The economic growth in China is a huge driver of the luxury goods market and demand for high-quality products increases correspondingly – there are more international brands entering this space than ever before! In 2023 alone, sales revenue of leather luxury goods reached US$9 billion! More young generations purchase fashion and the importance of social media for customers has increased with their tastes expressed in expressing themselves through purchasing high-end items.

The importance placed on having an omnichannel strategy for distribution combined with how much younger generations care about sharing their purchase decisions means retailers need to find ways to attract consumers online. In this article, we will present the potential in distribution, customer behavior, and social commerce in China.

China Leather Goods Market Overview

Comparing both domestic production and imported foreign products, China itself is an enormous exporter of leather goods worldwide generating 25% of the annual global leather production. China’s leather industry is well-known for heavy skin made for manufacturing belts, straps, and soles, as well as light leather used for shoes, bags, and jackets.

In terms of the potential of the Chinese luxury leather goods market, there are growing demands for imported leather of all kinds for manufacturing and foreign manufactured finished products such as quality footwear and leather fashion handbags. Imports of leather and finished products rose to US$9.8 billion, growing by 10.7%.

In terms of the market size, the leather goods market in China grew from $6.22 billion in 2018 to $9.14 billion in 2023, and will continue to grow at a CAGR of 4.95% up to $11.64 billion in 2028. China is second after the US, and the market has a lot of potential, but it’s pretty centered around just a few luxury brands, which we will cover later.

Bags & leather goods consumption in China

Chinese consumers spent an average of $6.26 in 2023 on leather goods. Most of the sales are done online, and especially Chinese female luxury consumers prefer to see, try on, and touch the product before the purchase. It’s even more evident when it comes to the top luxury brands, like Louis Vuitton or Hermes, as those brands offer an exquisite customer experience in their shops. In 2023, offline sales accounted for 77% of total purchases.

Customer purchase factors include design and materials, as well as brands. Among those buyers, 68% of them collect at least a handbag once every other season and 36% even purchase one per season.

Leather goods consumers are getting younger

Currently, a quarter of Chinese customers purchase fashion leather goods aged from 18 to 24, followed by working-class women aged from 25 to 34( 22%) with higher purchasing power on average. Some purchase fashion bags and luxury bags to express their fashion taste, as a gift reward, and due to the preference of certain brands, designers, quality goods, etc.

For instance, the French classical luxury shoe brand, Roger Vivier, launched new categories and in-trend colors targeting young generations. Roger Vivier collaborates with Chinese celebrities, such as Nana Ouyang, to promote their luxury bags in China targeting their young customers. They choose their digital presence on one of the Chinese most-used social media, Weibo, to reach Chinese who frequently spend their time on social media.

Additionally, shoppers aged 18-44 who search for information on fashion leather goods before purchasing have a correlated high transaction rate. Considering this customer group is the primary target in this category, a diverse digital presence, and corresponding marketing would bring your brand more publicity and help strengthen your brand image.

In China, the young generation enjoys socially sharing their purchase including luxury and fashion leather goods, even online. Some share videos in Billibili and RED including unboxing reviews of goods, trends analysis, collections sharing, etc.

Although customers aged from 45 to 54 only account for 4% of purchases, half of them still search online before purchasing. Meanwhile, they enjoy buying in physical stores as well. Thus, omni-channels would still be your consideration in building your presence in China.

Leather goods segments in the Chinese market

Biggest market share: Leather Bag

In general, luxury bags are one of the most sought-after luxury products in China, as they show the status and wealth of its owner. In 2023, the revenue from luxury handbags accounted for almost $7 billion. luxury leather handbags take a big market share as well, and the average amount spent on a luxury handbag in 2021 was approximately 3 435€ (27.000 RMB) (not to mention that was during COVID-19 pandemic!).

When it comes to the main trends, one big trend observed is the unisex bags. People also purchase luxury bags at a younger age than before and those young generations are the main consumer group of the whole leather goods market.

Not to mention the sustainability efforts and the growth of the second-hand luxury market. In fact, the majority of luxury bags seen on the streets in China are either counterfeit products or second-hand, as many Chinese can’t afford a luxury bag, but still really want to have it.

Leather shoes in China

In the footwear category, most sales were credited to women’s shoes (47% and RMB206.7 billion), then followed by men’s shoes(38%) and children’s shoes (63 billion). According to HKTDC, primary leather shoe buyers are office workers.

Speaking of the factors in choosing leather shoes, men prefer traditional designs as the formal and professional expression in China. Women prefer to purchase trendy and new designs. according to China Leather Industry Association, the leather shoe segment is the fastest-growing segment in the footwear category in China and is predicted to have a stable growth of 1.5%.

What are the trends in the Chinese leather Goods market?

Based on the trends that were anticipated in the leather goods market, here are four main trends that could have been prominent in China’s leather goods market in 2023:

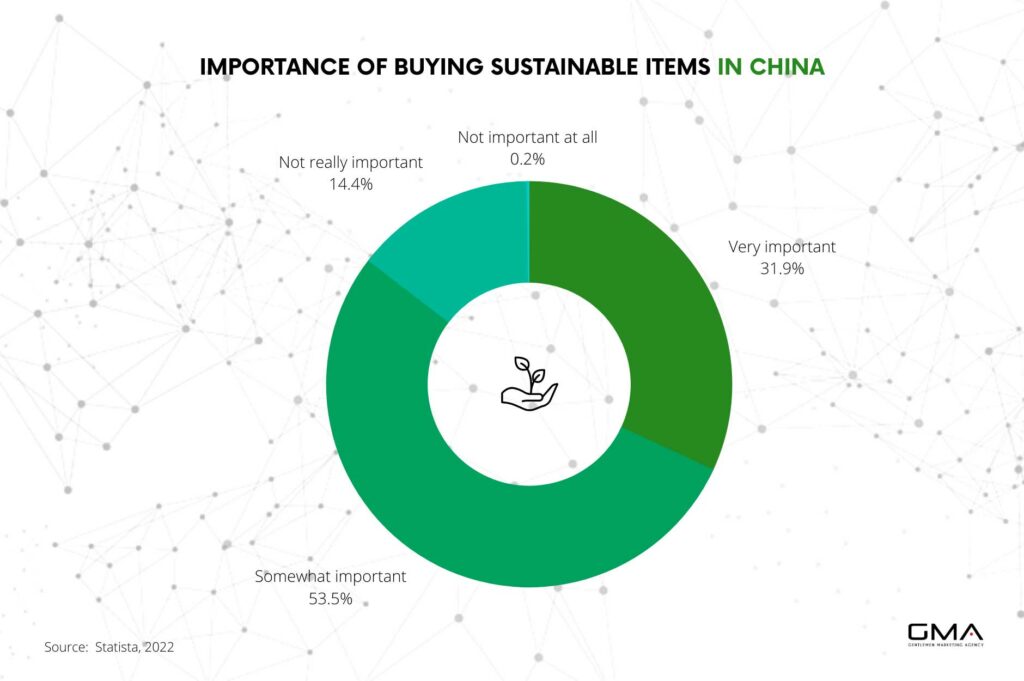

Sustainability and Ethical Sourcing

With increasing awareness about environmental concerns, consumers were expected to prioritize sustainable and ethically sourced leather goods. Brands that demonstrated eco-friendly practices and transparency in their supply chains were likely to gain favor among conscious consumers.

Digital Transformation and E-commerce

The growth of e-commerce and online retail was projected to continue, with brands investing in digital platforms to enhance their presence. Online shopping experiences, mobile apps, and personalized interactions were trends to watch, as consumers sought convenient ways to shop for leather goods.

Customization and Personalization

The demand for unique products was driving the trend of customization and personalization. Brands offering options for customers to tailor their leather goods, from colors to designs, were expected to stand out and attract consumers looking for individualized items.

Innovative Materials and Alternatives

As sustainability became more critical, the adoption of innovative materials beyond traditional leather was expected to grow. Brands exploring alternatives like lab-grown leather, plant-based options, or recycled materials could tap into the eco-conscious market segment.

Local Brands and Designers

Chinese consumers were becoming more appreciative of homegrown brands and designers. This trend was likely to encourage the growth of local brands that offered unique designs and quality craftsmanship.

Focus on Functionality

Leather goods that combined aesthetics with functionality were expected to gain popularity. Consumers were looking for products that offered practicality along with style.

What are The Main Channels to Sell Leather Goods in China?

Classic distribution: working with Chinese distributors

Distributors in China focus on products’ value and potential to collaborate. Distributors are in charge of product delivery, paperwork, and regulation. They do not assist with marketing development. Reaching out to them would be a challenge as well, but the network would be more helpful.

Brick-and-mortar stores: still a channel of choice for Chinese consumers

Although eCommerce has gained a lot of ground, the bulk of customers still visit physical stores before making a purchasing decision with a luxury brand. After all, purchasing luxury goods is also about the experience. It is becoming more and more common for luxury consumers in China, to first visit a physical store and later purchase an item online to enjoy some promotion or be able to have access to customization and so on.

In China, joint-venture is the common enterprise model which will also help the trends observations. You can collaborate with an individual or a company in China. To protect your intellectual property, you are also suggested to register your company with the State Intellectual Property Office.

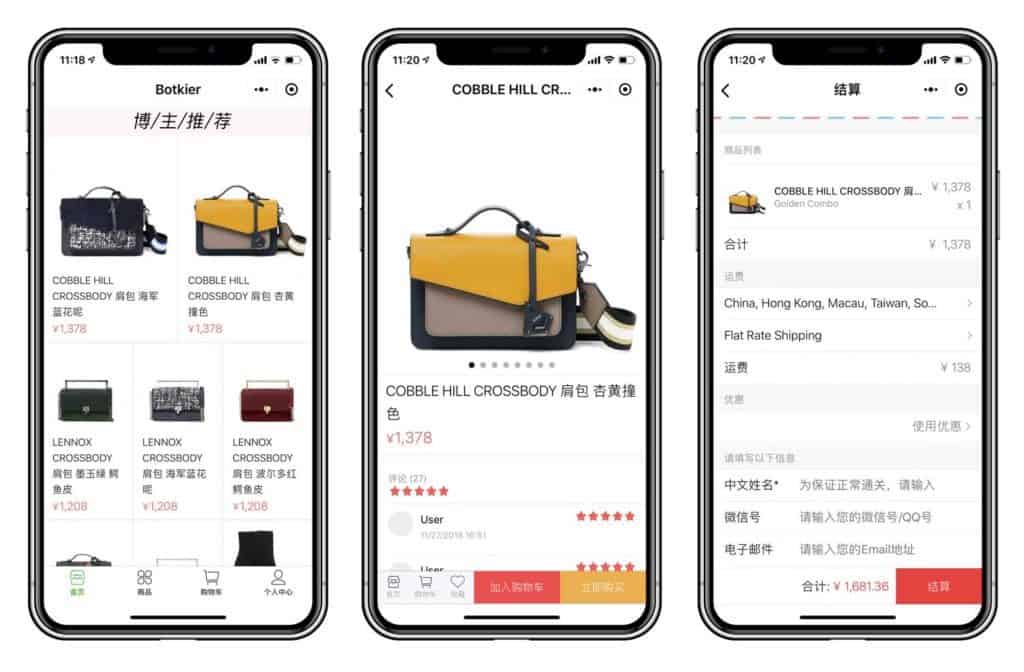

Chinese eCommerce Platforms

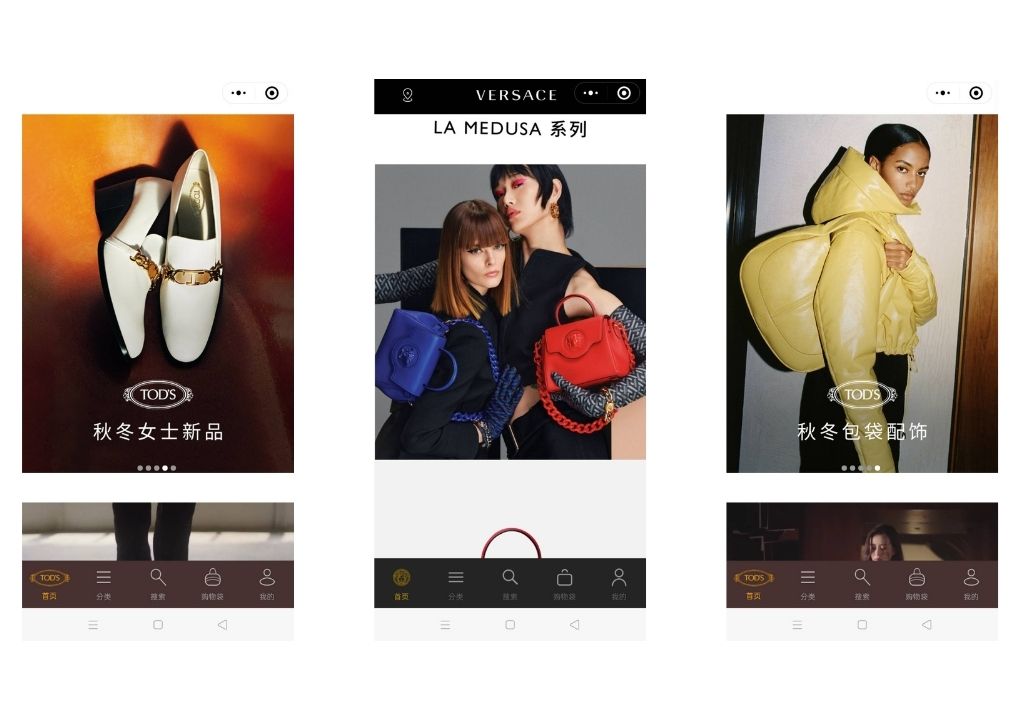

Offer your customers a worry-free transaction directly from their mobile phones. The idea, that eCommerce cheapens the luxury experience is quickly becoming obsolete in the Middle Kingdom. Indeed, e-commerce apps are designing more and more tools allowing Luxury brands to offer VIP experiences to their customers, even online. Tools such as AR, gaming, live streams, etc.

Tmall & Tmall Global

Tmall is China’s biggest eCommerce platform and is widely trusted by consumers and brands for the services it provides. It also offers a global version for brands that do not have stock in China and have Chinese business licenses.

There are 29000 brands present on Tmall Global and mostly purchased here are beauty, mom, and baby products. Both versions of Tmall are a great place to be for luxury brands. Tmall also has a dedicated zone for Luxury brands known as Tmall Pavilion.

Tmall Luxury Pavilion was created in 2017 and 200 brands from apparel to high-end cars were invited to join in only two years. Tmall’s “Hey Box” feature uses artificial intelligence and big data to select brands presented to the users. On the Tmall Luxury Pavilion webpage, the main section is recommendations from garments and bags to accessories for both females and males.

In the app, there is a specific luxury platform that features new events, new arrivals, new benefits, and new trends. You can pre-launch limitation sales in new events for users to set the notification for purchasing in advance as Michael Kors Super Brand Day. This platform is also connected to Farfetch. Although Tmall Pavilion is available to any customer, only some Tmall users have easy access to it.

Tmall Luxury SoHo is a platform that allows young and trendy luxury buyers to search and discover new designer brands in one place. Brands can sell off-season goods here when brands encounter inventory overstocks; meanwhile, customers can also purchase seasonal goods at more affordable prices.

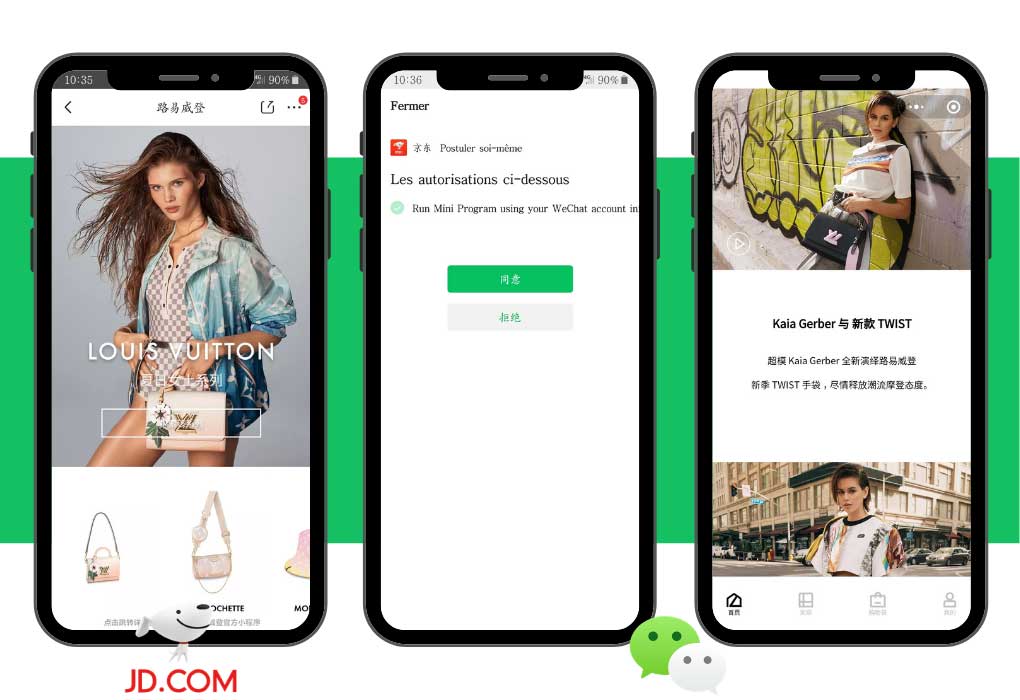

JD & JD worldwide

JD.com is another Chinese eCommerce giant we do not need to introduce anymore. If the app was initially more focused on electronics, it has started to catch up with Tmall when it comes to luxury, cosmetics, and fashion.

Over 200 luxury brands have established partnerships with JD. Furthermore, JD provides free service helping launch WeChat mini-programs within just one week to generate extra traffic. JD members can connect to the WeChat mini program through JD pages to purchase the products and pay with WeChat Pay.

Where to Promote Your Leather Goods Brand in China

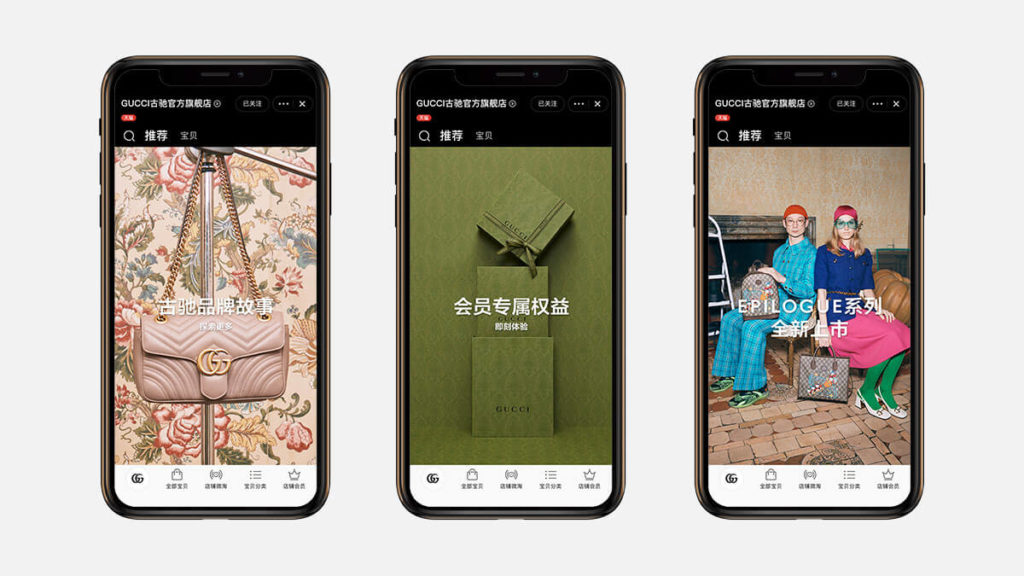

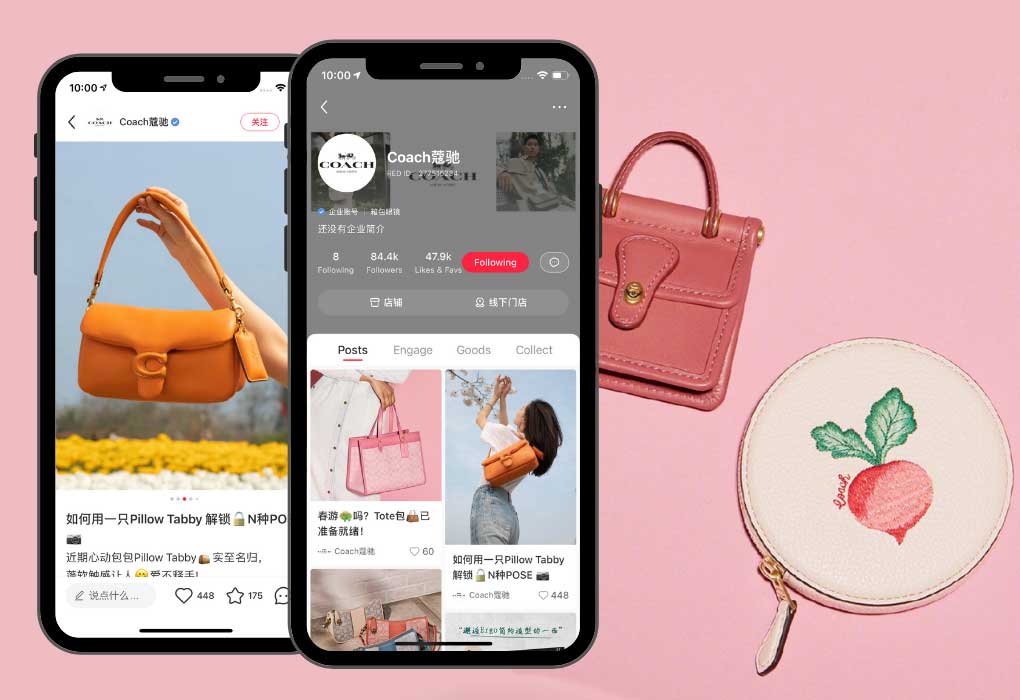

Xiaohongshu: The Social Ecommerce App for Luxury & Lifestyle Brands

Xiaohongshu is a social commerce app that allows brands to sell & promote products at the same time. It is mainly social media that the young generation uses to share cosmetics, fashion, luxury, and lifestyle.

As more and more Chinese customers purchase luxury and fashion for their personality and self-expression, they also share those on Red. For instance, users and KOLs share their OOTD (Outfit of The Day), brands, and reviews with the hashtag, location, and tagging of that account. Luxury leather goods brands such as Gucci, Coach, and Givenchy present themselves on Xiaohongshu.

Little Red Book is also used to share buying experiences and product reviews which is extremely valuable for brands in a country like China where word of mouth is key. RED, because of its core function of shopping notes (the reviews) has quickly become a Kols App.

The app also offers a paid ads function as well as an official account & eCommerce store (RED Store) for brands.

WeChat: China’s most used Social media

Not only does WeChat have the largest user base in China, but it also has an abundance of tools and features that can be used by brands to work on their reputation. Having a WeChat Business account enables you to take full advantage of the app ecosystem. With a WeChat business account, you’ll be able to send promotions and campaign messages to your followers but also sell your product, create VIP events, and so on.

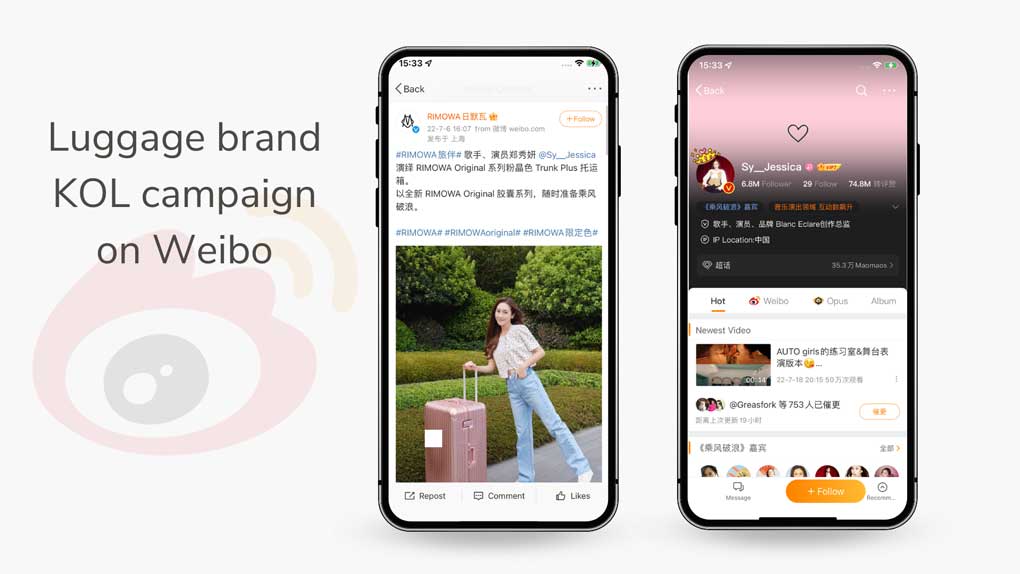

Weibo: Perfect for Fashion brand Advertising

Weibo is one of the biggest Chinese social media and is widely used by Chinese luxury consumers and brands. Weibo has one of the best-paid advertising systems for social media in China. Its efficiency/pricing could be compared to Facebook.

Because Weibo (like Twitter) is an open social media, posts can become viral quite quickly, offering a lot of visibility. Weibo is a great place to build a following and engage with your target audience. Weibo, also offer an official account system with marketing tools for brands such as contest and lucky draw.

Get Yourself a Chinese Website & rank on Baidu

Why do you need a Chinese website?

It is all about credibility for your brand. If you don’t have a website, especially in the FCGM industry, consumers might think you are not legit. You would not enter your local market without a website so why would you do so in China?

You may tell me that your local website is enough, but first of all, many Chinese do not speak your language or English for that matter, and English website tends to not rank so well on local search engines. Not only that, your current website is most likely optimized for Google and probably also uses Google plugins that will simply not work in China. The easiest solution is to have a separate Chinese Website, hosted either in China or close countries, optimized for Baidu.

Why do you need to rank on Baidu?

Most of us google a brand/product name to look for more information and reviews about it, Chinese consumers do so on Baidu. You want to be visible, not only to get traffic but for your credibility as a brand on the market. Chinese consumers are not risk-takers, so if no results are attached to your brands when looking for them on Baidu, that is a sign that you are not reliable and that will affect your sales on other channels.

Having an ICP (Internet Content Provider) License to build your website locally can provide a better user experience with a faster and more stable server. ICPL enables you to verify your website with more feature accessibility and bring more trust to be ranked higher and increase your web traffic on the dominant China search engine, Baidu. Moreover, SEO for organic search traffic cost less than investment in campaign and advertisement and can be your long-term investment.

Contact GMA to Start Selling your Leather Goods in China

Omni-channels, local preferences, and purchase factors can help you design attractive products and touchpoints for Chinese customers. As the main customers are the young generation, comprehensive online digital purchase experience, thoughtful after-sales customer service, and values of social sharing bring more attractiveness to Chinese young customers.

Besides the apparent personality of brand image, collaboration with influencers and celebrities can also create trends in China.

At Gentlemen Marketing Agency, we delve deep into the heart of this thriving market, guiding you through the nuances of captivating the discerning Chinese gentleman.

- Craftsmanship Meets Aspiration: We understand the art of creating luxury pieces that resonate with the aspirations of the Chinese gentleman.

- Authentic Storytelling: We weave your brand’s story into the cultural fabric, forging authentic connections with your audience.

- Cultural Insight: Navigating cultural nuances is our forte, ensuring your brand’s message aligns seamlessly with Chinese values.

- Digital Savvy: Our mastery of digital platforms propels your brand into the digital spotlight, engaging influencers and captivating audiences.

- Choose Excellence: With Gentlemen Marketing Agency, your brand becomes synonymous with sophistication, exclusivity, and luxury.

Ready to embark on this luxurious journey with us? Contact Gentlemen Marketing Agency today! We have solutions to help you grow/enter the Chinese leather goods market!

4 comments

pieterpetros

Hi, we want to offer our collection to retailers in China.

Contact us please

admin

Hello

We contact you via email 😉

Abdullah malik

We make leather production all items .yes my friend we have everything in leather from pair leather jacket leather cap leather bag leather belt all size all Design all colours available.watsapp.00923147613081.

josephine

Hi.. I’m Zozo , we’re legal and famous leather manufacturer from Indonesia ,

We offering many kinds of reptile skin such as lizard , croco , snake, dll

Any requests recently ? Don’t be hesitate to contac me ,

Looking forward to your reply soon 🙂