The Chinese luxury watch market represents a dynamic and rapidly evolving segment within the global luxury industry. Characterized by a robust blend of traditional preferences and modern trends, it reflects China’s growing economic strength and the rising affluence of its consumers. As the demand for high-end timepieces grows, the market is becoming increasingly influential in the global luxury watch sector.

10 key points about the Chinese luxury watch market:

- Rapid Growth: The market has seen significant growth in recent years, fueled by China’s expanding economy and increasing consumer wealth.

- Shift in Consumer Demographics: Younger, affluent Chinese consumers are becoming a major force in the luxury watch market, often seeking both status and quality in their purchases.

- Preference for Prestigious Brands: Brands like Rolex, Patek Philippe, and Omega are highly sought after, signifying status and taste.

- Rise in Female Consumers: There is a growing interest among female consumers in luxury watches, both for fashion and investment purposes.

- Emerging Interest in Vintage and Pre-owned Watches: The market for vintage and pre-owned luxury watches is burgeoning, driven by a combination of investment potential and a desire for unique pieces.

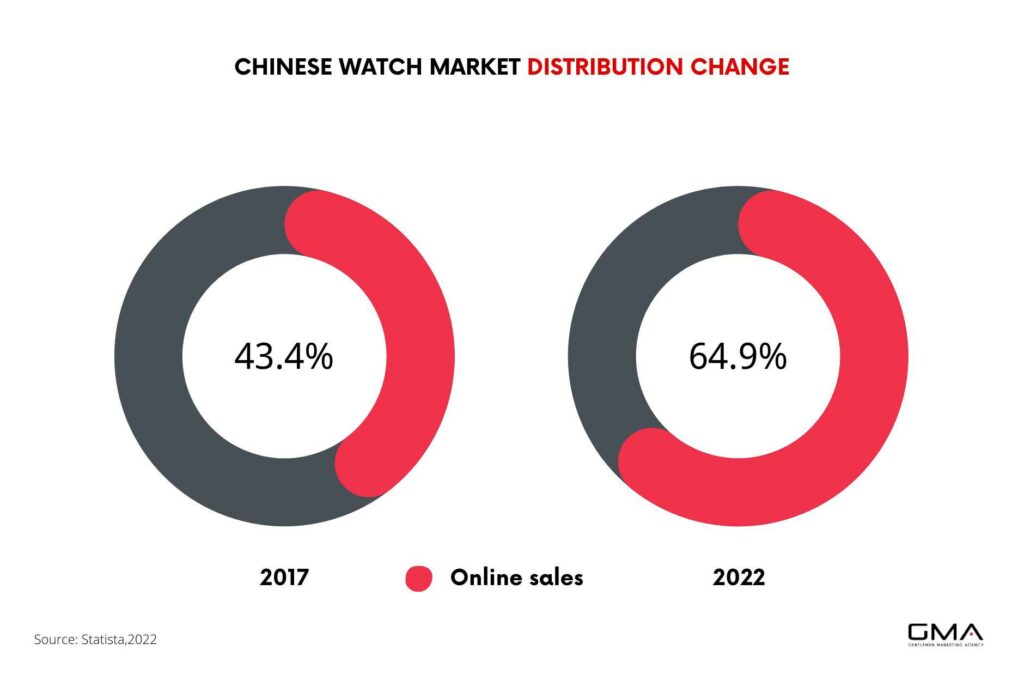

- Digital Influence: Online platforms are playing a significant role in the luxury watch market, with consumers increasingly researching and purchasing watches online.

- Cultural Significance: Luxury watches are often purchased for significant events and as gifts, rooted in cultural practices that value longevity and craftsmanship.

- Increasing Brand Diversification: Beyond traditional luxury watchmakers, newer and niche brands are gaining traction among Chinese consumers.

- Consumer Education and Awareness: There is a growing interest in understanding the craftsmanship, history, and technology behind luxury watches.

- Impact of Global Events: International events and changes in the global economy, including the COVID-19 pandemic, have had an impact on the market, influencing both supply chains and consumer buying habits.

Read more

Growing Collectors’ Market

China’s pre-owned luxury watch market is a small but rapidly expanding segment of the global market. Thomas Piachaud, Head of Strategy at Re-Hub, predicts that China’s growth in this area may soon surpass that of more established markets. This growth is driven primarily by high-net-worth (HNW) collectors at the top of the wealth pyramid. According to Hurun’s Chinese Luxury Consumer Survey 2022, 49 percent of HNW individuals in China collect luxury watches, a significant increase from the previous year. This trend reflects a broader interest in China for passion investments, with 29 percent of consumers acknowledging the long-term investment value of watches.

Piachaud notes that the collector mindset is reducing barriers to purchasing pre-owned luxury items, especially in the secondary market.

Aspirations and Bargain Hunters

The lower end of the luxury market is attracting aspirational and younger consumers who are drawn to the affordability of pre-owned luxury watches. These buyers, well-versed in pricing through social media and informal networks, are keen on finding value for money.

Re-Hub’s research indicates significant discounts on pre-owned watches in China, citing examples like Cartier watches on the resale platform HongBuLin (also known as Plum) offering an average discount of 53.9 percent. Importantly, the “China premium” historically associated with certain pre-owned items is diminishing. read more jingdaily

Market Dynamics

The pre-owned luxury watch market in China is evolving due to a mix of supply and demand factors. Despite global price adjustments in the secondary market, Piachaud points to a robust supply, with many timepieces being sold as consumers upgrade their collections or seek liquidity.

While China’s secondary market is still developing compared to more mature markets, there is an increasing impetus for major players to carve out a significant presence. Early engagement in this market is key for understanding competitive dynamics and building consumer trust.

$300 million auction

Patrick Getreide decided to auction his unique One-of-a-Kind (OAK) watch collection, estimated to be worth between $100 million and $300 million, he selected Hong Kong as the venue, rather than traditional choices like Geneva or New York.

Asia’s growing culture of affluent collectors and dynamic economy made Hong Kong an ideal location for Getreide. “It is the gateway to reach collectors not only from Hong Kong but also from Japan, Singapore, and China,” he explained to Jing Daily before the auction.

Patrick Getreide and his OAK collection. Image Credit: Patrick Getreide

While Geneva and New York have historically been the epicenters for major watch auctions, such as the sale of Paul Newman’s Rolex Daytona for about $17.8 million and the Patek Philippe Grandmaster Chime (6300A) for approximately $31 million, the focus is now shifting to the Asia-Pacific region. Christie’s Asia Watches department, after its recent fall sale and the first tranche of the OAK collection auction on November 26, achieved a record annual sales volume of $88 million, more than double its pre-pandemic level.

1937 Patek Philippe Wristwatch, owned by the Last Emperor of China, has been sold at auction

$6.2 Million, Setting Multiple Auction Records

In 1937, Swiss luxury watchmaker Patek Philippe crafted the Reference 96 Quantieme Lune, an extraordinary timepiece once owned by Aisin-Giro Puyi, the last emperor of China’s Qing dynasty. Its history, intertwining with Puyi’s turbulent life, which included ascension to the throne as a toddler and later rule over the puppet state of Manchukuo, adds to its rarity. The watch, resurfaced after decades, is part of a Phillips auction, beginning at their new Asia headquarters in Hong Kong. Puyi’s possession of the watch, which later passed to a Soviet official and tutor during his imprisonment in Siberia, marks a significant chapter in its storied existence. source

Dynamic in China and Hong Kong

In the first half of 2023, the Asia-Pacific region alone accounted for nearly 50% of Christie’s global watch sales, according to Alexandre Bigler, Senior Vice President and Head of Watches at Christie’s Asia-Pacific.

Getreide’s OAK collection, amassed over nearly 40 years, features over 500 timepieces from prestigious brands. The first part of the auction in Hong Kong saw 139 watches sold, totaling $6,677,662 (HKD 51,810,570).

Interestingly, independent watch brands overshadowed traditional ones at this auction. The top performers included pieces from Akrivia, founded in 2012 by Rexhep Rexhepi, and Voutilainen, established in 2002 by a Finnish watchmaker. An Akrivia stainless steel wristwatch from 2022 fetched the highest price at $679,223 (HK$5.3 million), and a Voutilainen watch achieved $452,815 (HK$3.5 million), surpassing its high estimate of $410,717 (HK$3.2 million).

Bigler attributes the allure of these independent brands to their rarity and exclusivity, noting that the auction presented a unique opportunity for collectors to acquire exceptional pieces from these sought-after creators.

China’s thriving economy and the growing affluence of its consumers have positioned it as a crucial market for luxury watchmakers. Alongside China, other countries like the United States, Switzerland, Japan, Germany, and the United Arab Emirates, especially Dubai, have also exhibited a strong demand for luxury watches, buoyed by a long history of appreciation for these timepieces and a substantial base of luxury watch retailers and enthusiasts.

Top 5 Luxury Watch Brands in China

In the Chinese market, several luxury watch brands have established popularity and a significant presence. Among these are:

- Rolex: Known globally for its craftsmanship and timeless design, Rolex is a symbol of status and a sound investment for many Chinese consumers.

- Omega: This Swiss brand is prominent in China, celebrated for its sports watches and precision, as well as its association with high-profile events like the Olympic Games.

- Patek Philippe: Revered for its exquisite craftsmanship and limited production, Patek Philippe appeals to Chinese collectors and watch aficionados who value unique and intricate timepieces.

- Cartier: With its elegant designs, Cartier has captivated Chinese buyers, offering a blend of luxury, prestige, and timeless appeal.

- Audemars Piguet: This Swiss watchmaker is esteemed in China for its sophisticated mechanical watches, innovative designs, and exceptional craftsmanship, attracting a discerning clientele.

Read more