Consumers in China are paying ever-increasing attention to personal grooming habits and are showing a growing willingness to invest not only in their appearance but also their smell, with this resulting in dynamic growth in fragrances towards the end of the review period. Furthermore, as incomes rise and brand awareness becomes more prominent consumers are showing a strong preference for well-known premium fragrances, with these products proving particularly popular among the post-90s generation.

The Chinese fragrance market is booming

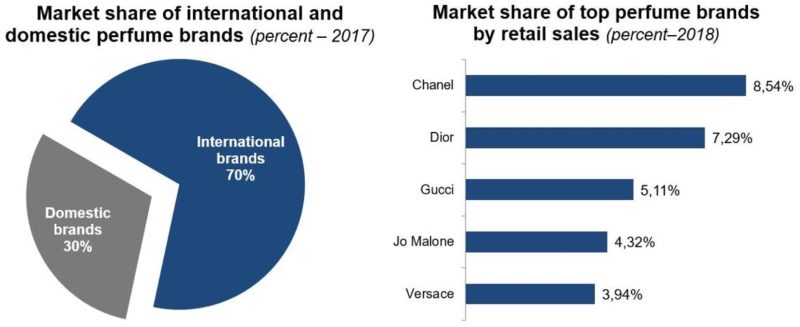

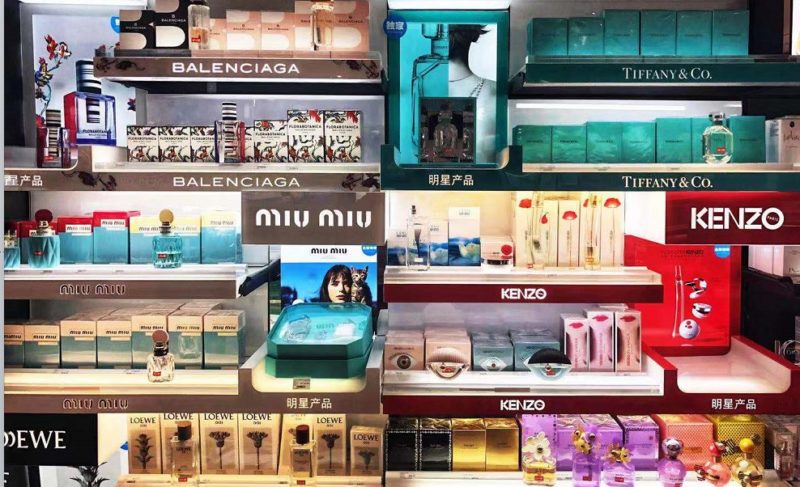

Well-known international companies dominate fragrances in China with strong investment in marketing helping to drive brand awareness and loyalty. Although Chanel retained the lead in 2019, it continued to lose share as other players made headway. Chinese consumers never paid attention to fragrance or perfume, and this trend tends to reverse the past few years thanks to millennials’ growing attention for luxury products.

A little bit of context about the Chinese perfume industry

In 2017, the perfume industry only had a 1% sector in China. Although small, it demonstrates that China’s perfume market holds huge marketing potential, with the prediction that the perfume market in China might reach 6.65 billion RMB (around 1.05 billion $USD) in 2018.

Top 10 emerging fragrance brands in China

- Armani Beauty

- Atelier Cologne

- Chanel

- Dior

- Diptyque

- Gucci Perfume

- Hermès Fragrance

- Jo Malone London

- Louis Vuitton Fragrance

- Yves Saint Laurent

How can niche perfume brands implement themselves in China

Niche brands are using innovative ways to attract Chinese consumers – French perfumer Diptyque paired ice cream flavours with fragrances at an in-store event, while British brand Jo Malone London teams up with hotels to do afternoon teas. Their approach appears to be working – according to Euromonitor, consumers increasingly favour niche brands as opposed to mass-market perfumes.

Fragrance brands should follow the social Chinese trends

To be sure, this period of time is a tremendous boon for the fragrance industry, but what — if anything — can luxury brands learn from them? Even though much of the information in the fragrances list was speculation, the virality of the list shows just how committed young Chinese are to their favourite young stars, and more importantly, to what they wear, buy, and know what they smell like.

The trend reflects a general shift in the outlook of Chinese millennial consumers. They have a good attitude regarding their lifestyle, they’re not just thinking about brands and price, they’re looking for products that are quality, unique, and exclusive.

The home fragrance market is also booming

“Home fragrance is booming in China for three reasons,” said Chinese millennial Grasse institute of perfumery student, Wanqiu Chen.

- The Chinese have burnt incense ever since the Han Dynasty.

- There are more home fragrance choices than ever before.

- The marketing strategies for perfume and fragrances has been very strong lately, with lots of celebrities and KOLs sharing their decor and candle purchases on Chinese social media.

Until recently, Chinese luxury consumers only bought perfume and fragrance because of their brand names, purchases that were less about the scents and more about the status of the brands. But now, younger consumers want to know how to fragrance their interiors as part of their holistic luxury lifestyles, and thanks to social media, this demand continues to blossom.

Men fragrance market trend in China

In China, most consumers are still lukewarm about perfumes and colognes. Fragrances based on traditional Chinese medicine were widely used before the Cultural Revolution began in 1966; after that, using fragrances was viewed as indecent.

Perceptions began to change with the growth of China’s luxury industry and as more consumers travelled abroad, but even then, most members of the elite only bought perfumes or men’s cologne to give as gifts, not to wear themselves.

The Chinese culture is impacting fragrance consumers’ behaviour

Fragrance brands that are seeing success in China have adapted to meet the needs of their customers – people who are looking for ways to express themselves but who are still getting used to using fragrances, meaning they seek scents that are not too strong. Kamila Elliot, vice-president and general manager of Jo Malone London, says the brand’s most popular scents in China are ones that are light and floral, such as Bluebell, English Pear & Freesia, and Wood Sage & Sea Salt.

What is the future of the Chinese fragrance market?

Sales of fragrances are now expected to decline by 2% in 2020 in 2019 constant value terms in light of the impact of COVID-19. This compares to an expected 21% rise forecast for 2020 during research conducted at the end of 2019 before the spread of COVID-19.

All areas of fragrances have been hit by COVID-19 as consumers do not typically wear fragrances for use around the home. With the restrictions impacting household incomes this will likely also have a negative influence on sales.

How to promote your fragrance brand through KOLs in China

Brands reach China’s fragrance novices not just via the blotter; their marketing strategy is multi-pronged and uses fashion influencers (or KOLs – key opinion leaders) and events.

“People need time to learn about fragrances and how to use them, and to accept them in their daily life, it will take at least three to five more years to see a big shift in people adopting this lifestyle.”

GMA is a specialized agency in China which dedicated years to know the Chinese market and its trends. Our team of China experts can help you settle and succeed in the Chinese market. From marketing content to promote on Chinese social media and event or KOLs. Contact us directly on our website to get advice from professionals!