For several years now, China is becoming unavoidable for most luxury brands in the world. In 2021, luxury sales in China will surely continue to grow. Regarding the global pandemic, China recovered from its aftermath compared to Europe and the USA which are still fighting. Even if the Chinese government was very restrictive regarding the implementation of foreign brands in the country, China became the promised land for some of the most recognized luxury brands. Today, fashion brands depend on Chinese consumers.

Nowadays, some luxury brands rely on Chinese shoppers as they represent a huge part of their revenue. They used to target Chinese travelers. With the current travel restrictions, international brands must target Chinese consumers… in China. And for that, they need to understand the consumer behavior of Chinese luxury shoppers on the domestic market.

All eyes on China: Why do fashion brands target Chinese consumers?

China is having solid growth in 2021

Despite the global pandemic, China recovered fast. Growth in mainland China should be very solid and includes double digits. According to the International Monetary Fund (IMF), China should meet an 8% growth in 2021.

Luxury and fashion brands already present in China faced a crisis thanks to strong consumption in China. The Q4 2020 growth presented by Hermès is mainly coming from strong communication and sales in China. While the luxury brand decided to cancel all its worldwide events, it keeps proposing popup stores and events in China. Smaller luxury and fashion brands have also noticed the strategic opportunity. The number of new overseas brands joining Tmall Global increased by 64% year-on-year in 2020. In a word, the future is China.

Which fashion brands rely the most on Chinese consumers?

A new report from the Deutsche Bank shows us which are the most dependable brands on the Chinese market regarding their revenues just released and the results can be quite surprising. Swatch, Ferragamo, and Gucci are on the podium but are closely followed by Burberry and Hermès. If we look at the figures concerning the brand turnover among Chinese customers inside and out of China, Swatch and Ferragamo are still at the top of the ranking.

Both fashion and luxury brands rely a lot on Chinese consumers due to their increasing purchasing power. Especially people from 3rd and lower-tier cities are key for international brands. On average, Chinese people leaving in 3rd-tier cities spent 394K RMB for luxury purchases annually compared to 344K RMB for 1st-tier cities and 275K RMB for 2nd-tier cities.

The impact of the yuan’s devaluation on fashion brands

When the yuan lost value in August 2020, some luxury brands expressed their concerns. A downturn in China’s luxury spending can directly hit those companies dependent on Chinese consumers.

Finally, the yuan’s devaluation should not cause as much trouble as it was predicted. China’s economy is still expected to grow in the coming year and the sales of luxury items should as well grow. The only problem is the fact that Chinese luxury consumers could be tempted to go outside of China to buy luxury goods. Due to travel restrictions, they prefer purchasing in duty-free stores or using daigous. For instance, Hainan island is the luxury hub for Chinese shoppers who want to purchase luxury goods at a lower price.

With the lower taxes and lower general prices of luxury goods, luxury consumers are even planning a proper budget and time to buy luxury goods while traveling in France, Italy, or America for example. Fashion and luxury brands used to target Chinese consumers in European boutiques or airports. Today, China is taking back its domestic market and international brands need to adapt.

How can we explain the popularity of those fashion brands among Chinese consumers?

It is actually quite simple to explain, that these brands are communicating with Chinese consumers. They have succeeded in applying the “Think global, act local” strategy. They know how to diffuse their values to Chinese consumers and how to do good branding.

Discover the 10 most sensitive topics luxury brands should avoid in China

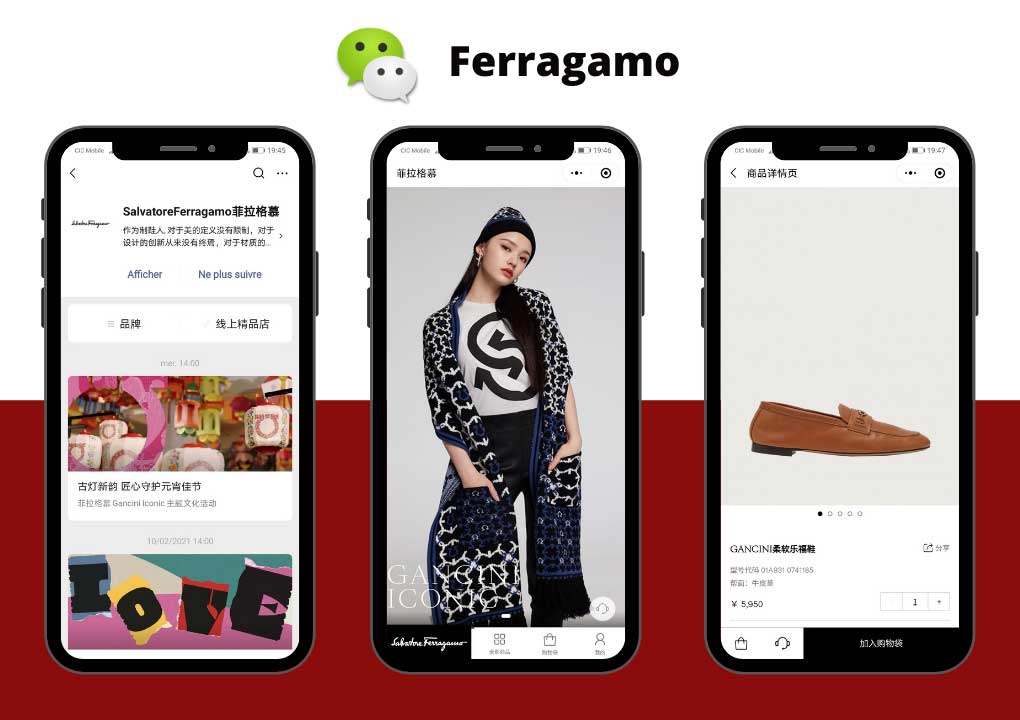

But the more important point will be that they are very active online, on Chinese social media for example as some of them are very reticent in the West. Let’s take the example of Ferragamo which is very active on WeChat and Weibo. They are very good at entertaining their community and interacting with their followers. On their WeChat posts, they diffuse beautiful photos and achieve more than 7K views per post.

Online communication is very important as Chinese consumers are very active on social media. On average, Chinese people spend 6 hours per day on their phones. So, this is an incredible breeding ground for brands looking to communicate. Luxury brands do not have to be scared of communicating on social media.

Even the youngest brands should use this channel to establish direct communication with their Chinese consumers

Isla & Caraibica case study

Isla & Caraibica, the french luxury brand understood that to be successful in the Chinese market, a brand must be active online. The brand is communicating on WeChat and Weibo as well as on famous online magazines such as Elle China. Public relations are as well an excellent way to increase brand awareness in the Chinese fashion market.

We can send you a complete case study on our work for Isla & Caraibica

Contact us to establish your fashion brand in China

Our agency, the Gentlemen Marketing Agency (GMA), is established for almost 10 years in China. We have experience in marketing, and digital, a passion for the Chinese culture, and for international brands wanting to succeed in China. If you are looking to establish a strategy to enter the Chinese market, you can contact us. We can help you with the following services:

- Reports and analyses of the market and its sectors

- Digital marketing strategy consulting for your brand

- Marketing campaigns on Chinese social media

- Marketing campaigns on Chinese e-commerce platforms

- Undercover marketing, KOLs, Baidu SEO

- And so many more…