China’s fashion market is an ever-evolving tapestry of trends, tastes, and economic forces. As the largest consumer market in the world, it offers an intricate web of opportunities and challenges that continually captivates the global fashion industry. But what makes China’s fashion market truly intriguing is the diversity embedded within its various segments, each of which tells a unique story of consumption and growth.

From the luxury spenders in major metropolitan cities to the budget-conscious consumers in smaller towns, from the young, tech-savvy shoppers to the more traditional adult audience, the revenue in China’s fashion market is not just a singular entity. It’s a multifaceted mosaic, shaped by factors such as age, gender, geography, product category, and price range.

In this article, we will dissect the revenue streams of China’s fashion market by examining these critical segments.

Overview of the Chinese Fashion Market

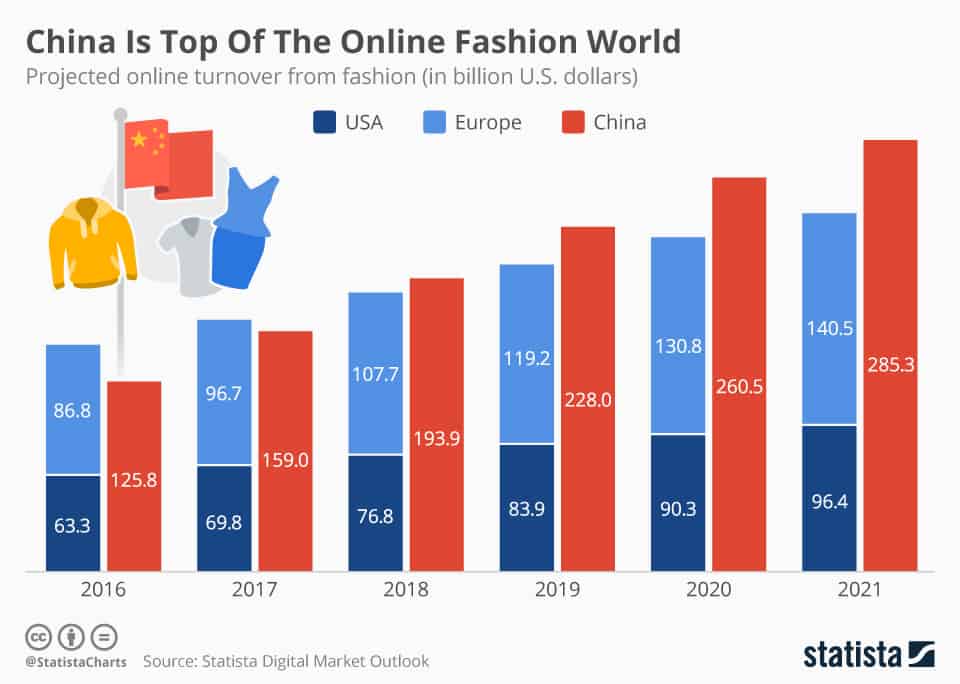

In a notable development that defines the global shift in the fashion industry, China surpassed the USA in the Fashion & Apparel Market at the end of 2020. This accomplishment was not an overnight phenomenon; it was the result of relentless growth that saw the Chinese market expand almost four times over the past 10 years.

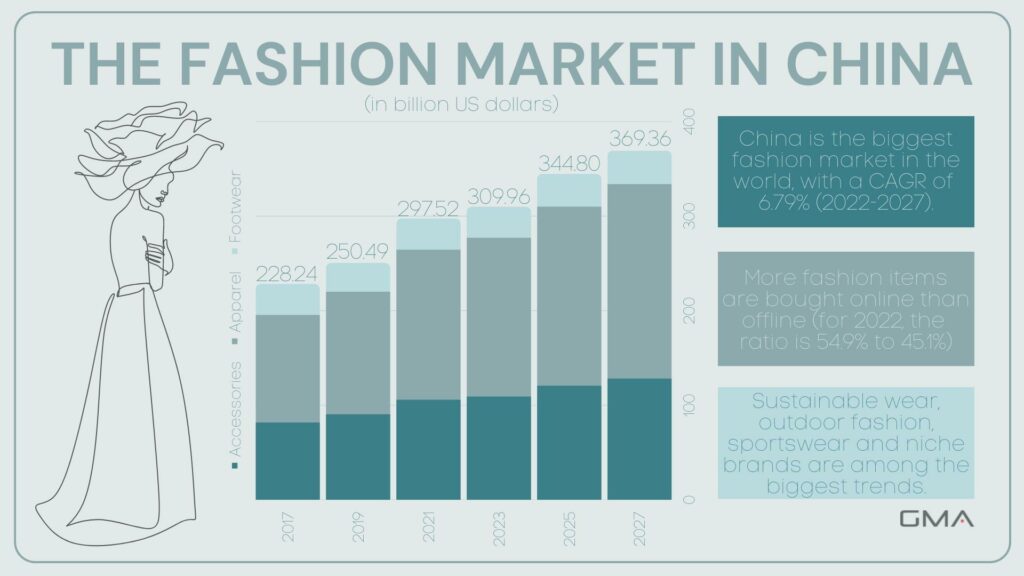

By 2023, this growth had culminated in a market worth $310 billion, reflecting a consistent annual growth rate of 25%. Now the CAGR is predicted to reach 6.79% in 2022-2027.

But China’s significance in the global fashion landscape extends beyond sheer market size. According to McKinsey, Chinese consumers are projected to account for 40% of the world’s luxury spending by 2025. Strategic marketing efforts focused solely on China could potentially attract more than 1 million consumers, marking an unprecedented opportunity for expansion and engagement.

This incredible success and immense growth potential can be attributed to three major factors, as identified in a report by Statista Digital Market Outlook. Firstly, the rise in disposable income has given Chinese consumers greater purchasing power. Secondly, the rapidly changing fashion trends have played a pivotal role in shaping consumer behavior and preferences. Lastly, there has been a pronounced willingness among Chinese consumers to invest more in high-quality products.

Fashion Industry in China in Numbers

Understanding the Chinese fashion market requires a nuanced exploration of its diverse segments. The revenue streams can be dissected across various axes including gender, age, product category, and price. Below, we delve into each of these segments to offer a more granular view of this dynamic market.

Gender-based segments

Men’s Fashion

With increasing purchasing power among Chinese consumers, the men’s fashion market has experienced significant growth, particularly among male shoppers who are now more inclined to invest in clothing.

As of 2023, the Chinese men’s fashion market reached an impressive US$103 billion and is projected to expand further, with an expected annual growth rate of 4.44% (CAGR 2021-2025). Per person, revenue amounts to $70.82 in 2023. One person purchases on average 4.6 items.

Women’s Fashion

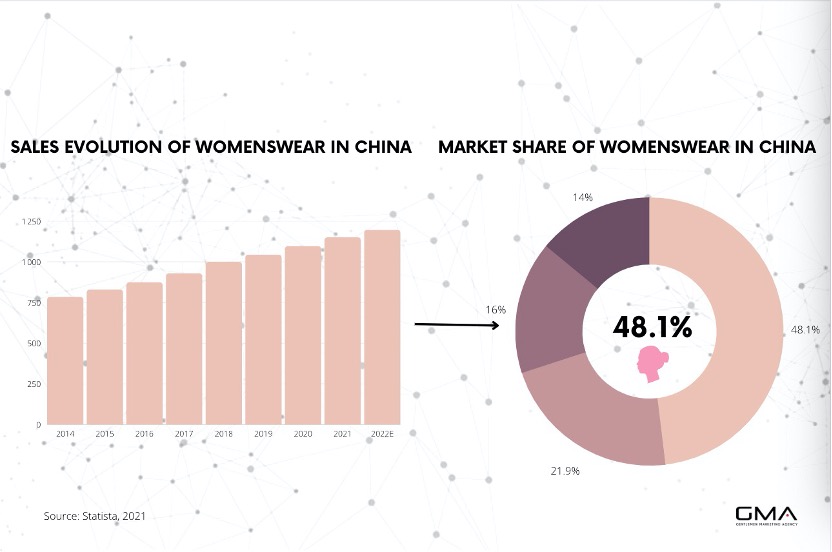

As the primary driving force behind fashion consumption, women’s fashion encompasses a wide range of products. From high-end luxury brands to affordable fast fashion, women’s wear is marked by diversity and responsiveness to global trends. The focus on individuality and style has given rise to niche brands targeting specific needs and tastes.

Womenswear is taking 48.1% of the whole Chinese market. The women’s apparel segment reached $172 billion in 2023, and the market is expected to grow annually by 4.31%. Per person, revenue amounts to $117 in 2023. One person purchases on average 9.6 items.

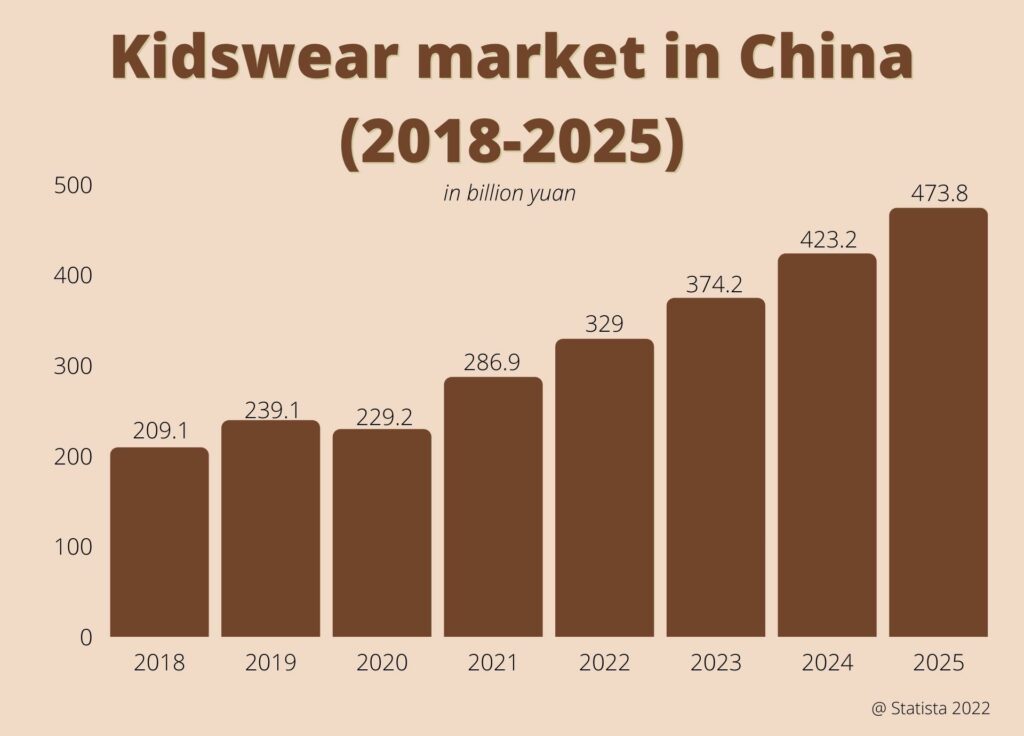

Children’s Fashion

In China, the sales revenue for the kidswear market is on track to hit an estimated $43 billion (374 billion yuan) in 2023, with projections showing growth to around $72.9 billion (473.8 billion yuan) in the following three years.

Research from Statista reveals that despite women’s wear being the largest segment within the Chinese apparel industry, it’s the kidswear and sportswear segments that are recording the most rapid expansion. These emerging trends herald significant opportunities, particularly for brands specializing in children’s clothing and luxury sportswear.

The children’s fashion segment has witnessed significant growth, driven by increased spending on children’s education and upbringing. The emphasis on quality and design, coupled with the influence of children’s entertainment and characters, has shaped this vibrant segment.

Category Segments

Apparel

Apparel remains the core of the fashion market, including everyday wear, formal clothing, sportswear, and niche categories like maternity wear. The diversity within this segment reflects the multifaceted needs and preferences of Chinese consumers.

As of 2023, the China apparel market stands at a remarkable US$318 billion, with projections indicating an annual growth rate of 4.28% (CAGR 2023-2027).

One of the critical aspects of this market is the dominance of Women’s Apparel, which constitutes the largest segment, with an impressive market volume of US$172 billion in 2023.

On an individual level, the average volume per person in the Apparel market is slated to amount to 20.9 pieces in 2023, reflecting personal consumption patterns and preferences.

A significant insight into the market dynamics is the prevalence of Non-Luxury goods, which are anticipated to account for 98% of sales in the Apparel market by 2023.

This statistic emphasizes the enduring appeal of accessible and affordable fashion, catering to a wide spectrum of consumers. The apparel market is also seeing a shift toward traditional Chinese clothing preferences and a raise in Chinese fashion brands.

Footwear

Footwear has seen innovation in design, functionality, and sustainability. From luxury brands to localized manufacturing, the choices are vast, reflecting urban sophistication and traditional craftsmanship.

China’s Footwear market is poised for growth, projected to reach US$83 billion in revenue in 2023 with an annual growth rate of 3.77% (CAGR 2023-2028). The largest segment, Textile & Other Footwear, accounts for US$40 billion in 2023.

Key insights include an expected per-person revenue of US$56.74 in China’s Footwear market by 2023 and a market volume anticipated to reach 3.1 billion pairs by 2028. Growth is steady, with a rate of 0.7% expected in 2024, and an average volume per person predicted to be 2.1 pairs by 2023.

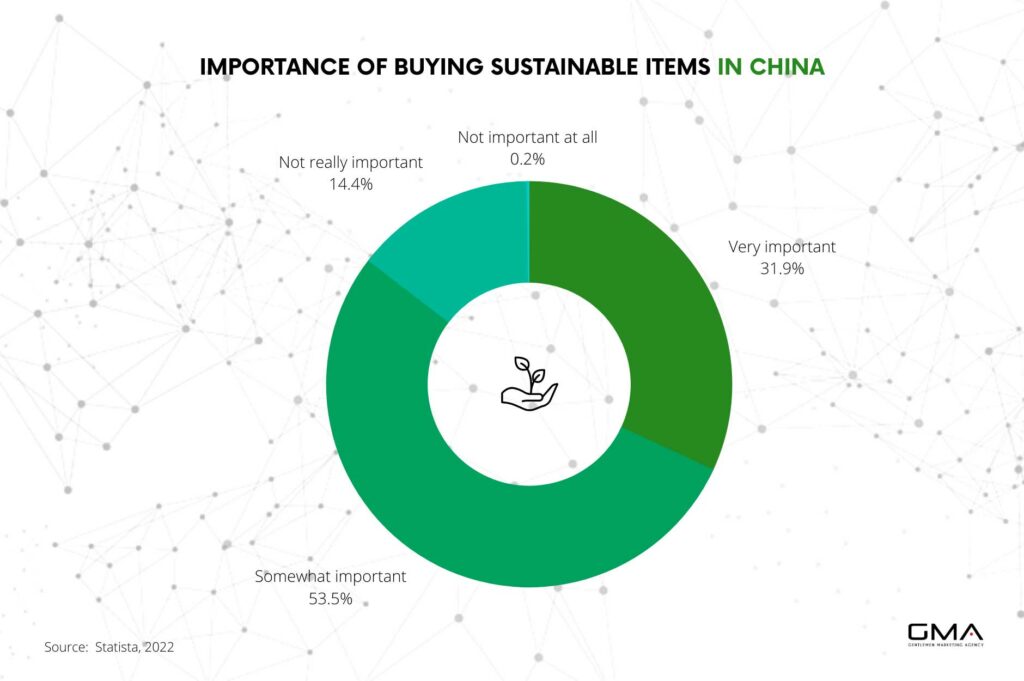

The market largely favors Non-Luxury goods, with 96% of 2023 sales expected in this category. Notably, China’s Footwear market is experiencing a shift towards sustainable fashion and locally-made products by Chinese designers, reflecting changing consumer preferences and environmental consciousness.

Accessories

Accessories, including handbags, jewelry, and watches, offer opportunities for personal expression and luxury spending. Collaborations with designers and limited edition releases fuel this thriving segment.

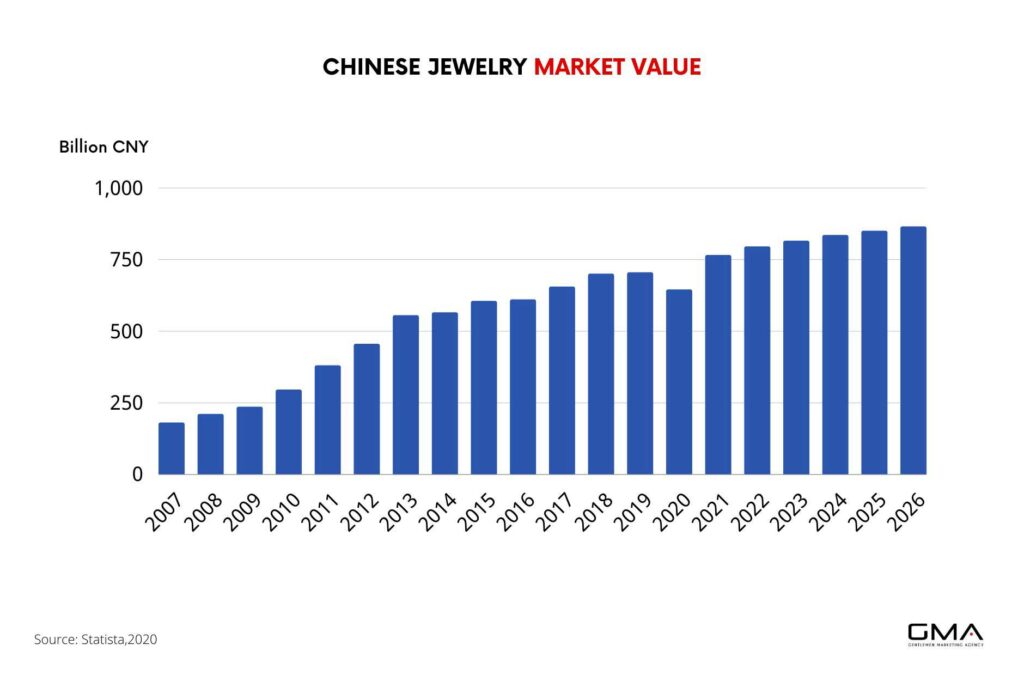

The Accessories market is witnessing a surge, with revenue reaching US$110 billion in 2023 and an anticipated annual growth rate of 5.06% (CAGR 2023-2026). Leading this market is the Watches & Jewelry segment, accounting for a substantial volume of US$90 billion in the same year.

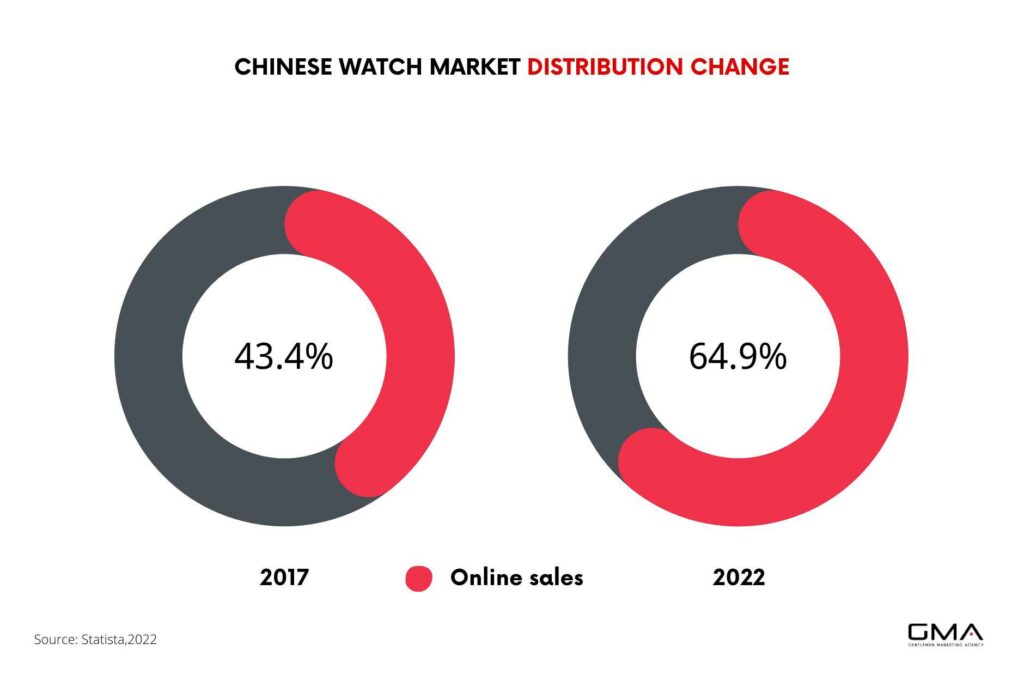

A striking feature of the Accessories market is the shift towards digital commerce, with online sales expected to constitute 62.0% of total revenue by 2023. This trend reflects the changing landscape of retail and the growing preference for online shopping.

Future Trends and Predictions for the Chinese Market

The China fashion market is complex and ever-evolving, reflecting Chinese culture and preferences. Let’s delve into the future trends and predictions that are shaping the industry:

Emerging Technologies (e.g., AI, Blockchain)

- AI and Personalization: AI is increasingly being used for hyper-personalization, offering tailored recommendations and experiences to consumers. AI algorithms can analyze customer preferences and trends to create highly personalized shopping experiences.

- Blockchain for Authenticity: Blockchain technology is being employed to ensure the authenticity and traceability of products, particularly in the luxury segment. It helps in combating counterfeits by providing a transparent and unalterable ledger of a product’s history.

- Virtual and Augmented Reality: These technologies are enhancing the shopping experience by providing virtual try-on features and immersive in-store experiences, even when shopping online.

- Sustainability through Tech: Technologies like 3D printing are allowing for more sustainable production methods, reducing waste, and allowing for localized manufacturing.

Changing Consumer Expectations

- Demand for Sustainability: Chinese consumers are increasingly conscious of environmental impacts, leading to a growing demand for sustainable and ethically produced fashion.

- Local Preferences: There’s a resurgence of interest in local brands and traditional designs, blended with a modern twist. This trend reflects a sense of national pride and a desire for unique, culturally resonant fashion. Foreign brands are not the only choice anymore, giving some room for domestic brands.

- Health and Wellness Focus: Fashion products that align with wellness and health, such as athleisure, are gaining traction, reflecting a holistic approach to lifestyle.

- Convenience and Customization: The expectation for seamless, convenient shopping experiences and personalized products is growing.

Global Influences and Collaborations

- Global Collaborations: Chinese brands are increasingly collaborating with international designers and celebrities, creating unique products that appeal to both local and global markets.

- Influence of Global Trends: While local trends are strong, global fashion movements continue to impact the Chinese market, creating a blend of Eastern and Western aesthetics.

- China as a Trendsetter: With its massive market and innovative designers, China is also beginning to influence global fashion trends, especially through social media platforms and Key Opinion Leaders.

- Cross-border E-commerce: Easier cross-border shopping is making international brands more accessible to Chinese consumers, influencing tastes and expectations.

We Can Help You Enter the Chinese Fashion Market

The China fashion market is on the cusp of a transformative era. Shaped by emerging technologies, shifting consumer preferences in fashion choices, cultural confidence, and a unique fusion of global and local influences, the opportunities for growth and innovation are vast.

As these trends continue to unfold, businesses and brands that adapt and align with these evolving dynamics will find themselves at the forefront of a thriving market.

Gentlemen Marketing Agency, with its deep understanding of the Chinese market and cutting-edge marketing strategies, is uniquely positioned to help brands navigate these complex landscapes.

Leveraging insights, technology, and creativity, we can help you connect with the Chinese people in meaningful ways, tap into new segments, and drive sales.

Contact us today to explore how we can partner with you to achieve success in the exciting world of China’s fashion industry.