China’s fashion industry is growing fast, making it a great market for fashion brands globally. But, it can be hard to enter the Chinese market without enough knowledge and support. Tmall and JD.com are two of the largest e-commerce platforms in China and are popular choices for fashion brands who want to reach the country’s large consumer base.

In this comprehensive guide, we’ll explore everything you need to know about Tmall and JD.com as a fashion brand entering the Chinese market, from understanding their key features to succeeding on their platforms. So grab a cup of coffee and let’s dive in!

Tmall And JD.com: Key Players In The Market

Tmall and JD.com are major players in China’s e-commerce world, offering a wide range of products. Tmall is known for clothing and cosmetics, while JD.com specializes in technology and high-end fashion.

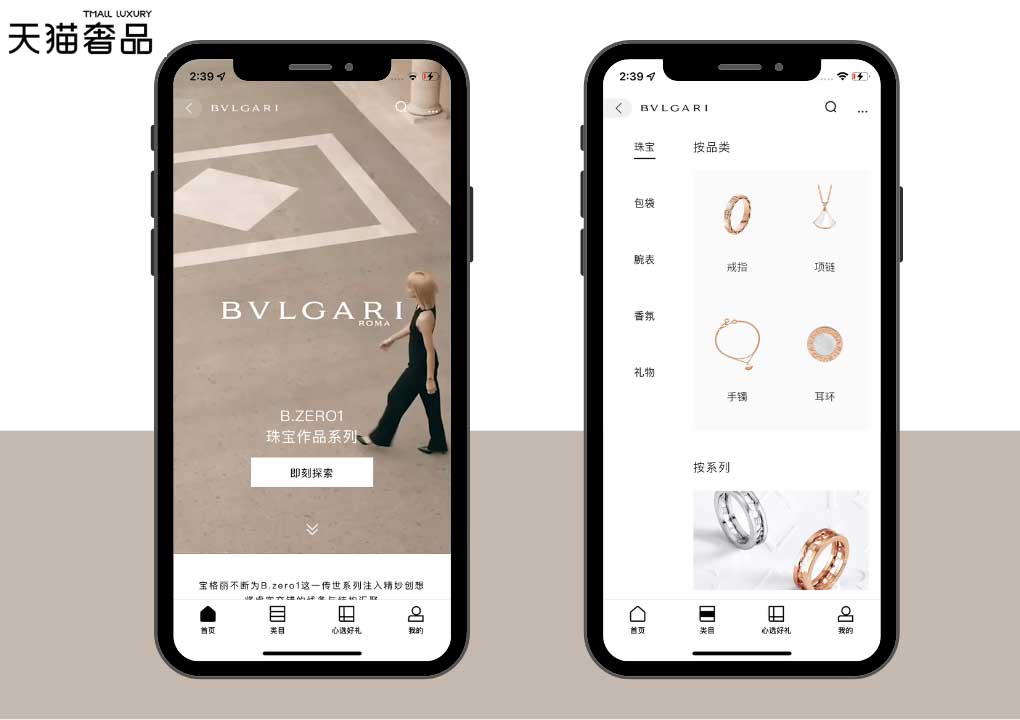

These platforms offer a massive opportunity for foreign merchants to tap into China’s booming consumer market. Luxury fashion brands like Alexander McQueen, Saint Laurent, and Mulberry have already partnered with them, making it easier for fashion-conscious consumers across China to access these brands.

Understanding Tmall And JD

To succeed in China’s e-commerce market, fashion brands must know about Tmall and JD.com. These platforms have many users and can help you reach a large audience.

It’s important to understand the differences between Tmall and JD.com. While both e-commerce platforms are popular in China, they have different strengths when it comes to product categories and target audiences.

Tmall is great for luxury brands and attracts wealthy, educated shoppers. JD.com is known for selling quality products at affordable prices, making it popular with budget-conscious consumers.

Tmall and JD.com have different features to improve user experience. Tmall has attractive storefronts with multimedia, while JD.com has a reliable logistics network with many warehouses.

Furthermore, JD.com delivers faster (same-day or next-day delivery) in many Chinese cities and JD Worldwide helps international merchants sell in China without import restrictions.

Also, Tmall is known for its emphasis on clothing, cosmetics, and food and beverage purchases, making it an attractive option for fashion brands specifically. On the other hand, JD.com is favored more for home goods.

Succeeding On Tmall And JD

Creating A Visually Appealing Store

To succeed on Tmall and JD.com, a visually appealing store layout is crucial. Customers are more likely to browse and buy when the design is attractive, easy-to-navigate, and showcases products effectively.

Tmall allows customization based on seasonality and promotions, while JD features high-quality images and concise descriptions.

Adapting To Local Pricing Strategies

As a fashion brand looking to succeed on Tmall and JD.com, it’s crucial to understand local pricing strategies. The Chinese market has unique consumer behaviors and preferences when it comes to price points.

To adapt pricing strategies for the Chinese market, it’s essential to understand consumer behavior. For example, luxury brands have higher prices due to high import taxes. During big shopping holidays like Singles Day, Chinese consumers expect deep discounts.

Foreign brands can learn from domestic competitors to understand local pricing trends and which products appeal to different demographics.

Localizing Communication

For international brands launching in China’s digital market, offering Mandarin customer service and adapting to local cultural preferences is crucial for building trust with customers on Tmall and JD.com.

Partnering With Influencers And KOLs (Key Opinion Leaders)

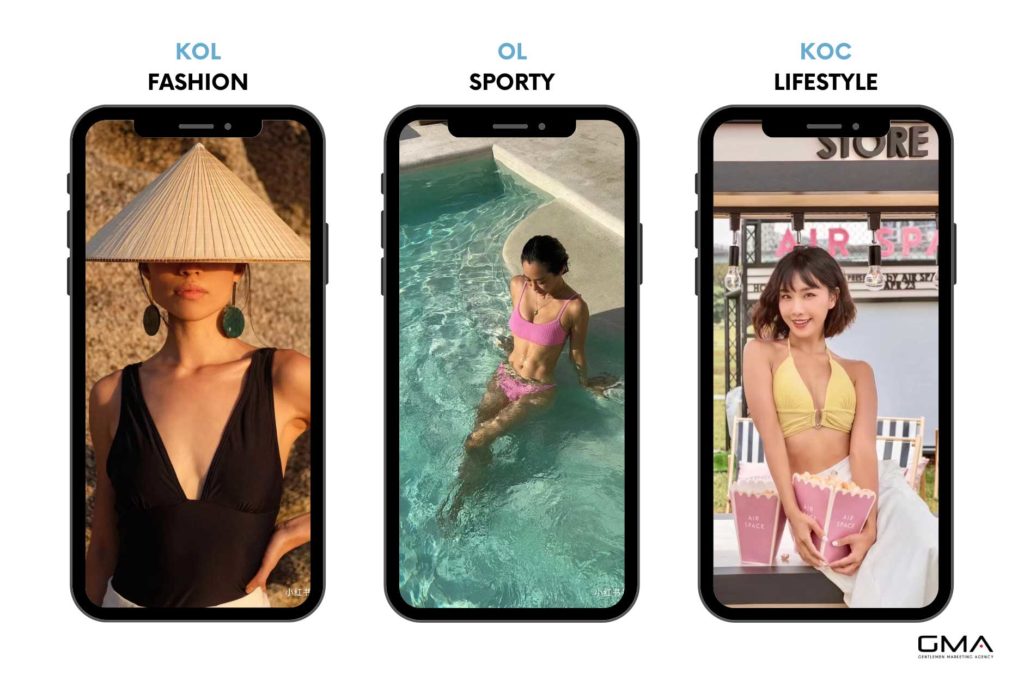

Collaborating with influencers and KOLs is crucial for success on Tmall and JD.com. In China, these figures hold significant influence over consumer behavior, making KOL partnerships a great way to build brand loyalty and increase online presence.

Many luxury brands have already partnered with popular fashion bloggers like Mr.Bags to promote their products.

Note that there are different types of influencers in China’s digital landscape, including micro-influencers and KOCS, who have smaller but highly engaged followings.

Utilizing Social Media Platforms Like Weibo And WeChat

To succeed on Tmall and JD.com, consider using social media platforms to reach Chinese consumers. Weibo has over 500 million registered users and is great for mass audiences or viral content. Luxury fashion brands are finding success on WeChat and Tmall Global.

Influencers and KOLs can promote your brand on Douyin through sponsored posts and live-streaming events.

Example: Last year, global fashion brand H&M leveraged influencer marketing on Douyin by encouraging content creators to feature their favorite H&M products and clothing styles on the app.

Adapting To Cultural Differences And Consumer Preferences

It’s essential to understand that cultural differences and consumer preferences play a significant role in the Chinese market. Brands must take into account factors such as language, customs, and traditions when creating marketing campaigns or designing products for the Chinese market.

For instance, localized communication and support can help build trust with consumers who might be unfamiliar with your brand.

To succeed on Tmall and JD.com, know what Chinese consumers want: quality, exclusivity, and uniqueness.

Case Studies: Successful Fashion Brands On Tmall And JD

This section will analyze brands that have excelled on the Tmall and JD.com platforms, highlighting their key strategies and takeaways for other fashion brands looking to succeed in the Chinese market.

Examples Of Brands That Have Excelled On The Platforms

Here are a few examples of brands that have excelled:

- Louis Vuitton – The luxury fashion brand joined Tmall’s Luxury Pavilion program and created their own store on JD.com in 2017.

- Alexander McQueen – The British brand’s Tmall store has boosted sales since 2018, thanks to KOLs and platform-specific marketing events.

- Saint Laurent – The French label’s sales have improved since joining JD.com’s Toplife program in 2018. They now have a standalone store in Beijing and sell through the platform.

- Mulberry – The British brand launched their first online store in China with JD.com in late 2020. They utilized JD’s logistics network and consumer insights to attract Chinese shoppers.

Overall, these brands serve as examples of how a strong online presence on Tmall and JD.com can drive growth in the Chinese market.

We Recommend You Find a Local Partner First! Contact us!

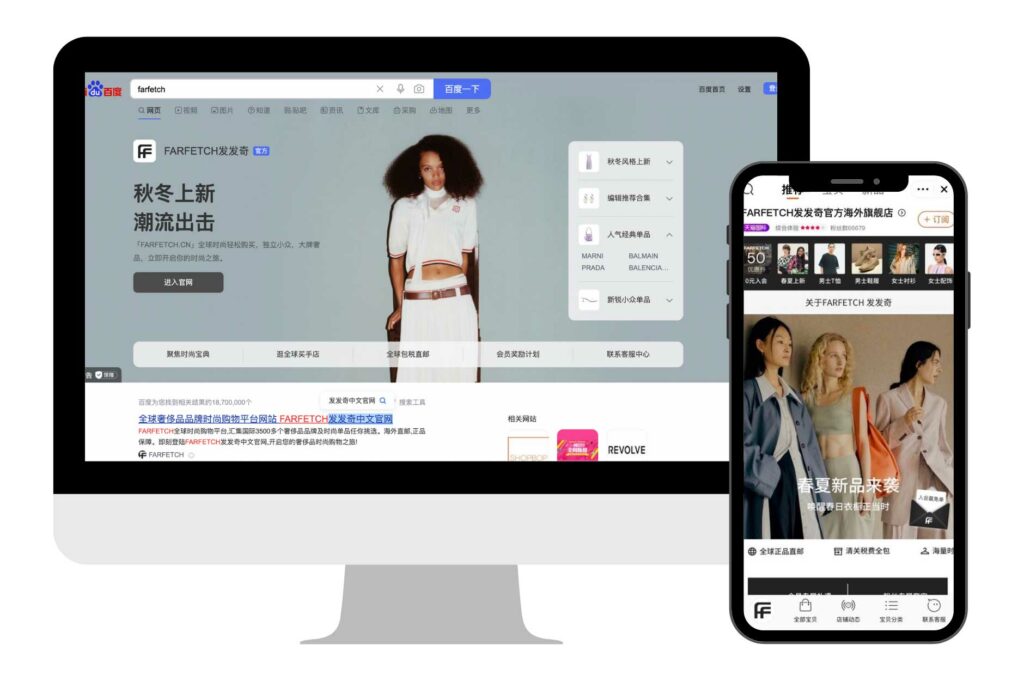

In conclusion, investing in a strong online presence on Tmall and JD.com is essential for fashion brands looking to enter the Chinese market.

By tailoring your brand messaging, offering competitive pricing and promotions, utilizing data and analytics, prioritizing customer service and engagement, and implementing effective marketing strategies, you can successfully navigate the challenges of this unique marketplace.

If you need help getting your brand off the ground or integrating your strategies into Baidu, you know where to turn to. Contact us today for not only educational blogs but to have a partner in building your business and making it relevant in the minds of the Chinese consumer.