What about the Chinese online presence?

Chinese online presence has been going up and continues to go up, with China already the world’s largest internet population, at the same time, the world’s largest e-commerce or online business market. Many Chinese locals are now buying online instead of the on-site experience given by the physical stores.

Some of the consumers’ reasons for the boom of shopping online is that they could land better deals in the internet shops, some because it’s less time-consuming, and some because the shops guarantee authentic goods from different countries. Many businesses, both local in China and international, are now taking advantage of this huge opportunity to reach the Chinese people by selling online. One market that is going big in the e-commerce world is the Chinese luxury market.

How is the Chinese luxury market?

The Chinese are synonymous with luxury; Chinese shopping is synonymous with luxury products. Chinese have been attracted to luxurious products and lifestyles like religion, especially the wealthiest. A lot buy luxury products for self-wear and use as well as for gift giving. Having a luxury lifestyle makes China upscale in the social ladder of the Chinese people.

The Chinese love going to countries of origin of the luxury brands and buying them there, because of the high tariff and sales in entering the Chinese market. Now, with the online sales of these luxury brands, a lot are really seeing the convenience and price change of these products, and a lot are very into them.

Opportunities of the online luxury market in China

Most of the Chinese buying luxury products online are using third-party sites like Alibaba’s big e-commerce platforms Taobao and Tmall. The reason is that very few luxury brands are opening their e-commerce websites or stores for the Chinese market to enjoy. The luxury brands are having a hard time entrusting these e-commerce stores in China as they fear the Chinese won’t get the full brand experience and their luxury side as well as in a physical store.

Since the start of Tmall and Taobao, a lot of luxurious branded products have been selling out like pancakes, with discount prices original brands are unknown. Some made complaints against Alibaba, but with contract agreements, Alibaba and the luxury brands are now removing gray area markets in the e-commerce store, with the condition of the luxury brand creating an official store in Tmall for sales and benefits of the brand, Alibaba, and of course, the Chinese consumer.

Why luxury brands should invest in the e-commerce or online market in China

1. China’s online luxury market is already big and is continuously growing

The Chinese market will search for the best brand and product before purchase. With your brand in China’s online market, it could definitely gain more followers and in the end, more sales. China’s online and digital shopping is developing rapidly in the past recent years.

Furthermore, the trend of e-commerce luxury is gaining popularity among the youth in China not only on the national level but also internationally. China’s luxury market is 770 billion RMB (110 billion USD) today and will double to 1.2 trillion RMB by 2025, delivering 65% of 2018–25 global growth.

2. Online luxury market among Chinese resellers

Since the start of Alibaba’s Taobao, the Chinese are buying luxury products overseas and selling them in the online marketplace at discounted prices, as luxury products from overseas tend to be cheaper than buying in mainland China. According to the “2019 China Luxury E-Commerce Report”, although more than 60% of luxury online consumption is contributed by first and second-tier cities, third to sixth-tier cities have greater development potential, and sales growth is staggering.

Areas, where no stores are opened, have huge room for development. Therefore, in the face of this huge luxury market that still has development prospects, domestic e-commerce giants Tmall, JD.com, and other e-commerce giants have also joined in. The pressure of luxury e-commerce competition is increasing.

3. Chinese consumers are really into online luxury shopping

The numbers are already showing that 70% of Chinese consumers are openly buying luxury products online. After 2015, luxury e-commerce began to develop on a large scale. It is very important to notice the difference between the Chinese e-commerce ecosystem and other ones. Although digital marketing is a powerful tool for brands to reach luxury customers, yet there is a long way to approach the desired goals.

The rapid changes in China’s Internet environment have prevented many operational decisions from reference to past and other regional experiences. The story of luxury e-commerce in China is also a story of the ”sinicization” of European and American luxury e-commerce. However, one thing is for sure that we are going to witness a new era of the luxury world’s engagement with the digital world.

4. What are the essential platforms for luxury branding

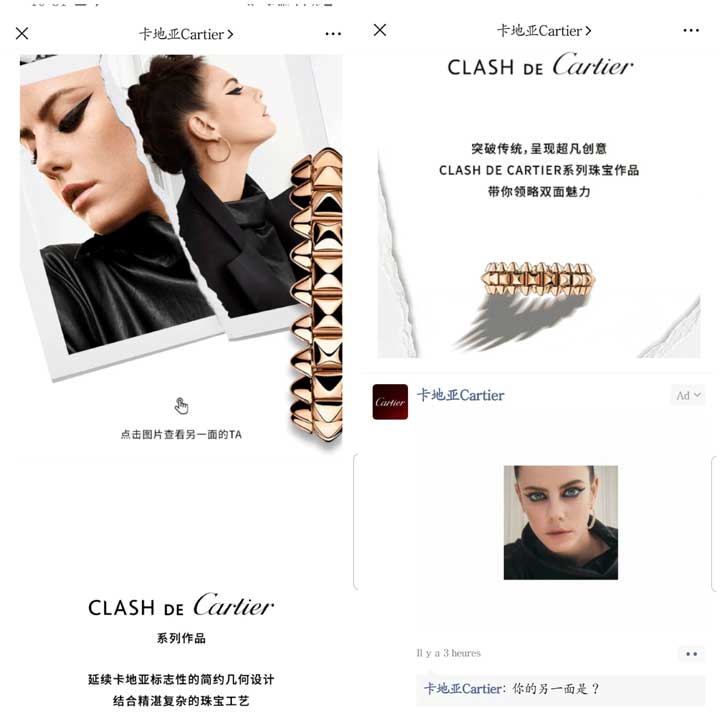

- WeChat – The biggest social platform

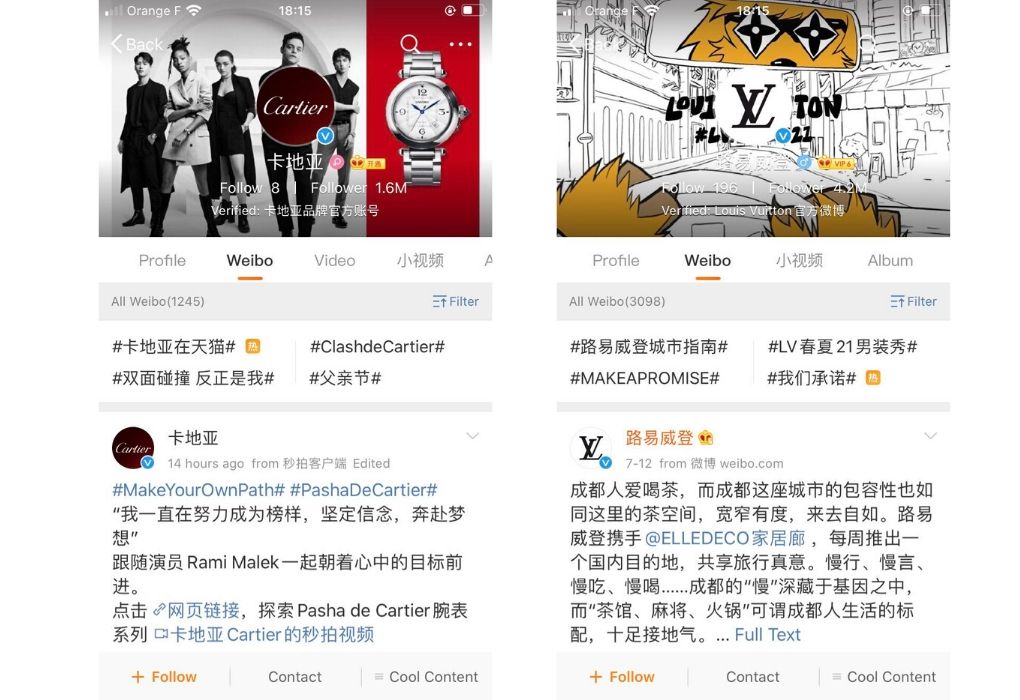

- Weibo – Ideal for luxury brand awareness

- Xiaohongshu – A comment-generated platform

- Bilibili – The must for luxury cosmetics brands

- Tmall Luxury Pavillion – The secure and elitist way to sell

- JD – The second largest e-commerce platform in China

- Secoo – China’s largest multi-brand luxury B2C website

Choose GMA to promote your luxury brand in China

Do you want to know more about China’s luxury market? Contact GMA, a digital marketing agency, specialized in the Chinese digital market. You will have the opportunity to discuss with our team of professionals, passionate about China and e-commerce. Our expertise in the luxury brands in China could help you settle in China and establish your digital marketing strategy. If you want to know more about luxury fashion it’s here.

- A team of 70 digital marketing specialists in China

- Experienced & Professional in supporting companies for their development in China

- With a deep knowledge of the Chinese lifestyle

- A passionate international team

Read more about luxury online in China:

3 comments

Hustler Gan

I agree! But I don’t think the market is saturated, Chinese consumers trust luxury brands because of their reputation and trendy products but there is still space for high-end brands entering the market, only if they adopt a good communication model…

Joe

Very good article. DO you have example of small brands who sell online ?

Did they success in China ?

Claude

Thank for your advice as I think like you but the market is so saturated that I got to think of a strategic marketing plan to get business revenue, I really cannot compete with the rich people and the young energetic sales people in the market right now unlike the 1998 to 2001 when the GST is 5%. I really cannot sit down and do nothing and just depend on the rental of the China Girl Tenant. It not enough for me to travel especially Singapore standard of living are so expensive…