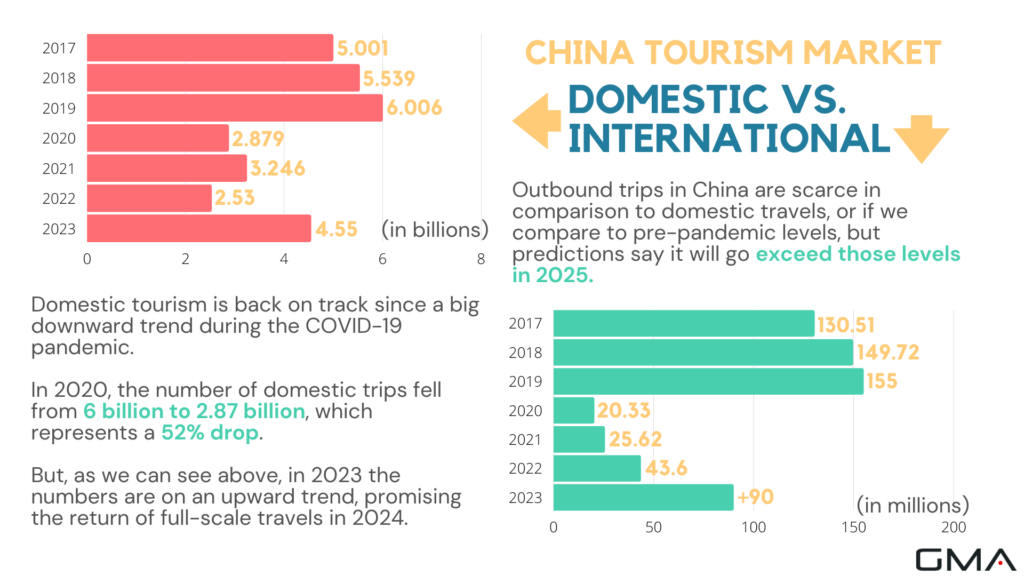

The rise of wealthy Chinese tourists is reshaping the global luxury market. With China’s economic growth, more of its citizens are traveling and shopping abroad, seeking top-tier brands and experiences. For luxury brands, this presents a golden opportunity. Catering to Chinese luxury tourists means understanding their tastes and habits and recognizing their growing influence on the luxury landscape.

This article delves into the challenges and strategies for luxury brands targeting this affluent demographic, offering insights into navigating this evolving market segment

Wealthy Chinese Travelers: A Profile

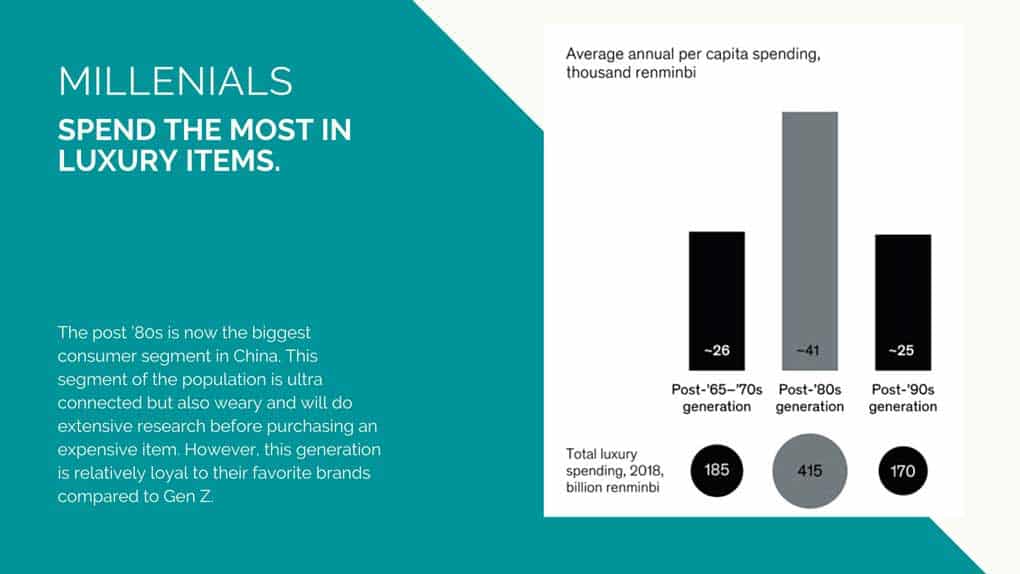

The Chinese luxury market is dynamic, driven largely by its younger generation. Particularly, Millennials and the emerging Gen Z are emerging as the most significant luxury spenders, reflecting a mix of the country’s modern aspirations and traditional values.

Millennials, having witnessed the rapid transformation of China’s economy and global standing, have developed unique spending habits. They prioritize both iconic luxury brands and niche high-end labels, often seeking symbols of status and prestige. Yet, alongside their penchant for high-quality items, there’s a growing trend of valuing experiences, be it in travel, dining, local culture, or entertainment.

Gen Z, on the other hand, while still appreciating the allure of luxury, often approaches it with a more discerning and individualistic lens. Their choices frequently blend global trends with a renewed respect for traditional Chinese values. This means they might gravitate towards a contemporary designer brand, but equally value a product that resonates with their cultural heritage.

What are wealthy Chinese tourists looking for while traveling?

Wealthy Chinese tourists have distinctive preferences when it comes to travel, seeking experiences that are both luxurious and meaningful:

Demand for Premium Service

A significant number express dissatisfaction with existing services. They cite issues such as lackluster customer care, misleading promotions, and unexpected costs. Brands aiming to attract this discerning market segment must prioritize delivering impeccable service, ensuring every touchpoint exceeds expectations.

Emphasis on Educational Experiences

For these affluent travelers, trips are not just about leisure; they’re about enrichment. They gravitate towards offerings like short study tours, in-depth business visits, and etiquette workshops abroad. More than just sightseeing, they aim to immerse themselves, seeking genuine interactions with locals and a deep dive into the culture and essence of their destinations.

The Power of Personal Recommendations

While many consumers turn to advertisements or media, wealthy Chinese travelers place immense trust in personal advice. Insights and tips from friends, family, trusted travel consultants, or business associates often play a pivotal role in shaping their travel decisions.

A Non-Negotiable Focus on Safety

The security and well-being of these travelers, especially in today’s context with concerns like COVID-19, can’t be overstated. Brands need to not only implement stringent safety protocols but also proactively communicate these measures across digital platforms, instilling confidence in potential travelers.

The Appeal of Seamless Convenience

The modern wealthy Chinese tourist cherishes convenience, especially when it’s backed by technology. Features like digital payments, quick online bookings, and instant confirmations elevate their travel experience, making their overseas travel both effortless and enjoyable.

The Thrill of Uncharted Territories

There’s a growing trend in both international and domestic travel of seeking out novel, off-the-beaten-path experiences. Instead of flocking to traditional tourist hotspots, they are increasingly exploring hidden gems, less commercialized locales, and unique offerings that promise exclusivity and a break from the ordinary.

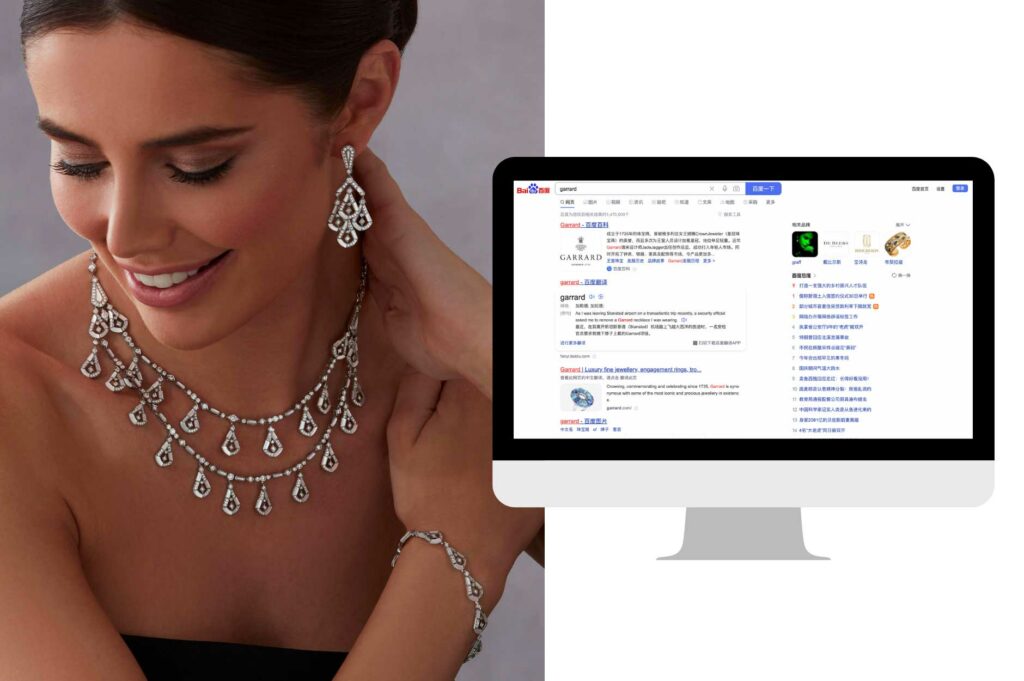

Trends in China’s Luxury Shopping Abroad

The evolving preferences of Chinese travellers reflect not only their purchasing power but also the shifts in global trends and societal values. Here’s a closer look at some of the key trends shaping their overseas shopping habits:

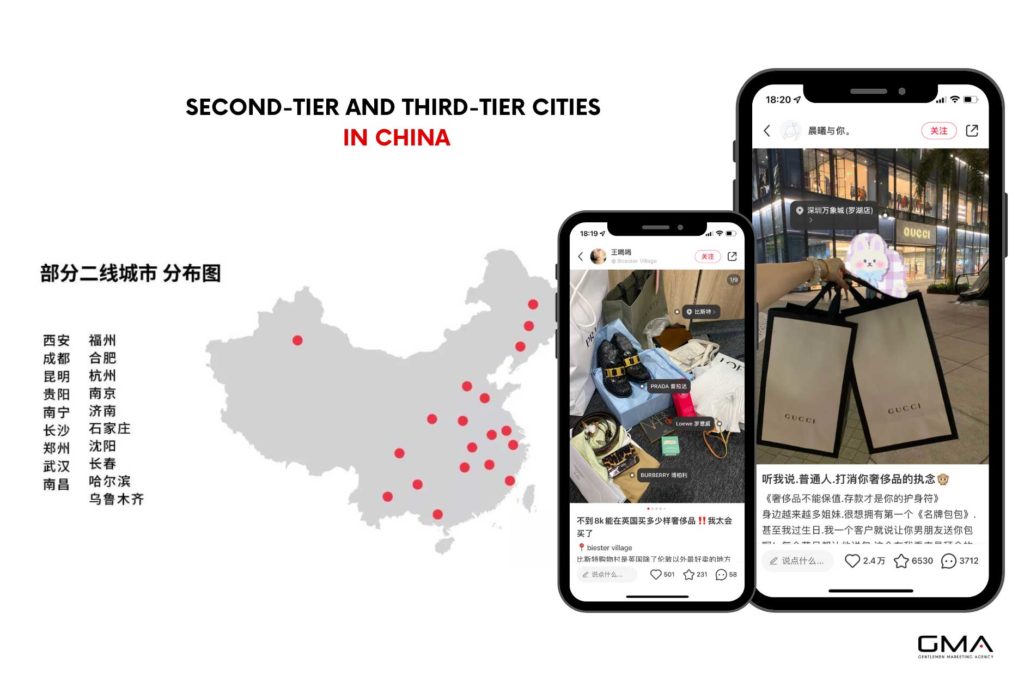

Destination Popularity Shifts

While places like Paris and Milan have traditionally been luxury shopping hotspots, Chinese tourists are now exploring new destinations. Countries such as Korea, Australia, and even parts of Africa or further parts of Southeast Asia are becoming favorites in the Chinese outbound market, offering a blend of luxury shopping and unique cultural experiences.

Experience Over Possession

It’s not just about owning a luxury item anymore. Today’s Chinese luxury consumer places immense value on experiences. High-end travel adventures, gourmet dining experiences, and exclusive events often take precedence over simply adding another luxury item to their collection.

Digital Influence

The digital landscape is a major influencer in shaping the buying decisions of Chinese tourists. Chinese social media platforms like Little Red Book (Xiaohongshu) play a pivotal role and can help you attract Chinese tourists by offering authentic user reviews and recommendations, giving potential buyers a taste of what to expect from luxury products and experiences abroad.

Health and Wellness Integration

Wellness isn’t just a trend; it’s a lifestyle choice. Chinese luxury shoppers are seamlessly blending their health and wellness priorities with their luxury purchases. This can be seen in the rising demand for high-end organic foods, luxury wellness retreats, and premium athleisure brands that cater to both the style and well-being of wealthy travelers from Mainland China.

Personalization and Customization

In a world of mass production, the allure of something unique stands out. Chinese consumers are increasingly seeking products and experiences that are tailor-made for them, adding a touch of personal exclusivity to their luxury collections.

Key Strategies to Target Wealthy Chinese Travelers

Successfully targeting the Chinese luxury tourist involves more than just showcasing quality. It’s about understanding their evolving preferences, valuing their cultural heritage, and providing immersive experiences that keep them coming back.

Localized Marketing Campaigns

Chinese consumers resonate deeply with messages that appreciate and incorporate their cultural nuances. To truly connect, brands must invest in crafting campaigns that speak directly to these sensibilities. Integrating local celebrities or influencers can amplify this connection.

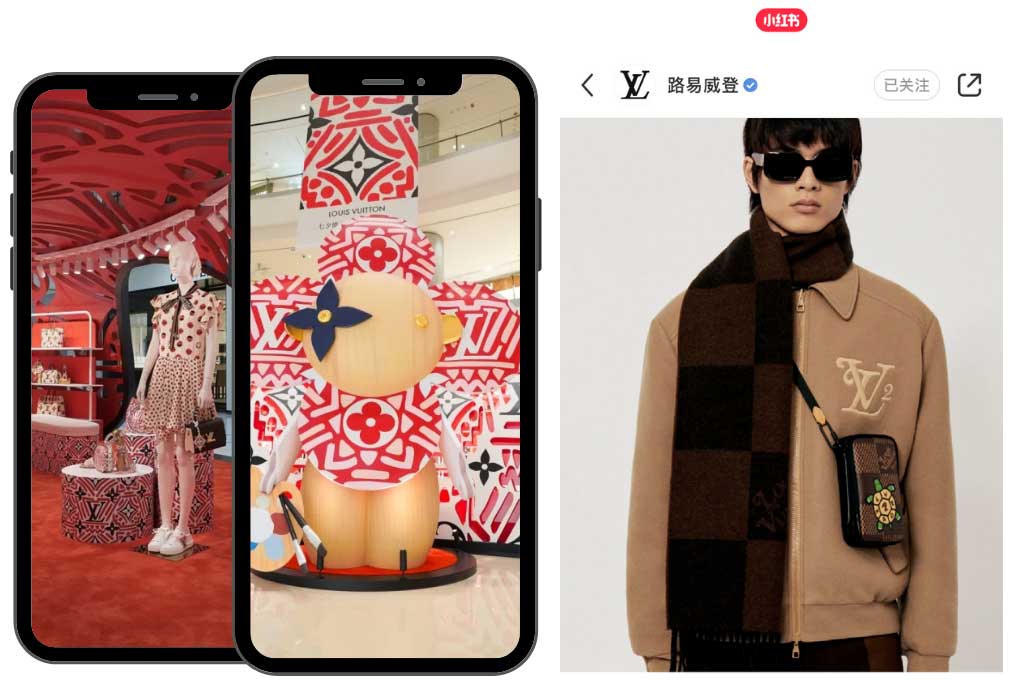

Unique In-Store Experiences

Modern Chinese visitors seek more than just products; they desire experiences. The retail environment should be transformed into a sanctuary of luxury immersion, providing personalized services like exclusive previews or personal shoppers. Louis Vuitton, in its global outlets, has encapsulated this ethos by creating curated shopping experiences, turning each purchase into a memorable journey.

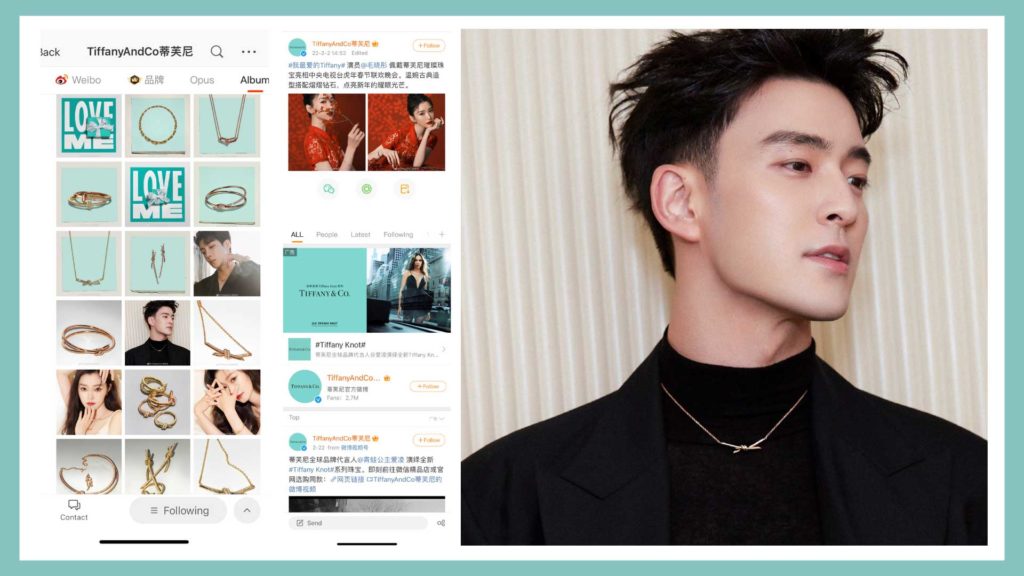

Leverage Digital Platforms

The immense popularity and reach of Chinese social media platforms like WeChat and Weibo make them indispensable for luxury brands aiming to engage with the discerning Chinese market. Their integrated ecosystem offers not just a platform for marketing, but also tools that bridge the gap between online browsing and offline purchasing, embodying the online-to-offline (O2O) paradigm.

Bulgari’s WeChat initiative is a shining example of leveraging these platforms effectively. By offering an immersive digital experience coupled with the option to transition seamlessly to a physical store visit, Bulgari demonstrates the future of luxury shopping. The company also has accounts on other social media, for bigger reach.

Furthermore, the rise of Douyin and Xiaohongshu underscores the evolving dynamics of online influence. Douyin, known globally as TikTok, with its short-form video content, provides a platform for luxury brands to showcase their offerings in dynamic and engaging ways, catering to the younger audience’s appetite for visually rich narratives.

Xiaohongshu, or Little Red Book, on the other hand, is a fusion of social media and e-commerce, where user reviews, recommendations, and storytelling around luxury products cultivate a community-driven approach to brand loyalty and purchasing.

Collaborations and Limited Editions

Offering something unique can set a brand apart. Collaborations with local talents or limited edition collections are more than just marketing gimmicks; they represent a fusion of values. Gucci’s partnership with Chinese artist Pei Jing is a stellar example, bridging the gap between traditional Chinese art and contemporary luxury aesthetics.

Experiential Luxury Offerings

Experiences leave lasting impressions. Luxury brands have the opportunity to redefine themselves by providing experiences that go beyond products, such as curated travel adventures or exclusive events. Rolex’s yachting experiences exemplify this trend, transforming luxury from a tangible good into a cherished memory.

Tiffany & Co. in Toronto, partners with Pure Luxury magazine and with tour operators in order to hold shopping events at its Bloor St. store. It’s a smart move, considering many of these tourists often travel in tour groups, due to their language dependency.

Post-Purchase Engagement

Maintaining Chinese customers’ engagement post-purchase is essential for fostering loyalty. After-sales services, loyalty programs, and exclusive member events can all contribute to building a lasting bond. Chanel’s members-only previews stand out in this realm, continuously nurturing and deepening the relationship with their clientele.

Cultural and Seasonal Campaigns

Tapping into Chinese cultural milestones, such as festivals, can yield significant dividends. Lunar New Year or Mid-Autumn Festival-themed collections that integrate traditional motifs, like Dior’s festive range, create a harmonious blend of luxury and cultural appreciation.

Sustainability and Social Responsibility

Modern Chinese consumers are increasingly conscious of ethical practices. Luxury brands can differentiate themselves by emphasizing their commitment to sustainability and corporate social responsibility. Stella McCartney’s ethically-focused fashion line showcases how luxury and responsibility can coexist, resonating deeply with today’s conscientious consumer.

Case Study: Tiffany & Co.’s Success with Wealthy Chinese Travelers

Tiffany & Co., a luxury jewelry brand renowned for its iconic blue boxes, wanted to tap into the lucrative market of wealthy Chinese tourists. Recognizing the potential of this affluent demographic, the brand initiated a comprehensive strategy to captivate and serve these discerning travelers.

Objectives

- Enhance brand visibility and allure amongst wealthy Chinese travelers.

- Customize the in-store and digital experience to cater specifically to this segment.

- Amplify post-travel engagement to ensure repeat business and brand loyalty.

Strategy

Collaborative Pop-Up Stores in High-Footfall Areas

Tiffany set up pop-up stores in China’s major airports and popular luxury travel destinations. These stores showcased exclusive collections, often launched in partnership with well-known Chinese celebrities or designers, appealing directly to the desire for unique offerings.

Digital Integration for Convenience

Understanding the tech-savvy nature of its target audience, Tiffany integrated digital payment systems like Alipay and WeChat Pay. They also launched a Mandarin version of their mobile app, offering features like virtual try-ons and instant access to personal shoppers.

Cultural and Seasonal Campaigns

Capitalizing on Chinese festivals and traditions, Tiffany released exclusive Lunar New Year collections and offered special promotions during occasions like Golden Week, resonating with the cultural sentiments of their clientele.

Experiential Offerings in Global Stores

The brand curated exclusive experiences for Chinese tourists in their global flagship stores, including private viewing rooms, personal shopping services, and bespoke jewelry customization.

Post-Purchase Engagement

Acknowledging the importance of post-travel engagement, Tiffany introduced loyalty programs, offering exclusive previews of upcoming collections and invites to private brand events for their Chinese clientele.

Results

- Sales Surge: Tiffany reported a significant increase in sales to Chinese tourists, both within China and globally.

- Increased Digital Engagement: The brand’s Mandarin mobile app saw a substantial rise in downloads and active users.

- Brand Loyalty: Post-travel engagement strategies led to repeat purchases, with many Chinese tourists becoming long-term customers.

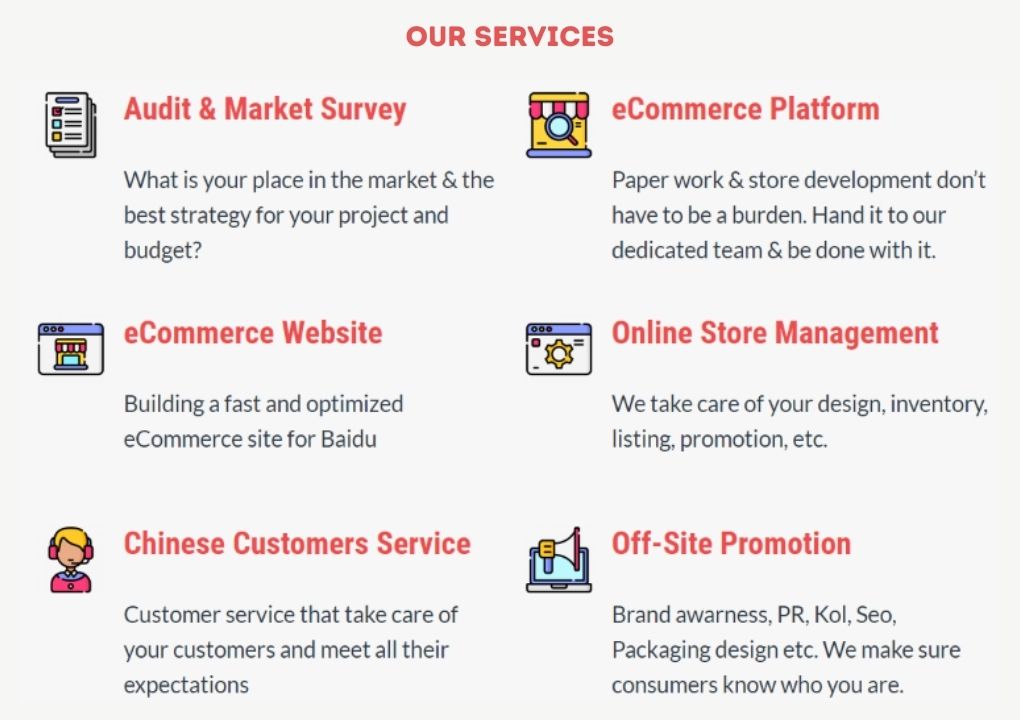

Unlock the Chinese Luxury Market with Gentlemen Marketing Agency

Navigating the intricacies of the wealthy Chinese tourist market demands a tailored strategy, and that’s where we excel. At Gentlemen Marketing Agency, we’ve been at the forefront of the Chinese luxury market, offering brands the expertise and tools needed to succeed.

- Deep Market Insights: With years of experience under our belt, we understand the Chinese luxury consumer, their evolving preferences, and their purchasing habits.

- Digital Mastery: From WeChat and Weibo to Douyin and Xiaohongshu, we’re adept at leveraging China’s top platforms to amplify your brand’s presence and engagement.

- Localized Marketing Campaigns: We craft campaigns that resonate. Whether it’s capitalizing on cultural events or leveraging local influencers, we ensure your brand speaks directly to your target audience.

- End-to-End Strategy Development: We’re not just about marketing. From strategy formulation to implementation and after-sales engagement, we’ve got you covered.

- Successful Track Record: Like we’ve done for numerous luxury brands, we aim to transform your brand’s connection with the affluent Chinese market, driving both engagement and sales.

Take the leap with Gentlemen Marketing Agency and unlock the boundless potential of the Chinese luxury tourist market. Our expertise is your competitive edge. Contact us to discuss your options!

5 comments

gigi

Yes I agree! But I don’t think Luxury brands have to “target” Chinese rich consumers, they are kinda attracted by those brands

pedo cum

always i used to read smaller articles which also

clear their motive, and that is also happening with this piece of writing which I am reading at

this time.

Martin

100% true that s the challenge of every travel businesses in the world.