Taxes on imported products can be extremely high in China. The Chinese Government used to practice this kind of methods as a protectionist way to grow domestic consumption. But, as a result of these practices, the consumption of counterfeited products raised and the wealthier part of the population managed to purchase their products while they are abroad. Still in the same “Growing domestic demand” objective, the Chinese Government decided that the best solution were to cut taxes on imported products. These measures took effect on the 1st of June.

A great news for consumers…

Chinese consumers have always preferred international brands rather than local ones. The phenomenon of always looking for imported products have a name in China, Hai Tao. Imported products is reassuring for Chinese consumers, they believe they are better, with higher quality (which justify the higher prices).

The gap between Chinese prices and Western prices is huge, indeed, a Night repair serum costs 92$ usually but it will cost 155$ in China, a pair of Nike worth 120$ in the West while it will be at 160$ in China or Baby diapers that will have a 11$ value in U.S.A for example will get obtained at 18$ in China.

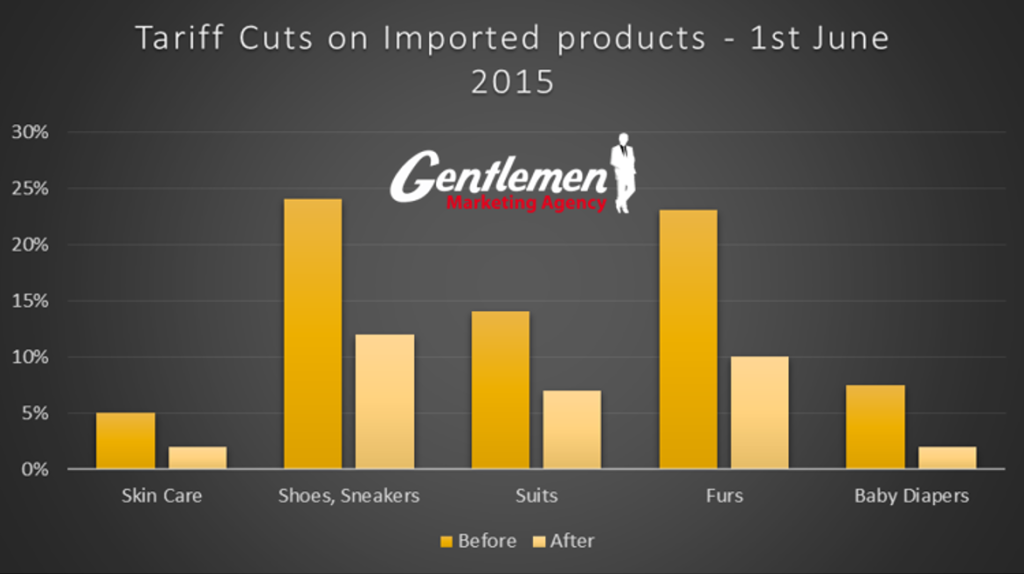

To spur spending, Chinese authorities are planning on cutting taxes in key sectors such as Skin Care products, Fashion (Clothes & Shoes), Baby Food, Baby Care & Supplies and Kitchen utensils. All these categories are the most imported items by Chinese consumers, which represent a strategic choice from the Chinese Government. However Luxury and Super Luxury products will not be concerned by the tariff cuts.

These measures became necessary, and be sure it wouldn’t be an insignificant price change, the duties will be cut by half!

…and retailers

The decision made by the Chinese Government is awesome news for international players of these industries. Their growth suffered from their lack of competitive prices. Indeed, Chinese tourists who went abroad were 90% to buy Cosmetics products, 85% bought Fashion and Footwear items and 64% of them bought Baby Food and Baby Care products.

They will now be able to operate a consistent Price Policy in order to boost their sales in China, fit consumers’ needs and their global offer.

How will it change?

Here is a graphic representing how the measures will affect prices:

What’s the future of Cross-Border?

The Hai Tao phenomenon help to the development of new E-Commerce platforms, the Cross-Border platforms, which are online retailing platforms connecting Chinese consumers to International retailers. These platforms are usually a B2C marketplace such as JD.com, Tmall Global, Ymatou… Once again, proportionally to the size of the market, the Cross-Border offer is highly rich. But with a renewed interest for local brands and niche labels plus the Governmental actions to refocus the consumption on the national market, it is possible that the Cross-Border model may suffer.

The question that remain is: Will it be still profitable to a consumer to purchase its imported products via Cross-Border websites or will the tariffs cuts offer unbeatable prices directly on the local market?

It is a smart move operated by China, as a lot of highly spending consumers where buying their products abroad in France, South Korea, Hong Kong or Japan.

To have a better understanding of the fashion industry, you can have a look here.

1 comment

Otto.van.otto

Hi! I like this article. Do you have updated graphics or charts for tariff cuts on imported products? I saw it inside the article. Thanks!