloves” and “Shawls & Scarves” are the top 3 categories in the Chinese accessories market.

Online Sales is Generating the Majority of Sales Revenue

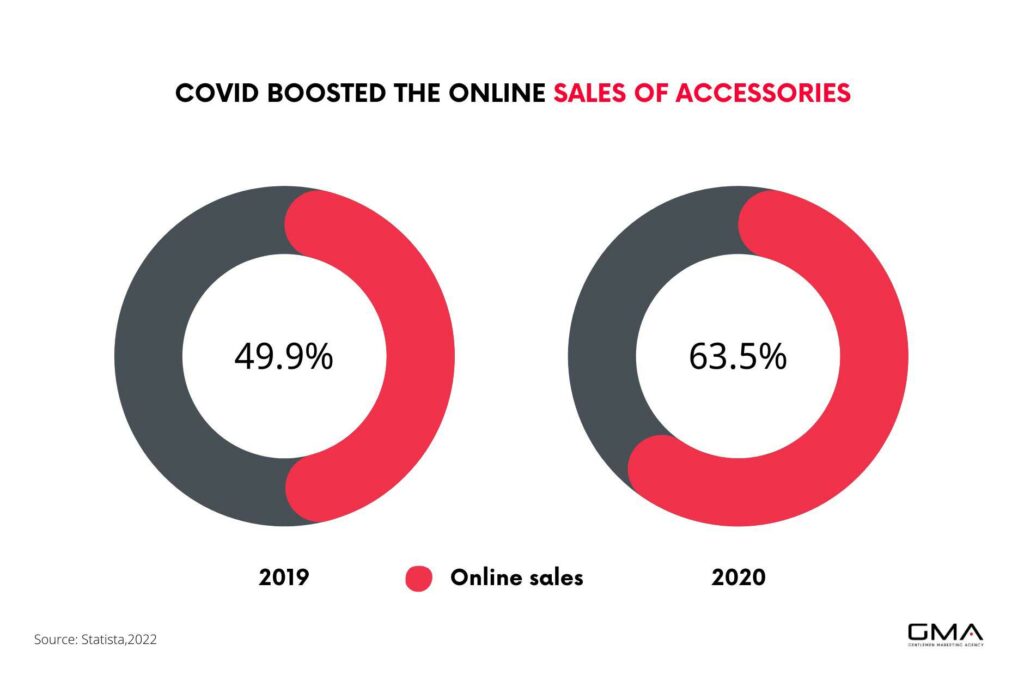

E-commerce has been an important part of Chinese people’s daily life. When Chinese e-commerce is more and more developed, its importance in accessories sales is growing. The online sales of accessories in China have been taking more than 40% of the total market share since 2015. The growth was boosted by the Covid when most offline retailers are not available in 2020 and grew from 49.9% in 2019 to 63.5% in 2020. This rate dropped a little after Covid, but still remained around 60%.

Market Trends and Best Accessories Features in China

Fewer and Fewer People are Wearing Ties

Ties and bow ties are very common men’s accessories. But compared to the wide use in Europe or America, the usage of ties is decreasing among Chinese younger generations. When fewer and fewer employees are asked to wear suits in their offices, young workers in China are less tending to purchase ties. This caused lower demand for ties among low-middle-class customers.

The Increasing Price Per Unit of Leather Clothes

The market share of leather clothes is only 1.76% in 2022, but the average value is growing rapidly. The price per unit of leather cloths for men, women, and children is 311.6 USD, 238.7 USD, and 101.2 USD in 2022, but is expected to grow to 631 USD, 536 USD, and 228.7 USD by 2027. Even though it’s not a huge market, we can see the increasing demand for high-end leather clothes.

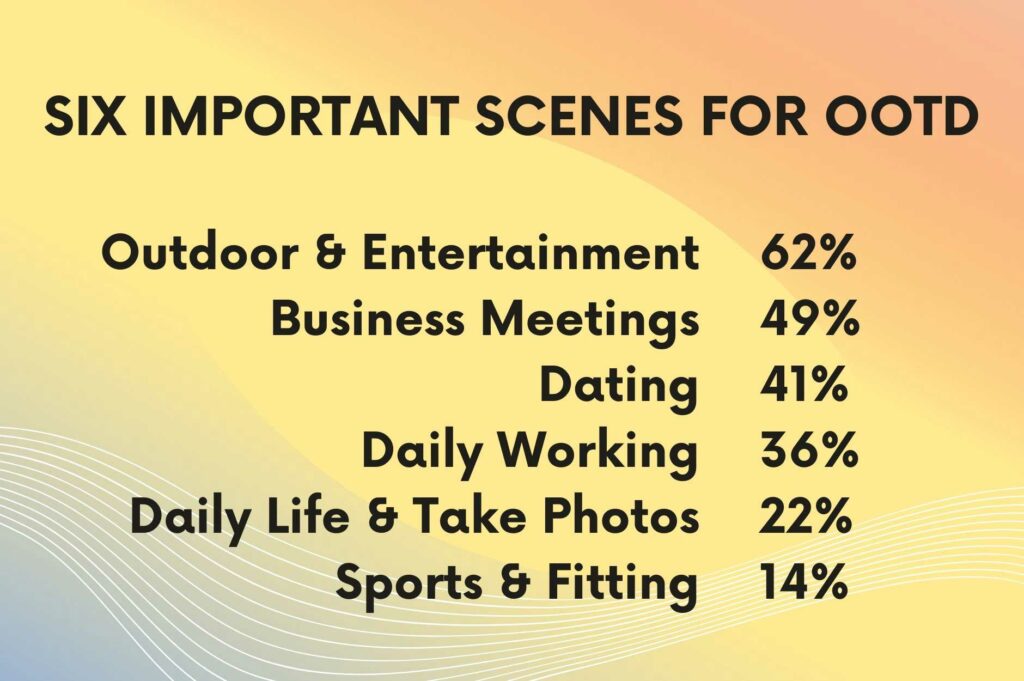

Outdoor and Entertainment are Important for the OOTD of the Chinese Youth

OOTD, as known as “Outfit Of The Day”, is now a very important topic for the youth in China. In research by TOPKLOUT in 2022, they tested how much Chinese youth care about their OOTD in different scenes. The six scenes are Outdoor & Entertainment, Business Meetings, Dating, Daily Working, Daily Life & Take Photos, and Sports & Fitting. The research shows that 62% of Chinese Youth put emphasis on Outdoor & Entertainment scenes, counting for the most important scene. Followed by Business Meetings at 49%, Dating at 41%, and Daily Working at 36%. Only 22% of them see the OOTD of Daily Life & Take Photos as important while 14% of them care much about their outfit in Sports & Fitting.

This research shows the demand of Chinese younger customers for their accessories in different scenes. Brands should pay more attention to the accessories for Outdoor & Entertainment, Business Meetings, Dating, and Daily Working.

What are the Considerations of Chinese Gen Y vs Gen Z?

Another research by TOPKLOUT in 2022 has dug into the factors Gen Y & Gen Z in China care about. The 4 main factors people might take into consideration when choosing their accessories are Design, Price, Material, and Brand. Among these 4 factors, Design shows an incomparable supporting rate at 96%. This shows that almost all Gen Y and Gen Z are more focused on Design. The appearance of an accessory becomes the very key leverage in the Chinese market.

Price is the second important factor, 79% of the respondents are putting cost performance into their consideration. Followed by Material with 63% of respondents and Brand with 49%. It might be quite surprising that brand is no longer a very key factor for accessories. In the 2020s, what can keep a brand growing in China is now the design and appearance.

How to Market My Accessories Brand in China?

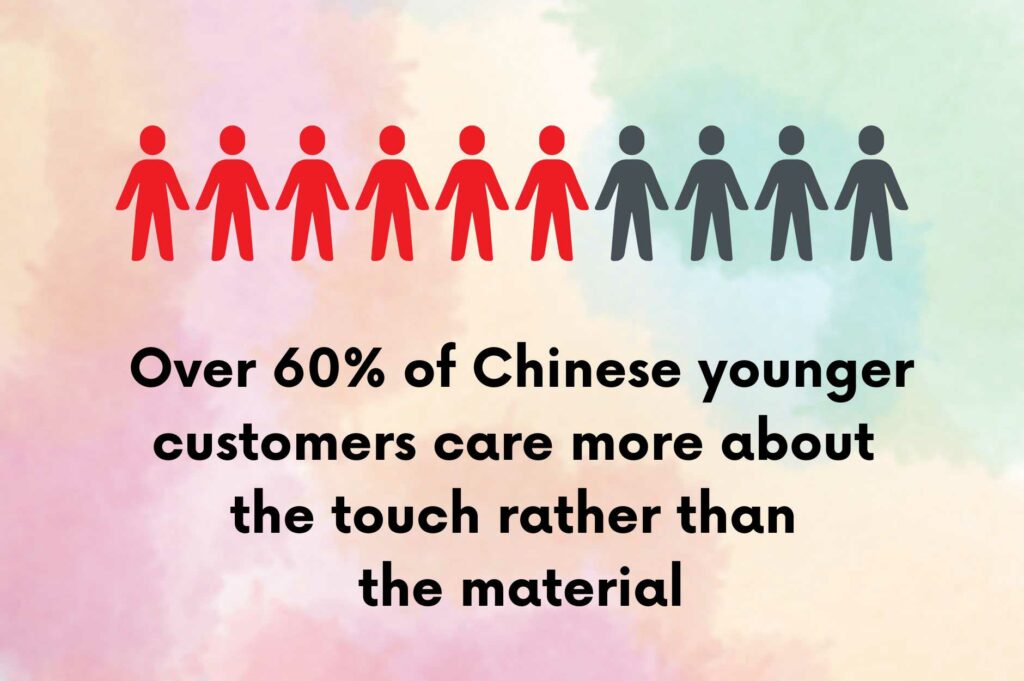

Promote With the Touch & Feeling Rather Than the Material

Over 60% of Chinese younger customers are not caring much about the material, and only 29% of them are checking the material tag. 58% of them claim that no matter what material it is, they will like it as long as the touch is comfortable. Seeing this phenomenon, brands can put more emphasis on promoting the feeling of wearing rather than the use of material. Especially for accessories like gloves, scarves, and hats, a creative description of the touch is more efficient.

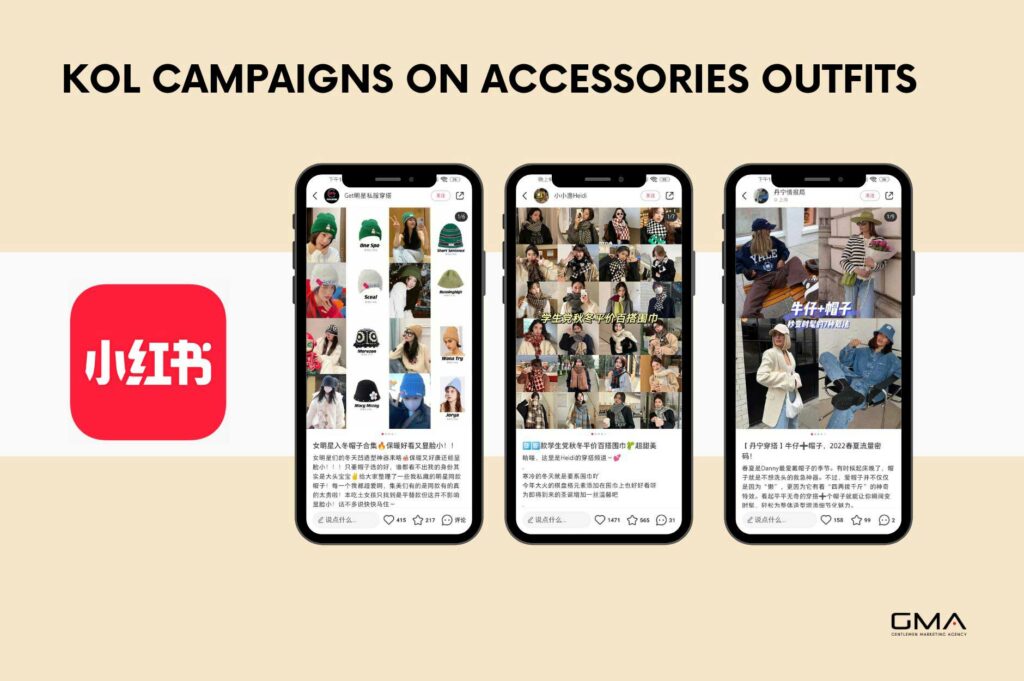

Xiaohongshu: For Both your Brand and your Products

Xiaohongshu is currently the top 1 social media for fashion topics. So far, fashion is the No.1 mentioned tag on Xiaohongshu. The user base of Xiaohongshu has 70% of them are female, 72% of them are younger generations, and 50% of them are from first and second-tier cities. This user portfolio made it a perfect channel to target your right audience.

You can create a brand account on Xiaohongshu as your official account with a blue check (official verification by Xiaohongshu). Depending on your budget, you can choose to open a store on Xiaohongshu for easier purchases or redirect your audience to your Tmall or JD store. Little Red Book does not authorize to display of external links. You will have to be creative to incorporate your store into your post with specific Chinese copywriting and optimized design.

For promotion, you can promote with different strategies depending on your demand. You can make official posts about your brand or products, cooperate with KOLs and KOCs, or invest in paid ads. You can use the tool of “sponsored ads” to select which cities to target in priority. For example, if you are a tie brand, you already know that Chinese people are wearing less and less ties except in Tier-1 cities and specific jobs. You can use this tool to target users living in priority in Beijing, Shanghai or Shenzhen. Making a complete strategy to promote Xiaohongshu can help your brand grow better in China.

Outline Your Accessories with OOTD on Social Media

When more and more younger generations are putting emphasis on their outfits, they need a source to improve their taste. Under this demand, there are more and more Fashion KOLs showing their outfits on social media like Douyin, Weibo, and Xiaohongshu. Fashion lovers are used to checking these OOTD content for their own outfits.

You can cooperate with these KOLs and launch campaigns about how to make outfits with your product. By showing how your product can match different outfit styles, you can attract more customers to purchase your product.

Open your Flagship Store on E-Commerce or Social Commerce

When we see that 60% of accessories are sold online in China, e-commerce becomes a key sales channel. There are 2 types of e-commerce in China:

- Traditional e-commerce: the 3 main e-commerce platforms in China are Tmall, JD, and Taobao. We highly recommend brands launch flagship stores on Tmall or JD, this way brands can show their official e-store among other distributors or fake products. Also, brands can choose to launch on Tmall Global or JD Global depending on their business license for easier launch in China.

- Social e-commerce: in 2022, social media in China are no longer only social media but incorporated CBEC (cross-border e-commerce) apps. Douyin, WeChat, and Xiaohongshu all have launched their e-store function. Launching your e-store on these social media can make it easier to convert your audience into your customers.

Baidu: Boost your SEO and Online Reputation in China

Baidu is the NO.1 search engine in China. When Google is blocked in China, you need to do SEO on Baidu for a better search ranking. Make sure your brand website pops up when your customers are searching for your brand name, otherwise your brand will not be seen as a good brand.

Your first step will be to work on your Baidu Brand Zone. You will need to gather a lot of backlinks mentioning your brand using your international name and Chinese name. More than SEO, your brand can also benefit more from a profile page on Baidu Baike (the Chinese Wikipedia) and specific campaigns on Baidu Zhidao. Take full advantage of this top search engine in China, and boost your online reputation in China.

GMA: Your Best Choice in Marketing

About Us:

GMA is one of the best marketing agencies for your growth in China. Based in Shanghai, we provide you with 360°support depending on your demand. With more than 10 years of experience, we have been trusted by hundreds of brands. Contact us for a first consult and win the Chinese market in the 2020s.

How Will GMA Support You

GMA can help you start with market research. Knowing what you need and what’s your brand identity can help us know your brand better. We will also analyze your competitors and make your marketing strategy in China. GMA has a professional team for your different needs, no matter if you want to open an account on social media or run an e-shop on Tmall, we will always be by your side.

Selected GMA Case Study of Accessories

ZEISS

ZEISS is an internationally leading technology enterprise operating in the fields of optics and optoelectronics. The Sunlens Division of ZEISS contacted GMA to build their next development strategy and operations in China. After several meetings, GMA was proud to offer a complete 360° strategy with technical levers to activate during their development.

Result:

- Marketing Research

- Consulting

Hermes

Hermes is the quintessence of luxury. Since 1837, the luxury brand remains loyal to its saddler history and its exceptional know-how. The quest for beautiful materials and the artisanal model is at the heart of Hermes’ uniqueness. All around the world, it is the luxury brand that better stands the test of time. In China, the success of Hermes no longer needs to be demonstrated.

Hermes needed to better understand the specificities of Chinese consumer behavior outside of China. Our agency was contacted by the luxury brand to gather and share several insights on Chinese cultural specificities and trends. Our experts implemented team training, PowerPoint presentation, and seminar organization to share meaningful insights on Chinese consumers with their Parisian team in Hermes headquarters (HQ).

Results:

- Consulting

- Chinese consumers insights

- Team training

SMILEY

SMILEY is an award-winning brand shaping and sharing happiness. Registered in over 100 countries worldwide, Smiley is always looking for new retail partners to join and spread the happy revolution. For the past 45 years, the brand is dedicated to shaping the way its clients share happiness online and offline. In China, Smiley needed to pursue its happiness revolution with a strong strategy.

Results:

- +1.5M Views on Weibo

- +40K Followers on Weibo

- +20K WeChat Followers