Navigating the whirlwind that is China’s fast-moving kidswear market can feel a bit like trying to catch a butterfly with chopsticks – complex and challenging, but also intriguing.

With so many brands striving for recognition, one name consistently floats to the top of my research: Balabala. Commanding an impressive 6.8% slice of the market as of 2023, this brand stands tall in competitive terrain and serves as a fascinating case study on flourishing amidst fierce competition.

So get ready folks! In this piece, we’re rolling up our sleeves to dissect the strategies and success nuggets that make Balabala stand out in China’s vibrant childrenswear landscape.

Are you prepared for some fashion-forward insights? Because they might just help your brand carve its own niche in this booming industry!

Key Takeaways

- Balabala is the leading brand in China’s childrenswear market, with a 6.8% market share in 2023.

- The Chinese childrenswear market is growing rapidly, driven by rising purchasing power and a demand for adult-like clothing for kids.

- Balabala’s success can be attributed to its unique marketing strategies, such as staging fashion shows on the Great Wall of China and collaborating with popular cartoon characters.

- With the implementation of China’s Three-Child Policy, there is potential for a significant increase in demand for children’s clothing, presenting an opportunity for brands like Balabala to capitalize on this trend.

Overview of the Chinese Childrenswear Market

Chinese parents have more money to spend now. They are choosing to buy good clothes for their children. This leads to growth in the market for kids’ clothes in China. More money spent on children’s clothing shows it is a top priority. Parents with high incomes like brands that sell high-end clothes for kids.

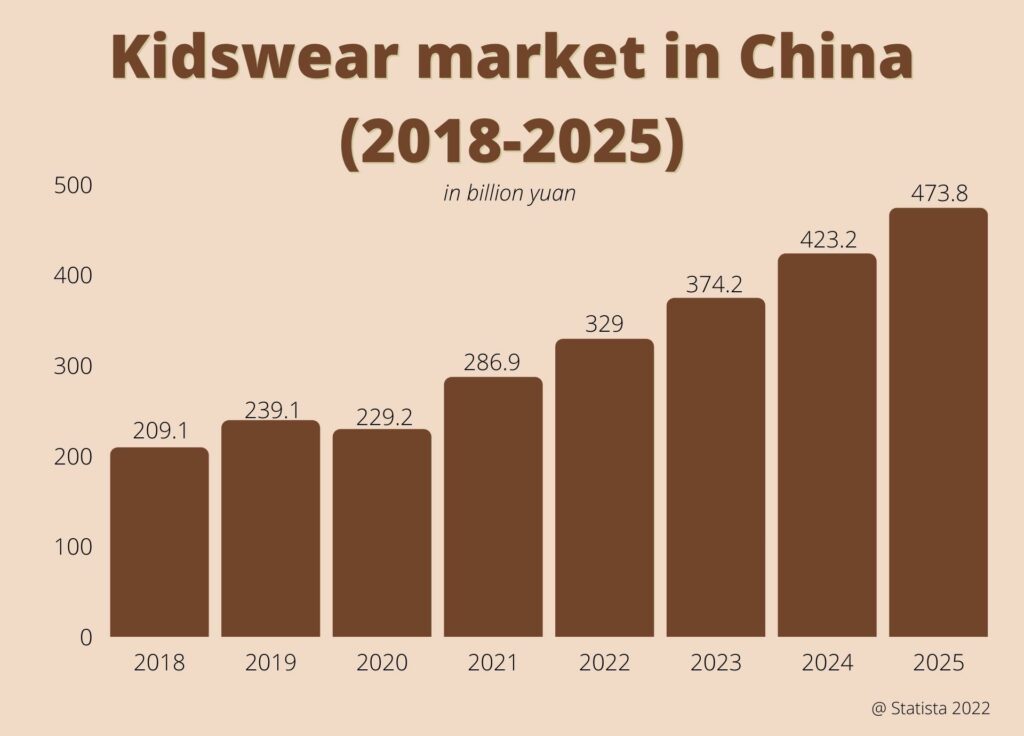

The money made from selling kids’ clothes is expected to grow a lot. It’s estimated to reach 374 billion yuan in 2023 and will likely jump to 473.8 billion in just two years. Research from Statista shows that even though women’s clothes sell the most in China, kids’ clothes and sports clothes are starting to sell really fast. This means there’s a big chance for companies that make fancy kids’ clothes and sportswear to do well.

Popularity of luxury children’s clothing

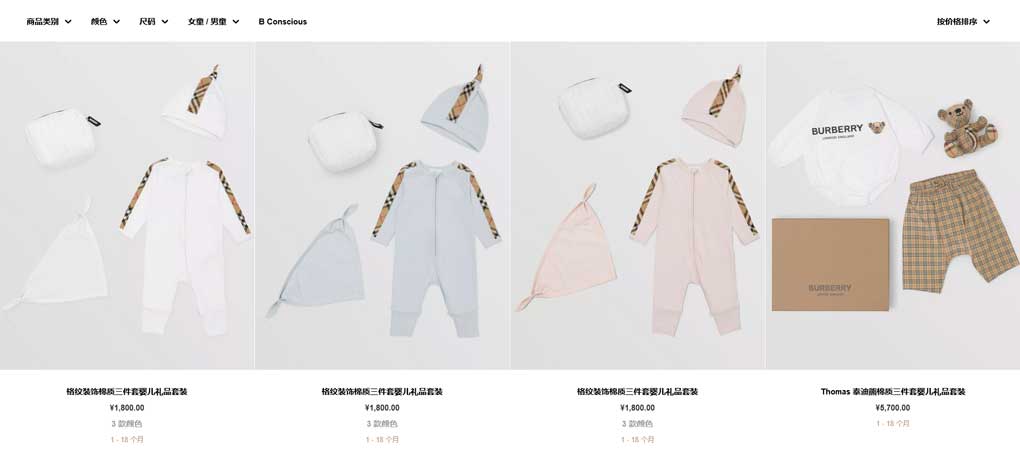

In China, kids are wearing high-end clothes. A lot of Chinese families have a lot of money. They want their children to wear luxury fashion. This is a new trend among the well-off in China.

The children’s clothing market in China is growing faster than any other type of clothing. In fact, it grew by 14.4%. More and more kids are seen wearing fancy clothes that look like what adults wear.

These clothes can be quite expensive, but many parents don’t mind paying extra for quality and style.

Kids’ outfits are no longer just about function or comfort — they’re also about showing off status and wealth.

Think about how your brand can tap into this booming market!

Demand for adult-like clothing for kids

Kids want clothes that look like what adults wear. This trend is hot in China right now. Many parents love to buy such outfits for their children. They feel happy when their kids look stylish and grown-up.

Trendy pieces boost the growth of the baby and kids’ clothing market in China. This opens a big chance for mass-market brands to make more sales. Brands can create new designs that reflect adult styles but are still fitting for children.

There is no sign of this trend slowing down, so it will help double sales by 2027.

Balabala’s Dominance in the Chinese Childrenswear Market

Balabala, one of the biggest local brands in the Chinese childrenswear market, is holding a significant 6.8% market share in 2023. Compared with its competitors such as Anta Kids and Adidas, Balabala has a significant presence, making it a dominant player in the industry.

Balabala is also dominating the whole Asian market, with more than 4700 stores operating in 11 countries (60 of those stores are located outside of Mainland China).

Here’s a quick comparison of these brands’ market shares in the Chinese childrenswear market:

| Brand | Market Share |

|---|---|

| Balabala | 6.8% |

| Anta Kids | 3.7% |

| Adidas Kids | 1.3% |

Despite this dominance, it’s notable that the top five kidswear companies in China hold a combined market share of just 8.8%, noticeably lower than the market share of kidswear companies in the US, Japan, and the UK, which stands at around 20%.

Unique marketing strategies

As a marketing manager, I want to highlight Balabala’s unique marketing strategies in the Chinese childrenswear market. Here are some key tactics that have helped Balabala dominate the industry:

- Staging a fashion show on the Great Wall of China, creating buzz and attracting attention from both local and international media.

- Unveiling a new playful identity and store concept designed by retail design agency Dalziel, which refreshed the brand image and provided an engaging retail experience.

- Using unconventional advertising strategies to stand out in a crowded market, such as collaborating with popular children’s cartoon characters to create eye-catching campaigns.

- Implementing creative promotional methods, like offering personalized styling tips through their website and social media platforms, or launching products via live-streaming on Douyin.

- Embracing innovative technology by launching China’s first virtual child influencer, Liu Genghong, who helped promote the brand to a wider audience.

- Offering a modern WeChat mini-program, with VIP memberships offering discounts and special offers

Expansion plans

To grow further in the Chinese childrenswear market, Balabala is focusing on expanding its presence and reaching more customers. The brand plans to open new stores across China, targeting both first-tier cities like Beijing and Shanghai, as well as second and third-tier cities where there is untapped potential.

Balabala also aims to increase its online presence by strengthening its e-commerce platforms and leveraging social media channels to engage with a wider audience. This expansion strategy aligns with the projected growth of the market due to factors like rising purchasing power and the introduction of the three-child policy.

With these expansion plans, Balabala aims to solidify its dominance in the childrenswear industry in China and seize new opportunities for growth.

Impact of China’s Three-Child Policy on the Kidswear Market

China’s recent implementation of the Three-Child Policy has generated significant excitement in the kidswear market, as a potential boom in demand for children’s clothing is expected.

This presents a golden opportunity for Balabala and other brands to capitalize on this growing trend. Find out more about how Balabala has positioned itself to benefit from this policy shift and what it means for the industry.

Potential boom in demand for children’s clothing

The introduction of China’s Three-Child Policy has created the potential for a significant increase in demand for children’s clothing. Even without this policy, the childrenswear market was already expected to experience double-digit growth.

Now, with more families planning to have three children, the baby and kids clothing market is set to boom even further. Per capita spending on childcare-related products like baby clothes is increasing rapidly in China, indicating a growing interest and investment in children’s fashion.

The children’s wear market is outpacing the general apparel sector with a yearly growth rate of 6%. This presents an exciting opportunity for brands like Balabala to capitalize on this potential surge in demand for stylish and high-quality children’s clothing.

Opportunity for Balabala and other brands

With China’s Three-Child Policy leading to an expected boom in demand for children’s clothing, there is immense potential for growth in this industry.

This means that Balabala can capitalize on the increasing market value of $53 billion and expand its customer base even further. Additionally, with Chinese parents having higher disposable incomes, they now have more spending power to invest in their children’s products.

This presents a great opportunity for Balabala and other brands to cater to this growing demand and capture a larger share of the market. By focusing on innovative marketing strategies and unique offerings, these brands can position themselves as leaders in the ever-growing childrenswear industry in China.

Balabala’s Innovation: First Virtual Child Influencer in China

Balabala’s innovation in utilizing the first virtual child influencer in China has revolutionized their marketing strategy and catapulted their brand to new heights. Discover how this unique approach has propelled Balabala’s success in the Chinese childrenswear market.

Liu Genghong’s role in promoting the brand

As part of Balabala’s innovation in the Chinese childrenswear market, they introduced Liu Genghong as their first virtual child influencer. Liu Genghong played a crucial role in promoting the brand through his online presence and popularity among young kids and parents.

With his charming personality and relatable content, he effectively showcased Balabala’s products and encouraged people to purchase them. This marketing strategy of using a virtual influencer helped Balabala gain more visibility, increase brand awareness, and connect with their target audience on social media platforms.

The success of this campaign further solidified Balabala’s position as a dominant player in the childrenswear market.

The success of the virtual influencer campaign

Balabala’s virtual influencer campaign has been a great success. They were one of the first childrenswear brands in China to create a virtual influencer, Gu Yu. This innovative marketing strategy has captured the attention of their target audience and helped increase brand awareness and engagement.

The success of Balabala’s virtual influencer campaign shows how popular and accepted virtual influencers have become in China’s social media landscape. It also highlights the impact of technology on advertising and the growing trend of using digital content creation for online brand promotion.

We Can Help You Enter China’s Kidswear Market

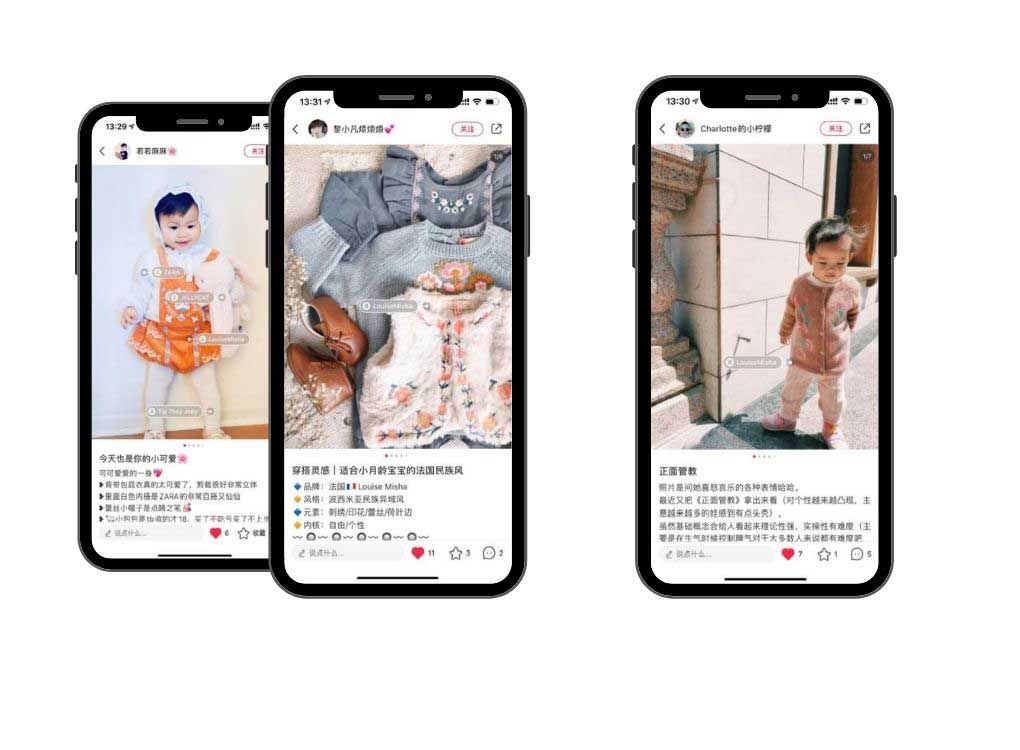

Dive into the burgeoning kidswear market in China and make a splash with the expertise of Gentlemen Marketing Agency. We bring a proven track record of success, having propelled brands like Louise Misha to new heights in this competitive landscape.

Our Expertise, Your Advantage

At Gentlemen Marketing Agency, we blend market insight with creativity to craft strategies that resonate with families across China. Here’s what we offer:

- Market Mastery: We understand the Chinese market’s heartbeat, using this knowledge to position your brand effectively.

- Brand Storytelling: Like we did for Louise Misha, we’ll weave your brand’s story into the fabric of China’s culture, creating a narrative that captivates and endears.

- Digital Dominance: With our digital prowess, your brand will shine across all platforms, reaching parents and children where they are most engaged.

Our Services

Partner with us and benefit from a spectrum of services designed to dress your brand for success:

- Brand Analysis: We evaluate your current brand presence and tailor a strategy that speaks to the Chinese consumer’s heart.

- Campaign Creation: From concept to execution, our campaigns are crafted for impact, driving both sales and brand love.

- Social Media Engagement: We leverage platforms like Weibo and WeChat, ensuring your brand becomes a household name.

- Influencer Collaborations: With our vast network of influencers, we create partnerships that introduce your brand to new, receptive audiences.

- Analytics and Adaptation: We track your campaign’s performance and fine-tune our approach, ensuring optimal results.

Witness firsthand the Gentlemen Marketing Agency difference. Join us in threading your brand into the vibrant tapestry of China’s kidswear market. Contact us today and let’s tailor your success story.