In 2023, China’s luxury market demonstrated a remarkable turnaround, showcasing a resilient rebound from the pandemic-induced slump. The new Bain&Co report delves into the dynamics of this recovery, unveiling key trends and their implications for the future of the luxury sector in China.

Summary Points:

- 12% Yearly Growth: China’s luxury market experienced a 12% increase in 2023, bouncing back from the previous year’s downturn.

- Uneven Half-Yearly Performance: The first half of 2023 saw robust growth, while the second half faced challenges due to wavering consumer confidence and high comparison bases.

- Category-Wise Recovery: Diverse segments like Fashion, Jewelry, and Leather Goods showed notable growth, with Beauty and Watches also contributing to the market’s recovery.

- Emerging Trends: The return of overseas luxury shopping and the evolution of the Daigou market are shaping the future of China’s luxury landscape.

- Global Impact: Chinese luxury consumption remains a major global force, estimated to comprise 22%-24% of the world’s total in 2023, with projections to reach up to 40% by 2030.

+12% market growth for 2024

In 2023, China’s luxury market saw a strong recovery across all sectors. Fashion, Lifestyle, and Jewelry were at the forefront, growing by 15% to 20%. Leather Goods also grew, but more modestly at 10%-15%, with a focus on less expensive bags. The Beauty sector, including fragrances and makeup, grew by about 8%, and Watches experienced a modest rebound with 5% to 10% growth, varying across different brands. source Bain

Duty-free sales in Hainan increased by about 25% compared to the previous year, but still didn’t reach the heights of 2021. This increase was helped by a rise in domestic travel and government stimulus in Hainan. However, the average amount spent by each shopper dropped by more than 25%, likely due to lower discounts, fewer Daigou (a form of cross-border purchasing) activities, and more cautious spending by consumers.

Bain & Company identified two major trends influencing China’s luxury market in 2023, which are likely to continue:

- Shift Back to Overseas Luxury Shopping: During the pandemic, over 90% of luxury purchases by Chinese consumers were made domestically due to travel restrictions. However, with the resumption of international travel, Bain expects a decrease in domestic luxury spending to 70% in 2023. Chinese spending on luxury goods in Europe and Asia has started to recover, reaching about 40% and 65% of their 2019 levels in these regions, respectively.

- Price Differences Drive Overseas Shopping: The price difference between luxury items in mainland China and other markets has remained significant and unchanged from 2022. This gap, especially noticeable in fashion and leather products, has made shopping for luxury goods more appealing overseas.

Changes in the Personal Shopper Perception

South Korea’s duty-free market, a key player in the Daigou system especially for luxury beauty products, is facing challenges. Sales to international travelers are expected to drop by 30%, amounting to about 60-65 billion RMB. This decline is attributed to reduced commission fees for Daigou by travel agencies and limited availability of popular beauty products in China by brands.

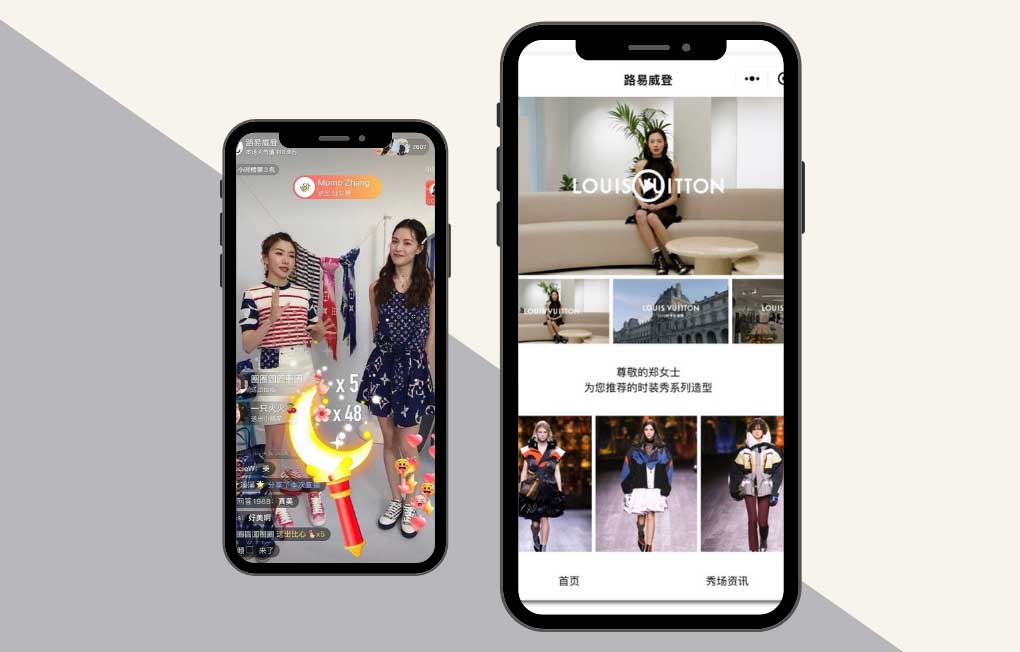

Despite tighter controls in the beauty sector, Daigou is evolving, especially in fashion and leather goods. New, more sophisticated Daigou models are developing, using a platform-based approach. This allows for a more organized and verified shopping experience, offering consumers access to foreign goods through wholesalers at more competitive prices. you need to understand that 80% of Chinese buyers are under 45 years of age

The Daigou market shows no signs of slowing down. Its future will largely depend on how global brands manage their wholesale markets abroad.

The recovery in 2024 will largely hinge on the pace of economic recovery and changes in travel and accommodation costs. We expect another year of growth for Chinese overseas luxury consumption, especially in Asian destinations. It’s vital for brands to adopt consistent global pricing strategies to sustain mainland China’s market consumption. China is evolving fast, which is the biggest challenge for foreign companies

Read more

In 2023, Chinese luxury consumption is estimated to represent about 22%-24% of the global total, with mainland China accounting for around 16% of this (excluding Daigou). By 2030, China’s share in global luxury consumption is anticipated to rise to 35%-40%, with mainland consumption reaching 24%-26%, further establishing China as a dominant luxury market globally.

Read more