China was (once again) the key market for international luxury brands in 2023. From unique festival campaigns to phygital pop-up stores, the Chinese market was still thriving, and luxury brands were not reluctant anymore to invest in it.

While the worldwide markets are still facing the Covid-19 pandemic drawbacks, China has never been so powerful. 2023 definitely brings its share of success, growth, and development. Now, what lies ahead in 2024? What are the top luxury trends to watch in China in 2024?

The New Face of the Luxury Market in 2024

This is true for every market: trends and consumer habits are constantly evolving. For the most highly connected and digital-driven population of the world, the Chinese are shaping the local trends for luxury at a fast pace. In 2024, Chinese netizens (or digital users) are expected to reach 1.1 billion people according to the last survey. Especially for mainland China, the key is now to cope with the new digitized face of luxury.

Revenue: A Growth for Luxury in Mainland China

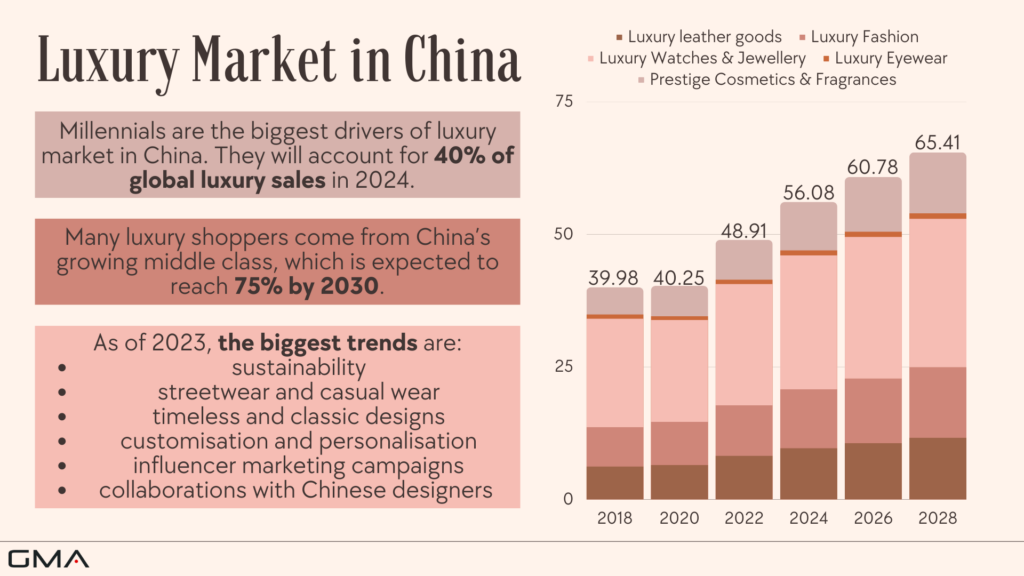

In 2024, the luxury market in mainland China is expected to reach 56.08 billion dollars. The “land of opportunities” described by so many fashion and luxury brands is now increasing its luxury spending. The main shift is coming from the pandemic outbreak. More and more, Chinese luxury shoppers are shopping locally by choice and decide proactively to increase their spending on luxury.

The major market force is composed of post-90s consumers. According to BCG and Tencent, they account for half of the consumer base and 46% of luxury sales. While many luxury brands stick to their core Chinese customers, luxury leaders in mainland China are now targeting younger consumers as their revenue target.

In 2024, luxury brands must meet luxury newcomers who will make their first luxury purchase. If you want to maintain growth, a perfect blend of targeting existing customers and welcoming the 20% luxury newcomers will be key.

Consumer Insights: New Chinese Consumers’ Expectations for Luxury

In 2024, the key motivations for purchasing luxury in mainland China will change. While it used to be about “high quality” and the unique know-how of luxury brands, Chinese customers are not driven by this selling point anymore. All the post-90s Chinese customers are now looking for “self-reward” and “brand service and experience”. In the Chinese digital world, netizens are looking for an immersive experience mixing social media, digital events, and influencers’ endorsements.

If you are familiar with the Chinese market, you must know that the Great Firewall is preventing the use of Google, Facebook, Instagram, and many more Western platforms in China. Chinese customers are even more sensitive to the ability of international luxury to understand and master local social media and e-commerce platforms like WeChat, Weibo, Xiaohongshu, Tmall, or even Bilibili. Today, Chinese luxury consumers even favor domestic e-commerce over cross-border e-commerce due to better customer service.

Market: New Evolutions for Branding and E-Commerce

In China, branding is essential to build local success and e-commerce is key to scaling up and generating high sales. Indeed, an international luxury brand (even famous worldwide) will always need to start from scratch when entering the Chinese market. If it is already in China, then you will need to carefully monitor your e-reputation and avoid the main luxury threat: “badvertising”.

In 2024, the main shift for international luxury brands will be to register local entities to manage a local store like Tmall Classic. Chinese customers have constantly raised requirements in terms of delivery time, packaging, and customer service. Luxury brands will need to invest even more in their local teams to provide a high-quality service to answer clients’ questions and surprising requests… in less than 20 minutes.

Especially now, international luxury brands are subject to users’ testimonials and shopping notes. And the influencers’ crisis including the queen of live streaming Viya tax evasion scandal is reshaping consumer trust and expectations.

A New Breath for Growing Categories in China

The novice luxury consumers are shaping the “new luxury” in China. With their preference for self-reward consumption and sustainable quest, luxury newcomers are putting categories under a new expansion. All categories are facing a massive development potential. Only international luxury brands that understand and meet the growth curve will be the ones to manage the Chinese future market opportunities. What should you look at?

- Fashion & Accessories – The clothes and accessories categories will be driven by winter sport and outerwear collections. Thanks to the Winter Olympic Games held in Beijing in February 2022, the winter sports market is thriving. On Tmall, winter sports equipment sales increased by 140% YoY in the first hour of 11.11 sales. Meanwhile, Moncler reported a doubled revenue in mainland China while Canada Goose increased its direct sales by 86%.

- Bags & Leather Goods – The bags and leather goods categories will be affected by the last measures from the Chinese government to protect endangered species and consumers’ interest in sustainable leather. A progressive shift is made regarding exotic leathers such as crocodiles, python, sturgeon, etc. While Chinese customers are looking for traditional leather, some others are looking more into vegan leather such as apple leather.

- Watches & Jewelry – The watches and jewelry categories will be driven by Generation Z which accounts for 30% of the consumption and +105% YoY growth in GMV. Especially, men from Tier 2 and Tier 3 cities are reshaping the face of the market with new consumption habits and new trends. The consumer demand is mainly focused on style and design, with a special taste for manga, cartoons, traditional Chinese style, and outdoor extremes. The noble jewelry market is now changing face with new disruptive designs.

- Cosmetics – The cosmetics category will be boosted by the sales of fragrance. According to the latest report from Mintel, the fragrance industry in China must grow at an annual rate of +17% by 2025. The Chinese luxury consumers are now looking for sensory experiences with interactive events to deep dive into the world of perfumery. Key market players are now investing in their fragrance portfolio in China. Meanwhile, Coty confirmed a +50% increase in its prestige fragrance revenues in China.

The Hot Luxury Trends in China in 2024

The new consumer insights are definitely shaping the luxury trends for 2024 in China. Some of them emerged in recent years but the majority of them should definitely meet a surge in the coming year due to local regulations, consumers’ demand, and the latest innovations. What will you bet on for your next marketing campaign in China?

#Guochao – The Rise of National Pride

In Chinese, Guochao 国潮 literally means “national pride”. After the surge of “Made in China” associated with poor quality, Chinese netizens decided to focus on “Designed in China”. This is the official recognition that local brands develop high-quality products and unique storytelling about their products.

In general, international brands tend to minimize the impact of domestic luxury brands on their market. While they only look at their international competitors, they turn a blind eye to their fierce local competition. The unique design, cultural elements, and sense of nostalgia that Chinese brands manage to incorporate are appealing to Chinese luxury consumers more than ever.

In order to meet the rising Guochao opportunity, international brands tend to associate local cultural specificities with their international design. You can collaborate with Chinese artists, use local craftsmanship techniques, incorporate festival elements, and propose co-branding campaigns with Chinese brands.

For instance, Dior released a Fall collection for men incorporating the Chinese technique of seed embroidery (打籽绣) on its famous blazers. Meanwhile, Scandi and Random Identities partnered with the Chinese sportswear leader brand Li Ning to work on co-branded partnerships.

#WinterSports – The Success of Winter Olympic Games

China is manifesting a new appetite for winter sports. This trend is taking its roots from the pandemic, which accelerated the quest for a healthier lifestyle. In China, people are more and more concerned about their food habits, sports practices, weekend hobbies, and wellness activities. In a word, fitness centers are booming while outdoor activities are entering the field of new Chinese practices.

Especially with the Winter Olympic Games taking place in mainland China, Chinese people are more interested in winter sports such as skiing, snowboarding, mountain climbing, or camping. The sales of winter sports equipment increased by 140% YoY in the first hour of Double 11 on Tmall.

Meanwhile, the Chinese government aims at having 5,000 elementary and middle schools teaching winter sports and the World’s Largest Indoor Ski Resort is opening in Shanghai. Yes, winter sports are definitely a trend to watch… and to catch.

This new opportunity is the center of attention for many luxury and premium brands in China. If you have a brand specialized in down jackets, winter accessories, or winter lifestyle, this is definitely the right time for you to enter the Chinese market. With the right marketing and storytelling about wellness and fashion, you could meet your next best-selling market.

On the other side, your brand does not necessarily need to revolve around winter sports or athleisure. You can definitely work on a co-branding campaign or launch a limited edition to catch this trend. Again, everything is possible in China and your creativity must have no limit.

#Involution – The New Concern of Gen Z and Millennials

In China, “involution” or Neijuan 内卷 is a buzzing word on main social media. On Weibo, the hashtag #involution# reaches more than 1 billion views and keeps gathering new content every week. Originally, the trend started in Chinese university campuses where pictures of students doing extra long hours, working up to 6 or 7 days a week, and always studying went viral. The new generations feel they keep working hard but will never achieve a golden breakthrough compared to other generations despite their efforts. In a word, they are trapped and will spiral on themselves without any evolution.

As you can imagine, many brands enter the Chinese market with their big shoes thinking about Chinese customers as walking wallets. This is the best way to fail in China. If you do not understand the local culture, history, and current society you cannot provide value to local consumers. Having a luxury brand is not enough today, and you must deliver value to your potential clients.

If you understand the current challenge of involution in China, you are definitely making a step towards your local target. You can use this trend to engage with Chinese people and create a more meaningful connection. For instance, we launched a campaign for Averac around the hashtag #involution# in late 2021. The skincare brand was not a random cosmetics brand anymore but a key account they could share their thoughts and concerns with.

#Metaverse – The Power of Luxury NFTs in China

The global trend of metaverse landed also in mainland China. While Facebook and Google jumped at the opportunity, Tencent is now looking into creating their own metaverse. If you have not heard about this latest craze, the metaverse is a combination of real and virtual worlds to create a unique 3D experience. Especially in luxury and fashion, this trend was already a thing with the creation of virtual try-ons, digital flagship stores, etc.

Metaverse is the logical continuation of the new digital world we entered. Today, the main challenge will be to capitalize on the hype and make the right moves. The Chinese consumer is already familiar with digital experience and metaverse will definitely be the trend to watch in 2024. Baidu launched its own metaverse platform called XiRang, with events and exhibitions.

In the future, the application of the metaverse in China may be more and more extensive and will penetrate into all aspects of people’s lives. We know that Chinese consumers have always been on the digital train and luxury brands should take advantage of it. In China, a digital sneaker RTFKT x FEWOCiOUS was sold at 3 MILLION USD for the Year of the Ox.

Yes, a sneaker that was only available digitally. Meanwhile, Gucci announced a collaboration with Chinese IP Marsper to build a fashion-oriented metaverse. For your business, the key is definitely to use this digital universe to improve customer experience and share value: virtual try-ons, immersive exhibitions, digital flagship stores, virtual events, or even metaverse luxury communities. If you know how to catch the trend in a meaningful way, the concept of the metaverse unlocked creativity with no borders.

#Virtual KOLs – The Reshaped Market of Influencers in China

While influencers and Key Opinion Leaders (KOLs) are in crisis, virtual KOLs are thriving. The exit of the queen of live-streaming Viya definitely changed the luxury landscape. Since she was the leader of luxury and fashion campaigns, the luxury market lost its Top 1 influencer. So far, the majority of viewers turned to Li Jiaqi instead of other live streamers. Meanwhile, 90% of KOLs did not pay their taxes, which is also risky for brands.

For e-commerce live streaming, the game-changer will be to focus on niche KOLs, small influencers like KOC, and obviously virtual KOLs. With virtual influencers, you avoid all risks of unpaid taxes or badvertising related to their social life. For instance, the virtual influencer AYAYI reaches 12.1M followers on Little Red Book with a brand endorsement for L’Oréal, Bose, and Sandro.

#Secondhand – The Success of Vintage and Reused Luxury Products

The consumption of secondhand luxury goods in the USA or Japan reached 20% of total luxury consumption in 2020. Meanwhile, it was only 5% of the luxury market in China. But everything changed in 2021, and it sealed the common basis to become a key consumer trend in years to come. For a long time, Chinese luxury shoppers wanted to purchase only new products.

Some consumers felt left out due to a limited budget to acquire such premium pieces. Both the combination of low price and vintage appetite benefited the development of secondhand consumption. Some influencers promoted reused luxury products as the new lifestyle to pursue unique pieces at a low price. Many local platforms jumped on the opportunity to challenge Tmall with only secondhand luxury products.

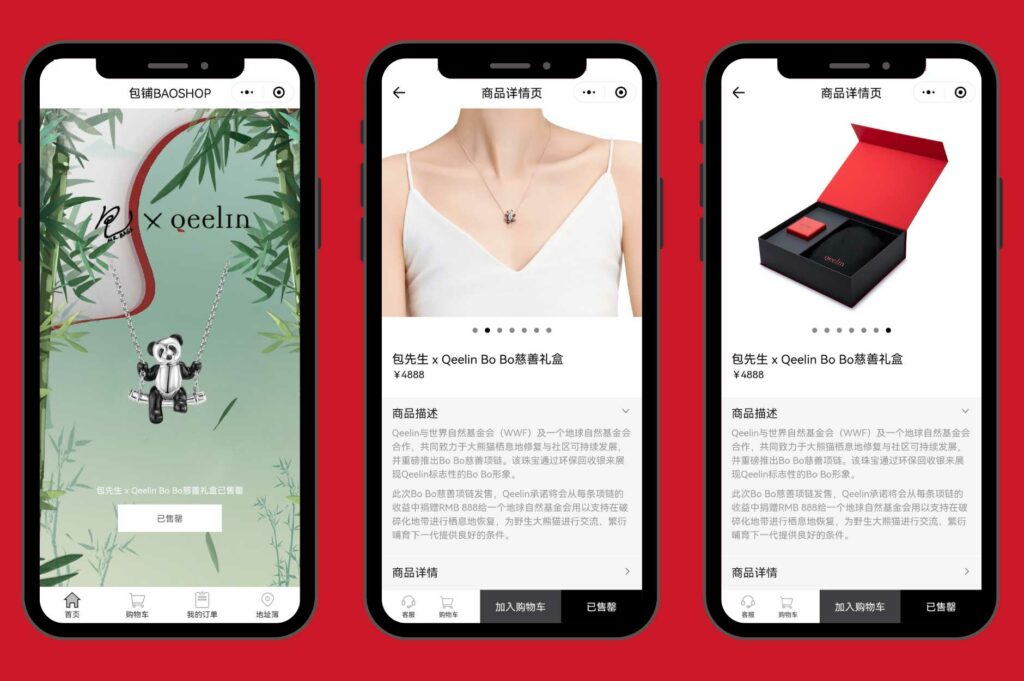

In order to meet the secondhand rising trend, some luxury brands are now joining these new e-commerce platforms. All the major secondhand platforms are selling via live broadcasts like Douyin / TikTok for instance. They mainly target the jewelry and leather goods industries, with Feiyu being dedicated to secondhand watches and HongBuLin being dedicated to secondhand bags.

If you have a secondhand commitment or vision for your brand, selecting the right platforms can be a key strategy for China. Especially, such business tactics could benefit your brand image, showing the durable and timeless nature of your collections and products.

#Sustainability – The Rise of Green Habits and Eco-Consciousness in China

With the world’s largest population of 1.4 billion inhabitants, Chinese consumers are more exposed to environmental issues than their Western counterparts. They face more waste, more pollution, and more water issues. Xi Jinping decided to take concrete actions to drive green development and restore a “Beautiful China” (美丽中国) by achieving cleanness, prosperity, and development by 2035.

With this strong commitment and detailed action plan, China became one of the world’s 10 nations to outright ban plastic straws. Meanwhile, the country is expecting to reach its peak carbon before 2030 and to become carbon-neutral by 2060. All these measures are driving the rise of green habits and eco-consciousness among Chinese citizens. Sustainability is becoming trendy.

If you are a sustainable brand or you are promoting a sustainable collection, you can definitely meet a new audience in China. For a long time, luxury and fashion brands did not advertise their eco-friendly collections. It was not a unique selling point at that time, and definitely not a value that could motivate Chinese potential clients to actually purchase.

But the pandemic accelerated the need for Chinese people to take care of the planet with more sustainable consumption. Today, you can communicate about a product that respects the environment, and you can turn it into a USP.

For instance, we decided to focus a campaign on the Eco Power Solar collection for Jacques Lemans. We turned the watch into a fashion item that could benefit the other generations. Since family values are very important in China, we built a unique campaign showcasing couples, families, and influencers loving to purchase design watches while contributing to a better future.

What to Expect for Your Business in China in 2024?

Both the Chinese luxury newcomers and luxury trends will define the evolution of your business in China in the coming year. Now, the question is how to take advantage of these changes to build a strong brand and reach higher sales. If you are a new entrant, the brand-building phase is still mandatory. Chinese luxury consumers need to deep dive into your brand universe, identify with your core values, and read about your vision.

Then, you definitely need to monitor your brand e-reputation, especially due to the latest influencers crisis. If you are already established in the Chinese market, the key will be to audit your brand to improve your online reputation and incorporate key trends to build more creative campaigns.

Once again, China will not be easy… but everything is possible. Many competitors are entering the Chinese market every day with better knowledge and better preparation than before. The smart strategy is not about entering or not the market but rather HOW and WHEN. We decided to incorporate the majority of the above trends in a unique way to enrich our campaigns. From NFTs to winter sports, it is now time to use twice as much imagination.

You can contact us to get access to our complete Luxury Trends 2022 report and book a consulting meeting with our Head of the Luxury Division. Click here to find out more about our advertising & marketing services for China.

3 comments

Eugen

I am reaching out to express my interest in the Art Director position in Paris. My name is Eugen , and I hold a Master of Arts in Fashion Design with a major in Fashion Image and Art Direction from the Institut Français de la Mode.

admin

hello

Send your CV to us, more effective than Comment Eugen 😉

Alexsandra Silva

I would like to receive to receive the complete report Top China Luxury Trends of 2022 with 3 additional trends,