Navigating the complex landscape of China’s footwear market can often feel like finding a needle in a haystack. I’ve also grappled with this challenge and unveiled an interesting fact: China currently accounts for over 60% of total footwear production globally!

This blog post will guide you through statistics, key industry trends, and insights about the Chinese footwear industry to help anticipate its future trajectory.

Ready to take a deep dive into one of the world’s leading shoe markets?

Key Takeaways

- China accounts for over 60% of global footwear production, showcasing its dominance in the market.

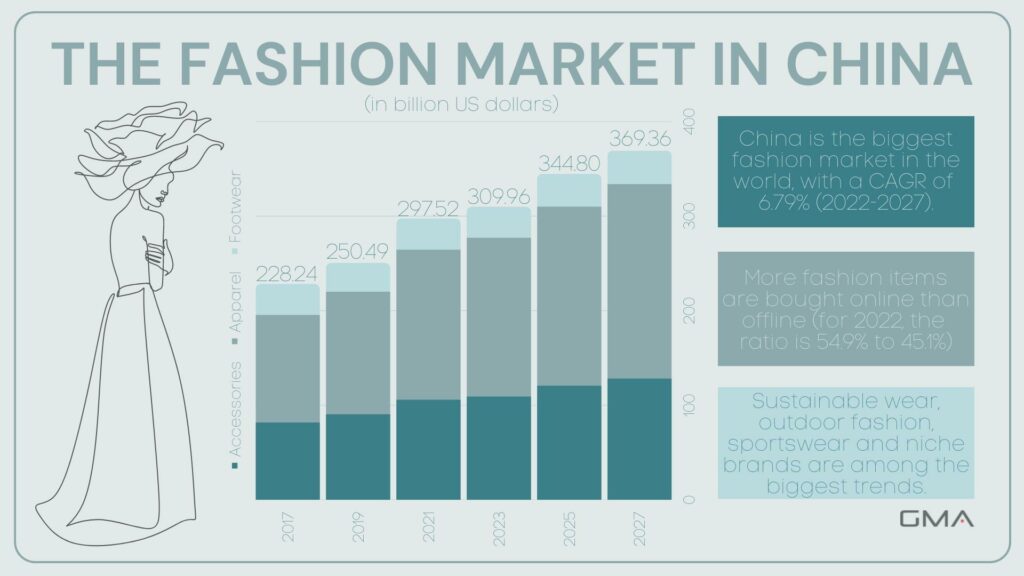

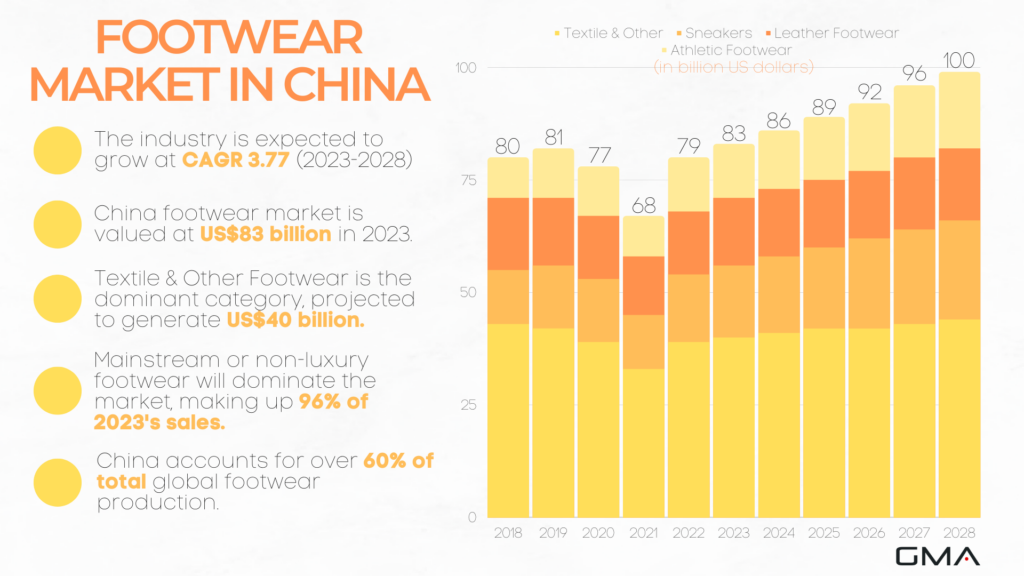

- China’s Footwear market is poised for growth, projected to reach US$83 billion in revenue in 2023 with an annual growth rate of 3.77% (CAGR 2023-2028).

- Key players in the industry include Belle International, Anta Sports, Fuguiniao Co., Ltd, Daphne International Holdings Limited, Red Dragonfly, Adidas, and Nike.

- Demographics indicate that around 400 million Chinese consumers will have higher incomes by 2030 which contributes to the growth of the footwear industry.

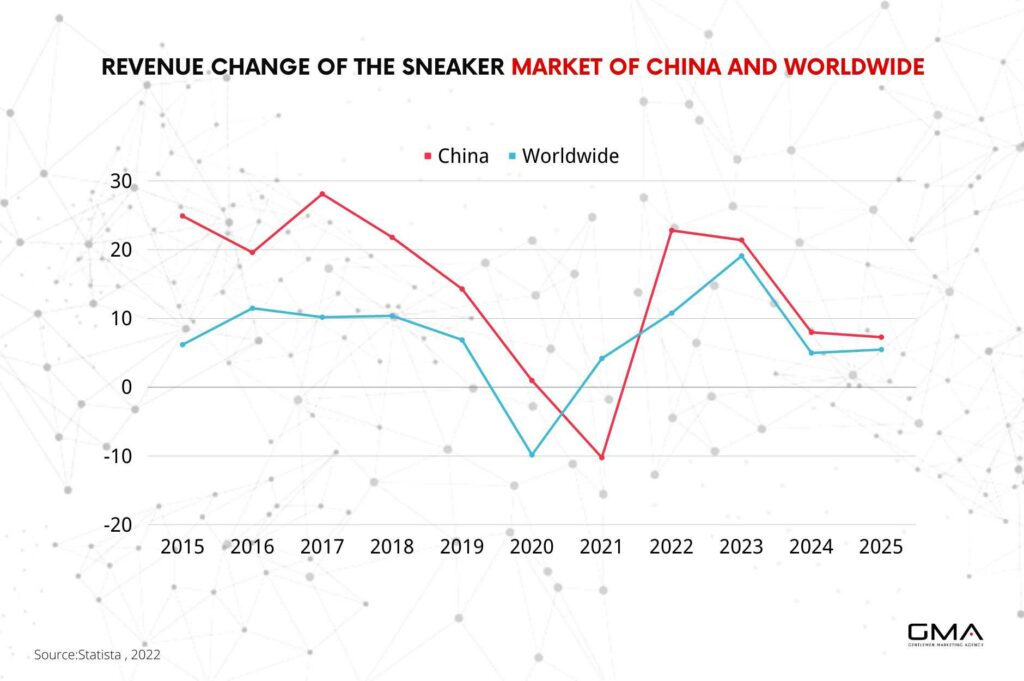

- Emerging trends in the Chinese footwear market include increased demand for athletic shoes and the rise of e-commerce as an important sales channel.

- Consumer preferences are shifting towards style, comfort, and brand reputation rather than just functionality and price when buying shoes.

- The impact of e-commerce on the industry is significant as more consumers choose to shop online resulting in decreased foot traffic for physical stores.

Overview of the Footwear Market in China

Shoe designs have evolved significantly, encompassing novel designs, enhanced features, and eco-friendliness. Both high-end brands and local artisans offer a broad array of options, showcasing a blend of contemporary flair and timeless artistry.

China’s shoe industry is on an upward trajectory, with forecasts suggesting a valuation of US$83 billion in 2023, growing at a CAGR of 3.77% from 2023 to 2028.

Textile & Other Footwear is the dominant category, projected to generate US$40 billion in 2023. It’s anticipated that, by 2023, every individual in China will account for an expenditure of US$56.74 on footwear, and by 2028, the market volume will have burgeoned to 3.1 billion pairs. A modest growth of 0.7% is projected for 2024, with an average shoe ownership poised at 2.1 pairs per person by 2023.

Mainstream or non-luxury footwear will dominate the market, making up 96% of 2023’s sales. A significant trend to highlight is the growing affinity for eco-friendly footwear and creations by local Chinese designers, mirroring a shift in consumer tastes and a heightened environmental awareness.

Please note that China accounts for over 60% of total global footwear production. This is a clear demonstration of China’s dominance in the footwear market.

Key players in the industry

I am going to talk about some key players in the Chinese footwear market. These companies make a lot of shoes and play a big part in the industry.

- Belle International: This is China’s largest shoe retailer. They have many stores all over China.

- Anta Sports: This company makes sports shoes. They are very famous in China and abroad.

- Fuguiniao Co., Ltd: This company makes high-end men’s shoes. Many business people like their shoes.

- Daphne International Holdings Limited: This company mainly sells women’s shoes. They are famous for their trendy styles.

- Red Dragonfly: This brand is known for its comfortable and good-quality casual shoes.

- Adidas and Nike: Even though these two brands are not from China, they play an important role in the Chinese shoe market.

Demographics and target consumers

Chinese consumers play a significant role in the footwear market, with China and India being the top consumer markets globally. By 2030, it is estimated that around 400 million Chinese consumers will have higher incomes, contributing to the growth of the footwear industry.

With this projected income growth, there is great potential for market expansion and increased demand for shoes in China. The Chinese footwear industry has already reached an impressive market size of USD 72.35 billion by 2021.

This shows that there are plenty of opportunities for marketers to target this large consumer base and tap into the growing Chinese footwear market.

Trends in the Chinese Footwear Market

Impact of e-commerce on the industry

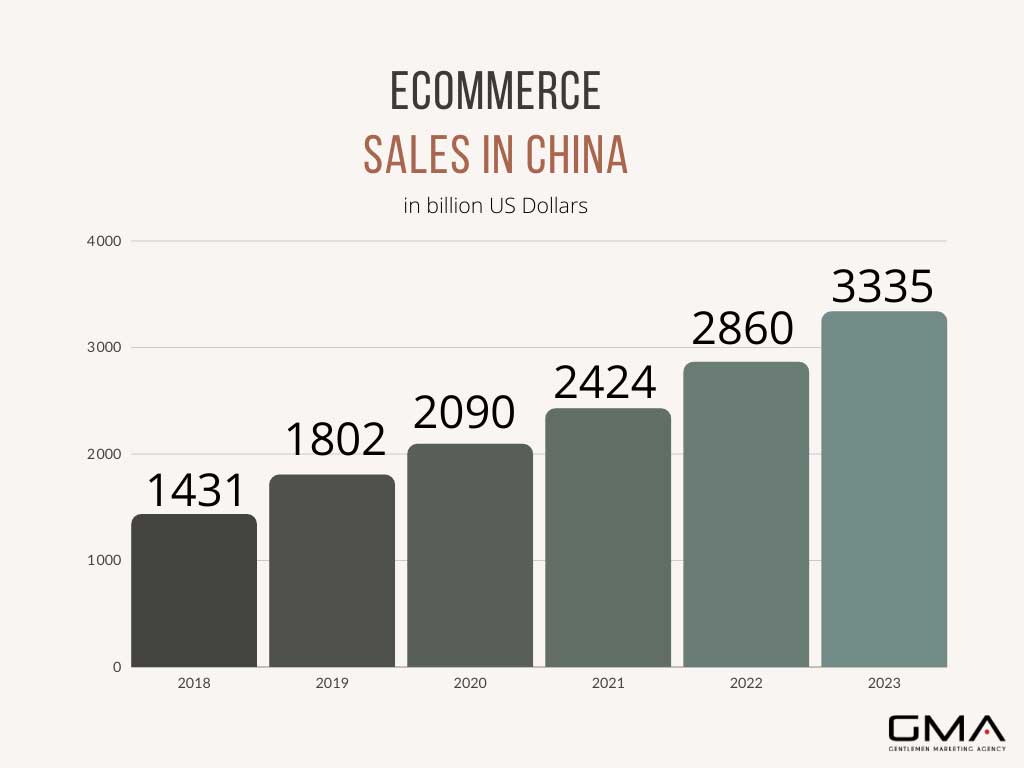

The impact of e-commerce on the Chinese footwear industry has been significant. With the rise of online shopping, more and more consumers are choosing to buy their shoes online rather than in traditional brick-and-mortar stores.

China is the largest e-commerce market globally, accounting for almost 50% of the world’s transactions. It is predicted that by 2023, the Chinese footwear e-commerce market will reach US$31,488.3 million, making up about 13.9% of the fashion e-commerce market in Greater China.

This shift towards online shopping has led to a decrease in foot traffic for physical stores and an increase in sales through digital channels. In fact, it is estimated that over 70% of China’s total retail sales will be conducted through e-commerce platforms.

Sustainability and Eco-Friendly Production

With growing global awareness about environmental issues, Chinese consumers are becoming increasingly conscious about sustainability. This is leading footwear manufacturers to adopt eco-friendly materials and sustainable production methods.

Local Brand Emergence

Local Chinese brands are gaining traction and competing strongly against international brands, thanks to improved quality, innovative designs, and a better understanding of local preferences.

Athleisure

The blending of athletic wear with leisure and fashion has been on the rise globally, and China is no exception. Footwear that is comfortable for sports but stylish enough for casual wear is seeing increased demand.

E-commerce and Digital Platforms

E-commerce platforms like Tmall, JD.com, and Pinduoduo are dominant channels for footwear sales, aided by reviews, live-streaming sessions, and influencer recommendations.

Customization

With advancements in technology and changing consumer demands, there’s a growing interest in personalized and customized footwear, whether it’s for style, fit, or function.

There’s a growing segment of consumers willing to pay a premium for high-quality, branded footwear. Luxury and premium brands are capitalizing on this trend.

Smart Footwear

The integration of technology into footwear, like shoes with embedded sensors for fitness tracking or heating elements for cold climates, is a budding trend.

Casualization

With changing work cultures and lifestyle preferences, casual shoes, including sneakers and slip-ons, are becoming more popular as daily wear.

Collaborations and Limited Editions

Collaborations between footwear brands and celebrities, artists, or popular culture franchises lead to the release of limited edition shoes, which create buzz and cater to collectors and enthusiasts.

Strategies for Success in China’s Footwear Market

As a marketing manager, it’s important to understand the strategies for success in the Chinese footwear market. Here are some key strategies to consider:

Focus on e-reputation and branding

Chinese consumers, particularly the younger generation, are increasingly relying on digital platforms, from WeChat to Taobao, to research and make purchasing decisions. Online reviews, influencer endorsements, and social media presence are powerful tools in shaping the perceptions of a brand. A negative review or a scandal can quickly tarnish a brand’s reputation, while positive endorsements can significantly elevate its status, boosting apparel and footwear sales.

Brands should not only ensure they maintain a robust online presence, but also consistently engage with their audience, address concerns promptly, and invest in campaigns that resonate with local culture and values. Cultivating a trustworthy and appealing online persona is essential for any footwear brand aiming to captivate the Chinese market.

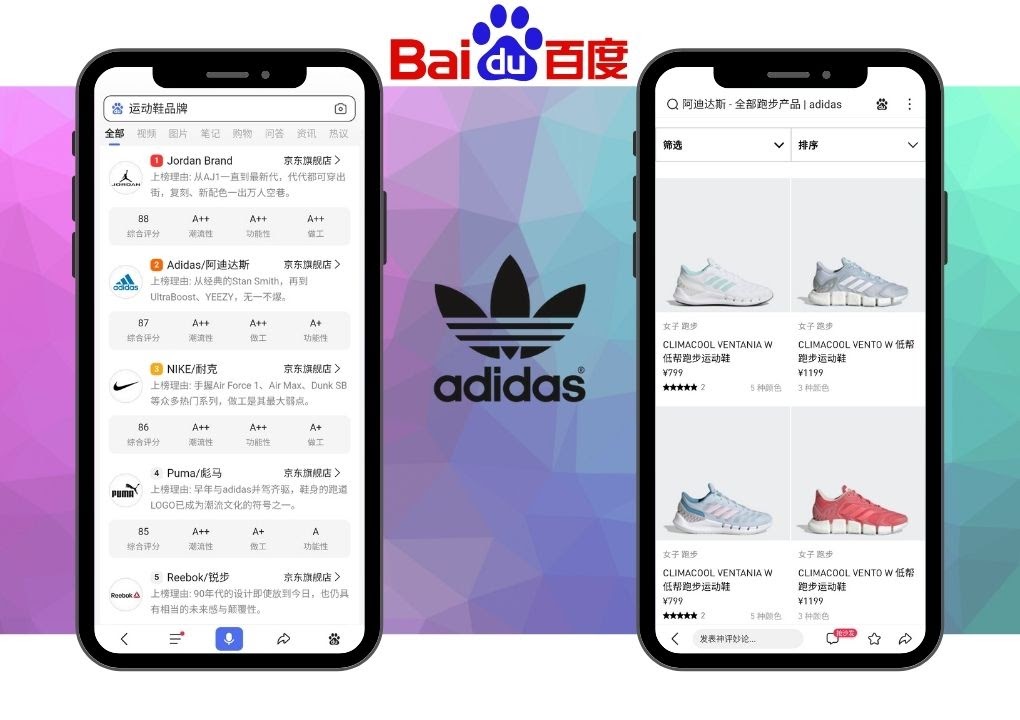

Create a Chinese website and pay attention to Baidu SEO

To be able to reach out to Chinese consumers and compete with leading brands in the footwear industry in China, a Chinese website hosted in Mainland China is a must. Chinese people like to do their research online, and just like we rely on Google, they rely on Baidu, the biggest Chinese search engine.

Therefore, we advise you to start from a Chinese website, so that they can find you online. A website in China is not supposed to sell, because international and domestic brands use e-commerce platforms for that, but it serves as a hallmark of your brand. You should make it appealing to the Chinese audience, adapting its look and message to the Chinese market. And remember to include the contact information and Chinese social media accounts.

When your website is ready, focus on Baidu positioning, so that you appear in the first pages of search results. I believe Baidu SEO is one of the best and most cost-effective solutions for your footwear products in China. Apart from selecting the right keywords, working on backlinks, etc., I also advise participating in Baidu forums, which will serve as a perfect word-of-mouth marketing and SEO booster.

Localize your brand message

In China, merely translating your brand’s message isn’t sufficient; it needs to be localized to resonate deeply with the Chinese audience. The cultural nuances, traditions, and preferences of Chinese consumers can vary vastly from those of Western audiences, making it imperative for footwear brands to tailor their messaging accordingly.

From leveraging local festivals like the Spring Festival to aligning with popular trends in Chinese pop culture, a brand’s narrative should reflect an understanding and appreciation of local sensibilities.

Successful localization goes beyond language—it involves understanding the aspirations, values, and emotions of the Chinese consumer. For a footwear brand, this could mean highlighting attributes or features most sought after by the local audience or collaborating with regional influencers. A localized message not only builds trust but also fosters a deep-rooted connection between the brand and its target market.

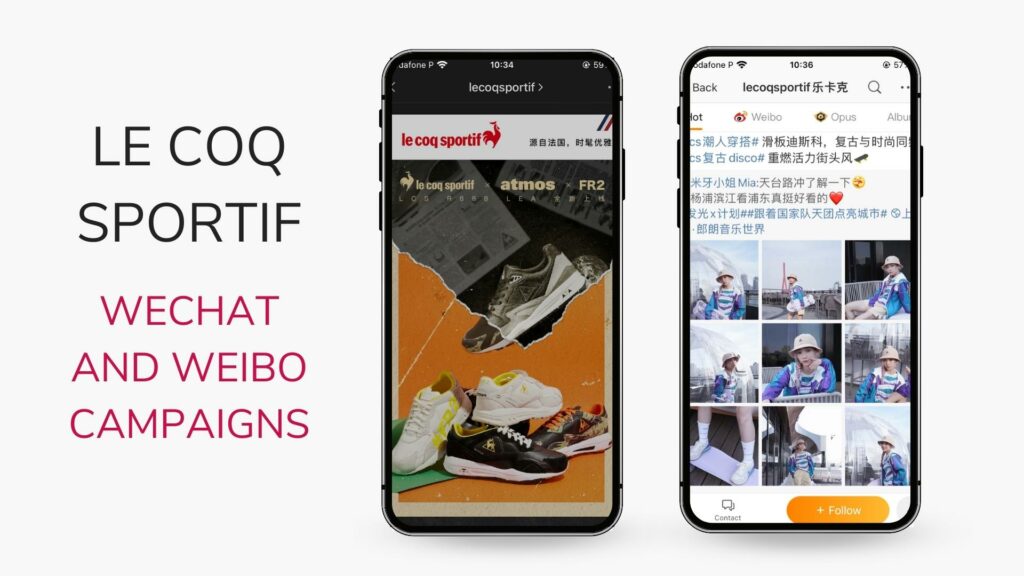

Be active on Chinese social media platforms

Navigating the dynamic digital ecosystem in China is pivotal for footwear brands, especially when tapping into its major social media platforms.

Often referred to as the “app for everything” (even in the global market), WeChat is an indispensable tool for brands entering the Chinese market. Its multifunctional features range from messaging to shopping, payments, and even booking appointments.

For footwear brands, WeChat’s ‘Moments’ feature, akin to a Facebook feed, allows for targeted advertising, while its ‘Mini Programs‘ can act as a mini-app within WeChat, offering a seamless shopping experience without users ever leaving the platform. Actively engaging on WeChat not only ensures brand visibility but also facilitates direct communication and e-commerce capabilities with the target audience.

A hybrid of Twitter and Facebook, Weibo is where trends are made and opinions are shaped. The platform allows brands to post updates, engage with followers, and run advertising campaigns.

For footwear companies, Weibo can be a goldmine for influencer partnerships, with many Chinese celebrities and KOLs (Key Opinion Leaders) actively promoting products. Regular posting, interactive campaigns, and real-time engagement can help brands stand out and reach a broader audience.

Xiaohongshu (Little Red Book)

Primarily a platform for user-generated content, Xiaohongshu combines social media and e-commerce in a unique way. Users often share product reviews, shopping tips, and lifestyle posts.

Footwear brands can harness this platform’s power by encouraging satisfied customers to share their experiences, thus creating organic buzz. Collaborating with influential users or sharing brand stories that resonate with the platform’s mostly female demographic can further elevate brand recognition and loyalty.

Douyin (TikTok)

As China’s leading short-video platform, Douyin is where the younger demographic spends a significant amount of their online time. Footwear brands can capitalize on Douyin’s visual appeal by creating catchy, engaging, and shareable video content. From showcasing the latest shoe designs in dynamic video formats to collaborating with popular Douyin creators, the platform offers endless possibilities for creative brand promotion.

Enter China’s e-commerce

China’s e-commerce landscape is a powerhouse, dominated by platforms that differ significantly from those in the West. Platforms like Tmall, JD.com, and Pinduoduo are the titans of online shopping, each offering unique features and audiences.

For footwear brands aiming to penetrate this market, understanding the intricacies of each platform is essential. Tmall, an offshoot of Alibaba, offers premium branding experiences and boasts a vast middle-to-upper-class user base. JD.com, on the other hand, is known for its robust logistics and authentic product guarantee, making it a trusted choice for quality-conscious consumers. By identifying the right platform alignment, brands can position themselves effectively, ensuring they cater to the right audience while maximizing their online visibility and sales potential.

Promote Your Footwear Brand in China with Gentlemen Marketing Agency

Navigating the dynamic landscape of China’s footwear industry requires more than just a strong product. It demands a deep understanding of the market, cultural nuances, and the latest trends. That’s where Gentlemen Marketing Agency comes in.

Our expertise lies in crafting bespoke marketing strategies tailored to the unique demands of the Chinese footwear market. Whether you’re an established brand looking to strengthen your presence or a newcomer aiming to make an impactful entry, we’ve got the tools and insights you need.

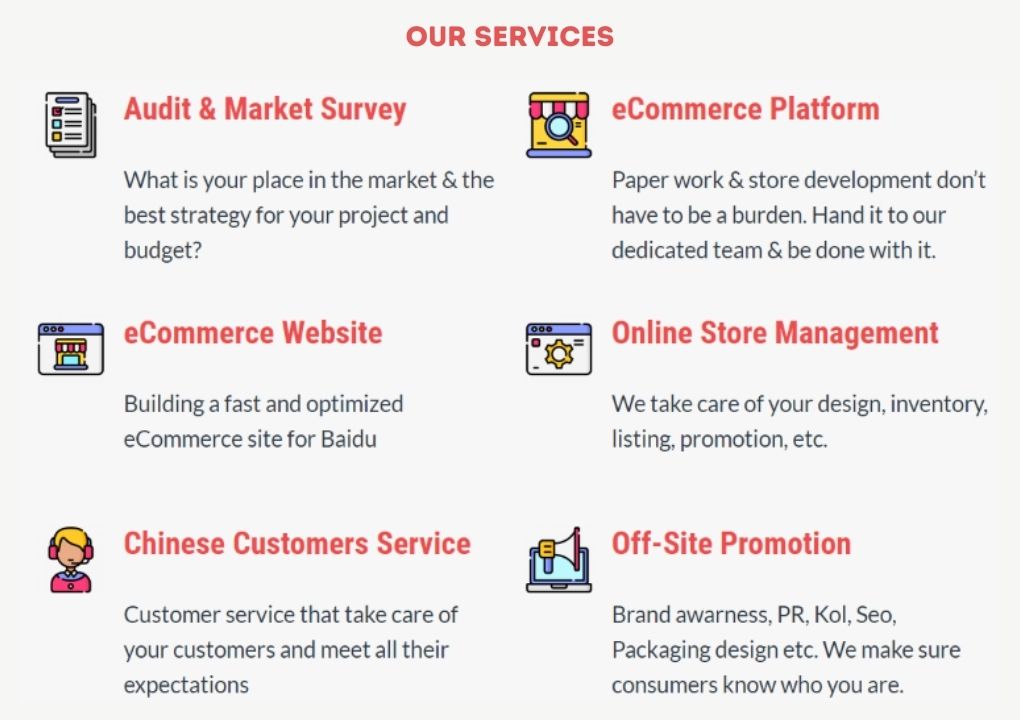

Here’s how we can help:

- Influencer Collaborations: Partner with the right KOLs to showcase your footwear, tapping into their vast followership for instant brand visibility.

- E-commerce Integration: Seamlessly integrate your brand into leading platforms like Tmall, JD.com, and Pinduoduo, capturing a massive online audience.

- Localized Branding: Adapt your branding and messaging to resonate with the Chinese consumer, from aesthetics to cultural sensibilities.

- Digital Marketing: Engage potential customers across popular social platforms like WeChat, Weibo, and Douyin, turning interest into sales.

- Trend Analysis: Stay ahead of the curve with our deep market insights, ensuring your footwear brand aligns with the latest trends and consumer preferences.

Ready to make your mark in China’s booming footwear industry? Trust the experts. Trust Gentlemen Marketing Agency and contact us today!

2 comments

Joel LECROQ

Can you introduce further your company and capability to retail offline or online Brands in China? Do you have any footwear market positioning available?

Best regards,

Joel Lecroq

joel.lecroq@sems-united.com

Putian / Fujian Province

188 5092 3030

admin

Sure , we will contact you