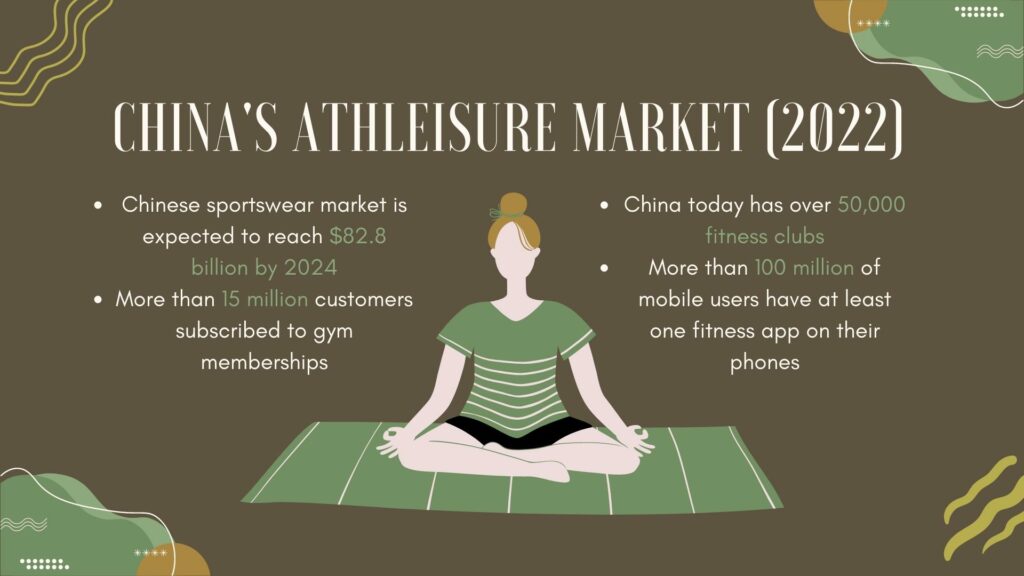

The Chinese sports culture is evolving at a whirlwind pace. From the first manufacturing supplier to an emerging country for consumers of products and sports spectacle. Thanks to trends coming from the West and the latest Winter Olympics that gathered a lot of attention in China, China’s activewear market is experiencing rapid growth. Chinese sportswear market is expected to reach $82.8 billion by 2024, with an annual growth rate of 11%.

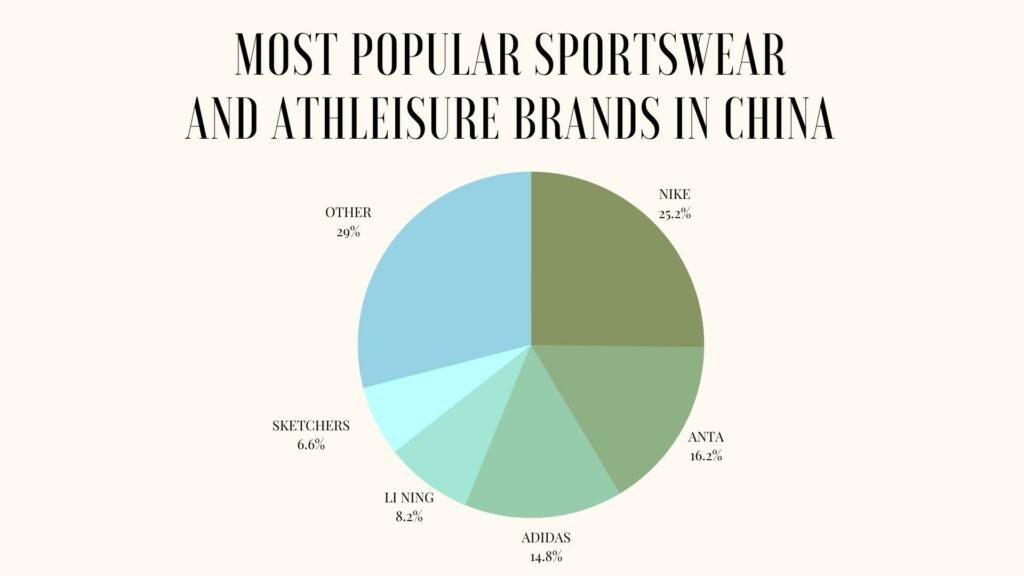

Although there are many brands that are ruling the athleisure and sportswear market, with Nike being on top with more than 1/4 market share, there is still room for new brands, as the market is growing. Le Coq Sportif, a small French brand of athletic apparel can be an example of it, carrying successful marketing campaigns on Chinese social media.

In this blog post, we will understand the reasons for the rapid growth of the athleisure market in China and see how foreign brands can join China’s fitness industry with success.

Overview of the Sportswear and Athleisure Market in China

Since 2008, when Beijing hosted the Olympics, China has seen its fitness/wellness sector grow in a prodigious manner. Today, the market is booming, with many new players joining the game. As we mentioned, the Chinese sportswear market is expected to reach $82.8 billion by 2024. More than 100 million mobile users have at least one fitness app on their phones.

From just 500 gyms in 2001, China today has over 50,000 fitness clubs and the number is growing daily, with more than 15 million customers subscribed to gym memberships. Chinese people are embracing a healthy lifestyle, with new sports enthusiasts following the trend. But what are the reasons for such a massive popularity of sports and fitness in China?

What are the Reasons for the Growing Interest in Sports Among Chinese People?

Although healthy lifestyles are being chosen by many people in the world and the trend for doing sports and attending fitness classes has been on the rise in the past years in all developed countries, the reasons for each country’s netizens to join the fuss might be different. Let’s explore why Chinese people are gaining more interest in sports and athleisure trends.

Concerns about health problems

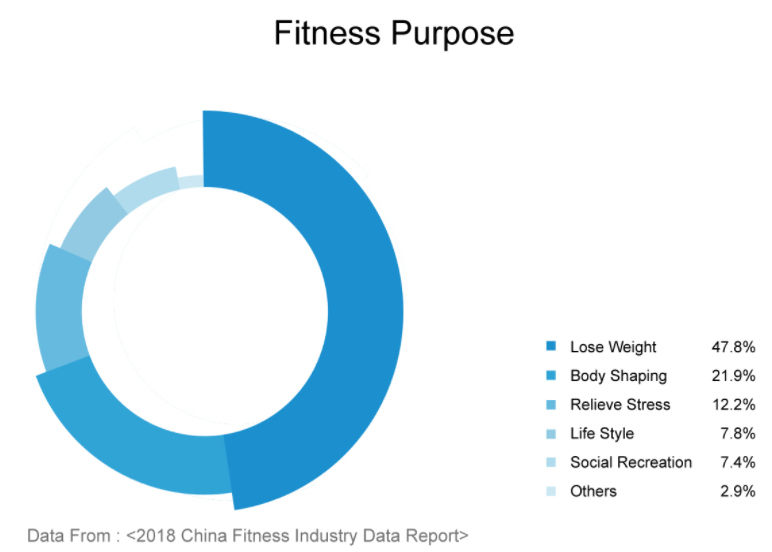

In recent years China has been one of the countries with the growing level of obesity among its netizens. The problem is especially serious when it comes to children, with one in three kids having problems with weight. Chinese government noticed the problem and is trying to find solutions for the Chinese population to be healthier. Chinese people are also trying to lose weight, which is reported to be the main purpose of fitness and sports activities.

What is more, China is facing the problem of an aging society and therefore, in 2018, the Chinese government introduced the “Healthy China 2030” initiative, which aims to engage 700 million people in sports and physical activities. The authorities are investing in healthcare and sports, investing more than 5 trillion RMB in the sports industry by 2025.

The Chinese government is encouraging people to do sports at least once a week and it also tries to make people eat healthy, introducing plant-based meats and trying to halve meat consumption until 2030. All of these initiatives are clearly working, as the sports industry and healthy food industry are growing at a rapid rate.

Fitness passion and the growing popularity of fitness apps help sportswear

Although Chinese people always preferred a very slim and delicate look, nowadays the standards of beauty are changing, with the preference for a strong and athletic body. Therefore, more and more people are joining gyms and fitness clubs, in pursuit of a slim but healthy-looking body.

Fitness and sports are a new trend, with many sports apps being downloaded every day in China. Although the biggest amount of gyms and trendy fitness places as well as healthy restaurants can be found in the main cities of China, lower tiers can’t be overlooked, as the demand for sportswear and fitness facilities is also growing there.

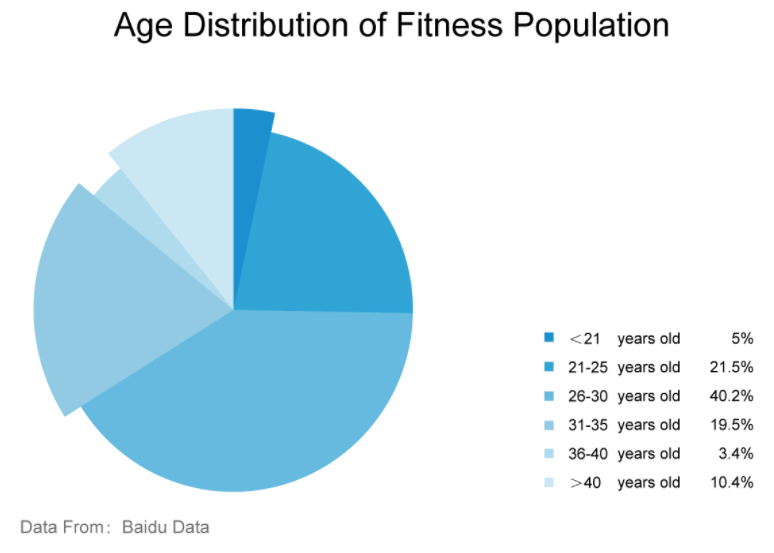

What is interesting is that the growing interest in sports is not only reserved for Millenials and Gen Z. As you can see, more than 10% of the fitness population is more than 40 years old. This shows that the trend for a healthy lifestyle is popular among all age groups, in higher and lower-tier cities. It’s important information for all athleisure brands that need to target their marketing strategies to all of these age groups, instead of focusing only on young people.

Covid-19 lockdowns encouraged people to train at home

The COVID-19 pandemic made people stay at home for months around the world, with sports facilities and gyms being closed for safety reasons. As people lost access to those facilities, they began to exercise at home, raising the demand for fitness apps, which have experienced enormous popularity since then.

People started downloading fitness apps, joining forums for sports enthusiasts, taking part in online challenges, and many more, encouraging each other to stay in shape during lockdown. This grew the demand for athleisure apparel (which is a mix of fashion and sports apparel, suitable for sports as well as casual wear, perfect for lockdown outfits) and sports equipment.

The new generations demand appropriate clothing for all sports and fitness activities

The new generations of Chinese, especially Millennials, in addition to running and marathons, seem to appreciate more and more gyms and fitness activities. Traditionally, the Chinese love slow movement, with practices such as tai chi, but Millennials are keen on gym activities more like their Western counterparts, such as bodybuilding, CrossFit, or aerobics.

Domestic demand for sports-related consumption has increased significantly in recent years. The Chinese not only buy more and more sports items but with the increase of the passion for fashion they always want more stylish clothes linked to sports activity, which is the perfect ground for the athleisure market in China.

Winter Olympics in Beijing raised the demand for winter sportswear

As China entered this new lunar year hosting the Winter Olympics in Beijing, the athleisure and sportswear market has experienced significant growth. China entered an Olympic rush, with many athletes ending up with medals and new stars being born (like the Chinese freestyle skier Eileen Gu, who became a role model for many Chinese people).

Apart from worldwide recognition and good PR, the Olympics also brought local and foreign companies a lot of business the the Chinese market, encouraging people to start doing sports and spending money on new trends in the industry.

The market share of Anta Sports, one of the leaders of local brands that was also an official sportswear partner of the 2022 Beijing Winter Olympics Games and Paralympics Winter Games, went up more than 5% in one day during the games.

The Main Players in the Athleisure Market

It might not be surprising that Nike takes the first place as the leading brand in the sports and athleisure market in China, as it’s the world leader. But what is interesting is that in recent years Anta won with Adidas the battle for the second position. Anta Sports is a local brand, so is Li Ning and both of them were struggling to overtake two giants of the sports industry.

With the growing demand for athleisure clothing and bigger disposable income among Chinese consumers that enjoy spending money on themselves, those two local brands climbed the ladder to the top, gaining consumer’s trust.

Luxury embraces athletic apparel in China

Virgil Abloh at Louis Vuitton and Demna Gvasalia at Balenciaga have started contamination in the fashion world, where sportswear and streetwear embrace luxury. And looking at the figures it seems clear that it is not a passing trend, but fulfills many desires of young people and not of China. Moreover, luxury activewear is increasingly widespread.

This is demonstrated by the report: “True Luxury Global Consumer Insight 2018” by the Boston consulting group: of the 12,000 luxury Chinese consumers interviewed, 48% say they have “embraced” casuals because it is now socially accepted on several occasions, 31% due to a formalwear saturation, while 27% more comfortable.

This is not just about Millennials: the choice of

How to Sell Athleisure to the Chinese Consumers

Any brand interested in entering the Chinese sportswear market or athleisure market needs to remember, that many Chinese yet don’t know the benefits and functionalities of wearing athleisure brands, as the trend is fairly new. So it’s important to present benefits and educate your audience in your marketing actions.

Apart from that, there are some key steps to take in order to cater to new trends in the Chinese athleisure market and start selling your products in China.

Great branding starts with good e-reputation

The Chinese put in place a particularly long process before ordering something online on platforms like Taobao or Tmall (to name the most popular). They also pay close attention to the products to make sure they are not counterfeited, accustomed to moving in a market that is also famous for copies.

First, they look at the advertising photos of the products: they offer them a first impression. Then they go to all the details related to the product and the reviews. You need to know that Chinese shoppers rely on reviews and recommendations that support their purchasing decisions far more than we do in the West. That’s why e-reputation is the first step you should consider while crafting your marketing strategy.

To gain the trust of the Chinese consumer it is therefore essential to insert a detailed description and have a good reputation. In fact, it is through websites and social media that Chinese consumers take their positions toward a brand. What is important is that your Website should be in Chinese, targeted at a specific audience from China, and it should also be well optimized, meeting SEO requirements, so that it will rank high in Baidu.

Anta has created a community in the lower-tier cities of China, creating an image of style and communication, thus bringing a positive flow to its digital image.

Focus on the professional image in the Chinese sportswear market

Chinese people are fond of luxury and they put a big importance on the quality of products, as there are a lot of counterfeit brands on the market. For the audience to get interested in your brand, you need to position yourself as a sportswear professional brand, preferably luxury. Only then you will be able to generate sales among a demanding audience from Shanghai or Shenzhen.

There are many fashion brands and luxury brands that started offering athleisure, as there are more and more Chinese consumers with disposable income interested in this type of clothing. To stand out you need to create a professional image that will make your audience believe, that the money spent on your athleisure or sportswear will be a good investment.

Be present and easy to find on Chinese social media platforms

Chinese social media platforms, like WeChat, Weibo, RED, or Douyin are go-to apps for most Millenials and Gen Z when they want to get to know about some brand or find some manufacturers of products they are looking for, as well as recommendations of products they are interested in.

Chinese social media platforms nowadays are the most important marketing tools in China, as most of the internet users are registered on at least one of them (for example, WeChat has 1.26 billion active monthly users). They offer many opportunities, on WeChat you can send newsletters, open a shop, etc. On Weibo, you can engage with your audience in many ways, and all of these platforms also offer paid advertising.

Social media platforms in China are your contact tools between your brand and your audience, this is also the place where you will reach new customers and try to interest them with your marketing content.

Check one of our case studies:

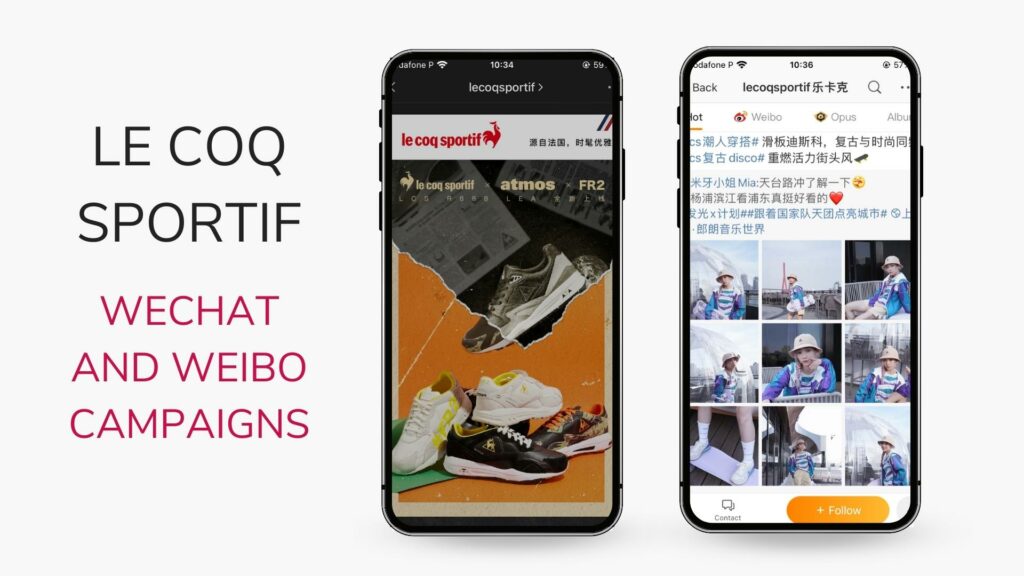

GMA had the pleasure of working with Le Coq Sportif on their social media strategy. Le Coq Sportif is a French producer of athletic and design footwear, activewear, and sporting accessories. The objective was to promote Tour de France and ‘French Touch’ events on Chinese social media platforms, which ended up in a 30% increase in the company’s Tmall traffic.

Partner with Chinese influencers

To develop brand awareness, both inside and outside China, domestic and foreign companies partner with Chinese KOLs and KOCs, which are respectively Key Opinion Leaders and Key Opinion Consumers.

A fitness KOL that advertises health and fitness-related products will always be the most effective to reach out to the right audience; this also applies to other brands and industries. Now, because of the Olympics, athletes are becoming the most powerful influencers in China, as they are those that Chinese customers look up to when it comes to lifestyle trends or fashion tips.

If you position yourself as a professional sports apparel company, it will be easier for you to partner with the right influencers on the market and raise your sales in China. All of the big brands, like Nike, Adidas, Li Ning or Anta are frequently partnering with Chinese influencers. Even Le Coq Sportif, the brand we introduced above, partnered with a fashion influencer, which you can see above (on the right).

Start selling your products on Chinese e-commerce platforms

Last but not least, selling on Chinese e-commerce platforms gives you the biggest exposure from all the other options, as these are the places where Chinese consumers actually shop the most. Although it’s not for every business, as the initial payments can be too high for small brands, it’s a good idea to consider.

But beware that to start selling on Tmall, Taobao, JD, or any other platform, you already need to have good e-reputation and branding in China, as Chinese people prefer to buy only from well-known brands or brands that someone recommended.

Start Selling Your Products on the Athleisure Market in China!

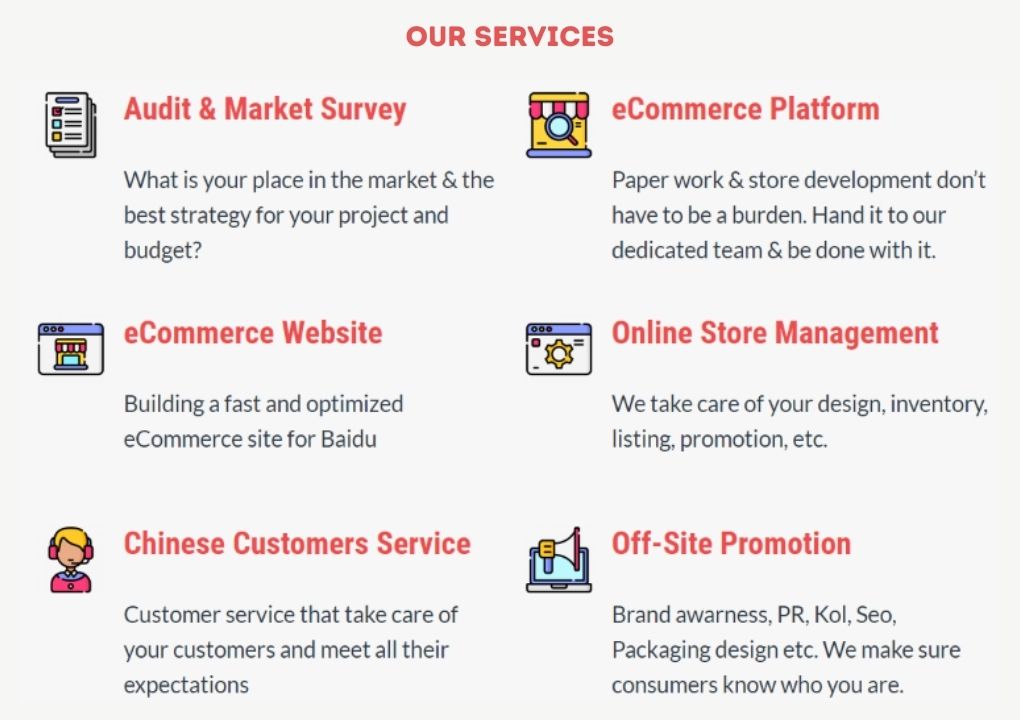

The athleisure market in China is one of the fastest-growing sector of apparel sales. There is room for many more brands to come, but entering China requires many more preparation and considerations than any other market in the world. This is why, we are here to help!

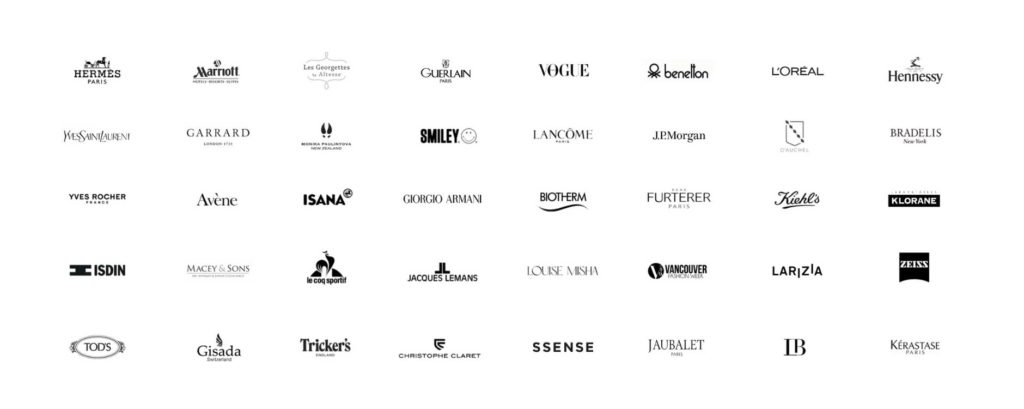

We are China digital agency with more than 10 years of experience and more than 70 professionals, that know exactly how to help foreign brands succeed on the Chinese market. We have many successful stories and more than 1000 satisfied customers, also in athleisure and sportsweat industry (we worked for Le Coq Sportif, Canada Goose and more).

Here are some of our fashion case studies:

Don’t hesitate to leave us a comment or contact us for consultation!

1 comment

Micky

Any exemple of sportswear Kols that I could check on chinese social media (weibo/douyin/little red book) please?