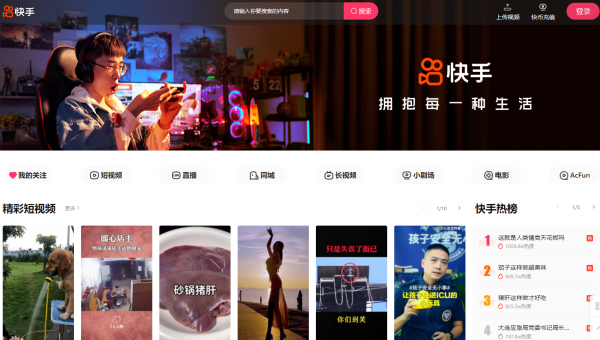

Kuaishou is a video app similar to Douyin. Kuaishou, a prominent player in the realm of social media and digital content, stands out as a significant platform in China’s fast-paced internet landscape. Originating as a GIF sharing application, Kuaishou has evolved into a comprehensive short-video and live-streaming platform, distinguishing itself with its user-friendly interface and a deep focus on community engagement. It caters to a diverse range of content creators and viewers, spanning various demographics and interests. Kuaishou’s growth trajectory reflects the dynamic nature of digital media consumption in China and highlights the platform’s role in shaping online trends and consumer behavior.

Key Figures of Kuaishou

- User Base: Kuaishou boasts a massive and active user base, with millions of daily active users, reflecting its widespread popularity and reach.

- Content Diversity: The platform hosts a vast array of content, ranging from entertainment and lifestyle to educational and e-commerce related videos.

- Revenue Streams: Kuaishou generates revenue through a mix of advertising, live-streaming, e-commerce, and virtual gifting, showcasing a robust and diverse business model.

- Market Presence: It holds a significant share in China’s short-video market, competing closely with other major platforms like Douyin (TikTok in China).

- Global Expansion: Kuaishou has made strides in international markets with apps tailored for global audiences, signaling its ambition for worldwide influence.

- Innovative Features: The platform is known for its innovative use of technology, including advanced algorithms for content recommendation and interactive live-streaming features.

In a complex and ever-changing marketing environment, accelerated intense marketing competition has emerged. Every brand in China is poised to face these challenges, revitalizing their brand vitality within a framework of sticking to their core while innovating, and finding growth logic amidst the surge of online traffic.

Accompanying the return of consumer rationality is an increased emphasis on brand value, meaning that just having a good product is not enough to sway consumers. Products with stories and content have the opportunity to garner attention and affection. Brands have arrived at a crossroads of content, where strategic thinking and scientific assistance are needed to achieve both reach and communication precision.

Kuaishou vs. Douyin: Key Differences

- Target Audience:

- Kuaishou: Attracts a diverse audience, including users from lower-tier cities and rural areas in China.

- Douyin (TikTok in China): Skews towards a younger, urban demographic, with a strong presence in first- and second-tier cities.

- Content Style and Diversity:

- Kuaishou: Known for its authentic, grassroots content. Encourages user-generated content from everyday life.

- Douyin: Focuses more on high-quality, polished content. Popular for trendy and creative videos.

- User Engagement and Community Feel:

- Kuaishou: Promotes a strong community feel, with higher levels of interaction between users and creators.

- Douyin: While also interactive, it places more emphasis on content discovery and consumption.

- E-commerce Integration:

- Kuaishou: Has a strong e-commerce integration, making it popular for live-stream shopping and grassroots marketing.

- Douyin: Also integrates e-commerce, but with a focus on brand collaborations and influencer marketing.

- Monetization and Revenue Streams:

- Kuaishou: Relies heavily on virtual gifts and tipping during live streams, along with e-commerce.

- Douyin: Earns significantly through in-app advertising and sponsored content, in addition to e-commerce.

- International Presence:

- Kuaishou: Limited international presence, with focused expansion efforts through apps like Kwai.

- Douyin: Has a global counterpart, TikTok, which is immensely popular worldwide.

- Algorithm and Content Distribution:

- Kuaishou: Uses an algorithm that promotes more diverse content, often giving visibility to new and lesser-known creators.

- Douyin: Employs a sophisticated algorithm favoring viral and trending content, often pushing popular creators.

- Market Position and Competition:

- Kuaishou: Competes as a major player in China’s short-video market, especially strong in lower-tier cities and rural areas.

- Douyin: Dominates the short-video sector in urban areas and among younger demographics.

These differences highlight the unique positioning and strategies of Kuaishou and Douyin in the Chinese digital landscape, each catering to different segments of the market with their distinct content styles and user engagement models.

Case studies

In the spring and summer of 2023, the Kuaishou platform witnessed many excellent marketing cases, bursting with definite power from an uncertain market.

The aim of fashionchinaagency is to analyze and select successful brand cases on Kuaishou, providing the industry with experiences in content creation, consumer communication, brand value enhancement, and business growth.

Each selected case in the series will be comprehensively evaluated from three dimensions: brand value, business conversion, and operational science.

The first series of 10 brand cases includes common industry issues such as node marketing, new product launches, off-season promotions, as well as micro operational tactics like store operation, fan accumulation, and traffic conversion, hoping to aid brands at different development stages facing similar problems.

Where are the marketing opportunities in China fr 2024?

In the confidence-rebooting year of 2023-2024, some brands have begun exploring more diverse communication methods, receiving positive market and consumer responses under the combination of scientific methodologies and marketing tools.

Major promotional events are often seen as a rapid, aggressive campaign, providing a burst opportunity for brands to invest substantial resources in a short time to facilitate more efficient audience circulation. However, consumers are continuously evolving. In this deeply connected world, they have new expectations, consumer behaviors, and values.

Kuaishou & Tmall Traffic

This ‘new’ not only refers to the shift in content from traditional to live short video formats but also to the competition for consumer attention and their deeper immersion in preferred activities. To capture the audience, brands need to establish connections in spaces and places most important to consumers, and must also build themselves through novel experiences, culture, and actions to enhance their appeal. In this regard, the variety show derivative livestreamfg “Entertainment 6 Turnover·Sister is Coming” co-launched by Tmall 618 and Kuaishou in the [Magnetic Engine·Case Show] set a new paradigm for content on live broadcast platforms.

“Sister is Coming”, based on the popular variety show “Sister Wave”, differs from variety show slices or celebrity live broadcasts. Centered around content, it connects celebrity resources, commercial needs, and fan requirements through the live broadcast IP.

Leveraging live broadcast scenarios, it enriches brand promotional scenes, effectively transforming content traffic into business traffic, achieving an explosive effect with a total exposure of over 2.8 billion across the network, more than 226 million total live views, and 77 trending searches on the interne

Kuaishou & Food ECommerce

Tianhai Cang is clearly aware of the importance of first-mover advantage and content for e-commerce. Leveraging Kuaishou’s first Super Brand Day in the fresh food industry, Tianhai Cang ventured into Kuaishou e-commerce for the first time.

With the strategy of “expert distribution + brand self-broadcasting,” it quickly built a sustainable and long-term operational stronghold, breaking through barriers and seizing the upcoming content dividend window. It became a dark horse in the first issue of [Magnetic Engine·Case Showroom], providing a paradigm for fresh food category marketing on Kuaishou.

Kuaishou is more for Local Brands

Good content not only touches hearts but also transcends time, bringing compound value to the brand like a snowball. GAC Trumpchi, focusing on car model selling points, tailored an interactive challenge “Break Anxiety, My Pace, My Speed,” allowing users to intuitively feel the charm of the model. Additionally, through cash incentives and interactive activities involving platform talents in content creation, the brand effectively expanded its interactive group, igniting the popularity of the car model.

At the same time, the combination of short videos and live broadcasts in content output effectively captured traffic, allowing the brand’s car model selling points to penetrate over a long period. It also helped the brand involve more new car sales leads, paving the way for final sales conversion. Ultimately, they achieved a 133% completion rate in sales volume.

What Changes in Marketing Logic in this Video App?

Consumers care about price, but the live broadcast room is not just a promotional field; it is also a content field.

Collaborating with platform IPs can leverage platform resources for maximal user reach. Additionally, the combination of IP and brand can find new driving points for brand content, surprising users with the momentum of the platform and the dynamic energy of the brand’s product.

In KFC’s Qixi marketing, Magnetic Engine planned a collaboration between KFC’s new product “CP Burger” and Kuaishou’s “Super Interesting Live Room” IP, approaching young people’s social topics and entertainment life in the name of love.

To continuously productize the content, KFC fully linked online live rooms and offline scenes, inviting over 30 internet celebrities to participate in a flash mob, creating an entertaining event. They also planned interactive games onsite, integrating product selling points into interactive segments, preparing the product for Qixi live broadcast. Moving away from the fast-food industry’s norm of distributing coupons in live rooms, the activity was synchronized to the brand’s live room during Qixi, allowing the brand to generate topics and sell new products simultaneously.

Super Brand day

As another important Kuaishou, “Kuaishou Super Brand Day” is also an opportunity for many brands to maximize their voice. Fuanna collaborated with Kuaishou Super Brand Day, integrating the brand’s “artistic” core into every marketing aspect of Super Brand Day, creating an online art flower room live broadcast to bring users closer to Fuanna products.

The high-quality content in the live room encouraged retention and conversion. Meanwhile, top streamers were invited to distribute products, reaching more influencer fans for brand product purchases. The president even parachuted into the self-broadcast live room with a plethora of super benefits, creating a sales climax. This set of marketing combinations achieved the brand’s stage transition goals, completing its overtaking curve on Kuaishou and opening up consumers’ imagination about the brand.

Kuaishou Cosmetics Case study

With S+ heavy resource diversion, live broadcast scenes will become another innovative content distribution field for brands, with effects that are not only cross-border but also break out of the circle.

In the highly competitive beauty track, Florasis used customized brand games and designed brand zones to divert traffic to its flagship store with various interactive methods. Simultaneously, they broadcasted on large screens in nine cities offline, continuously amplifying the event’s volume for a concentrated explosion of voice.

Conclusion: Is Kuaishou Good for Fashion Brands?

Fashionchinaagency analysis : Kuaishou, with its vast user base and diverse content, presents a lucrative opportunity for fashion brands. The platform’s strength lies in its ability to create an immersive and interactive experience for users, which can be effectively leveraged by fashion brands for marketing and engagement.

The success of marketing campaigns on Kuaishou, as seen in various case studies, illustrates the platform’s potential in driving sales and enhancing brand visibility. The integration of e-commerce capabilities within the app further facilitates direct consumer transactions, making it an appealing choice for fashion brands looking to expand their reach in the Chinese market. However, the effectiveness of Kuaishou for a particular fashion brand would depend on its specific strategy, target audience, and how well it adapts its content to resonate with the platform’s user base.

We prefer Douyin for international brands

(GMA), a digital marketing agency specializing in the Chinese market, often prefers Douyin for promoting international fashion and luxury brands in China due to several compelling reasons:

- Young and Affluent User Base: Douyin’s user demographic primarily consists of a younger, urban audience that is typically more affluent and has a keen interest in fashion and luxury brands. This demographic is often trend-conscious and more willing to engage with and purchase luxury goods, making it an ideal target for high-end brands.

- High Engagement Rates: Douyin’s platform is designed to foster high levels of user engagement. Its sophisticated algorithm promotes content discovery, encouraging users to interact with new brands and products. This interaction often translates into better engagement rates for fashion and luxury brands, which is crucial for building brand awareness and loyalty.

- Advanced E-commerce Integration: Douyin has seamlessly integrated e-commerce capabilities, allowing users to purchase products directly through the app. This feature is particularly beneficial for fashion and luxury brands as it simplifies the path to purchase, encouraging impulse buying and increasing sales conversions from content to commerce.

- Influencer Collaborations: The platform is home to numerous influencers and Key Opinion Leaders (KOLs) who hold significant sway over their followers. Collaborating with these influencers can provide fashion and luxury brands with a credible way to reach and engage with potential customers. These influencers often have a deep understanding of the latest trends and can present products in a way that resonates with the target audience.

- High-Quality Content and Aesthetic Appeal: Douyin encourages the creation of polished, high-quality content, aligning well with the premium nature of fashion and luxury brands. The platform’s emphasis on visually appealing and creative content helps these brands to showcase their products in an engaging and aspirational manner, which is critical in the luxury market where branding and image are paramount.

In summary, GMA recognizes Douyin as a highly effective platform for international fashion and luxury brands aiming to penetrate the Chinese market. Its unique features and user base provide an ideal environment for these brands to connect with their target audience, increase brand visibility, and drive sales.